Estimated reading time: 13 minutes

As reported last week by Trade Finance Global (TFG), the International Chamber of Commerce (ICC) and the World Trade Organization (WTO) have recently published the first-ever standards toolkit for paperless trade.

Drawing on stakeholder consultations through ICC’s Digital Standards Initiative (DSI) over the past year, the toolkit emphasises that one of the primary barriers to the adoption of paperless processes is a lack of awareness of existing standards for digital trade.

To better understand this toolkit and how it can help companies and government agencies adopt available standards to accelerate the digitalisation of trade processes, TFG’s Editor Deepesh Patel (DP) interviewed Emmanuelle Ganne (EG), Senior Analyst, Economic Research Department at WTO and Hannah Nguyen (HN), Director – Digital Ecosystems, ICC Digital Standard Initiative (DSI).

Get to know the experts

Emmanuelle Ganne works at the WTO leading work on micro, small and medium-sized enterprises and on digital technologies and trade, in particular blockchain. Ganne is actively engaged in different fora to promote trade digitalisation, including the ICC DSI, where she represents the WTO on the governance board of the initiative.

Hannah Nguyen works at the ICC Digital Standards Initiative – a collaborative cross-industry effort to advance the digitisation of trade globally.

Nguyen’s focus is on engaging industry participants, standards developing organisations, solution providers, governments and intergovernmental organisations to harmonize public and private sector’s standardisation efforts across the ecosystem.

Ganne and Nguyen wanted to send a signal that the move to paperless trade requires global action and that standardisation matters for all supply chain participants, public and private sector actors alike.

Paperless trade: importance and benefits of standards

DP: Why are standards so important in moving from paper to digital, and what are the benefits for international trade and supply chain actors?

EG: International trade involves many different actors, and many documents have to be exchanged. It has been estimated that on average, a cross-border transaction requires the exchange of 36 documents and 240 copies.

The purpose of digitalisation is to make processes more efficient. Ideally, one would want to avoid having to enter the same information 10 or 20 times in different formats. Imagine the burden and the inefficiencies this creates!

This is why we need to standardize the way data are entered and exchanged along the supply chain – to allow data to flow seamlessly across systems.

The wide-scale use of standards would be particularly beneficial for small companies which have more limited resources than their larger companies to deal with multiple formats.

Closing the trade finance gap

DP: It sounds like standards already exist in trade and supply chains, so what’s the current problem with real-time collaboration and data exchange?

HN: Ideally, international trade should be underpinned by a common set of standards adopted globally and in a legally conducive environment, enabling supply chain participants to exchange data across sectors and borders efficiently.

However, there are several problems behind the current lack of scale in trade and supply chain digitisation:

- The lack of coordination of digitisation efforts has resulted in multiple “digital islands”, each with its own set of standards and rules. In this fragmented ecosystem, it is possible to connect one-to-one, but too costly and complex to connect one-to-many

- There is no single view of available standards to facilitate such interconnection, including the common language to be used and elements of a trusted technology environment needed for seamless and trusted data exchange to occur.

- Not all countries have the appropriate legislative framework, including for Electronic Transferable Records (ETRs) to provide legal certainty to electronic negotiable instruments and recognize them as valid title documents

As a result of this, currently, less than one percent of trade documents are fully digitised end-to-end.

EG: I would add to this that there is little awareness among companies, in particular small companies, about existing standards and the benefits of using standards.

The Standards Toolkit we developed is meant to help fill this gap.

A closer look at the standards toolkit

EG: The toolkit provides an overview of existing standards for trade digitalisation to help drive adoption, identify potential gaps and promote interoperability.

It identifies close to 100 available standards, frameworks and initiatives that offer the potential to enable all parties in global supply chains to speak the same, universal language – regardless of the tools used to automate processes – by leveraging a core set of standardised trade-related document and data formats.

Our objective in developing this toolkit is to equip every supply chain participant, both companies and government agencies, with some of the most notable and widely used standards to help drive adoption of existing standards and through this accelerate the digitalisation of trade processes.

