On 23 March 2021, a 400-metre-long container ship ran aground in the Suez Canal in Egypt. Calculations suggest that each day of immobilization could cost global trade USD6bn-10bn.

The Suez Canal is the gateway for the movement of goods between Europe and Asia, and welcomed over 19,000 ships in 2019, or 1.25 billion tonnes of cargo. This represents around 13% of world trade so any blockage is likely to have a significant impact. In particular, this incident will likely result in shipping delays of everyday items for consumers around the world. According to Lloyd’s List, every day it takes to clear the obstruction will disrupt an additional USD9bn worth of goods.

Rough calculations suggest westbound traffic is worth around USD5.1bn daily while eastbound traffic is worth USD4.5bn. Yet, coping mechanisms are in place. According to Euler Hermes, every week of closure should cost from -0.2pp to -0.4pp of annual trade growth.

TFG heard from Ana Boata, head of macroeconomic research at Euler Hermes, the world’s leading trade credit insurer, said:

“The Suez canal disruption has the potential to cost the world economy up to $10bn in lost trade for each day that the Ever Given blocks the canal, adding to around $230bn of supply chain disruption to trade seen since the start of this year.

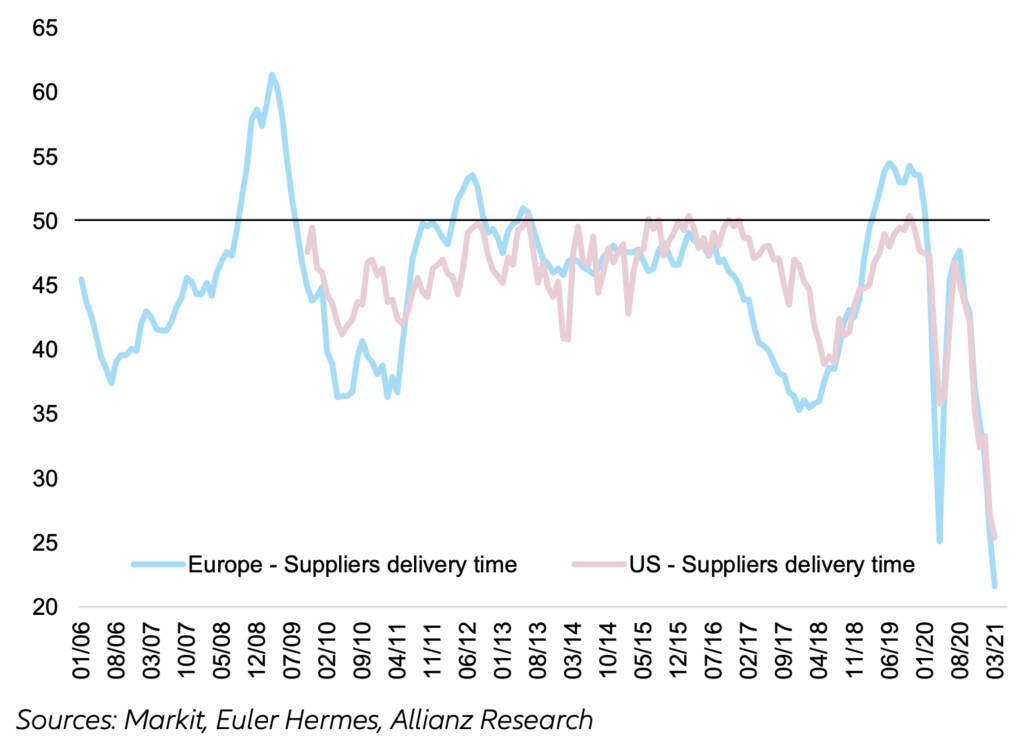

“The problem is that the Suez Canal blockage is the straw that breaks the camel’s back. Suppliers’ delivery times have lengthened and are now longer in Europe than during the peak of the Covid-19 pandemic in 2020. Importers have been grappling with a number of issues such as a shortage of containers and semiconductors, which are already hitting delivery of goods to consumers around the world. Second-round effects will be even more important as supplier input and possibly consumer prices increase.

“Businesses in the UK have also have the added headache of disruption at key ports as the country adapts to the new reality outside the EU after the end of the transition period.

“We forecast global trade to grow by 7.9% in 2021 as the world recovers from the low base of last year. A significant carry-over effect due to the recovery in late 2020 and strong January merchandise trade figures (in part due to China) are propping up our forecasts for 2021. Without this carry over effect the forecast falls to 5.4%.“

Read the full briefing here.