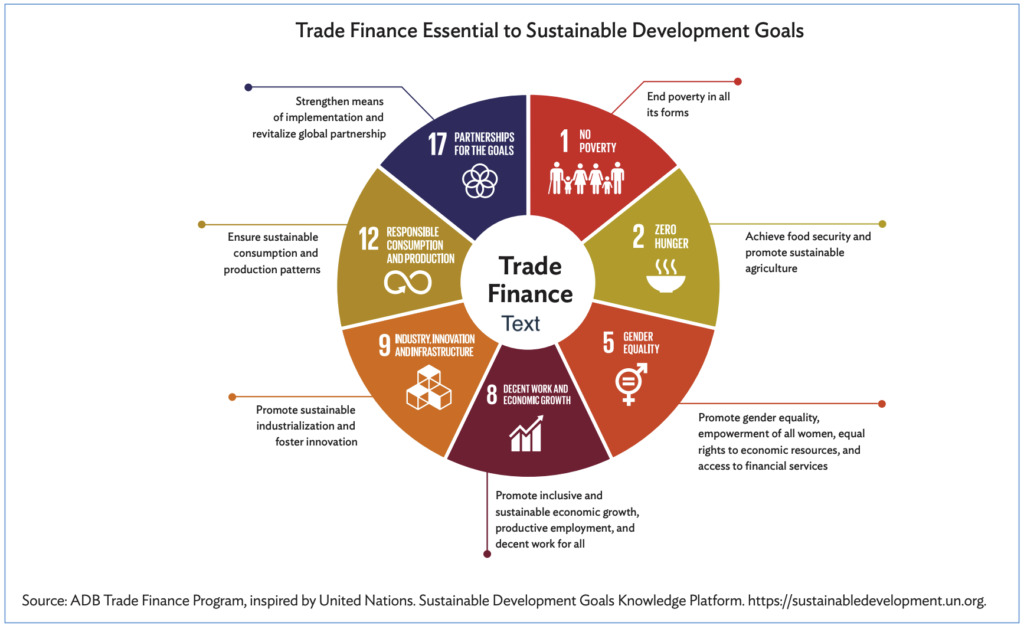

Emergence of Sustainability in Trade

Ever since the United Nations Sustainable Development Goals announcement alongside the United Nations Global Compact, there has been an increasing interest from responsible businesses to make their companies profitable, whilst earning sustainable returns for their shareholders. Multiple stakeholders have begun to rethink existing models, mandates, and policies surrounding sustainable and responsible production across supply chains in the trade arena.

An increase in stakeholder scrutiny is pushing governments to integrate sustainable development into their development policies and investors to reallocate capital after factoring in environmental, social, and governance (ESG) factors. At the same time, customers are demanding greener products and higher transparency across the entire supply chain. These changing trends are evident in the recent HSBC Sustainable Financing and Investing Survey, which shows that 98% of issuers are making changes towards sustainability, 58% of investors consider sustainability some of the time, and 59% of investors do not factor sustainability yet but plan to do so soon. In addition, with COVID-19 uprooting existing activities and disrupting supply chains, in many ways, it has become an ESG multiplier for building fairness and resiliency at every stage of the supply chain to protect vulnerable regions and communities from adverse ESG impacts.

Gaps in Sustainable Trade Finance

Common Standards

The capital markets have the Green Bond Principles issued by ICMA in 2012, while the debt markets have the Green Loan Principles defined by the LMA in 2018, to steer conceptual and applied practice for financing for sustainability. However, sustainable trade finance lacks common standards. The absence of market guidelines and improper application of applicable voluntary standards, certification schemes and other approaches have created market challenges.

Market Definition

At present, sustainable trade finance is not adequately defined. Establishing a definition is complicated as trade finance involves transactions across multiple jurisdictions, complex supply chains and various sectors, compared to capital or debt markets, where players, activities, and needs are standardised. Heterogenous definitions have harmed this market’s credibility due to “greenwashing”, a practice whereby trade transactions are inaccurately labelled as sustainable without any means of verification. There are also other risks like the rebranding of financial flows without additionality and improper adjustment in the cost of capital spreads between industries.