Foundational standards

DP: What are the foundational standards, who uses these, and what do these facilitate?

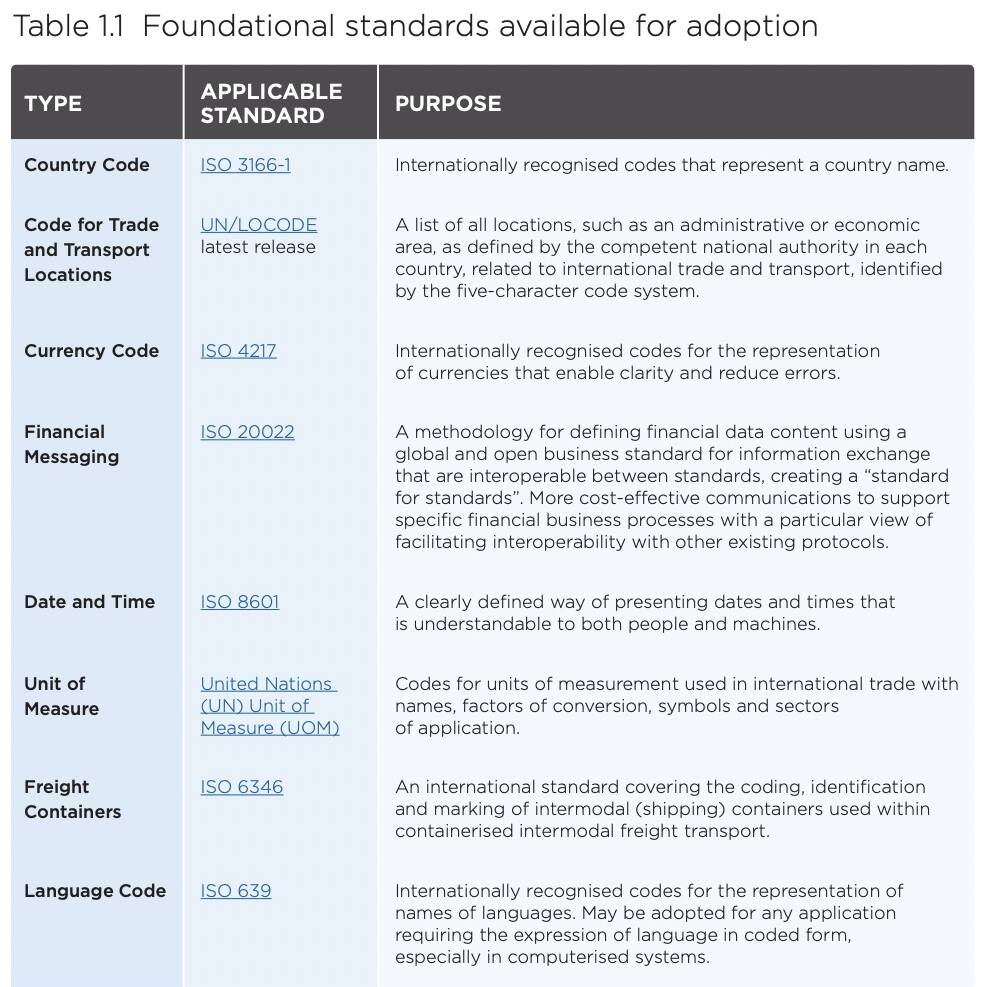

HN: We need to start with some standards that are frequently used and widely recognised regardless of the underlying processes and supply chain actors who may use them.

From country codes to transport locations, from date and time to units of measure, these standards when used consistently across the international supply chain would significantly reduce the amount of translation required when those data are transmitted from system to system and enable more efficient sharing, reporting and reusability of high quality, reliable data.

For instance, what do you make of 11.12.2022 or 11/12/2022?

Depending on who sends and receives it, it could be understood as 11 December 2022 (using European logic), or 12 November 2022 (using American logic). If everyone were to use the ISO 8601 standard, we would all correspond using YYYY-MM-DD format and avoid confusion for both people and machines.

