Digital Negotiable Instruments

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContents

Bringing negotiable instruments into the digital world

Digitising global trade has been a steadfast endeavour since before the outset of the COVID-19 pandemic, but pandemic-induced closures and remote work norms have vastly accelerated its need. Unlike in previous eras, it is no longer the state of technology that is holding back this cause, rather the limitations now stem from the legal and regulatory frameworks that global trade operates within.

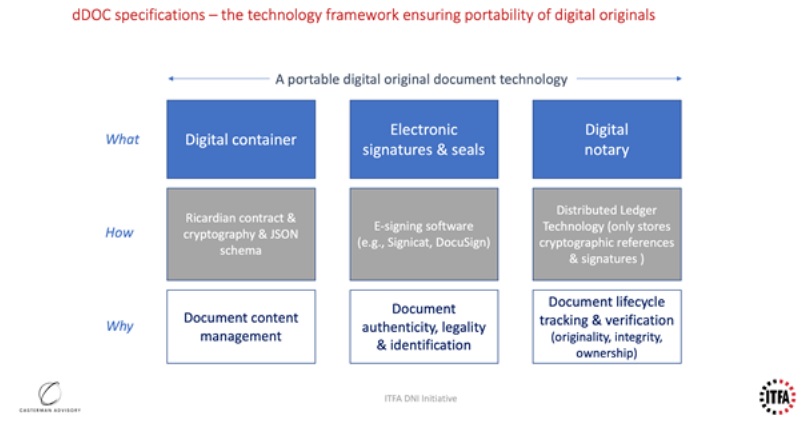

The International Trade and Forfaiting Association (ITFA) has established the Digital Document (dDOC) specifications, laying out the mechanisms and requirements for digital original documents to achieve regulatory compliance. These specifications make use of E-signatures, cryptography, and distributed ledger technology (DLT) to create digital documents that effectively replicate many legally necessitated properties of paper.

By applying these specifications to digital documents that replicate negotiable instruments, such as bills of exchange or promissory notes, the ITFA has created a type of digital negotiable instrument (DNI) that is referred to as an electronic payment undertaking (ePU).

This hub examines the steps that are needed to establish the certainty of these ePUs under English law. English law has been selected as a primary focal point due to its widespread influence around the world, with nearly 40% of the world’s legal systems being based on or inspired by the English system.

As English law stands today, such an instrument does not comply. This is due to the heavily criticised legal precedent that one cannot possess an intangible. This makes it impossible to deliver, which is done through the transfer of possession to another party, an inherently intangible ePU, a legal requirement for such an instrument under the Bill of Exchange of 1882 (BoE 1882).

To overcome this obstacle, lawmakers could adopt the UNCITRAL Model Law on Electronic Transferable Records (MLETR) or similar eCommerce legislation that would establish digital documents under English law. Another solution would be to formally change the definition of what it means to deliver something under the BoE 1882, establishing certainty for intangible ePUs.

Both of these, however, are expected to be longer-term solutions. In the interim, it should be possible to create an electronic instrument that has the features of a negotiable instrument and that is an enforceable debt obligation but that is not a negotiable instrument for the purposes of the BoE 1882. Utilising such an instrument would alleviate the need to consider the transfer of possession under the BoE 1882.

The specifications outlined in this paper offer policymakers the opportunity to refer to a vendor-agnostic industry-wide framework when considering the parameters of change and the necessary governance to guide change.

Digital Negotiable Instruments – Key Abbreviations

| B/E | Bill of Exchange |

| BoE 1882 | Bill of Exchange Act of 1882 |

| dDOC | Digital Document |

| DeFi | Decentralized Finance |

| DL | Distributed Ledger |

| DLT | Distributed Ledger Technology |

| DNI | Digital Negotiable Instrument |

| eB/E | Electronic Bill of Exchange |

| EBICS | Electronic Banking Internet Communication Standard |

| eIDAS | Electronic IDentification, Authentication and trust Services |

| eNI | Electronic Negotiable Instrument |

| ePN | Electronic Promissory Note |

| ePU | Electronic Payment Undertaking |

| eUCP600 | Uniform Customs and Practice for Documentary Credits Supplement for Electronic Presentation |

| FCAR | Financial Collateral Arrangements (No 2) Regulations 2003 |

| FTP | File Transfer Protocol |

| GDP | Gross Domestic Product |

| HIDC | Holder in Due Course |

| ICC | International Chamber of Commerce |

| IoT | Internet of Things |

| IT | Information Technology |

| ITFA | International Trade and Forfaiting Association |

| JSON | JavaScript Object Notation |

| LPA 1925 | Law of Property Act 1925 |

| MLETR | Model Law on Electronic Transferable Records |

| NI | Negotiable Instrument |

| PN | Promissory Note |

| SME | Small and Medium Enterprises |

| SWIFT | Society for Worldwide Interbank Financial Telecommunication |

| TERA | Technology Experts for Regulatory Action |

| UCP600 | Uniform Customs & Practice for Documentary Credits |

| UKJT | UK Jurisdiction Taskforce |

| UNCITRAL | United Nations Commission on International Trade Law |

| URL | Universal Resource Locator |

| WTO | World Trade Organization |

An introduction to Digital Negotiable Instruments

We are now publishing the second edition of the manual incorporating the dDOC specifications in one document to spread awareness of the valuable and implementable resources it contains.

In June, ITFA stated that:

“The need for more and better technology has never been clearer. The fragility of supply chains, small and medium enterprise (SME) finance, and world trade has never been more exposed. The World Trade Organization (WTO) estimates that 80 – 90% of world trade depends on trade finance, yet the best-known measure of the global funding gap developed by the Asian Development Bank of around $1.5 Trillion has persisted for a number of years (other measures put the gap much higher).”

Since then, what the United Nations is calling the “Great Disruption” has seen global gross domestic product (GDP) fall by 4.3%. The pandemic has, however, served to focus attention on the need to digitise world trade both to save costs and improve resilience. While much of the focus has been on physical manufacturing processes, leveraging new additive processes and the Internet of Things (IoT), the financial supply chain must also be digitised. This manual is a step in this direction.

Sections 2 and 3 set out how the technology works and what is required to replace paper originals with digital originals. Whilst it is recommended that the combined use of cryptography and distributed ledger technology (DLT) or blockchain, other types of technologies can be employed too. These sections have been written by André Casterman, Founder and MD, Casterman Advisory and head of the ITFA Fintech Committee.

Appendix 1 sets out an analysis of the law by our legal advisers, Sullivan, and a proposed solution to the issues discussed. We support this solution. ITFA continues to lobby for a change in the law in England and has had fruitful discussions with the Law Commission which is acting on a mandate from the UK Government. A copy of a letter received from the Ministry of Justice is attached in Appendix 3.

The solutions set out in Appendix 1 shows how to create functional equivalents of bills of exchange and promissory notes under the English Bills of Exchange Act 1882 (BoE 1882) in digital form. The foundation for such equivalents is explained in paragraph 9 of Appendix 1; the template wording for a digital equivalent of a promissory note is set out in Appendix 2 Part 1 and the wording for a bill of exchange in Appendix 2 Part 2. These equivalents are referred to in this paper as Electronic Payment Undertakings (ePUs). These constitute a type of Electronic Negotiable Instrument (eNI).