Policy Barriers

To stimulate and incentivise sustainable trade and practices, governments in consultation with the industry need to devise harmonised policies and mechanisms such as green protocols and ESG policies that keep the interests of both big and small players in mind. Presently, major MNCs and their banking partners have taken most of the initiatives in this area. The financial instruments in vogue for crowding in private sector investments are typically those that lower an investment’s risk (such as credit guarantees) or those that lower the costs of various inputs (such as concessional loans, which subsidise borrowing). Some banks are also pushing suppliers towards adhering to sustainable principles by offering preferential financing rates. However, such approaches are sub-optimal as they either subsidise financing or shift the cost of validating sustainable suppliers’ credentials to the institutions and their banking partners.

Role of Banks

Consider sustainable trade finance as an alternate growth avenue

According to the Standard Chartered Opportunity 2030 report, investment opportunities of approx. USD 10 trillion is available across emerging markets to deliver sustainable finance at a lower cost with better returns. These markets are a key part of global supply chains, but don’t have the requisite capabilities to invest in tackling sustainability goals. Banks can meet this demand and opportunity for providing innovative solutions (such as sustainable supply chain finance and sustainable shipment letter of credit) by monetising the entire sustainable supply chain through linkages between financiers, corporates and suppliers for ESG transactions. This model would strengthen relationships with benefits distributed across stakeholders.

Embed ESG frameworks into enterprise risk assessments

Banks are increasingly having to disclose more information on how they are operating and what they are financing. This has led to a concerted effort and peer pressure to join initiatives like Climate Action 100+, to transition away from carbon-intensive industries. By embedding ESG checks as part of the client onboarding process, funding criteria and limiting exposure to operations and assets that have detrimental ESG impacts, banks can help their clients achieve specific sustainability goals. As more transactions are conducted in this nascent market, banks will have a clearer idea of various risks throughout the funding cycle and their potential reputational, credit and regulatory impact on day-to-day business. The scale of success is likely to be contingent on banks receiving support from MNCs, governments and multilateral institutions to reward suppliers meeting their ESG targets via improved financing terms.

Engage in dialogue and foster collaboration

Banks need to lead advocacy and awareness efforts by working closely with corporations, universities, governments, trade associations, regulators and NGOs as part of working groups. For example, the ICC Banking Commission’s “Working Group on Sustainable Trade Finance” is playing a leading role in- 1) creating a tool to identify ESG risks attached to a particular commodity or country of origin, 2) formulating guidelines to assess ESG risks in relation to sustainable trade finance, and 3) educating stakeholders. Such initiatives can ensure the timely development and adoption of industry standards that fulfill core sustainability principles of transparent reporting, independent accountability and strong governance. Similarly, the Banking Environment Initiative and International Finance Corporation’s sustainable shipment letter of credit directed by the Cambridge Institute for Sustainability Leadership demonstrates how public-private partnerships allow for discounted financing at partner banks for trade of sustainably sourced commodities.

Potential Challenges

Digitisation Lag

The trade finance industry is mostly paper-based, which leaves documentation linked to financing open to tampering. Post COVID-19, banks have moved rapidly to digitise processes, but the introduction of advanced technological solutions based on blockchain holds the key to making transactions both transparent and irreversible. For example, Trado illustrates how “track and trace” solutions using blockchain could be utilised by banks for reliably identifying the origins, positions, and conditions of goods across supply chains and vet the same on ESG databases to fund fairer, more transparent supply chains.

Customer Approach

Despite the emergence of sustainability in trade, companies looking to integrate these practises have a high CSR maturity level. This is because sustainable initiatives tend to be burdensome, time-consuming and costly to be fully integrated. As a result, customers used to traditional trade finance transactions may be reluctant to engage banks for partaking in lengthy negotiations that involve a significant advisory component with senior management. Other customers may anticipate the demand, but want to see the establishment of common standards and certifications prior to establishing their own performance indicators for specific projects. As facilitators of global trade, banks can accelerate the transition by promoting market education and awareness.

Conclusion

In a post COVID world, it is evident that sustainable trade finance is firmly on the radar. The effectiveness of sustainable practises across transactions will largely depend on stakeholders being patient and deriving added value over time. This will come about through the development of common standards, proper guidelines and stakeholder assistance. Banks are well placed to assume a leadership role in this nascent market by embedding ESG checks, fostering collaboration and bringing in digital solutions. There is an untapped demand and opportunity to expand trade and enhance the performance not only of the first-tier suppliers, but also of suppliers at tiers deeper in the supply chain.

P.S. The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of any organisation.