Reference library for cross-border supply chain and foundational standards

DP: What’s the difference between the reference library for cross-border supply chain and foundational standards?

HN: In reviewing the standards for specific processes and documents exchanged in international trade, we recognize that there are some master references, or “standard of standards”, if you will, that have informed the basis of many currently available data standards and those in the works.

For instance, the Buy-Ship-Pay Reference Data Model developed by UN/CEFACT is one of those frequently cited master references. It describes the requirements for a generic reference data model supporting the trade and transport-related processes involved in the cross-border supply chain and covering, at a high-level, the involved business areas, the main parties and the information involved.

It provides the framework based on which supply chain actors, from both private and public sectors, could specify their own specific information exchange requirements while complying with the overall processes and data structures to facilitate interoperability.

UNCITRAL MLETR adoption

How widely adopted is the UNCITRAL MLETR, in your opinion?

EG: As I often say, “code needs law”. Trade digitalisation cannot happen in a regulatory vacuum.

A key component of the legal framework that needs to be in place to support trade digitalisation on a global scale relates to transferable documents, which play a key role in international trade. Electronic transferable documents need to be legally recognized across borders.

This is why the adoption of MLETR-compliant legislation is so critical. Unfortunately, only seven jurisdictions have adopted it to date (Abu Dhabi, the Kingdom of Bahrain, Belize, Kiribati, Paraguay, Papua New Guinea, and Singapore).

A few others, including the UK, are actively working on adjusting their legal framework to make it MLETR compliant. This is good news, but we need to convince governments across the globe to accelerate MLETR adoption. I’m very pleased to see that the ICC DSI is making a big push on this.

HN: in the context of ICC DSI’s efforts to create a globally harmonised and digitalised trading environment, we realised early in the process that we cannot achieve the ambitious aim of establishing a globally harmonized, digitised trade environment with standards development and implementation alone – legal reform is urgently required.

To rally a broad coalition to scale and coordinate global efforts, the DSI under the lead of Raoul J Renard, Deputy Director of Legal Reform, has recently constructed a new Legal Reform Advisory Board (LRAB), comprising of up to 30 members across a range of entities from multilateral development banks, regional economic communities to industry associations and international organisations.

LRAB Members includes the Asian Development Bank, Bankers Association for Finance and Trade, The Commonwealth, ICC France, ICC Germany, ICC Mexico, the International Trade and Forfaiting Association and the United Nations Commission on International Trade Law, to name just a few.

A breakdown of the identifier standard

DP: Can you give us an overview of the identifier standard, what these could include, and how they can be utilised?

HN: Identifiers are the ‘name’ and/or ‘ID’ of ‘elements’ such as products, packages, persons, entities, carriers, containers, trade documents and any other physical/digital items in supply chain and related data exchanges.

Identifiers are a key building block for integrating data within organisations, between business partners and across sectors and industries.

All supply chain actors would benefit from a consistent reference to established identifier standards that provide systematic identification of subjects (legal entities and natural persons with rights and obligations) and objects (entities without rights and obligations).

EG: Identifiers are indeed critical for international trade.

As global value chains become increasingly digital, knowing “who is who” and “what is what” is essential. Using globally accepted and standardised identifiers and code schemes would facilitate the creation and sharing of unique ‘end-to-end’ identification of subjects and objects, resulting in richer, high-quality data in the international supply chain.

It would also increase the ability to track-and-trace, be it locations of particular objects or status/tracking events such as receiving, packing, shipping and transporting, which occur to the traceable object during its lifecycle across different supply chain actors’ processes.

Let us give you 2 examples regarding systematic identification of subjects and objects.

When it comes to legal entities and natural persons, supply chain actors need to be able to verify the identity of customers, partners and suppliers in real-time.

Practically this means they need to answer a few fundamental questions such as “Who are you?”, “Which legal entity are you acting on behalf of?”, “What is that legal entity?”, “Show me that you are authorized to do xyz?”and “How can all this be proven digitally?”.

