2015 was a year of volatility in equity and debt markets, driven by tumbling oil prices, political issues and Greece taking the Eurozone stage. On the upside however, UK bank lending to businesses grew for the first time since 2009 and the construction and manufacturing industry saw a great year of growth.

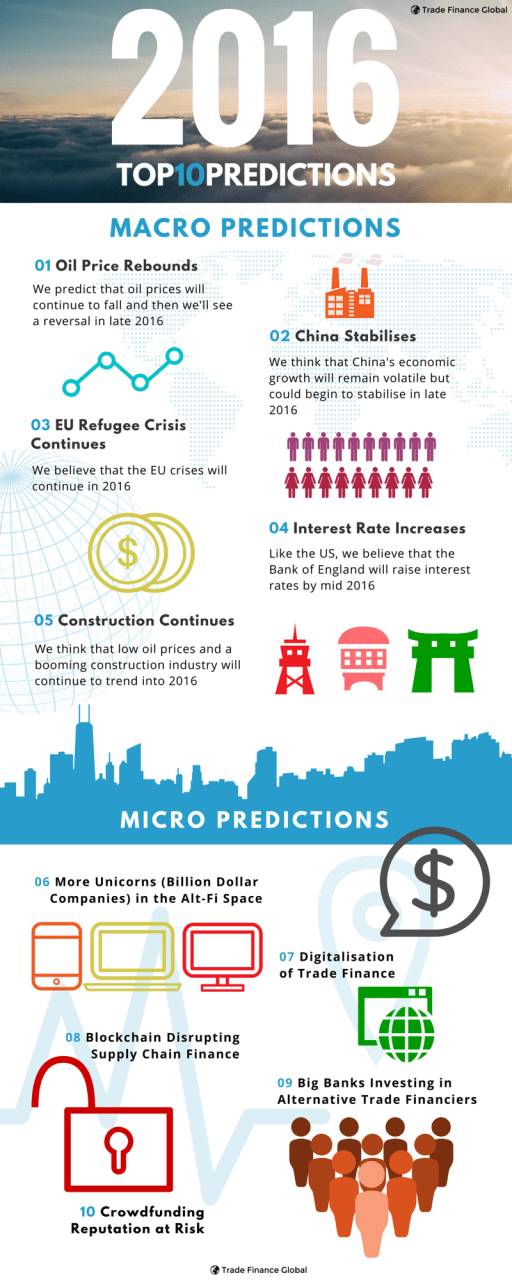

Here at Trade Finance Global, we’ve predict the top 5 macroeconomic and top 5 microeconomic trends that will carry us through 2016. Fortunately it’s fairly good news for trade and stock finance.

- Oil price rebound – 2015 has seen a remarkable drop in oil price, with brent crude falling from $110 per barrel in the summer of 2014 to a low of $37 per barrel. This has seen unprecedented cuts in oil exploration spend and the affects have been seen where extraction is no longer profitable, such as deep water drilling off the coast of Aberdeen, the UK’s oil capital. For the import and export global economy (who didn’t wrongly hedge), small companies have thrived with cheap production, lower cost prices and higher margins, although we believe that there were be a small reversal of this trend in 2016, bringing oil to around $60 per barrel by the end of the year.

- China growth will remain volatile but stabilise – If China sneezes, the world will catch a cold. For the first time, China’s economic growth has slowed down from 8% GDP growth in the last 5 years, to 5.8% in 2015. This year had all eyes on China as it’s currency, the renminbi, continued to devalue, imports and exports fell, and so did consumer confidence. As a global powerhouse relying on heavy debt and investment and population decline, we believe that China’s volatility will stabilise towards the end of 2016, however too much volatility could take us into a global recession.

- Continued refugee crises in Europe will cause political tension and instability – The UK will be holding a Europe in-out referendum in 2016, caused by migrant and refugee issues and the civil war in Syria. We doubt that the UK will leave the EU, but the fact that it’s on the cards indicates a lack of confidence in the European Central Bank. This year has seen a whirlwind of political, economic and social issues in the EU, including the terrible Paris terrorist attacks, the European refugee troubles, and Greece turmoil in relation to their International Monetary Fund loans.

- Increase in interest rates – Interest rates have remained close to 0 (some economies being negative) in order to stimulate the economy, which has consequently ballooned balance books of the central bank, however we believe that interest rates will rise incrementally in 2016. For the UK, despite the early news by the ONS of slow growth in the third quarter of 2015, it’s still likely that the UK will follow it’s counterpart’s footsteps in the US and raise interest rates by mid-2016. What does this mean for businesses? It’ll be more expensive to borrow, therefore margins will be squeezed and this will be challenging for exporters and the trade sector. However, this will be gradual with small increases.

- Construction will take the biscuit – Despite recent ONS statistics indicating a 1.9% and 0.4% contraction in the construction and manufacturing sector respectively, we believe that this a microeconomic trend, and that these sectors will grow in 2016. Low oil prices and a growing demand for housing gives us strong reason to believe that we’ll see a stellar 2016 in the construction sector, both in the US and Europe.

- Unicorns ($1bn+) in the business funding space – Unicorns are companies who’s valuation has exceeded $1bn. So who’s in the unicorn club? Guys like Uber, Funding Circle, Air Bnb and Spotify. Check out this graphic by Wall Street Journal to see who’s in the billion dollar startup club! We think that someone in the alternative finance space will join the unicorn club in 2016. Be that equity funding, peer-to-peer debt lending or car finance. A shift away from bonds to high yield investments such as short-term debt has been a growing asset class among investors, and we think that this will continue into 2016, especially given interest rate rises in the US, and the UK to potentially follow suite.

- Digitalisation of trade finance – We’ve covered digitalisation of the Letter of Credit, and know that electronic Bills of Lading (eB/Ls) already exist, but we are certain that changes in legislation and the huge advances in the fintech and electronic payments space this year will extend into the import/ export market. We don’t quite envisage an ‘Apple Pay’ style revolution just yet to one of the oldest financing solutions on the planet, but we are confident that we’ll see considerable investment in the digital / shipping space.

- Blockchain disrupting the SCF cycle – (Note, we haven’t used the term bitcoin here, rather, cryptocurrencies and the backing technology; the blockchain.) The blockchain has the potential to hold payments in escrow, and be validated by a third party other than an issuing bank, so we’re confident that there will be considerable investment and interest in technology to facilitate trust between buyers and sellers in the trade finance space.

- Big banks backing alternative finance companies – We think that we will see big banks and lending institutions backing smaller alternative financiers in 2016.

- Crowdfunding reputation at risk – It’s only been a few years since Crowdfunding for equity investment (e.g. Seedrs and Crowdcube) have launched; and they have grown like gangbusters. We believe that investors may not be prepared for the risks of not seeing an ROI (in fact, a loss) on some of their investments, which could cause mistrust within the lending space. Lenders should welcome regulation and rigour within their businesses, to protect the reputation of the industry.