Developing and harmonising existing standards within trade finance is key for digitalising trade. From ISO 20022 to the SWIFT TSU/BPO, TFG’s Deepesh Patel interviewed three sat down with three representatives from the Standardised Trust, who have been building an enriched semantic model and market practices for guarantees and Standby Letters of Credit (SBLCs), with the aim of democratising the use of digital trade finance-related design and development resources.

Featuring:

Harri Rantanen (HR) – Business Developer, SEB Large Corporate and Financial Institution, Transaction Services, Community Coordinator, Standardised Trust

Gunnar Collin (GC) – Head of Sales and Marketing, Enigio

Saila Alapiha (SA) – Senior Product Owner, Transaction Banking, Trade Finance, OP Financial Group

Interviewed by: Deepesh Patel (DP) – Editor, Trade Finance Global

Standards already exist

Establishing and enriching standards for trade finance has been the holy grail for digital trade enablement for over a decade. Already, data standards and harmonised semantics are helping banks talk to one another when passing on information on bank guarantees and standby Letters of Credit (SBLCs) through SWIFT’s messaging types (MTs). The development of the latest set of trade standards, ISO 20022, which the banking world will fully adopt by 2025, has the potential for providing rich datasets for the trade finance world. But are they perfect, and could we do more?

SWIFT, ISO 20022 and the Bank Payment Obligation

DP: What was the initial role of ISO 20022, and did it work for the Bank Payment Obligation?

HR: SWIFT has been a key player, yet not the owner, of the ISO 20022 standard, acting as its Registration Authority and one of the key feature contributors as well. In the trade domain, and especially in trade finance, SWIFT was the key driver of the Bank Payment Obligation (BPO), enabling its use by implementing the Trade Services Utility (TSU) matching engine with ISO 20022 standard only. Unfortunately, the BPO, with SWIFT’s TSU engine, was not able to break through, and the service was shut down by the end of last year.

In 2013, ISO 20022, supported by a SWIFT-run bank and a trade finance expert team, released a set of guarantee and Standby Letter of Credit (SBLC) data and process model. It didn’t include documentary credits, and this release didn’t really gain market traction on guarantees either, when the focus was on the more traditional MT798 message model for corporate and banking communications.

Improving ISO 20022 for Guarantees

HR: Although the work done for the structured data elements of guarantees was very thorough, the Standardised Trust working group decided to create a base model for guarantee messaging data, starting from scratch rather than using a vendor-specific or legal model. I think this was an excellent choice, as we can already now better cover items that are not even available in the upcoming guarantee SWIFT 2021 release.

“I think this was an excellent choice, as we can already now better cover items that are not even available in the upcoming guarantee SWIFT 2021 release.”

The Standardised Trust understood early on that there was the need for an approach where the guarantee information was not only exchanged as messages (as in SWIFT network), but also uploaded onto platforms where all guarantee parties are members and the transaction takes place only once.

SA: The trade finance ecosystem is changing as new parties enter the community. The traditional parties are digitalising their processes beyond the messaging exchange. As a result, the Standardised Trust working group wanted to turn the approach from using the existing standards to cater to product needs, to verifying if the standard is usable all the way to the back-end applications.

