Distributed Ledger Technology

Download our Tradetech Whitepaper

Accelerating trade digitalization to support MSME financing

Content

Distributed Ledger Technology

A distributed ledger is a decentralized, distributed record of transactions in which the transactions are stored in a manner that all parties to the network can trust, although the specific mechanism used to facilitate that trust varies from platform to platform. Distributed ledger technology (DLT) ensures immediate transparency in terms of a transaction’s status for the specific parties involved in that transaction. Because transactions added to the ledger are linked to one another, time-stamped, and tamper-resistant, DLT allows easy traceability and prevents double-spending problems such as the ones that have recently shaken the commodities world in Asia. Not only does DLT provide a secure and robust environment in which other layers and entities in the ledger can connect and in which various stakeholders can interact directly, on a peer-to-peer basis, without intermediaries, it also allows for traceability. For these reasons, it is believed that “what Enterprise Resource Planning (ERP) did for the single enterprise, blockchain can do for the whole supply chain”.

Potential benefits for Micro, Small and Medium Enterprises (MSMEs)

DLT has tremendous potential to facilitate the digitalization of trade finance and brings several key benefits to the parties involved, from the tokenization of assets (including collaterals) to the possibility of transferring digital assets, preventing double-spending and forgery, rendering payments and other processes automatic, reducing paper waste, and introducing a new approach to identity management. DLT can empower individuals and companies around the globe to make transactions more efficient, economically and quickly, while retaining a high level of security. It has the potential to digitalize trade and trade finance processes; it could be to trade and trade finance transactions what the internet has been to communication.

With such widespread benefits, it is no surprise that such a vast number of DLT platforms and projects have emerged in trade. According to the TFG and WTO co-publication DLT in Trade: where do we stand?, there are at least 44 DLT projects currently active.

When it comes specifically to MSME financing, DLT brings a holy trinity of value: trust, transparency and traceability. These benefits can make it easier for MSMEs to build a digital credit history and for banks to assess MSME creditworthiness. Some DLT projects, such as the European-based we.trade, are focused specifically on serving MSME firms, amplifying the benefits of DLT for smaller firms that will be able to access solutions tailored more specifically to their needs. The increased transparency provided by DLT can also make it easier for Tier 2 suppliers and lower which are often small businesses, to access finance. Common supply chain finance solutions are usually only available to established Tier 1 suppliers, which are able to convince their big corporate buyers of their trustworthiness. By enhancing visibility into deeper-tier suppliers, DLT can make their access to finance easier. Various companies like Linklogis and Skuchain are leveraging DLT to this effect.

Another potential benefit of DLT for MSMEs is its ability to allow traditional processes or sources of finance to be bypassed. DLT allows companies and individuals around the globe to make transactions on a direct, peer-to-peer basis, without the need to go through traditional banks. In doing so, DLT allows MSMEs that do not have access to bank financing to access the international trade market through other means. The platform FastTrackTrade, for example, leverages DLT to enable MSMEs to build a credit history and access the services of various fintech companies, thereby bypassing banks.

Anecdotal evidence also suggests that the use of cryptocurrencies and stablecoins (i.e. cryptocurrencies that try to peg their market value to an external reference, such as the US dollar, or to the price of a commodity, such as gold) by traders from the developing world to settle international trade transactions is increasing (see Box 1). Indeed, even large global banks and consortia in the developed world, such as Fnality International, are creating their own stablecoins. A recent interpretative letter issued by a US federal banking regulator allowing US financial institutions to use stablecoins for payment activities is likely to accelerate the move. Last but not least, some projects have emerged that use digital assets to settle global payments and bypass the traditional correspondent banking system, such as Ripple.

Last but not least, the establishment of a global digital identity system can be a powerful tool to help MSMEs access finance. By making it possible for entities to manage their identities themselves (by using self-sovereign identities, or SSIs – i.e. the capacity to own and control one’s digital identity without the intervention of administrative authorities), as well as to manage related verifiable credentials and their usage throughout global supply chains, DLT presents interesting opportunities to break existing identity siloes and improve the verification of companies’ credentials (see Box 2). In doing so, DLT makes it easier for MSMEs to build an identity and to reduce the costs related to supplier verification processes which can weigh heavily on small businesses.

Various DLT-based identity solutions are already in production across the world, such as the Sovrin Network, a public-permissioned DLT platform designed as a global public utility exclusively designed to support SSI and verifiable claims, Civic and uPOrt. Other projects, like KYC-Chain, are developing DLT-enabled digital identities specifically for companies with a view to enhancing verification of customers’ identities and streamlining the KYC onboarding process. Ensuring interoperability between these different systems is essential to enable the development of a global digital identity system. It is critical that the various solutions developed integrate globally accepted standards such as the decentralized identifier (DID) developed by the World Wide Web Consortium (W3C).