Verification, authentication and authorisation are pivotal within any business transaction. Broader adoption of standards such as the LEI and W3C Verifiable Credentials can improve transparency, trust and efficiency in the entire international supply chain.

EG: When it comes to objects, currently different supply chain actors may use different ways to identify trade items that move through the supply chain.

The Global Trade Item Number (GTIN) is a standard that can be used by any company to uniquely identify all of its trade items anywhere, including on the physical products, in business transactions, in Internet applications, as well as within databases and IT systems.

Another example is the Global Shipment Identification Number (GSIN) that the seller or the shipper of goods can use to assign a globally unique number to identify a shipment.

The move from paper to digital

DP: How can corporations and MSMEs use data standards in their organisations and how can this help ensure the movement from paper to digital?

EG: we developed this toolkit because we realized that one of the reasons why adoption is so low is that many companies are not aware of existing standards.

This toolkit is meant precisely to help companies make better use of standards and through this accelerate the transition to a fully digital environment for trade processes.

There’s often a disconnect between the trade financiers and the freight forwarding industry. Can standards for carriers, freight forwarders and logistics operators help facilitate the flow of goods from both a physical and monetary perspective?

HN: We definitely support the development of standards that take into account the requirements and feedback of various supply chain actors that need to leverage or interact with those standards.

For instance, the ICC Banking Commission has numerous rules, frameworks and standards that support trade financiers, which we need to ensure are harmonised towards the standards for electronic Bills of Lading (eBLs) developed by DCSA, BIMCO and FIATA.

One example is the ICC Uniform Customs and Practice for Documentary Credits (UCP600), which has a supplement for the electronic presentation of documents for banks (eUCP).

Ultimately, all stakeholders including banks, customs and regulators interacting with the electronic data generated by carriers, freight forwarders and logistics operators, need to incorporate standards into their workflows to enable meaningful end-to-end integration.

That’s the reason why one of the most important pillars of the DSI is the Industry Advisory Board (IAB), where we have importers, exporters, freight and logistics, banks and other strategic organisations sitting around the same table.

They are there to ensure the physical flow, the financial flow and the data flow are in sync and support one another.

The role of customs authorities and cross-border regulatory agencies in standardisation

DP: How can customs authorities and cross-border regulatory agencies streamline processes by standardising? Can you give a few examples of current market practices that exist?

EG: International trade is about crossing borders so customs and other government authorities play a key role in international trade processes.

The WCO developed its data model for customs processes because they realized that customs agencies needed a common language.

A 2005 study had found that in Australia, 22 agencies collected the name of the exporter on 118 forms in 16 different formats ranging from 20 to 300 characters. I think these numbers speak for themselves.

The WCO Data Model that was subsequently developed and that is now used by customs includes data sets for different customs procedures, as well as information needed by other regulatory agencies for the cross-border release and clearance at the border. But customs are only one link of the chain.

For paperless trade to become a reality, we need an end-to-end approach to trade digitalisation and standardisation.

Interoperability helping connect the dots

Interoperability is also important to leverage digitalisation frameworks. What are the most important frameworks and how can they help connect the dots?