The language of…trade finance

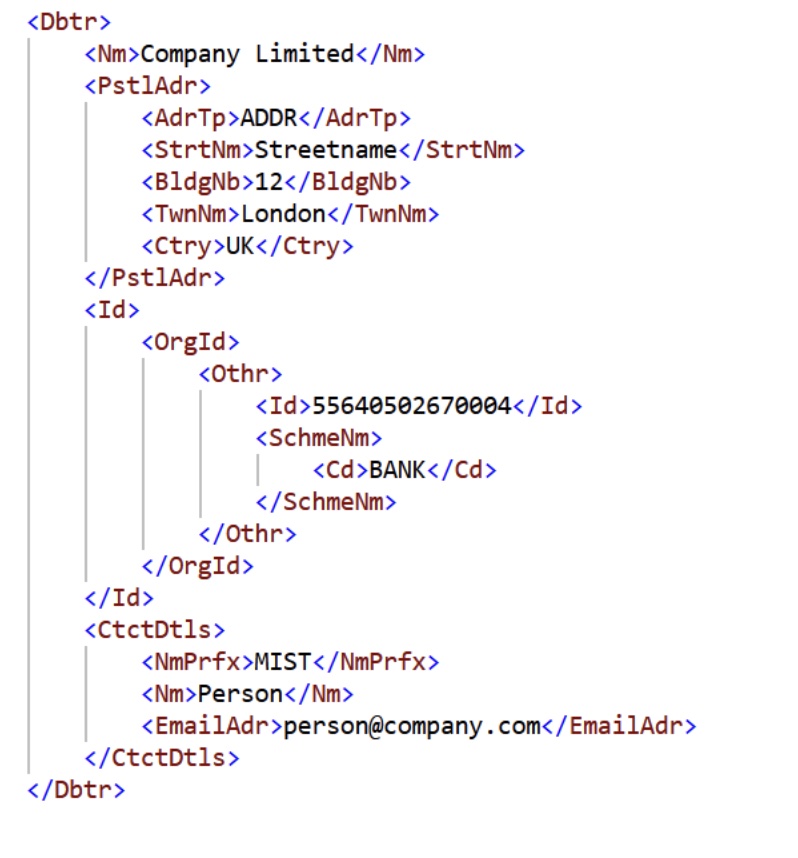

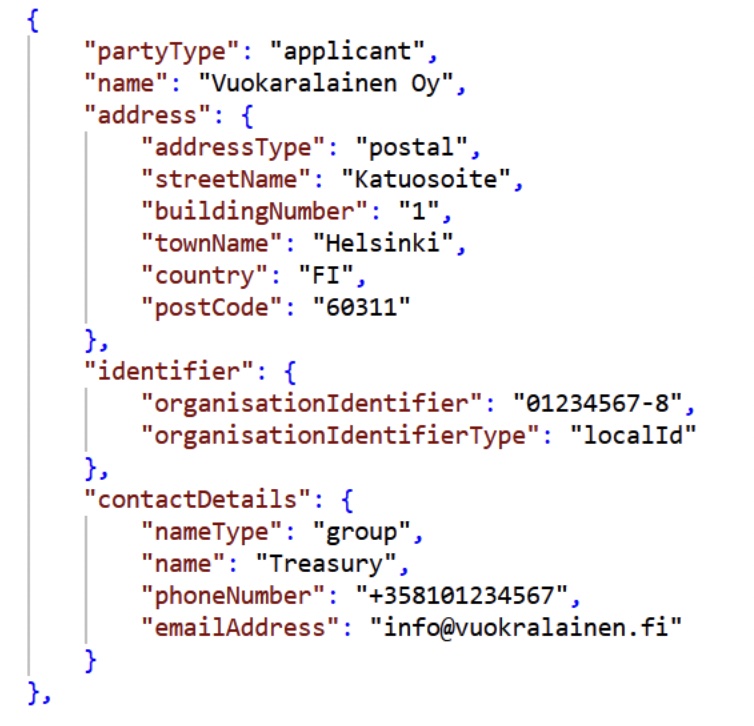

HR: That is why it was crucial to fine-tune the ISO 20022 basement and make the structure more developer-friendly. We did this by flattening the many levels and nested structure that ISO 20022 XML-schemas have. This would offer a common trade finance language to exchange and link various systems, platforms, and processes together, for example, via Application Programming Interfaces (API).

Peeling back the layers: Reinventing ISO 20022’s standards in JSON

Debtor in ISO 20022 XML

Applicant in Standardised Trust JSON

HR: In the Standardised Trust semantic model, the data structure-specific rules will be listed alongside the data model, making the rules available when developers are using the semantic model, thus ensuring their correct use.

These rules are entitled URDG758 and ISP98 for guarantees, and eUCP 600 for documentary credits. The International Chamber of Commerce (ICC) is currently finalising the new Uniform Rules for Digital Trade Transactions (URDTT) – a set of rules to help manage the upcoming Model Law of Electronic Transferable Records (MLETR) – implementations at local jurisdictions enabling digital global trade, and, therefore, simultaneously supporting digital trade finance.

HR: At the Standardised Trust, we have been applying these rules into the model and using them as market practice standards, which helps prevent old interpretations and avoid exceptions, which often derive from the use of free text.

Updating the semantic model

DP: Why is it important to update the semantic model, and who benefits?

HR: ISO 20022 has done an excellent job at creating a structured information model with accompanied process descriptions of various parties involved in each stage of transaction processing.

On one hand, the ISO 20022 model has collected all market practices and fields – any possible combination or consequence – but on the other, this makes it quite overwhelming for a new market participant. So despite the power of encoding such a model using XML schema, this also reveals a complexity that can be hard to process and understand.

We have seen that, as a result, new API developers are a bit weary of these deeply nested, complex data structures. Even the shortening of data field names with abbreviations has caused challenges for new platform integrations.

That is why it is important to make the Standardised Trust semantic model more attractive for common use, by simplifying the original ISO 20022-based model, expressing the model in JSON – JavaScript Object Notation – encoding, and creating a rule-set based on existing market practices, along with actual data structure. This combination makes it possible for any developer or business to come to terms with a simple common language, and create opportunities to integrate legacy with new systems, as well as exchange data in an understandable way.