The most frequent use of DLT is in platforms, the members of which conduct transactions using a common rulebook. On such platforms, the distributed ledger is a “holder of the truth” for all messages and transactions between members. This not only provides transparency and security for its members but also gives the platform’s members clear data definitions and a defined transaction process. “Ricardian contracts” (see Box 3) even allow legal contracts to be interpreted digitally. The use of DLT allows various costs that can weigh heavily on trade transactions and indirectly impact the smaller players, from coordination costs to processing and verification costs, to be slashed.

As work in the trade finance DLT sphere has continued to progress, another unforeseen benefit has also emerged: DLT has the capacity to incentivize an internal industry push to address the challenges of standardization. Different DLT platforms have different data standards and communication protocols, which limits their ability to talk to each other. This “digital island” problem has brought to the fore the need to develop a set of globally accepted standards spanning the entire supply chain. Increased pressure to develop trade standards, if executed, would provide immense benefits to all traders, including the smaller traders, and would support the wider adoption of nearly all of the digital technologies discussed in this publication.

Box 1: Using cryptocurrencies and stablecoins to settle international trade transactions

When cryptocurrencies were originally conceptualized in the wake of the 2008 financial crisis, they seemed able to address many of the shortcomings and inefficiencies of the cross-border payments system. Remittances and fiat currency devaluation have driven cryptocurrency use in developing countries, in particular in Africa. Unfortunately, many of these original crypto-assets, like Bitcoin, suffer from severe price volatility.

Enter stablecoins. A stablecoin has many of the same features as a cryptocurrency, but it stabilizes its price by linking its value to a certain pool of tangible assets. Stablecoins are particularly popular in East Asia as a result of the Chinese government’s decision in 2017 to ban exchanges of yuan for cryptocurrency. According to the “Chainalysis 2020 Geography of Cryptocurrency Report”, the most popular stablecoin is the controversial Tether, which is claimed to be “tethered” to the value of national currencies like the US dollar, the euro and the offshore Chinese yuan. Tether makes up 93 per cent of all stablecoin value transferred by addresses in East Asia. The report provides anecdotal evidence that a significant share of cryptocurrency and stablecoin transactions between Eastern Asia and Africa, and to a lesser extent Russia, are for business purposes.

While stablecoins could help to address the value volatility issues that plague traditional crypto-assets in international trade, they are not without their own challenges. The G7 Working Group on Stablecoins identifies several challenges facing stablecoins, including legal certainty, sound governance, data privacy and tax compliance. Stablecoins that reach a global scale also offer challenges with regard to monetary policy, financial stability and fair competition.

Box 2: Self sovereign identity and decentralized identifiers

According to the Institute of Electrical and Electronics Engineers (IEE), SSI is a concept in the landscape of identity management according to which: “the user, and only the user, is to have full control over their identity data”. This is in contrast with the world of today, in which identity is managed by a cluttered collection of centralized independent bodies.

Decentralized identifiers (DIDs) can be used to enable SSIs. The W3C working draft on the topic states that “Decentralized identifiers (DIDs) are a new type of identifier that enables verifiable, decentralized digital identity. A DID identifies any subject (e.g., a person, organization, thing, data model, abstract entity, etc.) that the controller of the DID decides that it identifies”.

Currently, an individual may be called upon to display a driver’s licence, passport or identity card as a proof of identity. However, the extent to which this identity is trusted is directly linked to the level of trust that can be placed in the central authority that issued the identification. By making creative use of DLT, DIDs are able to circumvent these issues by creating a verifiable identity in a decentralized manner. This enables the owner of the data to control their own data while still making it verifiable, and also solves some of the data protection concerns raised by regulations like the EU General Data Protection Regulation (GDPR) of 2018.

Box 3: Ricardian contracts

According to R3, an enterprise software firm, Ricardian contracts, also referred to as “advanced document technology”, allow a legal contract to be interpreted digitally without losing the value of the original legal prose. They are unique legal agreements or documents that can be read by computer programmes as well as humans at the same time. Ricardian contracts can interweave computer language and human language, which can make transaction costs much lower, contribute to faster resolution of disputes, and allow agreements to be executed more efficiently. The use of cryptography helps to keep the risk of fraud to a minimum.

While they are similar to traditional smart contracts, Ricardian contracts introduce a human-readable form to the machine-readable agreement. In this sense, Ricardian contracts are legally enforceable, unlike their smart counterparts. Their technical setup also allows for added flexibility, as the intentions as well as actions of clauses can be clearly articulated within the prose of the contract.

