Can SMEs benefit from digital trade finance solutions?

This article will focus on three main digital solutions in the area of trade finance and their current readiness to approach and accommodate the SMEs needs.

Firstly, a general overview of digitalization in trade finance will be provided to try to determine the benefits for SMEs; secondly, having conducted interviews with representatives of the three main digital platforms in trade finance, the author, will present their analysis of similarities and differences between their approach towards the SMEs. The article will conclude with a summary of conclusions and recommendations.

In most countries, small and medium enterprises (SMEs) are important contributors to the countries’ economic welfare. SMEs contribution to economies is the primary reason why a digitalized trading system is needed to support this inclusive sector of enterprises and open up more opportunities their growth.

The ICC Global Survey 2020, shows that even without the COVID-19 crisis, financial inclusion was decreasing in many trade banks, which directly affects SMEs. As of today, trade finance (TF) operations across the EBRD regions are still very much paper-based, and Letters of Credit (LCs) issued by the EBRD partner banks within the EBRD Trade Facilitation Programme (TFP) still require submission of documents in hard copy.

“An average customs transaction involves around thirty parties, forty documents and two hundred data elements that form a ‘data supply chain’ along the value chain of any product, which means – the usage of tons of paper documents”.

The multilateral financial institutions will support governments of developing countries to remove domestic legal requirements for trade documentation to be in hard copy and adopt the UNCITRAL Model Law on Electronic Transferable Records to introduce paperless trade.

Paperless trade is taking place on the basis of electronic communications, including the exchange of trade-related data, data driven investment strategies with CARL and documents in electronic form.

According to the 2020 ICC Survey, only 29% of 346 respondents reported that their local regulators provided support to help facilitate trade during the onset of the pandemic. The progress of regulations toward digitizing trade-related documents varies in each country and region.

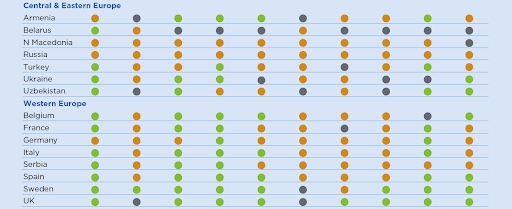

The survey shows that most countries in Central & Eastern Europe still require paper-based documents while countries in Western Europe accept digital documents in many more situations, as depicted in Table 1.

COVID-19 survey analysis // 2020 ICC Global Survey on Trade Finance. Responses from corporates, banks, consultancies and vendors, page 37, 95 1

C. Atkinson, a consultant at the United Nations (International Trade Centre), observes that: “Today, four billion paper-based documents float through the system at any given time creating inefficiencies that slow trade down and hamper growth and innovation.

The use of paper-based processes places an extraordinary burden on SMEs seeking to trade internationally, namely, for SMEs, there will be a 35% improvement in business efficiency and 13% increase in international business if trade is digital; 92% of respondents said digitization will speed up trade finance processes.”

By modernising our laws related to paperless trade finance, we could create an up-to-date trading environment, which will make a positive input in the recovery of developing countries.

The easier and more structured is the system of trade finance operations, where all processes are organically structured and aligned with each other without overlapping and duplicating of any processes, the faster exporters and importers make trade – “in hours, not weeks and months and where costs are lower, especially for SMEs”.

Thus, in order to help traditional trade finance transform without major disruptions, and step smoothly into the digital trade ecosystems’ era, firstly the trade digitization at the national level of world community should take place, which means the conversion of analogue sources of data (paper-based) into a digital form that can be processed by a computer.

As a result, it will lead to the next sequential stage – creation of some local digital trade ecosystem within global one, which will aim at ensuring that digital documents, generated locally in some countries, will be accepted everywhere in the world.

The countries, as per their national digitalization strategy, will start using distributed ledger technologies (DLT, Blockchain is a type of DLT) in order to improve trade process digitalization in their newly emerged digital trade ecosystems.

Collation of three main digital solution DLT platforms regarding SMEs

In the context of the digital transformations, there are a few fundamental components that need to be assessed in terms of their readiness to serve the SME segment.

