As businesses emerge from a series of lockdowns, working capital practices have shifted dramatically.

Even prior to the global pandemic, banks were rethinking the way they position themselves and deliver their services, as technological advances increase opportunities to meet the needs of corporate clients in a faster, flexible, and more agile way.

To explore advances in working capital and trade finance, Finastra, alongside The Center for Financial Professionals (CeFPro), conducted a survey of 110 professionals at financial institutions globally.

The goal was to determine what progress has been made towards end-to-end digitisation across financial services.

Five key areas stood out: changing business models; digitised trade finance; the adoption of supply chain finance; fintech partnerships; and the use of technology to reduce costs.

Changing current business models

Interestingly out of those surveyed, only a third of banks plan to make changes to their business model.

With 41% focusing on opportunities in new markets, it seems clear that of those looking to update their business models, many are grasping the opportunity of market changes and diversifying accordingly.

When asked what areas are expected to change in their trade finance models, the results showed trends towards expansion.

Almost half (49%) said expanding product offering was a top priority; followed by a transition to digital (40%); a reduction in market participation (30%); and a reduction in product offering (17%).

However, the pandemic has rocked most sectors and industries, and, as such, many organisations are looking to protect their business models from future volatility and disruption.

For example, some are looking to further diversification across markets and products to spread risk more widely.

In addition, increased use of digital channels and solutions is essential to address changing user experience expectations, and to deliver the personalised, smart digital experiences corporates expect.

Digitised trade finance

Through automation, businesses can further enhance efficiencies and streamline processes.

It appears that even with an increase in remote workforces and disruptions, many did not utilise digital solutions to limit disruption.

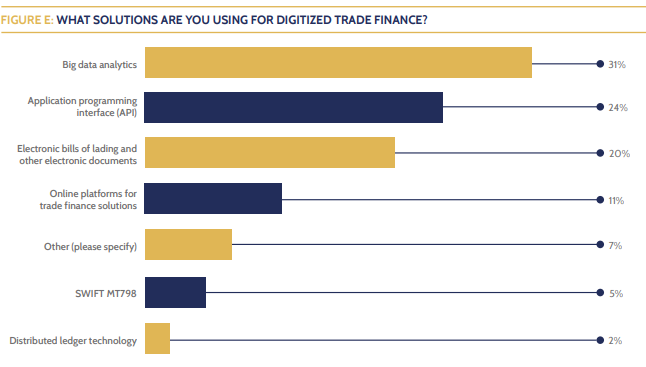

The research showed that 31% are leveraging big data analytics for digitised trade finance, while 24% are focusing on introducing application programming interfaces (APIs).

This influx of big data can seem overwhelming, but when used correctly, organisations can gain further insight into their customers’ needs and accelerate the business.

However positive digital transformation is for financial institutions, there are still some challenges that lie ahead.

The three key transformation priorities banks need to address through digital include regulatory compliance (71%), account validation (69%), and risk management (54%).

These insights highlight a difficult challenge for banks: that while they want to direct their focus towards customer service and meeting the needs of their clients, investment is having to be channelled towards meeting risk and regulatory challenges, such as anti-money laundering (AML) and know your customer (KYC) requirements.

The question is whether that will enable financial institutions to remain relevant over the next five years, or whether it will allow them to only focus on and meet immediate challenges.

It must be recognised that banks need support, and need to be empowered to go out and help businesses.

Fintech partnerships are the answer here. For example, banks can use specialist fintech apps to address KYC and compliance challenges, thus minimising the risk of fines.

Adoption of supply chain finance

There is still work to be done with the adoption of supply chain finance, as only 48% of respondents said that they offer a suitable or fully functioning supply chain finance platform.

While it is clear that organisations have identified their customers’ business projections and approaches, many remain uncertain as to their own.

Growth expectations appeared low compared to the level of adoption anticipated over the next two to three years.

Some 34% of respondents are expecting 1%-5% growth, while another 30% of respondents are expecting 11%-15% growth.

When analysing the potential obstacles within supply chain finance over the next five years, a range of areas were identified.

Some 24% of respondents expect competition from non-banks to have a ‘severe impact’ on supply chain finance, while 39% expect ‘no impact’ at all from non-banks or fintechs.

Once again, this could indicate the divide between those operating in traditional areas of trade finance compared with those moving towards digitalisation and updated business models, which non-banks are increasingly disrupting.

Overall, the adoption of supply chain finance and migration to new business areas seem moderately developed, albeit with a reluctance to move away from some traditional trade finance business models.

Fintech partnerships

Collaboration between banks and fintechs has become more common in recent years.

Partnerships give banks access to new technology at a faster rate than before, resulting in enhanced customer experiences.

Over the next five years, digital transformation annual budgets are expected to increase by around 29%, and many corporate banks are already partnering to achieve their digital transformation process.

Almost 70% of banks are either already engaged with or planning to engage a fintech partner to help them achieve the required transition.

Most banks have realised that, in order to access the required expertise and capabilities to stay relevant and meet clients’ future expectations, they need to work with these partners.

For example, to provide clients with the ability to self-serve via digital banking channels, with compliant solutions that integrate front-to-back, 24 hours a day, seven days a week.

Corporate customers’ priorities are shifting away from account/relationship management towards online banking portals and value-add services for working capital finance.

Using technology to reduce costs

A platform-based approach enables banks to innovate fast in a flexible way.

It allows them to add solutions from fintechs incrementally in response to changing customer requirements, and in line with their investment plans.

Corporates need an omnichannel experience that delivers truly connected corporate banking – leveraging market-leading solutions through a pre-integrated ecosystem.

That is something that fintechs, with their agile nature and expertise, can help banks deliver.

Banks must also minimise total cost of ownership in order to deliver solutions to clients efficiently and to surprise and delight customers, and must be ready for truly open finance.

The investment requirements can pose too much of a challenge for banks to do it alone.

They need outside expertise to manage regulatory and data security pressures, and they need expert partners who can effectively manage integration with existing systems and standardisation across the whole business unit.

They also need solutions that can be upgraded easily, without the need to start again from scratch every time.

Many will want to evolve one step at a time, implementing solutions that connect to their existing bank ecosystem, enabling them to grow their offering incrementally.

The future

Although world trade is predicted to grow by 4.9% as the COVID-19 pandemic eases and economic activity begins to stabilise, the greatest consensus from this survey is the current level of uncertainty.

As the industry emerges from the effects of COVID-19, moderate growth is expected.

However, costs will continue to be high without the adoption of automation and digitalisation, not least due to the high labour costs associated with manual processes.

Although respondents seem to be looking to expand their product portfolios in order to spread risk, many are focused primarily on traditional trade finance products, with less adoption within supply chain finance.