The world is in turmoil over the Russia-Ukraine conflict.

Supply chains are affected, commodity prices are rising, and payments are at risk.

Robert Meters, director of Schumann International Limited, discusses the current and long-term impacts of the conflict on receivables finance and credit risk management.

What effects will the Russia-Ukraine conflict have on receivables finance?

The world is in turmoil over the Russia-Ukraine conflict and supply chains have been strongly affected as a result.

The consequence is a price increase in all sectors where Russian oil, gas, coal, and diesel are needed for production and transport.

More than 15 countries depend on Russian gas for over 50% of their needs

Grain is a strong example, with more than 30% of the world’s wheat harvest coming from Russia and Ukraine.

Fertiliser shortages will undoubtedly affect production and trade, which may lead to supply shortfalls.

Companies in industries reliant on these goods may reduce their earnings before interest and taxes (EBIT) expectations.

Historically, high inflation levels in many countries have impacted the global economic situation and are expected to lead to a decline in consumption and increased salary expectations, putting further pressure on EBIT.

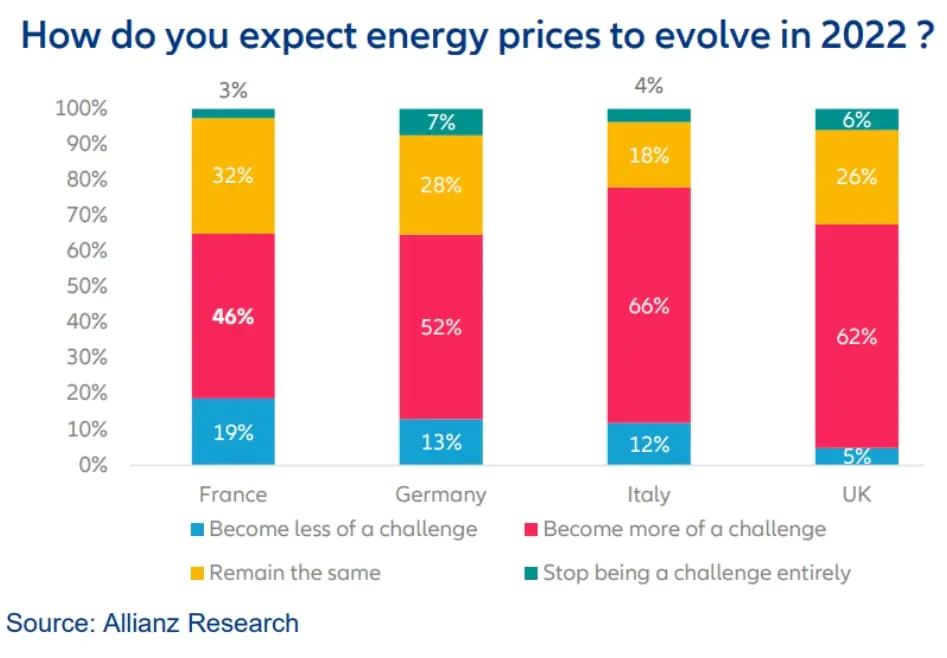

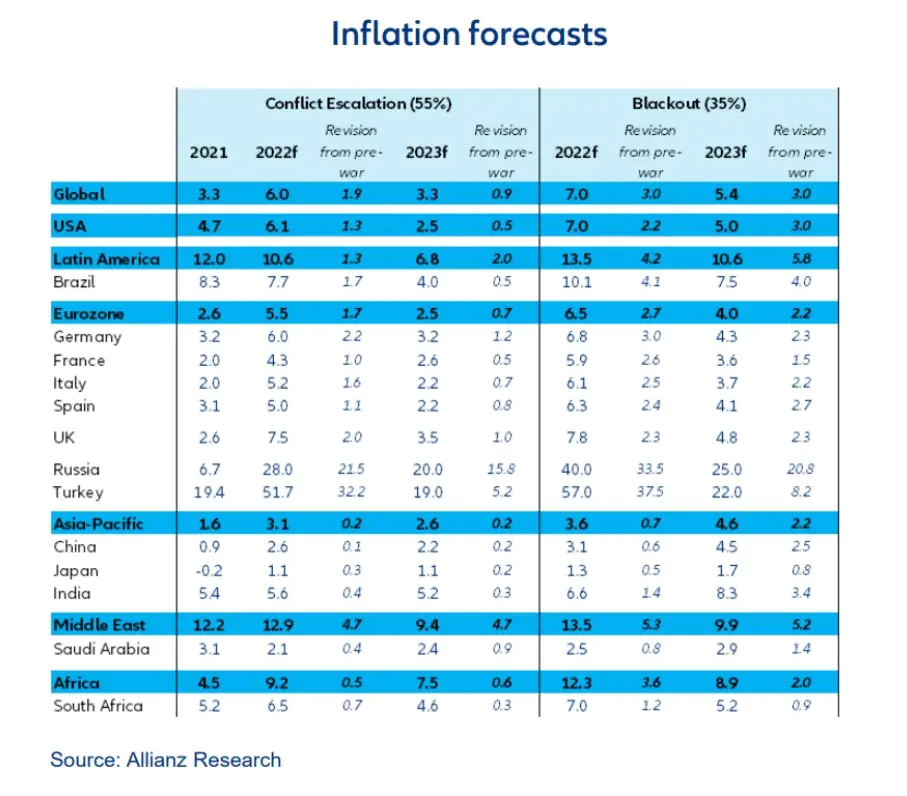

Allianz-Trade estimates high global inflation levels, revising their predictions up by 1.9pp to a minimum of 6% in 2022.

This is due to higher energy prices, longer than expected supply chain disruptions, and the post-pandemic recovery, all of which will contribute to price pressures in equal measure.

The current rise in mortgage rates and the increase in the cost of refinancing will also slow down construction activity.

Payment defaults, from the prevention of payments due to sanctions against Russia and the inability of companies in Ukraine to continue operating, will lead to insolvencies.

Russia is nationalising capital goods and Russian payment obligation servicing is still an open question.

Experts anticipate defaults, with Standard and Poor’s already calling the current status “selective default”.