These functional equivalents will need to be used as, at least in the UK and despite the engagement of the UK government and the Law Commission, the legislative time needed to pass the change in law will not be available until 2022, in all likelihood.

It is worth reminding readers why it was chosen to investigate and solve the position under English law. This is simply because English law is one of the most widely used systems of law in international trade. Common law countries globally tend to have a system very similar to English law; around 40% of the world’s legal systems are based on or inspired by English law. Hence, the discussion in Appendix 1 and the solutions suggested will be of broad relevance and application. Further legal research is required to evaluate the acceptability of these digital equivalents in other jurisdictions.

What are Digital Documents (dDOCs)?

The ITFA has defined the dDOC specifications. The specifications formalise a technology-centric and vendor-agnostic framework to leverage DLT in a manner that remains predominantly interoperable with existing practices, systems, and channels.

The dDOC specifications describe how to leverage advanced document technology to produce, manage, and share digital original documents. Such documents are natively digital originals that are portable amongst financial institutions, their correspondent banks, their clients, and any third-party platform they wish to use for value-added processing (e.g., bill of lading platform, payables and receivables financing). Those specifications have been developed with an “open banking” mindset leveraging hybrid blockchain technologies.

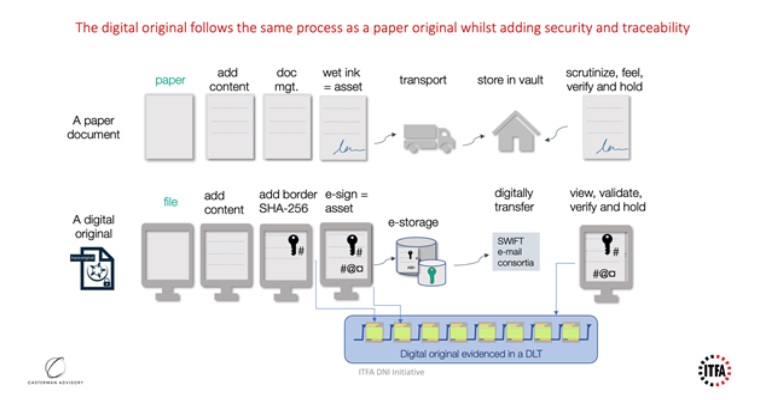

dDOCs vs Paper Documents

The first step in conceptualising the dDOCs specifications is to understand how the processes used for a digital document compare to those of its paper counterpart. The following diagram provides a high-level overview comparing the two. Some of the aspects of this diagram will be further broken down and examined in subsequent sections of this paper.

Understanding dDOCs

Until relatively recent advancements in cryptography and the advent of DLT, digital mechanisms for signing and storing electronic documents simply did not suffice in replicating many of the fundamental properties of paper documents needed for legal applicability. A simple PDF file, for example, can be digitally copied any number of times, with each copy indistinguishable from the original and freely editable by any number of players. For many applications, this poses no issue at all, however, when the document in question represents a legally enforceable promise to pay, in some cases, millions of dollars, this lack of digital accountability can pose major concerns.

Digitally signed documents do not inherently embed document ownership attributes and specific functions that a negotiable instrument (NI) requires. Digital originals, as designed on the basis of the dDOC specifications, however, embed additional features into digital documents, enabling the digitization of NIs. These features include:

- Ownership attributes;

- the ability to demonstrate the uniqueness of the document; and

- the ability to transfer ownership of the document.

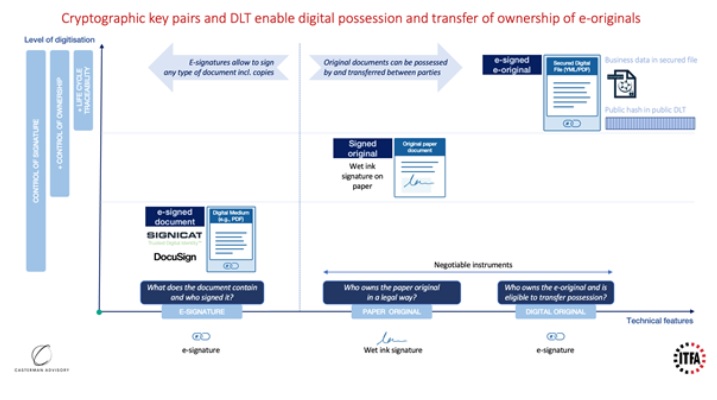

Transitioning from paper to digital originals also brings the highest levels of security, integrity and traceability. The following diagram illustrates the relationship that exists between documents when certain additional features are utilised or removed. As can be seen, E-signatures on their own do not provide the same level of control over ownership as a wet ink signature on a paper document. However, when E-signatures added to digital originals are protected with cryptographic key pairs and combined with DLT, the properties of digital possession and transfer of ownership are enabled. In effect, this provides a secure means of substituting E-signatures for wet-ink signatures.

The Benefits of dDOCs

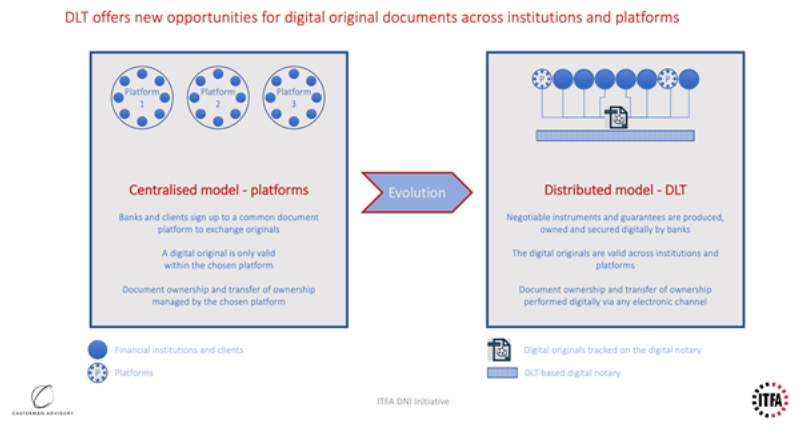

In essence, through the dDOCs standards, ITFA seeks to leverage cryptography and DLT to support the production, ownership, and transfer of digital original documents amongst financial institutions and other stakeholders. To do so effectively, these documents need to be in a form that can be handled in a traditional manner, such as being stored and processed on existing systems and exchanged via existing channels. This means that the dDOC must exist within a decentralised and vendor-agnostic framework.

A traditional platform-based model for sharing digital files is depicted on the left side of the diagram below. Under this model, a digital file is only valid within its specific system, meaning that any recipient of a document must be a member of that platform to receive and confirm the document. Decentralisation, as depicted on the right side of the diagram, is an evolution of this platform-based approach. Under this model, digital originals are valid across institutions and platforms with ownership of the digital document transferable via any electronic channel. The trend towards decentralisation is also prominent in other use cases such as digital assets and decentralised finance (DeFi).

An ecosystem designed with this decentralised approach at its core does not need to struggle through the early challenge of achieving network effects before its value can be realised by stakeholders. It is inherently born with network effects already achieved because all that is needed to receive and own a document is a computer and an internet connection.

