Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn

The last two years have been a difficult time for SMEs, who have had to grapple with the challenges of supply chain disruptions, a global credit crunch, and inflation during the COVID-19 pandemic.

But despite the uncertainty and volatility of the last two years, SMEs’ working capital practices have evolved significantly, and perhaps irreversibly.

Though the global trade finance gap has continued to make new highs, hitting $1.7 trillion in 2020, both SMEs and the banks that serve them are now focusing on new ways to access much needed capital.

At the forefront of this challenge is, of course, digitalisation, which in trade finance is driven by a mixture of new technologies and partnerships that aim to increase efficiency and reduce costs.

But where does the industry currently stand on the challenge of digitalisation, and how much closer are we to the ambitious goal of frictionless, borderless trade finance?

Iain MacLennan is the head of trade and supply chain finance at Finastra, a UK-based fintech with an annual revenue of over $2 billion.

In his current role, MacLennan oversees all of Finastra’s product management and engineering capabilities for trade and supply chain finance, and he also manages Finastra’s engagement with the International Chamber of Commerce (ICC).

☁️ #Cloud is more than a technology; it’s a way to transform and ride the wave of #digital innovation effortlessly and securely. Read more in this blog post and learn how cloud can maintain a high standard of compliance more easily and proactively protect your #data.

— Finastra (@FinastraFS) February 7, 2022

Pandemic post-mortem: SMEs suffered disproportionately

Looking back on the last two years, MacLennan believes the COVID-19 pandemic has raised the urgency of digitalisation in trade finance.

“If we talk to our clients and if you look across the industry, I think what the pandemic did was to drive digitisation not as a three-year journey, but as a question of how can we do this as quickly as possible – whether it’s on the channel perspective, the data perspective, or just in our operational processing needs,” said MacLennan.

While SMEs in rich western countries were spared the worst of the COVID-19 credit crunch, we know from the Asian Development Bank’s (ADB) 2021 report that this was the exception globally, not the rule.

For example, we know that 40% of trade finance applications rejected by banks during the pandemic were from SMEs, even though SMEs account for only 23% of trade finance demand (compared with 54% for large corporations).

Moreover, as MacLennan points out, the top pain points for SMEs were much the same as in previous ADB reports, suggesting that innovation at the technology level is struggling to trickle down in pratical terms.

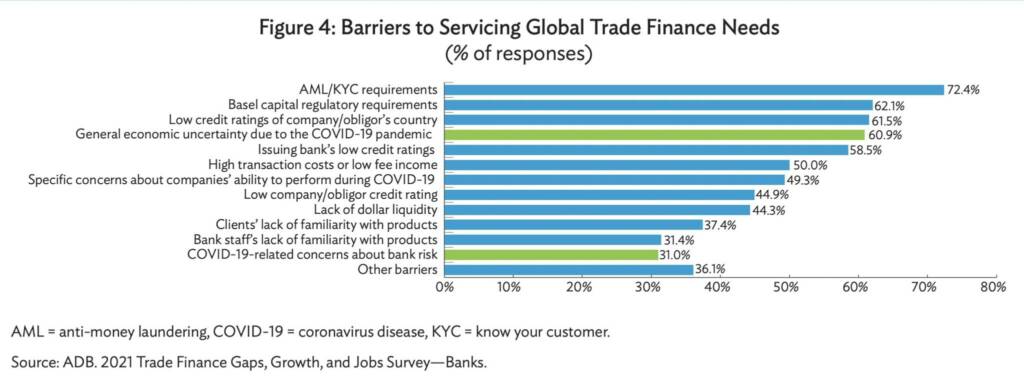

Know your customer (KYC) and anti-money laundering (AML) requirements were the number-one barrier to servicing global trade finance needs, cited by 72% of respondents.

This was followed by Basel capital regulatory requirements (62%); low credit ratings of company/obligor’s country (61%); general economic uncertainty due to the COVID-19 pandemic (61%); and issuing bank’s low credit ratings (58%).

“KYC and AML is the major friction point that a bank has – both within its own processes and in terms of what it has to do to meet regulatory requirements,” said MacLennan. “These processes are in place for the right reasons, but the question is how can we reduce that friction?”