According to C. Atkison, the digital trade ecosystem consists of such pillars as:

- Legal UNICTRAl model laws

- Organizational (e.g. digital identity of exporters/importers)

- Semantic (e.g. data standards -WCO, UN/CEFACT, OASIS, UBL) – Format and meaning – ‘What is sent is understood’

- Technical (e.g. systems able to exchange data, application interface)

- Discovery / Accessibility (e.g. find and receive rules – the internet). Further in this paper

I would like to review several main DLT-platforms that are trying to solve the technical pillar of trade policy automation. Nonetheless, below are the similarities and differences that were looked through DLTs-respondents at their SME approach by such DLTs as Contour, we.trade and Komgo.

One of main roles of trade finance-oriented DLT-platforms, together with other global market actors, is to ensure that local banks are not left behind and can expand SME access to trade finance and foreign markets.

Firstly, some benefits for SMEs of using DLT-platform solutions include:

- Reduced time of regular trade operations & increased trust via transparent communication between SMEs (importers and exporters), banks and other participants (altogether with reduced paperwork for all-parties involved staff).

- Automatic payments by banks triggered through smart contracts between SMEs (importers and exporters) together with enhanced security of operations for both importer and exporter.

- Faster trade cycles with increased speed of reconciliation and end-to-end tracking of goods in transit.

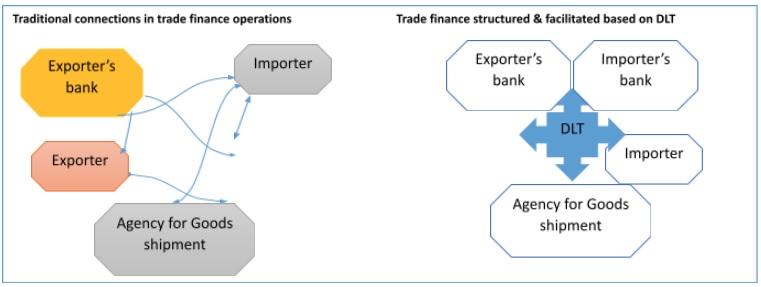

Secondly, all three respondents to my questionnaire positioned themselves as a safe trade ecosystem for all related market actors that provide real-time data management, paperless contracts and workflows harmonization delivering the users’ data confidentiality. Also, as per suggested Diagram 1 we can see some standard approach in structuring of the digital trade operations via some DLT- platform.

The responses highlighted SMEs as one segment of beneficiaries on the platforms. However, the focus of these DLT platforms is not only on SMEs.

SMEs were underlined in the platforms’ responses as one segment of the beneficiaries of their platforms. However, the focus of these DLT-platforms is not on SMEs only.

Lastly, the answers provided by the survey participants can serve as a basis to outline commonalities and differences in approach towards the SMEs.

Commonalities in DLTs operations with regards to SMEs:

- Majority of responded DLT-platforms have such common target audiences featured:

- all possible market actors mixed up, including SMEs and micro entities;

- local banks who can offer the solution and sponsor it even upon need to their local SME clients;

- locally represented large private businesses with their own SMEs network of some suppliers and customers.

- The marketing strategy on SME attraction: DLTs try to reach SMEs by means of referrals from their existing large corporate clients and the banks in the network, and by means of social media platforms (LinkedIn, Twitter etc.) and posts campaigns.

- Confidentiality of platforms: only SMEs engaged in trade can share and view documents between themselves. No other actors can see the documents, not even their banks. Even DLT itself does not have access to the data so there is no concern about it being sold

to a third party.

Differences between DLTs responded:

- Digital products: the DLTs-respondents deal with development of some unique digital financial instruments, which have similar risk mitigation functions as LCs in trade finance area. But as those products are all unique, they do differ between themselves. As, Contour specializes on digitalises LCs mostly, Komgo – on a range of digital trade-finance-related products including LCs together with a digital KYC solution and some e-certification functionality for documentation, while we.trade focuses on digitization of such financial instruments as auto-settlement, bank payment undertaking (BPU), BPU financing, and invoice financing.