Principles and requirements of dDOCs

2.4.1 Principles of the dDOC specifications

In order to achieve the benefits highlighted above, the dDOC specifications have been designed with interoperability and portability in mind. As such, dDOC-compliant document technology is able to demonstrate:

- Openness to any document format

- Openness to any financial institution and type of client (e.g., SMEs)

- Openness to any third-party trade platform (e.g., bill of lading platform)

- Compatibility with any communication channel (e.g., e-banking, SWIFT)

- Support for structured data, free text, or binary image within the document

- Ability to track the document lifecycle through a public register

- A natively digital design (i.e., no use of paper)

- Compliance with data privacy laws (e.g., full protection and control of client data).

The dDOC specifications enable banks to benefit from technological developments such as JavaScript Object Notation (JSON), cryptography, DLT, electronic signatures, and timestamps. With the power of these advancements in hand, the dDOC specifications are meant to help progress trade digitization in a highly interoperable and therefore scalable way.

2.4.2 dDOC Requirements

There are four fundamental requirements needed to achieve these key principles: the technology, a digital container, a digital notary, and data storage.

Requirement 1: The technology components

The dDOC specifications are designed around three building blocks:

- A digital container represented as an electronic file designed using “Ricardian” contracts (a type of contract that is readable both by humans and machines) and JSON, and secured using cryptographic key pairs;

- Electronic signatures and time-stamps; and

- A public distributed ledger acting as a digital notary to verify the state and ownership of the digital original. A ledger entry anchors a certain version of a digital original cryptographically by connecting it to the latest cryptographic seal in the document. The seal secures the integrity of the document and connects the document state with the ledger.

The combination of the above three technology components produces portable digital originals. These originals are compatible with any existing or future software capability and transport mechanisms.

Requirement 2: Digital container secured with electronic signatures and stamps

The term ‘digital container’ simply refers to the mechanism that is used to store and transport the file under discussion. These digital files exist in a digital container similar to how a paper file might exist in a sealed envelope. The digital container, however, has many more robust verification and security mechanisms than a standard envelope.

First, the digital container embedding the digital original must be:

- a cryptographically secure electronic document,

- independent of any information technology (IT) system or platform,

- linked to a public key (one of a cryptographic key pair, the other being private), and

- evidenced in a distributed ledger (DL).

In addition:

- the document must carry cryptographic evidence (hash values) of its content that are published on its associated DL;

- the document must contain a public key corresponding to a private key, to evidence the possession of the document;

- it must be possible to add content to the document but impossible to alter previous content;

- the document must be able to carry electronic signatures and electronic stamps;

- it must be possible for the owner to invalidate the document.

Requirement 3: Digital notary using DLT

In addition to the digital original, the DL verifying the state and holder of the digital original must:

- function as an incorruptible cryptographic assurance utility with central governance using a distributed block-chained ledger. This ledger must be continuously and independently validated and approved by its participants;

- be publicly accessible to any holder of a digital original or anyone holding a copy of a digital original; and,

- be associated with a uniform resource locator (URL) where any person or organisation can manage and receive a digital original

Requirement 4: Technology integration and data storage/privacy

The document technology solution should also:

- be operationally and technically compatible with integrations for existing and future front-to-back office practices, processes, systems (e.g., digital document processors/booking systems/platforms) and channels (digital couriers e.g., file transfer protocol (FTP), electronic banking internet communication standard (EBICS), SWIFT, e-banking);

- ensure that all business data stays in the digital container and no business data is, through the underlying technology, shared in any central register or in the associated DL;

- be a utility where participants using negotiable instruments and documents of title can share a common trust in the truth of what an original document is, what the current version of an original document is, and who the current holder of an original document is; and,

- enable the original document and its referred attachments and the secret private ownership key to be stored anywhere the holder sees fit, using a storage technology with security measures deemed appropriate by the holder.

Digital Trade Instruments

Before diving into their use cases as digital instruments, one must first understand what exactly promissory notes (PNs) and bills of exchange (BoEs) are.

Promissory Notes and Bills of Exchange

A BoE is defined as a written order to a person requiring the person to make a specified payment to the signatory or to a named payee. Similarly, a PN is defined as a signed document containing a written promise to pay a stated sum to a specified person or the bearer at a specified date or on-demand.

Both are independent payment undertakings (debt obligations) made from one person to another that are codified in English law under the BoE 1882, which has since been developed and interpreted by courts. The documents typically contain all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of issuance, and issuer’s signature.

A BoE differs from a PN in the sense that it is transferable; this means that one party can be obligated to pay another party who was not involved in the creation of the instrument. A BoE is usually issued by one party and endorsed by another. As it has been endorsed or there is an agreement to pay, there is little risk of non-payment.

An important characteristic of BoEs and PNs is that they are totally independent. If they are contingent on other instruments, such as purchase agreements or other underlying transactions, they are generally not accepted. In essence, this makes them irrevocable and unconditional promises to pay, with no defence to non-payment, to a holder who is free to transfer it to another party as they see fit.

Digital trade instruments

The ITFA Digital Negotiable Instrument (DNI) initiative has created a functionally equivalent instrument that operates in the same way as the BoE and PN, delivering the benefits of an eNI under English law. This solution, hereafter referred to as an ePU, is an important step towards achieving full applicability under English Law, specifically the BoE 1882. The ePU delivers a digitally native irrevocable, unconditional, and independent payment undertaking that fulfils all requirements of a traditional NI, albeit subject to contract law rather than common law.

Electronic Payment Undertaking (ePU)

An ePU requires the ability to create and sign an electronic document that has all the properties associated with a NI in English law. Therefore, an effective ePU must have the following characteristics.

3.2.1 Critical Characteristics of an ePU

- be identifiable as an original (i.e. distinguishable from a copy);

- be an irrevocable, unconditional promise to pay;

- to a holder in due course;

- who can freely transfer it;

- with no defence to non-payment; and,

- be evidenced in an immutable electronic original document solely controlled by the holder.

3.2.2 ePU Requirements

The requirements for an ePU, outlined below, closely mirror the dDOC requirements discussed in 2.4.2.

The underlying technology solution used for the ePU must be a cryptographically secure electronic document, independent of any IT system or platform, linked to a public key, and evidenced in a DL where:

- the ePU must carry cryptographic evidence (hash values) of its content that are published on its associated DL;

- the ePU must contain a public key corresponding to a private key, to evidence the possession of the ePU;

- it must be possible to add content to the ePU but impossible to alter previous content;

- the ePU must be able to carry electronic signatures and electronic stamps; and,

- it must be possible for the owner to invalidate the ePU;

In addition to the ePU, the DL evidencing the state and the holder of the ePU must:

- function as an incorruptible cryptographic assurance utility with central governance using a distributed block-chained ledger. The ledger must be continuously and independently validated and approved by its participants;

- be publicly accessible to any holder of an ePU or anyone holding a copy of an ePU; and,

- be associated with a URL where any person or organisation can manage and receive an ePU.