Projects in Russia or with Russian participation could be stopped or fail, as guarantees and warrants are unlikely to be enforced.

Payment defaults can also be expected from companies that are unable to generate sufficient sales due to supply chain disruption.

These disruptions coupled with high exposure to the current conflict may lead to insolvencies.

How can credit risk management deal with such dislocations in the market and the global impact?

First, credit risk management has the task of identifying transactions, business partners, and industries impacted by the conflict.

Business relationships subject to sanctions must be assessed and necessary restrictions applied to ensure that companies are compliant.

Global investors and buyers must reorient themselves, implement alternative investments, and reorganise supply chains.

Purchasing and sales departments need to be involved in creating scenarios to secure production and stabilise supply chains.

Firms must review delivery commitments with business partners and renegotiate them as needed in light of the current restrictions.

They should also review insurance policies with credit insurers to determine if they are still valid or require renegotiation in light of the current climate.

Another important step for managing credit risk will be for organisations to monitor financial data from business partners with an eye for any indications of insolvency risk or an inability to meet payment deadlines.

These default risks can be assessed with IT-supported secure credit management processes.

While reviewing external stakeholders is critical, firms must not neglect to review their own internal risks.

This can help them reflect on their own risk perspectives, information that can be leveraged for subsequent negotiations with business partners, insurance companies, and financiers.

The pandemic, followed by the war in Ukraine, has brought uncertainty to the world’s economies. The latest @allianztrade Global Survey has checked the pulse of 3,000 companies in 6 markets. Full #AllianzTradeSurvey: https://t.co/zV86FgzvFb pic.twitter.com/HfPmEpiTcm

— Allianz (@Allianz) April 21, 2022

What is the outlook for the receivables finance industry after COVID-19 and the Russia-Ukraine crisis?