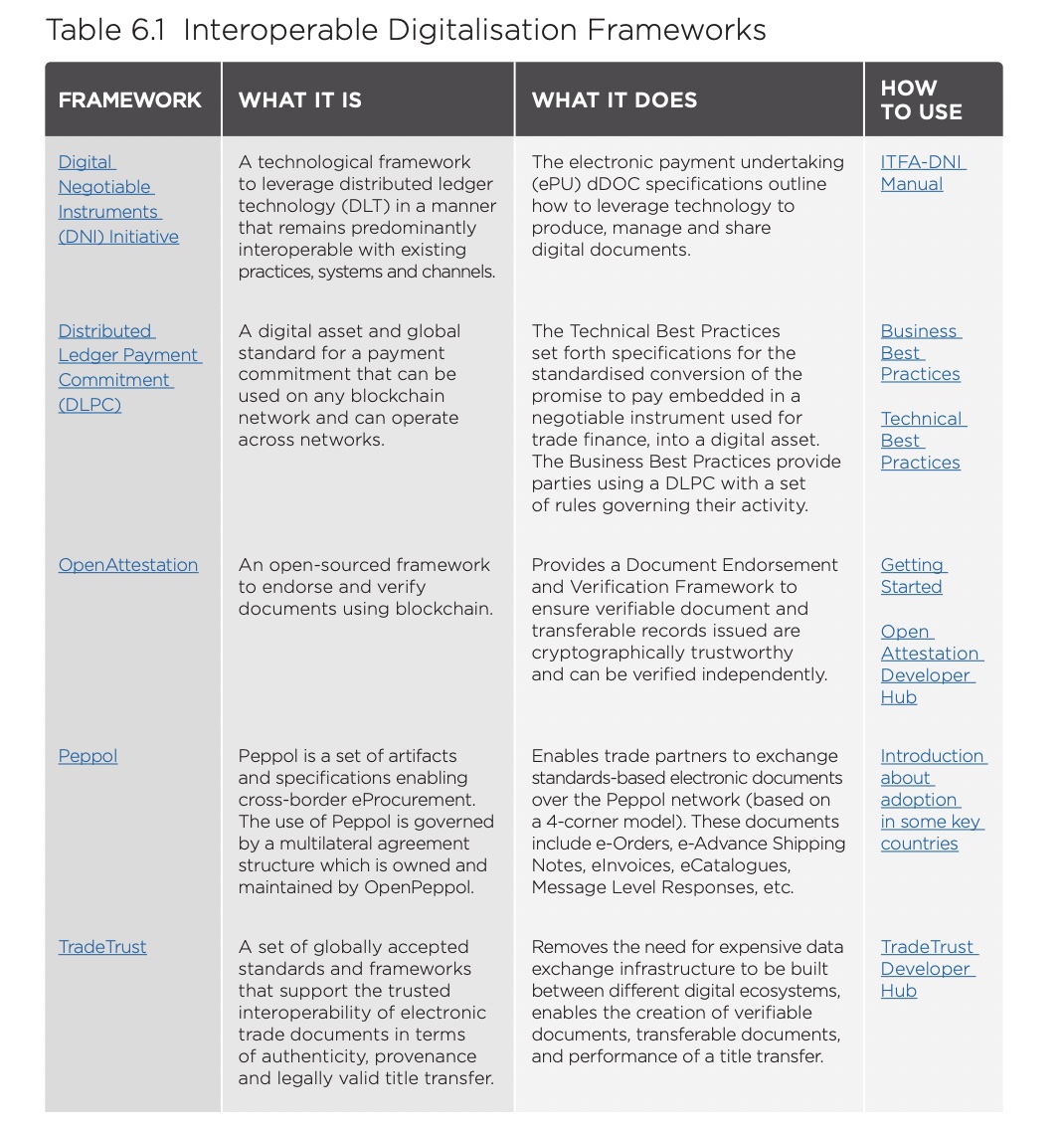

HN: For supply chain actors to fully reap the benefits of trade digitalisation, we need everyone in the supply chain to be connected.

Since we live in a diverse world where different actors may have different access to or make different choices when it comes to technology, vendor and technological complexity, we need Interoperable Digitalisation Frameworks that can enable all actors to talk and exchange information in a secure and trusted manner.

Take TradeTrust for example, it is one of the recommended frameworks in our toolkit because it removes the need for expensive data exchange infrastructure to be built between different digital ecosystems, enables the creation of verifiable documents, transferable documents, and performance of a title transfer.

When going digital, think long term

EG: Think long term, not short term!

Adopting standards and putting in place new processes does require some investment, but it will pay off in the medium to long term.

Moving digital can significantly cut costs and generate huge benefits, especially for small businesses. So don’t wait! The sooner you make the move the more rapidly you’ll be able to enjoy the benefits.