The underlying technology solution should also:

- be operationally and technically compatible with the integration of existing and future front-to-back office practices, processes, channels, and systems;

- ensure that all business data stays in the ePU and no business data is, through the underlying technology, shared in any central register or in the associated DL;

- be a utility where participants using negotiable instruments and documents of title can share a common trust in the truth of what an original ePU is, what the current version of an original ePU is, and who the current holder of an original ePU is; and,

- enable the original ePU document and its referred attachments and the secret private ownership key to be stored anywhere the holder sees fit, using a storage technology with security measures deemed appropriate by the holder.

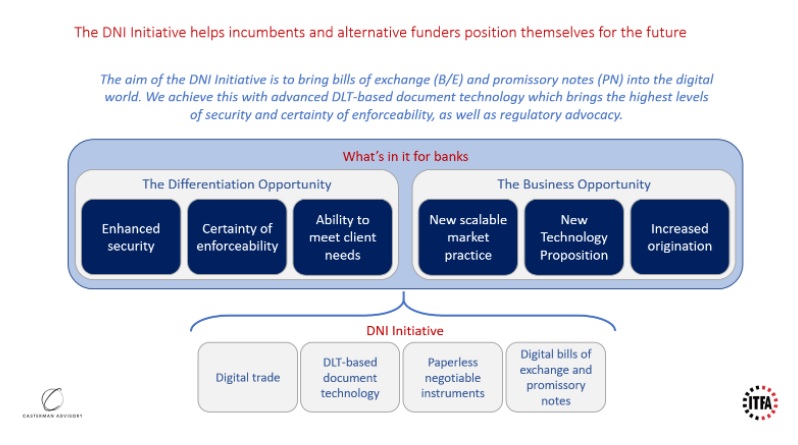

Benefits of Digital Negotiable Instruments

We believe the benefits for banks as well as alternative lenders and export funding platforms are numerous. The DNI Initiative helps them provide additional value thanks to a superior client experience while, at the same time, enhancing the security of the document and certainty around the enforceability of the instrument. The DNI Initiative aims to help banks increase origination volumes thanks to faster processing of client financing requests.

A Summary of the Legal Issues Surrounding an ePU

The BoE 1882, which governs NIs under English law does not explicitly require that a BoE be in paper form. While this is true, the act does require that certain physical actions are able to be performed on the document, namely the actions of writing on, signing, and delivering. As such, in order for an eNI to be recognized as a NI, its underlying system must be able to replicate these actions. The actions of writing and signing are already well-established under English law as actions that can be done electronically. Unfortunately, this is not the case for delivering, which is legally accomplished through the transfer of possession.

While it has been the subject of recent criticism, the current position of English law is that it is not possible to “possess” an intangible. Since an eNI is intangible, it is not possible to legally possess one. As it cannot be possessed, it is not possible to transfer possession of an eNI, one of the physical actions required for a NI. Therefore, it is currently not possible to have an eNI under the BoE 1882.

There are, however, means of achieving sufficient certainty about the delivery of eNIs. One method would be for the UK to adopt the United Nations Commission on International Trade Law (UNCITRAL) Model Law on Electronic Transferable Records (MLETR) or to pass another general eCommerce law that would effectively allow electronic promissory notes (ePNs). Another method would be for the definition of ‘delivery’ under the BoE 1882 to be amended to clarify that the delivery of an eNI in an electronic system is achievable.

There is a third option that can be used in the interim. Under English law, it should be possible to create an electronic instrument that has the features of a NI and that is an enforceable debt obligation but that is not a NI for the purposes of the BoE 1882. Utilising such an instrument would alleviate the need to consider the transfer of possession under the BoE 1882.

A full legal analysis conducted by Sullivan & Worcester UK LLP can be found in Appendix 1.

Opportunity for Policy Makers

In Q2 2020, ITFA set up the Technology Experts for Regulatory Action (TERA) task force. Recognising the importance of changing laws in most countries to progress trade digitisation, ITFA’s goal is for TERA to act as a centre for the coordination of regulatory advocacy work on priority topics. These topics include such things as DNIs, digital bills of lading, use of cloud computing, use of electronic signatures, use of trade assets to channel public relief efforts, and use of tokenisation and digital assets.

Regulators are increasingly being approached by several segments of the financial industry (e.g., securities services, digital assets) with similar requests regarding the use of DLT for recognising ownership and transfer of intangible assets such as DLT-based payment undertakings.

The dDOC specifications offer the opportunity for policymakers to refer to a vendor-agnostic industry-wide framework when considering the parameters of change and the necessary governance to guide change.

Legal Issues of Digital Negotiable Instruments

The emergence of digital negotiable instruments, such as electronic promissory notes and digital bills of exchange, presents various legal issues that need to be addressed. These issues include the recognition and enforceability of digital instruments under existing laws, the authentication and integrity of electronic signatures, the establishment of reliable electronic transfer mechanisms, and the protection of parties’ rights in digital transactions.

Additionally, legal frameworks must adapt to accommodate the unique features of digital instruments, such as their transferability and the potential for automated execution. Overall, navigating the legal landscape of digital negotiable instruments requires careful consideration of existing laws, the development of new legal frameworks, and the harmonisation of international standards to ensure legal certainty and facilitate the widespread adoption of digital instruments in trade and commerce.

Legal issues of electronic promissory notes and Bills of Exchange under English law

By: Sullivan & Worcester UK LLP

1. Background

1.1 This Part 2 contains analysis and advice on whether it is possible under English law, as it stands today, to have purely electronic promissory notes (ePNs) and purely electronic bills of exchange (eBoEs).

1.2 As there is likely no requirement for the electronic system to cater for bearer negotiable instruments, these forms of negotiable instruments have not been addressed.

1.3 Whilst this part concludes that it is not possible to create an eBoE or ePN (either or both, an electronic negotiable instrument (eNI)) under current English law, we are of the view that equivalent documents can be created electronically. Schedule 1 of this Part 2 sets out suggested template wordings for equivalent electronic payment undertakings (ePU) suggested for a BoE and a PN, based on our conclusions.

2. What is needed for an ePN

2.1 As English law currently stands, for a PN that exists purely in electronic form to be recognized as a PN under the Bills of Exchange Act 1882 (BoE 1882), the electronic system in which it exists must be able to replicate a series of actions that can happen to a piece of paper in the physical world. Essentially there are three actions required:

(a) creating in writing;

(b) signing; and

(c) delivering.

There is a fourth action, presentment, that is sometimes required in the physical world. As the need for presentment can be avoided, and presentment via an electronic system is already possible under BoE 1882, this action is less significant than the other three.

2.2 A PN as defined is an unconditional promise in writing made by one person to another signed by the maker, engaging to pay, on-demand or at a fixed or determinable future time, a sum certain in money, to, or to the order of, a specified person.

2.3 Once made, a PN will remain ineffective until delivery thereof to the payee.

2.4 Once a PN is delivered to the payee, if the payee wants to transfer ownership in the PN to a third party, the payee must indorse (that is sign) the PN over to the transferee and then deliver it to the transferee.

2.5 Section 32 BoE 1882 states that the indorsement must be written on the PN itself and signed by the indorser. The simple signature of the indorser on the PN, without additional words, is sufficient, and can be made blank (where no indorsee is specified), and therefore becomes payable to bearer or special (where the person to whom, or to whose order, the PN is payable is designated). Additionally, it must be an indorsement of the entire PN (i.e. it cannot indorse part of the PN or to transfer the PN to two or more indorsees severally).