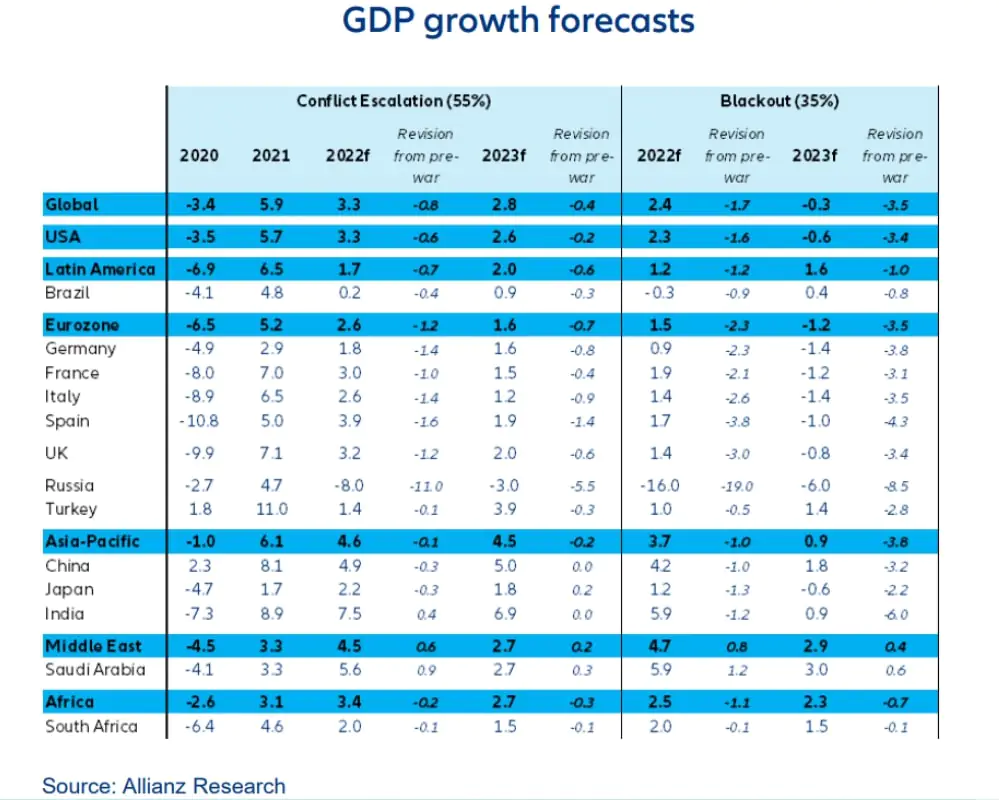

The COVID-19 crisis led to a worldwide downturn in GDP growth.

Prior to February 2022, however, the general pace of global and country-specific economic recovery was relatively clear.

The current conflict in Ukraine has reintroduced uncertainty and volatility into the economy.

Allianz Trade has cut its global GDP growth forecast to 3.3% in 2022 and 2.8% in 2023, revised down by 0.8pp and 0.4pp, respectively.

Ukraine is suffering in the war and the long-term consequences cannot be foreseen in full.

In Russia, the sanctions will lead to a recession this year (an 8% decline according to Allianz Trade), especially after comprehensive sanctions have been extended to the energy sector.

Gas, oil, coal, and other commodity deliveries from Russia will be restricted in the future so that Russia will have significantly fewer financing options from these deals in the long run.

In addition, Russia will likely be increasingly excluded from supply chains and investments in Russia are expected to decline sharply, if not cease entirely.

High inflation means every shipment, transaction, or sale that a company makes, will carry a higher price tag and thus a higher value receivable for the same volumes sold.

Even with lower volumes, demand for higher credit limits is expected to increase alongside the level of price rises and foreign exchange rates.

Economies that are not growing rapidly may have a higher demand for financing and credit lines, which, when coupled with higher interest rates in the financial industry, may increase market stress.

Supply chains will also see difficulties as globalisation remains politically contested.

Countries have become more nationalistic, a trend that started pre-pandemic with the re-emergence of interstate (or inter-block) trade wars being a prime example.

If the Russia-Ukraine conflict means further splintering into global trade blocks, pressure on supply chains and international trade may increase.

Read our latest issue of Trade Finance Talks, May 2022