Securing finance to purchase goods: There are many routes for SMEs

Equity or angel investment is great for kickstarting the growth of an awesome startup, but sometimes, it’s not appropriate.

Companies may often need to purchase products or raw materials as part of their supply chain, and this is often sourced from other markets (e.g. Asia or Latin America). Even with contracts in place from eager buyers of your product, it’s often time consuming and difficult to raise equity finance or angel investment to import the raw materials or pay for products. Importing raw materials is huge – US companies exported $373bn and imported $538bn of goods in Q1 2015*!

Rest assured there are financial products that allow SMEs to import goods, even without security. Trade finance is the umbrella term which encompasses a range of financial products allowing SMEs to trade goods internationally. International trade finance is growing at around 5% a year**, and it allows business owners to fund growth (it is separate to any existing banking relationships that the company might have) and can be quickly accessed to get a deal moving. Providing there are end-buyers of the final product and the exporter of the raw materials/ goods is reliable and creditworthy trade finance can be a great tool to increase revenue very quickly and impress clients with the ability to turnaround and execute large orders.

How could it work?

Most commonly, an SME would work with a financial advisor and a financier to arrange payment to the exporter (who will ship the raw materials or goods that are needed). A financial institution could issue a ‘Letter of Credit’ – this is a contractual agreement to the exporter’s bank which guarantees payment to the exporter providing they ship the product (and show shipping documents to their bank) as per the agreed contract. For the SME importing the product, it allows normal payment terms without eating into the balance sheet of the company. For this reason, the finance is secured on the stock being transported, rather than any assets the company may own (which is essentially how a bank loan works). So for example, if you’re a hardware company looking to import electronic hardware from China, trade finance would be secured on that hardware being transported – so in case of default, the bank or funder would seize the hardware from the SME and recover it’s losses.

Why is trade finance important for SMEs?

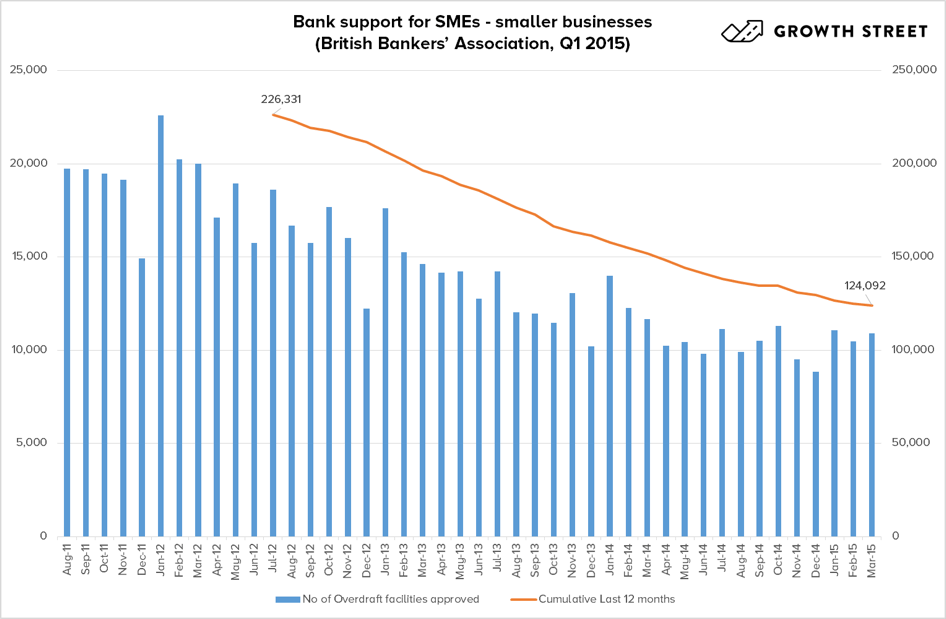

Cash shortages put small businesses under stress, and banks are supporting SMEs less due to regulatory pressures and the risks associated. However, nimble fintech startups and new technology platforms which can assess the risk of lending to a particular SME is closing the funding gap and allowing agile SMEs to grow relatively quickly, despite having a small balance sheet.

Banks supported by SMEs decline. Source: https://www.bba.org.uk/news/statistics/sme-statistics/bank-support-for-smes-1st-quarter-2015

If you’re considering exporting or importing goods, it can be a good idea to speak to an advisor about trade finance and options for your business. Here at Trade Finance Global, we have a network of expert advisors and funders from all around the world and specialising in different niches. Alternatively, we have put together an SME Trade Finance Guide which you can read and access here.

Sources:

*Cencus.gov and International Trade Administration: YTD (MAR) 2015 Imports from World of NAICS Total All Merchandise.

**International Chamber of Commerce (2014). Rethinking Trade and Finance. Paris.