2.6 In the physical world, when the PN is due for payment, it may be necessary to present the PN at the place where payment is due. Electronic presentment has been possible in the UK since July 2016.

3. What is needed for an eBoE

3.1 As with an ePN, for English law to recognize a BoE that exists purely in electronic form to be recognized as a BoE under the BoE 1882, the electronic system in which it exists must be able to replicate a series of actions. These include the three actions as set out in paragraph 2.1 of this Appendix 1, but additionally requires presentment.

3.2 A BoE as defined is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time a sum certain in money to or to the order of a specified person, or to bearer.

3.3 Once made, every contract on a bill is incomplete and revocable, until delivery of the instrument in order to give effect thereto.

3.4 In order for the payee to transfer ownership of a BoE to a third party, the BoE must be negotiated. A bill payable to bearer is negotiated by delivery and a bill payable to order is negotiated by the indorsement of the holder completed by delivery.

3.5 As with a PN, section 32 BoE 1882 sets out the requirements to have a valid indorsement of a BoE.

3.6 If a BoE is not duly presented for payment the drawer and indorsers of that bill shall be discharged. However, as previously noted, electronic presentation of a PN or BoE has been possible under English law since July 2016 and, as such, we do not further detail this requirement.

4. Writing and signing are possible in an electronic system

4.1 In order for a negotiable instrument (NI) to be created, it must be in writing and signed by the maker. Writing is defined to include print under the BoE 1882, but does not exclude any other forms. Under the Interpretation Act 1978 the definition is expanded so that “Writing” includes typing, printing, lithography, photography and other modes of representing or reproducing words in a visible form, and expressions referring to writing are construed accordingly. The Law Commission Paper of December 2001 (the Paper) took the view that emails will generally satisfy the Interpretation Act requirement for writing, as the sender and recipient will be able to view the message/attachment on screen.

4.2 The Paper took the view that, because of the number of paper-based concepts, the BoE 1882 use of a “bill of exchange” cannot be created by a series of electronic messages. The Paper did not elaborate on what paper-based concepts were incompatible with the idea of an electronic instrument but commented that there appeared to be no demand from industry to create an electronic bill of exchange. The Paper expressed the view that this may have been because “it is currently difficult, if not impossible, to ensure that the holder could not transmit the same electronic bill of exchange to more than one party. This problem will need to be overcome if an electronic bill of exchange is to be developed”. In the intervening years since the Paper was issued, that technological challenge has been overcome, and, as the ITFA initiative demonstrates, there is now a desire in industry for eNIs.

4.3 Things have clearly moved on since the Paper was published, and there have been a number of cases in which the Courts have taken a functional approach in order to apply paper-based concepts to the world of ecommerce. Some of these cases have considered requirements to be “in writing” and “signed”.

4.4 In Golden Ocean, which considered the requirement for a guarantee to be “in writing”, the Court of Appeal held that the exchange of a number of emails could constitute an agreement “in writing”. In Pereira the High Court considered what might constitute signing and signature in the context of emails and reasoned (obiter) that typing your name at the bottom of an email, or even inserting a pre-loaded email signature, for example by clicking an “insert signature” button when sending the email (as opposed to it being inserted automatically by the email system) could constitute a signature, providing there was an intention to authenticate the document. This reasoning was followed in the High Court case of Green.

4.5 Based on the sections of the Paper that are still relevant today and the subsequent cases mentioned above, in our view it is possible for an electronic system to facilitate satisfaction of the “’in writing” and “signed” requirements under the BoE 1882 for the creation of a NI, and for its indorsement provided that:

(a) the electronic format used:

(i) allows interested parties to view the NI; and

(ii) ensures that there is only one definitive record of the NI, or possibly that it is not possible for any party to create replicas of the NI;

(b) the maker (or indorser, as the case may be) signs the NI electronically in a manner that means the fact that they have signed it is evident in visible form on the NI when their signature is added; and

(c) it is evident from the NI once signed, or by virtue of the technological steps required for the maker’s (or indorser’s) signature to be added to the NI, that their signature can only have been added with the intention of authenticating the NI and binding the maker to the promise made in the NI (or the indorser to its indorsement, as the case may be).

4.6 If there were a need for the electronic system to facilitate presentment of a NI, it would be prudent to draft the NI in a way that ensures it could not inadvertently constitute a banknote. Precluding the possibility of a NI becoming a bearer NI would be one way to achieve this. That means it has to be payable to a specific person.

4.7 In order for the electronic system to preclude the possibility of creating a NI that is payable to bearer, as a NI made out to a non-existent payee defaults to being a bearer instrument, this may mean any payee on a NI would need authenticating (i.e. its existence would need confirming), at the point a NI is made or indorsed in its favour.

5. Signing in a way that is legally equivalent to a handwritten signature is possible in an electronic system

5.1 Although the cases mentioned above support the view that an electronic signature is possible, they do not expressly state what would unequivocally make the electronic signature equivalent of a handwritten signature.

5.2 As per the above, we are confident that it is possible to have a non wet-ink signature with legal effect under English law. The European Parliament addressed this under the Electronic IDentification, Authentication and trust Services (eIDAS) Regulation, which came into force in July 2016 and is directly applicable in all Member States.

5.3 The eIDAS Regulation states that an electronic signature shall not be denied legal effect and admissibility as evidence in legal proceedings, which supports our view. The eIDAS Regulation goes further and states that a qualified electronic signature shall have the equivalent legal effect of a handwritten signature. Article 3 of the eIDAS Regulation defines ‘qualified electronic signature’ [to mean] an advanced electronic signature that is created by a qualified electronic signature creation device, and which is based on a qualified certification for electronic signatures.

5.4 A signature that meets the following criteria is defined as an advanced electronic signature under the eIDAS Regulation:

(a) it is uniquely linked to the signatory;

(b) it is capable of identifying the signatory;

(c) it is created using electronic signature data that the signatory can, with a high level of confidence, use under their sole control; and

(d) it is linked to the data signed therewith in such a way that any subsequent change in the data is detectable.

5.5 Therefore, if the electronic system could be designed in such a way that all signatures would qualify as advanced electronic signatures (as per the eIDAS Regulation) there would, in our view, be no doubt as to the legal validity in any Member State of the signatures used in the electronic system.

6. Delivery under the BoE 1882 is currently not likely to be possible in an electronic system

6.1 For a PN to become effective, and for an indorsed PN to be transferred, it needs to be delivered to the first payee or transferee, respectively. Equally, a BoE must be delivered in order to give effect.

6.2 Delivery is defined under the BoE 1882 as the transfer of possession, actual or constructive, from one person to another. This reference to possession causes problems because, with the exception of the EU-imported use of that word in the context of the Financial Collateral Arrangements (No 2) Regulations 2003 (FCARs), there is a general and long-established tenant of English law that it is not possible to possess an intangible (which is what an eNI would be).

