Pre Shipment and Post Shipment finance | 2025 Trade Finance Guide

This content was produced in conjunction with ITFA.

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContents

Why does a small business actually use trade finance? We can categorise trade-financing options into: pre-shipment finance, post-shipment finance and supply chain finance (SCF).

When considering which trade finance route to choose, it helps to separate the options into three categories: pre-shipment finance, post-shipment finance, and supply chain finance (SCF).

Let’s explore each one in more detail.

Pre-shipment finance

Pre-shipment finance includes any finance that an exporter can access before sending goods to a buyer.

Once the exporter receives a confirmed order from a buyer, it has an obligation to deliver the finished goods.

This may involve manufacturing or procurement, and working capital finance is then often required to fund wages, production costs, and raw materials.

There are many different forms of working capital finance that exporters can access, as outlined below.

Trade and receivables finance

Trade finance is essentially a loan whereby the exported goods act as the main form of security or collateral.

Lenders will often fund up to 80% of the total value of the goods, but this varies depending on the risks involved.

For example, if there is a low demand for the goods (e.g. bespoke furniture) or they have a short shelf life (e.g. perishables), a lender may not be able to resell them if the borrower defaults.

In such cases, the lender may only be willing to finance a small percentage of the total value of the goods.

Inventory or warehouse finance

Lenders often require the finished goods to be kept in a warehouse or a secure location, or on the borrower’s premises but controlled by a third party.

The inventory can then be used by the borrower as collateral. A lender will provide short-term working capital or loans against the collateral (minus a percentage of its value).

Warehouse or inventory financing is often used to top-up existing credit lines.

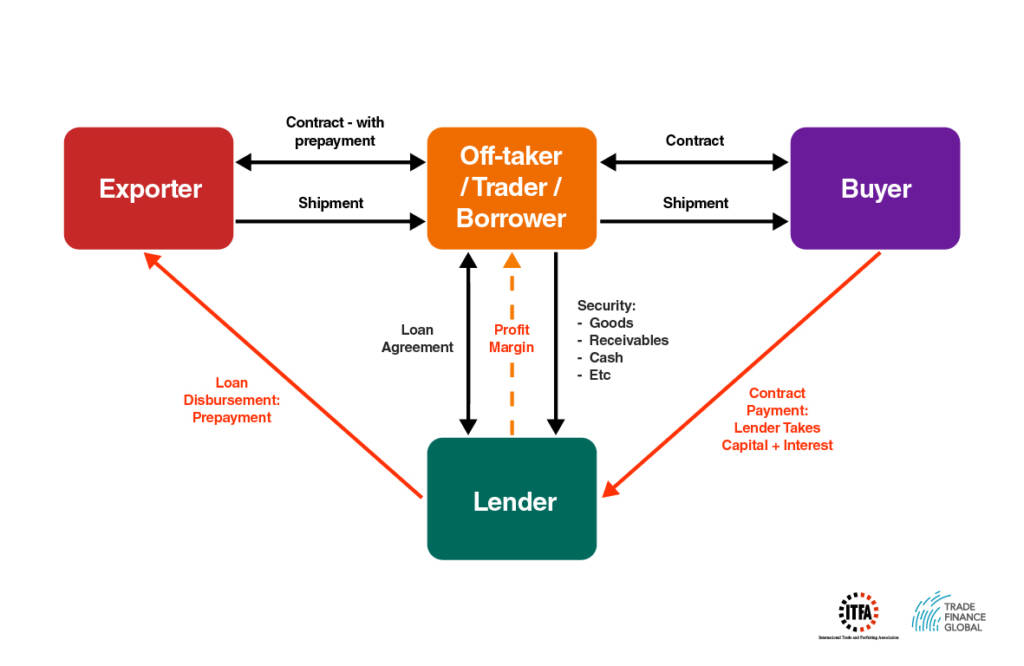

Pre-payment finance

This differs slightly from trade finance (or import finance) because the buyer takes out a loan specifically for paying the seller, in advance of the goods being shipped.

