Risks and challenges of trade finance | 2025 trade finance guide

This content was produced in conjunction with ITFA.

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContents

Managing risks is key to growing a successful trading business, either internationally or domestically and this can be done by using specific types and structures of trade finance products.

International trade carries substantially more risks than domestic transactions, due to differences in language, culture, politics, legislation, and currency.

This article summarises some of the main types of risk that international trade financiers might face.

International trade has particular characteristics that give rise to different types of risks. Trade financiers thus spend most of their time understanding and mitigating these risks.

Let’s take a look at some of the primary risks.

Product risks

Product-related risks are those that the seller automatically has to accept. As an integral part of their commitment, for example, they usually have to provide specified performance warranties, agreed maintenance, or service obligations.

The buyer must consider how external factors, such as negligence during production or extreme weather during shipping, could affect their product.

These matters could well lead to disputes between the parties, even after contracts are signed.

It is important for the seller that the contract is worded correctly, so that any changes that could affect the product are covered, with clear outcomes provided.

Manufacturing risks

Manufacturing risks are particularly common for products that are tailor-made or have unique specifications.

Often sellers are required to cover costs of any readjustments of the product until the buyer sees fit because the product can’t be resold to other buyers.

These types of risks can be addressed as early as the product planning phase, which often means the buyer has to enter payment obligations at a much earlier stage of the transaction.

To mitigate the risks for both the buyer and the seller (especially for bespoke products), the terms of payment may be part-payments and separate guarantees throughout the design, production, and delivery of the product.

Transport risks

These are the risks associated with the movement of the goods from the seller to the buyer.

About 80% of the world’s transportation of goods is carried out by sea, which gives rise to a number of risk factors, including storms, collisions, theft, leakage, spoilage, scuttling, piracy, fire, and robbery.

Cargo and transport risks can be reduced through cargo insurance, which is usually defined by standard international policy wording (issued by the Institute of London Underwriters or the American Institute of Marine Underwriters).

The agreed terms of delivery will usually state who is responsible for arranging insurance.

If the buyer fails to insure the cargo shipment in a proper way when it is their responsibility, the insurance could be invalid if, for example, the port or transport route changes and the items arrive in damaged condition.

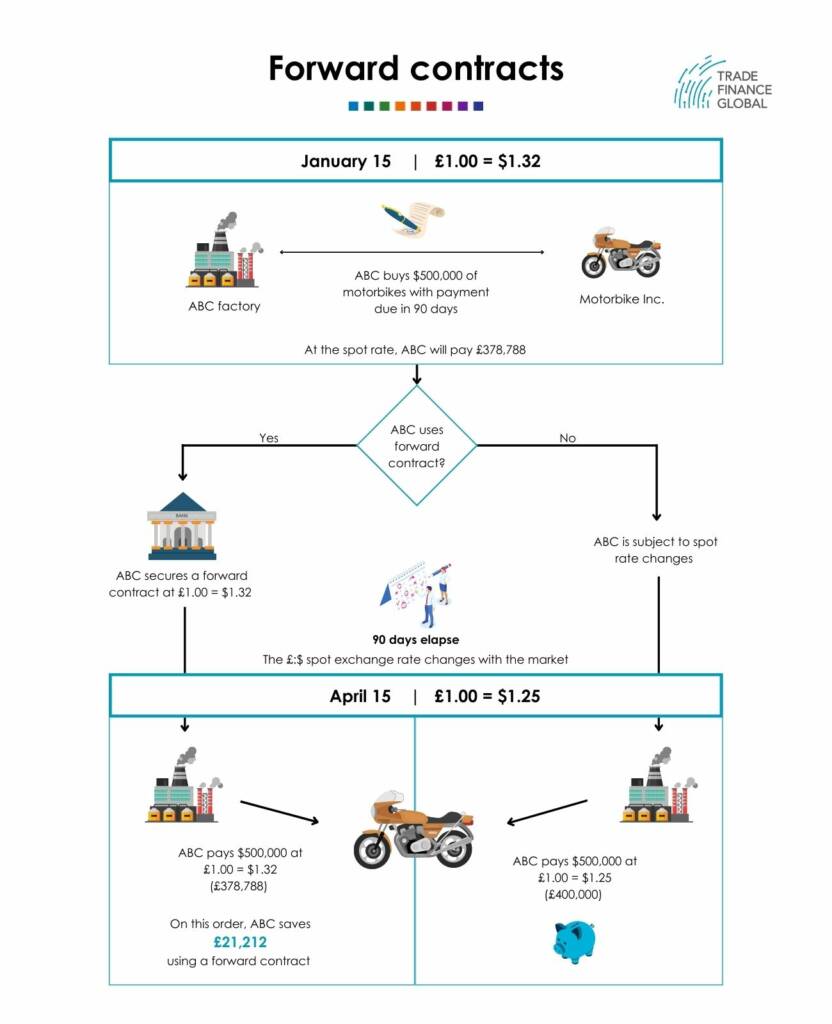

Currency risks

This is the risk posed by fluctuations in exchange rates that could affect payments and receipts in foreign currency.

Unless such risk is hedged, a trader has no control over the impact of exchange rate volatility, and in a worst-case scenario, such volatility can wipe out the entire profit and more that would have been accrued from the trade transaction.

Currency risk management is often misunderstood or neglected by businesses. Any business that purchases and sells products (or services) in multiple currencies should consider options to mitigate foreign exchange (FX) rate volatility.

Changes in exchange rates will impact the profit margin on international contracts, as well as the value of any assets, liabilities and cash flows which are denominated in a foreign currency.

There is a range of financial instruments available to manage FX risk. Due to the increasing volatility in the market and the need to operate in various currencies, policies need to be flexible and cater accordingly.

Prior to developing a foreign exchange strategy, a company should look at what proportion of their business relates to imports or exports, the currencies that are being used when payments are made, and what currency is used for supplier payments and invoices.

Various strategies are used to manage currency risk and these usually involve using spot contracts, options, and forwards.

Country risk

A collection of risks associated with doing business with counterparties based in a foreign country, including exchange rate risk, political risk, and sovereign risk.

Factors to bear in mind when considering country risks include the current political climate in the country, the state of the local economy, the existence of reliable legal structures, and the availability of hard currency liquidity.

Corporate risk

These are risks associated with the importing or exporting businesses and are primarily focused on their credit rating and any history of defaults, either through non-payment, non-delivery, or deficient delivery (e.g. faulty or damaged goods).

Commercial risk

This refers to potential losses arising from weaknesses stemming from, or defects in, the underlying trade.

Such factors could include the quality or adequacy of the goods being traded or the robustness of the contracts and pricing terms.

Fraud risk

These are risks typically associated with either unknowingly engaging with a fraudulent counterparty, receiving forged documents, or being the victim of an insurance scam.

Documentary risk

Documents play a vital role in international trade. Missing or incorrectly prepared documents pose risk for both buyers and sellers, as this can cause delays in shipments and ultimately delays in payments.

Our trade finance partners

- Trade Finance Resources

- All Trade Finance Topics

- Podcasts

- Videos

- Conferences

- Products we finance