6.3 There are no reported cases that consider the meaning of possession in the definition of delivery under BoE 1882.

6.4 There are very few reported cases that consider the question of whether possession of intangibles is possible in other contexts. Of the four reported cases, three of which we describe in more detail below, two are about the tort of conversion (and say possession of intangibles is not possible) and one is about the FCARs (and says in the FCAR context, possession of intangibles is possible). The first case is a House of Lords case in which there were two dissenting judgments. The ruling in this case was (very reluctantly) followed in the second, a first instance case. The third case, another first instance case, did not have to follow the House of Lords ruling because it is established that in the context of the FCARs, possession has a different meaning than its customary meaning in English law.

6.5 In the 2007 House of Lords case of OBG v Allan, the intangibles in question were contract rights. The holder of the floating charge enforced its charge over a company’s assets and sent in receivers. The receivers took various actions in connection with contracts to which the company was party. It subsequently turned out that the floating charge was invalid, and so the company brought an action to recover for the damages caused by the receivers’ actions. To make a case for damages under the tort of conversion, the company had to demonstrate that the receivers had taken possession of the contract rights. The House of Lords held that the tort of conversion could not occur with respect to the contract rights because you cannot take possession of an intangible. This point was dissented by Lord Nicholls and Baroness Hale.

6.6 The second case, Your Response, heard in 2014, concerned a database. The Judge was unable to distinguish the case before him from OBG v Allan and so ruled that it was not possible to possess a database. In his judgment, like those of the dissenting Judges in the House of Lords case, he voiced critical views about the legal fiction of it not being possible to possess an intangible and intimated that it was high time the law caught up with technological developments and resolved this anomaly.

6.7 The third case, Lehmans, concerned the use of possession in the FCARs – legislation that is primarily concerned with taking security over intangibles, namely money in bank accounts and dematerialised securities and equities. The FCARs were implemented into English law by requirement of an EU Directive, and the use of the word possession is taken from the EU legislation. In this case, the Judge ruled that possession (in the context of the FCARs) does apply to intangibles, and explains in general terms what could amount to possession when applied to intangibles.

6.8 This case is helpful in a number of other respects. It was argued in immense detail, no doubt so as to facilitate the Judge departing from some of the findings in the only other case on this point. The outcome in that earlier case provoked criticism among academics and practitioners and may have prompted an amendment to the FCAR aimed at fixing the issue that the case had highlighted. Consequently, the reasoning in the judgement in this case is very thorough and well-founded. The judgement does not refer to the OBG v Allan case, the implication being that the OBG v Allan was not at all relevant and there was therefore no need to distinguish it.

6.9 However, it must be stressed that, while the overall impression one gets from reading the judgment in Lehmans is that the Judge believed that the law should be updated to allow possession of an intangible in wider terms, he refrained from making any wider comments because it was not relevant to the case and would not have been consistent with the views expressed by higher courts in other cases.

6.10 In November 2019, the UK Jurisdiction Taskforce (UKJT) released a legal statement on crypto assets and smart contracts (the Statement). The UKJT for the Statement consisted of senior Judges, a QC and Sir Nicholas Green. The Statement was launched by the Lord Chief Justice, the Advocate General and the Chancellor of the High Court. Although the Statement is not technically binding, given the seniority of the taskforce and the “blessing” of those launching it, it is highly likely that anything contained in it would be followed by any court of England & Wales.

6.11 The Statement discussed if a crypto asset could be defined as property under English law. Traditionally, English law has recognised two types of personal property: a) things/choses in possession; and b) things/choses in action. The UKJT concluded that a crypto asset is not a thing in possession because it is not tangible and so cannot be possessed[37]. By making this statement, they confirmed the general tenant that you cannot possess an intangible at English law.

6.12 Unfortunately, the UKJT goes further than discussing crypto assets and they make direct reference to and discussion of the BoE 1882. Their view is that a crypto asset could not be an instrument due to the requirement of physical possession under the BoE 1882 (as discussed above). The UKJT concludes that:

whilst as a matter of principle a statute ought to be read so as to accommodate technological change, the principle that intangible property cannot be possessed is so well-established that we do not think it could be displaced by interpretation alone. That conclusion is reinforced by the international usage of bills of exchange, which necessitates a uniform approach to developments in the law. It therefore seems to us that intangible property falls outside the scope of the [Bills of Exchange 1882] Act.

6.13 This paragraph confirms the position that under English law, it is not possible to possess an intangible and that the judiciary should not attempt to interpret such definitions differently. Therefore, despite the trend for the courts to look favourably on technological advances, they see this as one step too far and would require legislative changes to accommodate this. The Statement is highly persuasive, and it would be likely that any court would rule that you cannot possess an intangible, meaning delivery of an eNI under the BoE 1882 is not possible.

6.14 We have therefore concluded that if an English Court was asked to rule on whether an eNI under the BoE 1882 can exist at English law, it is likely that they will find the answer to be no.

6.15 In light of the conclusion that delivery would not be possible, it would be impossible to create an ePN under the BoE 1882, as a PN as per the BoE 1882 is inchoate and incomplete until delivery to either the payee or bearer. This conclusion led us to state in our earlier note in 2018 (the 2018 Note) that an ePN would be unlikely to be upheld by an English court. As such, our analysis on this stopped at this point.

6.16 For completeness, even if delivery was possible (i.e. there was no requirement of possession in the definition), the term possession is used in both the definition of holder and bearer and therefore the same arguments and issues would arise for these.

7 Amending the BoE 1882 possession definition so it expressly facilitates electronic documents

7.1 The challenge that the use of possession in the context of the BoE 1882 definitions creates for an eNI system would be overcome if that part of the BoE 1882 were amended so it expressly contemplated electronic documents, or another law was adopted that effectively overrode this provision in the BoE 1882, or expressly provided that possession should be interpreted in a way that did not preclude eNIs.

7.2 The United Nations Commission on International Trade Law (UNCITRAL) adopted the Model Law on Electronic Transferable Records (MLETR) in July 2017. The MLETR, in its current form, specifically deals with how it would be possible to transfer/deliver/possess electronically. Should the UK adopt the MLETR, it would modify the definition of delivery (and therefore transfer of possession) under the BoE 1882, and allow delivery to happen electronically. Until very recently, we had not found any evidence to suggest that the UK is contemplating adopting the MLETR. We are aware of an International Chamber of Commerce (ICC) initiative and an ITFA initiative in this area but have no indication of timing or likelihood of success.

7.3 Explaining in detail the UK legislative process and the various routes by which an amendment to BoE 1882 delivery definition could be introduced is beyond the scope of this advice note. However, in brief, if Parliament has already empowered the Government with the authority to make such a change by means of a statutory instrument, then using this route is usually quicker and simpler than using the parliamentary process.

7.4 The UK Government has delegated authority under the Electronic Communications Act 2000 to amend enactments:

for the purpose of authorising or facilitating the use of electronic communications or electronic storage (instead of other forms of communication or storage) for the purposes of…

(a) the doing of anything which under any such provisions is required to be or may be done or evidenced in writing or otherwise using a document, notice or instrument; [and/or]

(b) the doing of anything which under any such provisions is required to be or may be done by post or other specified means of delivery.

This is another area of interest but again without indication of likely timing or success.