- On-Boarding of SME at a platform: some DLT-platforms provide SMEs on-boarding through their main partners – local banks, others choose personal on-boarding for each SMEs applied to their DLT. Thus, it leads to different time periods needed for SMEs registration – from several minutes and clicks at the platform to be done by their local banks-users of DLTs already up to two days the longest period for setting up and approving their account, at the first deal only. However, if you compare this with the registration approval process for some local banks – it can take up to 4 weeks.

- Costs for joining platform for SMEs: at some DLTs only the banks deal with their own pricing with their clients – SMEs, at others – SMEs have some options to get a membership fee directly from the DLT platform.

- Developing countries of SMEs are: from Brazil and Turkey to Eastern Europe (Bulgaria, Ukraine) to Asia (Vietnam and Bangladesh). No regional focus was mentioned.

Conclusion on the viability of DLT-platforms in trade finance for SMEs in 2021

After providing the overview of the main aspects of digitalization in trade finance and benefits for SMEs from it as well as having presented my analysis of the interviews in this respect with three DLTs such as Contour, we.trade and Komgo, I’d like to set forth my following assumptions on the readiness of modern DLTs to cooperate with SMEs.

Almost all interviewed DLTs are still at the very early stage of attracting SMEs in the developing counties of operations.

As based on case studies from the three DLTs, their present main strategy in some developing countries, is mostly to attract the main market actors, based on the actors’ large turnover and their high administrative influence in trade finance, which are banks (with their high administrative power) and the giant transnational businesses, which are out of SME criteria with a turnover over €50m.

Thus, they serve business corporate giants of the different economies that very organically fit the digital start-up solutions landscape and are their first target audience.

Having onboarded large players, the digital solutions then slowly start attracting SMEs into its network naturally, because some local SMEs serve and cooperate with their local giant transnational businesses. Despite their marketing campaigns and digital products introduced to the market, digital platforms prove that they do meet SMEs needs, namely in invoice financing and LC operations’ improvement, in the long-term perspective.

As such, this approach is understandable because these platforms changed their status of start-ups recently and are still gaining participants who can afford all related costs to digital transformation in their daily business, and which are usually not SMEs but large corporates.

The sizeable entities with their networks of partners already have their own ecosystem with SMEs included, even with SMEs as a focal point at times. In developing countries such roles of local large corporates as the referral role or the opinion leader’s role will play a crucial moving power in DLT-platforms’ promotion among SMEs and their governments.

As for the developing countries’ market, actors do need significant support in digitalization through knowledge sharing and through sponsorship from bigger market players, e.g., multilateral banks, transnational companies, developed countries with their donor funds.

As stated by United Nations Conference on Trade and Development, “digital trade is widely seen as a key enabler to help banks close the trade finance gap, with 55% of survey respondents positioning themselves to service more MSMEs using technology solutions. The challenge is to ensure enough local banks – that often serve these MSMEs – are sufficiently digitally enabled

to make it commercially viable to serve the MSME client segment.”

The promising potential of DLT to facilitate international trade, from customs procedures to trade finance, will only be realized if regulation evolves to support the large-scale deployment of the technology and if a globally harmonized, digitized trade environment is put in place. This will require global dialogue; a dialogue that involves all stakeholders, public and private.

Recommendations

My recommendations to digital solutions engaged in trade finance regarding the attraction of SMEs will be as follows:

- To partner with local business associations, local chambers of commerce at the countries of operations.

- To promote business matching functionalities of their solutions where local SMEs could find a foreign partner and start doing trade effectively via the digital solution.

- To cooperate with local state authorities by promoting digitalization and paperless transactions between importers and exporters which is offered via their digital solutions.

- To invest into educational activities with some highly-potential SMEs at their countries’ of operations in order to create a positive experience of using their digital solution by local SMEs.

- To improve their present engagement with local giant transnational businesses in order to enter their supply chain structure for establishing the long-term communication with SMEs within such networks.

This article was created as part of the International Trade Professionals Programme 2021.

Learn more about this incredible programme here.