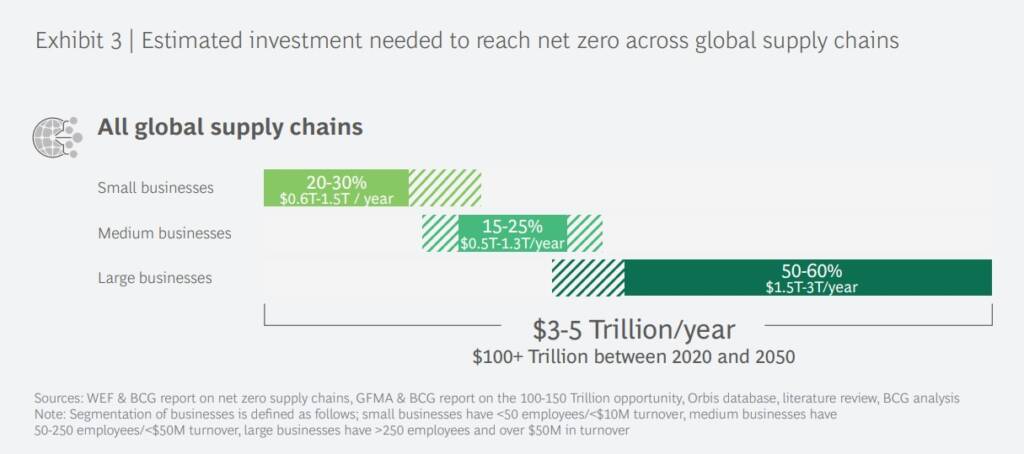

New research has found that up to $50 trillion in new investment in SMEs will be needed to reach global net zero transitions goals.

A joint white paper, released today by HSBC and Boston Consulting Group (BCG), found that up to half of the $100 trillion investment needed to deliver net zero supply chains will have to be directed towards SMEs.

In ‘Delivering Net Zero Supply Chains’, HSBC and BCG estimate that between $25 trillion – $50 trillion is needed by SMEs globally to stay on track to reach net zero by 2050.

Moreover, despite increasing numbers of large corporates making emissions commitments, the report found that delivering on Scope 3 emissions – indirect emissions that occur in a company’s value chain – remains a significant challenge.

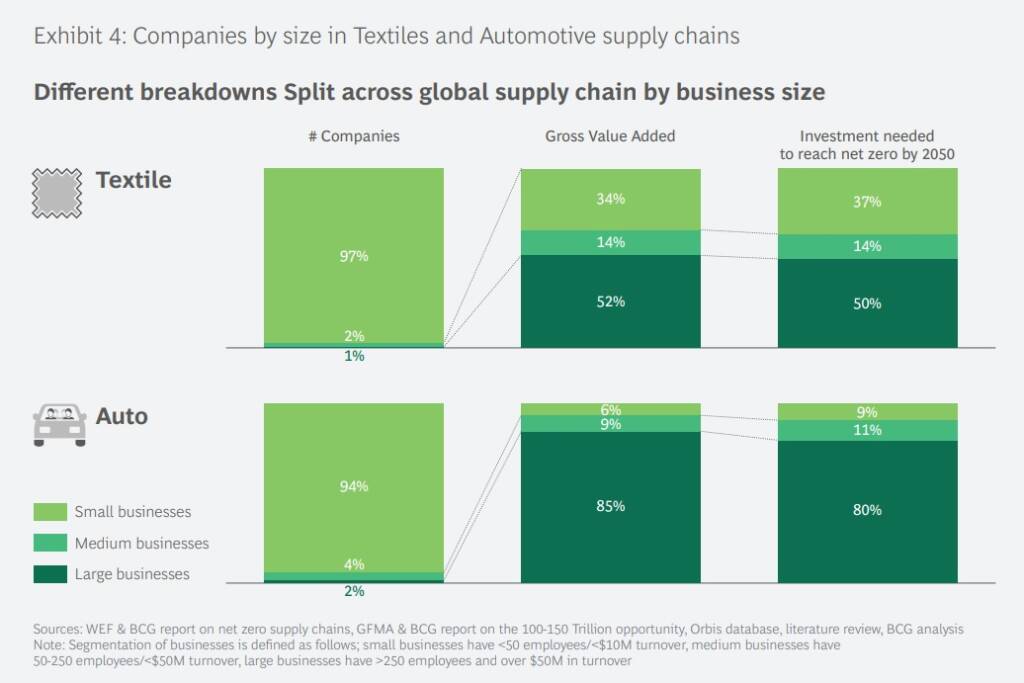

Based on a study of the automobile and textiles sectors, the study found that SMEs lack in-house climate expertise and access to capital to drive and fund climate transformation.