8 Summary and conclusions in relation to the BoE 1882

8.1 For an eNI to be recognised as a NI under English law under the BoE 1882, the electronic system in which it exists would need to facilitate the electronic equivalent of the physical acts of writing on, signing and delivering (by transferring possession of) a piece of paper. The status of English law is such that the acts of writing and signing are already well-established as acts that can be done electronically. This is unfortunately not the case for the act of delivery by transfer of possession.

8.2 Generally, under English law it is not possible to possess an intangible (which is what an eNI would be) and therefore not possible to deliver it by transfer of possession. In recent cases this legal fiction has been the subject of criticism, but none of these cases have been about the use of the word possession in the BoE 1882 definitions, and some of them have nonetheless upheld this legal fiction. The Statement confirms the position that is not possible to possess an intangible. Therefore, it is not possible to have an eNI under the BoE 1882.

8.3 Sufficient certainty about delivery of eNIs might be achieved if:

(a) the UK adopted the UNCITRAL MLETR, or passed another general ecommerce law that effectively provided that the BoE 1882 should be construed so as to allow ePNs; or

(b) the appropriate Minster was persuaded to amend the BoE 1882 delivery definition, to make clear the delivery of an eNI in an electronic system was achievable.

8.4 If none of the options are sufficiently appealing to pursue, then it is worth bearing in mind that under English law it should be possible to create an electronic instrument that has the features of a NI and that is an enforceable debt obligation but that is not a NI for the purposes of the BoE 1882. This would alleviate the need to consider transfer of possession under the BoE 1882.

9 Creation of an equivalent ePU

9.1 We note that an English law eNI as per the BoE 1882 is the desired result and would be the first-choice outcome but, as concluded above, it is unlikely that this can be achieved under current law. Therefore, we have looked at what ITFA could achieve and whether a functional equivalent document can be created under English law that will operate in the same way and have the benefits of an eNI.

9.2 To achieve the above, a signed, written alternative yielding negotiable equivalence to an eNI under English law in a purely electronic system (i.e. what we define as an ePU) would need to be created. This would require:

(a) an irrevocable, unconditional promise to pay;

(b) to a holder in due course;

(c) who can freely transfer it; with

(d) no defence to non-payment.

9.3 A fully electronic irrevocable, unconditional promise to pay

9.4 Under English law, parties are free (with very few, limited, exceptions) to agree to whatever terms they wish to be bound by for any contract, and the courts are, usually, prepared to enforce such terms. To create an English law contract, the following criteria must be met:

(a) offer;

(b) acceptance;

(c) the intention to create legal relations; and

(d) the party enforcing the promise having provided consideration.

The courts would determine if a valid contract was created and entered into on a case-to-case basis. At common law, the application of these principles are technology neutral. Therefore, if the four elements of a contract are evidenced, there is no reason an electronic contract would not be legal, valid, binding and enforceable under English law.

9.5 There are many examples of irrevocable payment undertakings that are enforceable under English law. For example, an English law letter of credit incorporating the terms of Uniform Customs & Practice for Documentary Credits (UCP600) and its Supplement for Electronic Presentation (eUCP600) would contain an irrevocable and definite undertaking to pay when a complying presentation is made.

9.6 As such, provided a document is created in a system that adheres to the rules for contract formation, it is possible to have a fully electronic contract containing an irrevocable, unconditional promise to pay.

9.7 Transferability/negotiability

9.8 Both PNs and BoEs are negotiable instruments (i.e. able to be transferred by mere delivery, or via indorsement and delivery, from one person to another, to pass title of the equities to a transferee who takes bona fide and for value, and with the right in the transferee to sue in their own name all parties to the instrument). For negotiation to take place, there is always a requirement for delivery under the BoE 1882. Due to the requirement for a transfer of possession to effect delivery (as discussed above), it is currently not possible to achieve negotiation electronically under the BoE 1882.

9.9 Notwithstanding the above, there are other ways that the rights and obligations of contracts can be transferred from one party to another under English law (for example, novation, subcontracting and assignment). Strictly speaking, novation does not transfer the rights and obligations from party A to party B in a contract with party C. Instead, the contract between party A and party C is extinguished and is simultaneous replaced (on the exact terms) with a contract between party B and party C. Due to a simultaneous extinction and creation of contracts, this would not be appropriate for use to create an equivalent document like the proposed ePU. A sub-contract does not transfer the benefits of a contract and, therefore, would also be unsuitable for use to create an equivalent document like the proposed ePU.

9.10 An English law assignment is the transfer of a right from one person to another. The benefit of a contract is a right and can be assigned to another party. The statutory provisions for an English law assignment are set out in the Law of Property Act 1925 (LPA 1925), which details the required criteria to have a legal assignment. However, the LPA 1925 does not forbid equitable assignments or impair their efficacy in the slightest degree. The result of this is that, should an assignment fail to constitute all the specified criteria (as detailed below) of a legal assignment, you may still have a valid assignment at equity.

9.11 Therefore, as English law currently stands, it is possible to transfer the rights of a contract via an equitable or legal assignment.

9.12 The main differences between a legal and equitable assignment are:

(a) a legal assignee can sue the underlying debtor in their own name (without joining the assignor to the proceedings); and

(b) a legal assignment will pass a legal right to the assignee, whereas an equitable assignment will only pass an equitable right.

9.13 To have an electronic legal assignment under section 136 LPA 1925, you would need to have:

(a) an absolute and unconditional assignment (i.e. not purported to be by way of charge only);

(b) over a wholly ascertainable (and not related to only part of a) debt, or other legal chose in action;

(c) in writing and signed by the assignor; with

(d) notice of such assignment given to the other party(ies) to the agreement.

9.14 Further analysis on the law of assignments is beyond the scope of this analysis, but there is nothing (in principle) that would mean that an electronic contract could not be assigned.

9.15 For an ePU to be effectively transferred, this would work provided that an electronic system was created where:

(a) the entire value of such note or bill would be assigned (i.e. it must be 100% of the value of the note or bill);

(b) over the rights of a contract, namely the ePU (which is a chose in action);

(c) in writing and signed (these points have already been dealt with above); with

(d) notice given to the other party.

On this basis, you would be able to have a valid legal assignment over such ePU.

9.16 Of the criteria, the only potential hurdle for an ePU in an electronic system is for notice to be given to the other party (for example, the maker or the drawee using BoE 1882 terms). One of the desired outcomes for an ePU is the ability to freely transfer the instrument/document. To achieve a legal assignment, each time the benefit (i.e. the promise or written order to pay) of the instrument/document was transferred, a notice would need to be sent to the maker/drawee. It is possible, within an electronic system, that notice of assignment could be given each time the ePU was transferred to a third party. This would create a valid English law legal assignment.

9.17 Therefore, providing an electronic system could create a method of transfer that satisfies a legal assignment, then the benefit (i.e. the right to receive payment from the maker/drawee on the maturity date) of the ePU could be legally assigned to a third party.

9.18 To a holder in due course

9.19 A holder in due course (HIDC) is a holder who has taken a BoE or PN, complete and regular on its face, before it was overdue, without notice that it had been previously dishonoured (if such was the case), in good faith for value and at the time the BoE/PN was negotiated to them, they had no notice of any defect in title of the indorser.