SA: Trade digitalisation changes the traditional trade finance environment by enabling the developers and technical teams to have a more independent role. When paper processes no longer act as insulation between separate processes, we no longer need to keep translating everything through the trade finance product experts. Therefore, by making the semantic model accessible and understandable to developers directly, the trade finance community can benefit from the new technical approaches. This has already happened in other areas like payment and customer portals that banks offer.

From Excel to JSON

DP: But the current Standardised Trust semantic model is in Excel format. Why expand it to JSON?

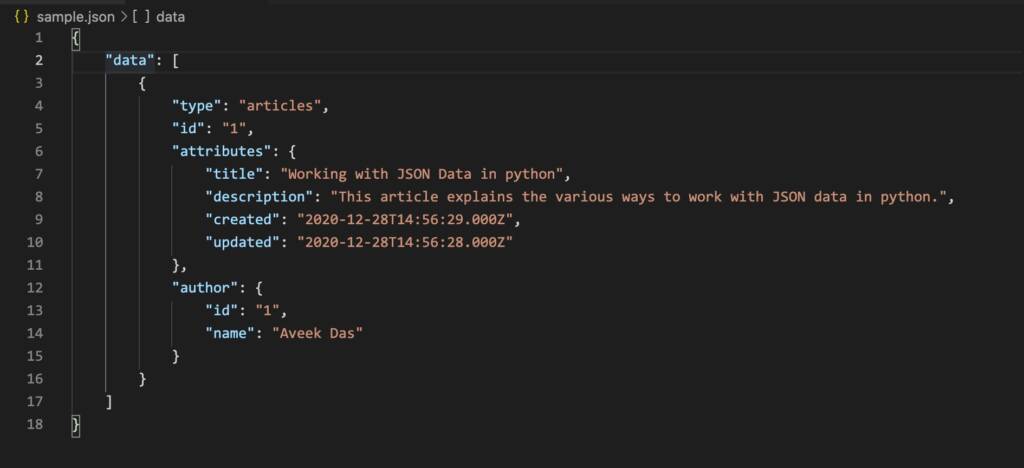

GC: There are many reasons for this shift. As with JSON Schemas, the standards can be widely spread, and everyone can reap the benefits, such as data interoperability and the ability for markup to be machine-readable – this in turn will allow for trade finance to be democratised and revolutionised.

Furthermore, the JSON standards will be easily accessible for all. If the publicly available JSON schemas are, for example, used when creating original documents with the digital document technology, trace:original, both the documents and the content structured in the JSON are digitised. One will get a freely transferrable digital original document and an agreed standardised content without the parties needing to be on the same platform or having to connect specific APIs beforehand.

DP: How far are you from moving the human semantic model to something that is machine-readable? What are the benefits?

GC: JSON is machine-readable – that is the point. This will definitely democratise and revolutionise trade finance, as data will now be structured, machine-readable, accessible, and freely transferrable in its original form if trace:original is used.

Trialling with real guarantees sample data

DP: Are you trialling this with real guarantees sample data?

HR: This new version is being trialled with real guarantees sample data. The Standardised Trust team started the semantic model creation in Excel workbook to make it easier to use and commonly update, however, the workbook has been dynamically linked with used code lists and possible sample text hyperlinks to www.standardisedtrust.com home-site repositories. The early sample case testing was enabled by sophisticated Excel choice list enablement and easy-to-fill- in sample columns. For now, the work will be continued on Excel, and at the same time most tech-savvy team members can build up the same Excel sheet describing schemas to JSON payloads, and control them with steering JSON schemas.

This will enable easier access for the openly available Standardised Trust repositories for the API-oriented developers, boost its possible use and spread globally, and, of course, the Excel-based model will be usable by any computer, system, platform as well as machine-readable manner.

The team has toyed with the idea of expanding the model available with Web Semantics (W3C) ontology schemas for the basement of Knowledge Graph use. Having all these resources and documents freely available on the internet – Standardised Trust home-site, OneDrive folders, and GitHub – will make them easily available for anyone, without any license fee or VIP membership access restrictions. Open-source, open-access for the trade finance digitalisation journey! The next step on this journey will be to test this on real bank guarantee data.

“Open-source, open-access for the trade finance digitalisation journey!”

GC: At Enigio, we are very involved in this work, and all standards created by the team can immediately be deployed and used in our trace:original documents. We are to trial with real bank guarantee data.

‘Open banking’ for trade finance

DP: Can we learn from the payments revolution (e.g. PSD2/Open banking) and bring these updates to trade finance? What are the benefits?