The buyer then pays the loan back once the goods have been received and sold on.

Not only does this ensure quick repayment, but it also allows a lender to clearly link the funding to their borrower’s trade cycles.

Post-shipment finance

This refers to any type of finance that exporters can use after sending goods to a buyer.

Without finance, the exporter would have to wait until the goods arrive, an invoice is raised, and the payment terms take effect, which is usually 30, 60, or 90 additional days.

If required, a financier can accelerate payment to the exporter, so that the payment is received when the goods are sent. This usually occurs as and when the goods are loaded onto a ship.

Post-shipment finance can be delivered using a number of instruments, such as:

- A letter of credit (LC)

- A trade loan

- Invoice factoring or receivables discounting

Supply chain finance (SCF)

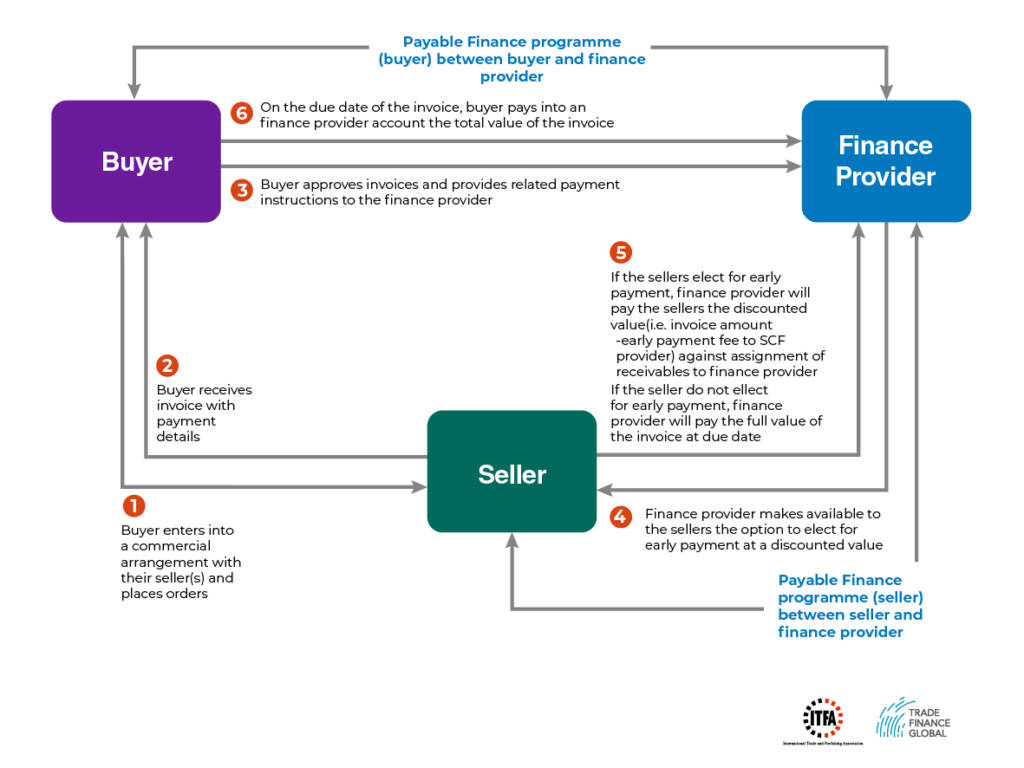

Supply chain finance (SCF) is a cash flow solution that helps businesses free up working capital that would otherwise be trapped in complex global supply chains.

Also known as global SCF (GSCF) or supplier finance, it’s a useful tool for buyers and suppliers alike – as buyers are able to extend their payment terms, and suppliers can get paid early.

Moreover, SCF allows businesses that import goods to reduce their risk within the supply chain, and it helps improve relationships between buyers and suppliers.

Our trade finance partners

- Invoice Finance Resources

- All Invoice Finance Topics

- Podcasts

- Videos

- Conferences