9.20 The essence of negotiability is that a transferee shall be capable of taking free of equities, that transfer by mere delivery or by indorsement by delivery shall vest in them absolute and indefeasible title; that they shall have the right to sue on the instrument in their own name.

9.21 Whether a holder of a BoE or PN would be a HIDC would depend on the circumstances in which that BoE or PN was delivered (or indorsed and delivered) to them. It should be possible to create an equivalent position in an electronic system, as a HIDC is determined by the facts. It may be that, strictly speaking, an electronic system could not create a HIDC as contemplated by the BoE 1882, but that an equivalent concept could be created electronically. In order to achieve this, any transfer would need to be by way of a legal assignment or in such a way that the maker or drawer (i.e. the issuer) agrees to pay without any defence to non-payment.

9.22 No defence to payment

9.23 One of the major benefits of a BoE or a PN, is the knowledge that in virtually all situations, the holder of the instrument can present the instrument on its maturity date for payment and that such payment will be made with no further questions, qualifications, or documents required.

9.24 By creating an irrevocable, unconditional payment undertaking in an electronic system (the proposed ePU), providing that undertaking was drafted adequately, it would be possible to contractually create an undertaking where there would be no defence to payment.

9.25 Conclusion

9.26 It should be possible under English law for an electronic system to contractually create an equivalent to an eNI, containing an irrevocable payment undertaking that is freely assignable to a “HIDC” where there is no defence to making payment on the maturity date to the person to whom the ePU has been assigned.

What is the template wording for an Electronic Payment Undertaking (ePU)?

By using a digital signature to sign this ePU and any subsequent amendments as contained and authenticated in this electronic system, the Issuer irrevocably and unconditionally undertakes to pay the Holder, on the Maturity Date, the Principal Amount in the Applicable Currency in immediately available funds without any deduction or withholding, set-off or counterclaim at the Payment Place. The Issuer hereby waives the need for any further action or notices or any defences to non-payment in connection with the delivery, acceptance, performance, default or enforcement of this ePU.

The holder of this ePU (authenticated by owning the private key which corresponds to the public key in this electronic system) is the legal owner of this ePU (the Holder). The Holder has all rights to this ePU, including but not limited to, having control of the ePU in this electronic system with the ability to make amendments. The Holder may freely transfer legal ownership and control of this ePU to a third party (an Assignee).

Upon agreement to transfer legal ownership and control of this ePU to an Assignee the Holder shall assign this ePU to the Assignee by [instructions to this electronic system] (a Transfer).

When a Transfer is executed, all rights, title, benefit and interests of the Holder arising out of or in connection to this ePU, whether present or future, actual or contingent are absolutely assigned to the Assignee.

Upon a Transfer, the Assignee owns the private key, which corresponds to the public key in the electronic system, for that ePU, and therefore becomes the Holder.

The Issuer irrevocably agrees that the recording of a Transfer in the electronic system constitutes notice to it of the assignment of this ePU to the Assignee. Each Assignee shall have all the rights of the Holder set out in this ePU.

This ePU shall be governed by, and construed in accordance with, the law of England and Wales.

[The courts of England and Wales shall have exclusive jurisdiction over any dispute or claim arising out of or in connection with this ePU.]

[ Any dispute arising out of or in connection with this ePU, including any question regarding its existence, validity or termination, shall be referred to and finally resolved by arbitration under the LCIA Rules, which Rules are deemed to be incorporated by reference into this clause. The number of arbitrators shall be one and the seat, or legal place, of arbitration shall be London.]

This ePU and any subsequent amendment is dated as at the time of the timestamp.

This electronic payment undertaking with reference [***] (this ePU) is timestamped [***].

Party Details

Name: [***] (the Issuer, Holder)

Company Number: [***]

Jurisdiction of incorporation: [***]

Email: [***]

ePU DETAILS

Principal Amount: [***]

Applicable Currency: [***]

Maturity Date: [***]

Payment Place: [***]

Payment Details

Payable at: Payment Place

Account Number: [***]

Sort Code: [***]

IBAN: [***]

Execution

Executed by the Issuer and signed by the person who under the laws of its jurisdiction are acting under the authority of the Issuer.

Electronic Signature: [***]

Position: [***]

Electronic Payment Undertaking – Bill of Exchange

By using a digital signature to sign this ePU and any subsequent amendments as contained and authenticated in this electronic system, the Issuer irrevocably and unconditionally orders the Acceptor to pay the Holder, on the Maturity Date, the Principal Amount in the Applicable Currency in immediately available funds without any deduction or withholding, set-off or counterclaim at the Payment Place.

Upon acceptance, evidenced by using a digital signature to sign this ePU, the Acceptor irrevocably and unconditionally agrees to pay the Holder the Principal Amount on the Maturity Date, in accordance with the terms of this ePU.

The Acceptor hereby waives the need for any further action or notices or any defences to non-payment in connection with the delivery, acceptance, performance, default or enforcement of this ePU.

The holder of this ePU (authenticated by owning the private key which corresponds to the public key in this electronic system) is the legal owner of this ePU (the Holder). The Holder has all rights to this ePU, including but not limited to, having control of the ePU in this electronic system with the ability to make amendments. The Holder may freely transfer legal ownership and control of this ePU to a third party (an Assignee).

Upon agreement to transfer legal ownership and control of this ePU to an Assignee the Holder shall assign this ePU to the Assignee by [instructions to this electronic system] (a Transfer).

When a Transfer is executed, all rights, title, benefit and interests of the Holder arising out of or in connection to this ePU, whether present or future, actual or contingent are absolutely assigned to the Assignee.

Upon a Transfer, the Assignee owns the private key, which corresponds to the public key in the electronic system, for that ePU, and therefore becomes the Holder.

The Acceptor irrevocably agree that the recording of a Transfer in the electronic system constitutes notice to it of the assignment of this ePU to the Assignee. Each Assignee shall have all the rights of the Holder set out in this ePU.

This ePU shall be governed by, and construed in accordance with, the law of England and Wales.

[The courts of England and Wales shall have exclusive jurisdiction over any dispute or claim arising out of or in connection with this ePU.]

[ Any dispute arising out of or in connection with this ePU, including any question regarding its existence, validity or termination, shall be referred to and finally resolved by arbitration under the LCIA Rules, which Rules are deemed to be incorporated by reference into this clause. The number of arbitrators shall be one and the seat, or legal place, of arbitration shall be London.]

This ePU and any subsequent amendment is dated as at the time of the timestamp.

This electronic payment undertaking with reference [***] (this ePU) is timestamped [***].

Party Details

Name: [***] (the Issuer)

Company Number: [***]

Jurisdiction of incorporation: [***]

Email: [***]

ePU DETAILS

Principal Amount: [***]

Applicable Currency: [***]

Maturity Date: [***]

Payment Place: [***]

Payment Details

Payable at: Payment Place

Account Number: [***]

Sort Code: [***]

IBAN: [***]

Execution

Executed by the Issuer and signed by the person who under the laws of its jurisdiction are acting under the authority of the Issuer.

Electronic Signature: [***]

Position: [***]

/

- Digital Negotiable Instruments

- TFG Legal Hub