One solution offered by MacLennan – and already in use at ICC TRADECOMM – is that of a marketplace platform that can automatically pull in the information that a bank would need to satisfy KYC requirements on a customer’s behalf.

“We look at it both from a KYC and a ‘KYT’ – know your transaction – angle, so we are asking: is this the transaction I would expect between these two parties?”, said MacLennan.

“What are the goods represented in the transaction, and is this deal something that I would expect to happen?

“What we can do from these data points is to then provide a link to the operational part: i.e. How do I make the job easy for you?”

Tech, law, and digitalisation

When looking at barriers to digitalisation in trade finance, MacLennan believes that the main obstacle now lies not in technology, but in law.

“We have always said that legislation lags innovation: the technology is there, and the law is catching up,” he said.

A prime example of this dynamic, as MacLennan suggests, is the slow uptake of the Model Law on Electronic Transferable Records (MLETR).

For MacLennan, the solution to this problem is to “bridge” new technologies in trade finance with both data and legislation, using harmonisation approaches such as the ICC’s Digital Standards Initiative (DSI).

One of the major challenges of this approach, however, is how to connect the dots between and within such enormous webs of data, and that’s where Finastra’s partnerships come in.

⛅️ Migrating operations to the #cloud enables banks to meet or even exceed current and emerging demands of their customers. Join Finastra’s Managed Services Partner program and help banks in making them fit for the future. https://t.co/N8l9KRmId6 pic.twitter.com/epCX0J3xFS

— Finastra (@FinastraFS) March 10, 2022

‘Open by default’ partnerships

Within the trade finance ecosystem, Finastra sees itself as “joining the dots” between clients, financiers, and their underlying transactions.

With this goal in mind, Finastra has partnered with the likes of Conpend, Cleareye, Enigio, Contour, and Marco Polo – partnerships that MacLennan describes as “open by default”.

When working with partners, MacLennan said the main challenge is always how to agree on resource investment, and how to prioritise what to bring to market.

“We obviously have FusionFabric.cloud, which is key to our strategy, both on ICC TRADECOMM and on Fusion Trade Innovation, but across the whole of the Finastra suite, it allows third-party fintechs to connect either into the core product or through our marketplace,” he said.

“A lot of this collaboration speaks to the idea of interoperability and adoption, and I think you can see that happening now around the digital ecosystem.

“With the ICC’s DSI and the like, we know that we need to cooperate to have a true end-to-end experience across all parties.”

You've heard of the cloud. But how does the cloud keep our data safe?

— Finastra (@FinastraFS) February 21, 2022

In the first session of our 3-part webinar series, Microsoft and Finastra will examine network security and help us understand how Best Known Methods (BKM) keep things secure. Watch now: https://t.co/dfXvSeezP4

When does collaboration become competition?

When working with the likes of Conpend, Enigio, and Contour, Finastra aims to strike a balance between competition and collaboration, knowing that each partner is expected to add value to the overall proposition, but without competing directly.

Admitting that this is one of the more delicate areas of fintech collaboration, MacLennan said that openness and conversation are key to keeping all partners happy.

“I go back to being open by default. We won’t dictate to a client what they should use. Obviously, we prefer them to have Fusion Trade Innovation as the base and then a series of ecosystem providers outside of that,” he said.

“But whether they choose to go with a particular digitisation and documentation compliance partner, that’s the customer’s choice, and what makes sense may vary depending on region and sector.”

At present, one of Finastra’s biggest partnerships is with Enigio on the transfer and ownerhsip of digital documents.

Enigio’s blockchain-based digital documents technology allows participants to sign and share the ownership of the document, so that individual users can see who is the owner of a particular document.

“What it allows our customers to do is to engage directly from Finastra, directly from Fusion Trade innovation through our open APIs, and into Enigio and the blockchain of Enigio,” said MacLennan.

“This way, we can make sure that customers take on the benefits of the blockchain, and ensure that ownership of and access to the documents is both secured and attributed.”

Please listen to the full podcast to find out more, and for more info about the World Trade Symposium mentioned at the end of the podcast, click here.