HR: Definitely. When I started my career on multi -banking software vendors, some 30 years ago in the payments domain, the documentation was held by banks and banking associations. Protected assets and banking material formats were fragmented and also specific to each country or bank. Fast-forwarding to now, the market has totally changed, and the ISO 20022 standard rules (by 2025), as well as documents and development resources, are almost all fully and openly available.

Of course, the trade finance scope and domain is bigger, given its numerous stakeholders and the inherent complexity over cross-border trade (versus payments), but we will still need to take the same approach and go on the same journey of openness, standard tools, common market practices, and strong community collaboration across the stakeholder groups, which include banks, corporations, governments, logistics, and insurers. This is a prerequisite for the successful digitalisation of trade finance.

SA: In addition to payments, trade finance has been governed by banks. Until now the major issue regarding digitalisation has been that every business process has multiple blockers, both internal and external. For example, even if the parties had been working together, the technical means did not exist or the solutions available had been too costly or not yet adopted widely enough to allow for effective, direct communication. PSD2 definitely supports this process of removing the barriers, and the digitalisation of the logistics processes is also likely to have a major impact.

DP: Can document digitalisation incorporate technical data set schemas and even semantics?

GC: Document digitisation, especially JSON schemas, can ensure a common language between sender and user, and any other party coming in contact with the document as the JSON Schema used is published online by the Standardised Trust or by the ICC, for example. The data will therefore be harmonised by default and also machine-readable, as well as readable by humans when the JSON is used in a digital document, but there will be a structure in the document so it will not look exactly the way it used to.

JSON Schema – additional benefits and practical applications

DP: Are there other use cases and benefits of this and what are the practical applications?

GC: All types of documents can be structured this way, such as contracts, purchase orders, invoices, guarantees, promissory notes, transport documents, and many more, so the practical use cases are endless.

The beauty is that the parties involved only have to agree on the SCHEMA, not on a rule book or platform (compared to how banks exchange standardised SWIFT messages, this requires membership to the SWIFT platform and infrastructure).

Once agreed, the schema can be sent as a trace:original document (if an original document is required) or in any other form, and once finalised, on a 121 basis all parties can start interacting immediately, therefore, completely eliminating the need for rule books, special software, or closed platforms.

The future of the semantic model

DP: What is the future of the semantic model?

HR: LEI (gleif.org as the ISO 17442 governor and foundation) is a good example of what is needed in trade finance: universal, unique, digital, and foundational identifiers. LEI is designed for corporations, and the same will be needed for individuals to generate digital trust within global trade. This may finally lead to new trade finance instruments that are easier to use, as not all risk mitigations will be needed, and will be closer to the ones used in the Payment Domain and invoice-based financing tools. Additionally, the new wave of automation in trade agreements and the triggering of financing will need more readily available financing instruments.

The wish-list

In summary, the panel’s wish-list for trade finance is:

- Adoption of the MLETR so that free digital original documents can be widely used by all parties

- Common Legal Framework to allow data exchange with or instead of documents

- Internationally interoperable digital identities for private persons, legal entities, persons, and things

- Human- and machine-readable, understandable, meaningful, and harmonised use of business data standards, also openly available

- Data sharing platform(s) where data owners (persons and legal entities) can securely and digitally consent to the use of data for the data consumer, allowing also digital ownership transfer of the data, where the platform(s) would have an openly available governance rule book for practical commitment.

- Technology does not matter if the development resources are openly available

DP: Thank you for a great roundtable!

About the panel

Harri Rantanen

With his extensive experience, Harri is familiar with the challenges and opportunities of digitalisation in the financial sector for banks, corporate customers and system suppliers. As a business developer of SEB’s transaction services – cash management and invoice and trade finance – he looks to the future of SEB, end customers and partners evaluating new, sustainable and digital business models through joint innovation and practical experimentation.

Gunnar Collin

Gunnar is a senior operations and banking professional with over 30 years of experience from the financial sector in different organisations, geographies and cultural settings. Gunnar’s focus has been trade finance and operations. Gunnar is now fully focused on making sure that Enigio’s ground-breaking inventions and services will be known and implemented wherever there is a need for digitalisation and transformation. The key areas where Enigio’s trace:original solution is a game-changer are foreign trade and the financial industry where paper versions of negotiable instruments and documents of title are still widely used. Other areas benefitting from Enigio’s solutions are any organisation using or storing large volumes of paper documents and records.

Saila Alapiha

Saila has a background in mechanical engineering and more than a decade of experience in trade finance and banking. Saila’s journey in trade finance started from letters of credit and has continued with the dedication to digital processes and solutions. Saila is currently focused on the OP Financial Group’s technical capabilities in trade finance for current and future solutions.