Natalie Blyth, global head of trade and receivables finance at HSBC, said:

“The reality is that delivering on ‘Scope 3’ emissions will be extremely challenging unless urgent action to support SMEs is taken now.

“This report highlights the need for a new front in the battle to combat climate change and to build coalitions, break down barriers across supply chains and stakeholder groups, and transition supply chains holistically.”

The research found that addressing these issues will go beyond giving SMEs incentives to work collaboratively to marshal technology, resources, and know-how and turn them into real-world action.

A bigger challenge might also be the need for wholesale changes in product, business models, and organisational culture, the report noted.

As a result, supply chains are seen as key, given the inter-dependency of firms and the need for a holistic economy-wide transition.

Sukand Ramachandram, managing director and senior partner at BCG, said:

“We cannot reach climate goals without transforming SMEs, and this report offers a road map for that transformation.

“Forward thinking governments, industries, and companies will have an eye to the economic opportunity that exists for those who can inspire and incentivise, and lead the charge from ambition to action.”

The research identified a need for a “leadership crucible” involving multiple actors. It also found that large corporates cannot simply mandate new standards and “demand more” of their suppliers, as this would likely lead to limited progress and missed goals.

Instead, they will need to co-invest and provide liquidity through supply chain finance, share transition knowledge and resources, and help propagate innovation and technologies across supply chains to reach scale.

The researchers found that governments will need to establish incentives to rebalance the economic equation or mandate change via policies in areas such as disclosure, while ensuring cross-jurisdictional alignment.

Industry bodies and NGOs will need to disseminate knowledge and resources, and lobby for change using their in-field expertise to support suppliers and inform development of industry standards.

Consumers may also have to compromises in price, form, and function, the report argued, and vote with their feet, even if that means changing habits.

According to the report, banks will be uniquely positioned to support clients big and small. They can ring-fence funding to finance the transition and use their data and experience to identify impactful projects and inform net zero risk-management considerations.

Additionally, they can partner with clients on sustainable supply chain finance programmes to lower the cost of borrowing for SMEs.

And while they can continue to facilitate investment through capital markets and syndication, they will also need to partner more with governments and development banks on public-private-partnerships (PPPs) to be able to fund more.

A roadmap for the transition

Though the roadmap for the net zero transition will vary from one sector to another, the report identified seven principles that apply to every sector in the move towards emissions-free supply chains:

1. Rethink product design – Go back to the drawing board and revisit product design, rather than just optimising existing processes. Net zero supply chains will not be delivered by tinkering at the edges, and may require a wholesale re-evaluation of how people use products and how they are made.

2. Embrace collaboration – Supply chains are asymmetric, with top-quality talent, education, and resources at one end, and many smaller, less sophisticated SMEs along the chain in need of help. All need to collaborate to succeed: to share knowledge, technology, investment, and resources.

3. Build the capabilities needed for change – The transition will expose skills and knowledge gaps, which will be greatest for SME suppliers. Capability development and training will help accelerate the shift.

4. Invest in climate tech – Hitting net zero by 2050 requires investment in R+D now, alongside close collaboration between industry, science, and finance to accelerate bringing innovation to market at scale.

5. Develop better data structures – There’s a need to build systems that can gather operational data across the supply chain to enable transparent, comparable, and consistent ESG metrics that are made widely available. This includes to end-consumers, so these can inform decisions at point-of-purchase.

6. Think about policy and standards holistically – A historic lack of consistency in policies, standards and market practices has resulted in businesses being held to ever-changing requirements by their partners – driving up complexity and cost. Momentum in delivering consistency needs accelerating. Supply chains cross national borders and need policies that hold all to a high but workable common standard.

7. Enable financing – Targeted, ring-fenced, and affordable capital is a key enabler, but the banks will not be able to do this alone. Banks need access to mechanisms to team together (e.g. syndication), co-invest with corporates, and form PPPs to help deliver financing to where it’s needed most. This requires appropriate data structures that provide transparency and traceability of financing – where is it being directed, how is it being used, and by whom.

‘Delivering Net Zero Supply Chains’, HSBC and Boston Consulting Group (BCG), pg 9-10