Use cases

- Several prominent DLT-based trade finance consortia simplify the trade finance process and inject streamlined efficiencies into the industry. Contour (formerly Voltron) focuses on addressing challenges related to letters of credit, Marco Polo focuses on working capital finance and payables finance, and we.trade targets a host of trade financing tools geared specifically to MSMEs.

- LinkLogis, a supply chain financing service provider based in China, and Standard Chartered work together to provide DLT-based deep-tier supply chain financing. Skuchain is another DLT-based commerce cloud platform that works with multiple large international commercial banks to offer deep-tier supply chain financing.

- Envoy and FastTrack Trade are digital marketplaces that use DLT to connect alternative financing lenders to buyers and sellers and digitize trade documents securely for trusted track records (purchase orders/invoices/payments).

- Halotrade and Provenance designed and demonstrated innovative applications of DLT in the open-source Project Trado, convened by Cambridge University in 2019, which enables new business models, such as data for financial benefits swaps for smallholder tea farmers in East Africa.

- Crowdz is a fintech company working to simplify business-to-business (B2B) payments with a platform that makes sending, paying and selling invoices much easier for MSMEs. They accomplish this by utilizing Ethereum-based smart contracts to record invoices and supporting documents on the blockchain. By also integrating with smaller accounting platforms, they help small businesses to manage their cash flows in a secure and immutable manner.

- An alternative use of DLT proposed by the International Trade and Forfaiting Association (ITFA) is to digitalize the exchange of trade document data using a combination of advanced document technology and DLT. By using this advanced document technology, which is provided by Enigio, negotiable instruments and relevant data can be freely transferable, can be controlled by the legitimate owner, and can maintain singularity (i.e. prevent double-spending). Furthermore, creating these documents to be readable by both man and machine allows data verification to be done with complete accuracy. These advanced document-negotiable instruments not only solve the interoperability challenge for DLT platforms, but also enable trade documents and data to be governed by existing international trade rulebooks and standards, such as the International Chamber of Commerce (ICC) Uniform Customs and Practice for Documentary Credits (UCP) or the 1930 Geneva Convention Providing a Uniform Law for Bills of Exchange and Promissory Notes. The ITFA proposal is open to all transactions in which the governing legislation is technology-neutral and accepts digital documents with electronic signatures.

Implementing advanced documents with the ITFA’s dDoc (i.e. digital document) specifications would enable gradual digitalization, whereby paper trade and digital trade could be performed in parallel. A second advantage with this type of technology is that it can be readily integrated into any current information technology infrastructure used by banks and corporations, and it would bolster the interoperability for MSMEs that are not on platforms, which cannot be solved simply through creating a network of networks.

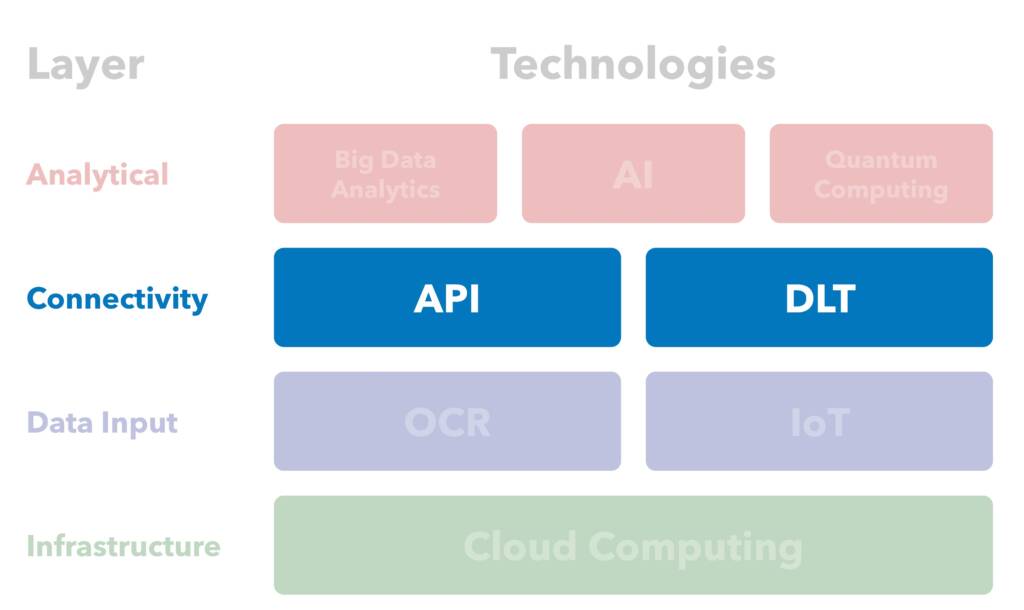

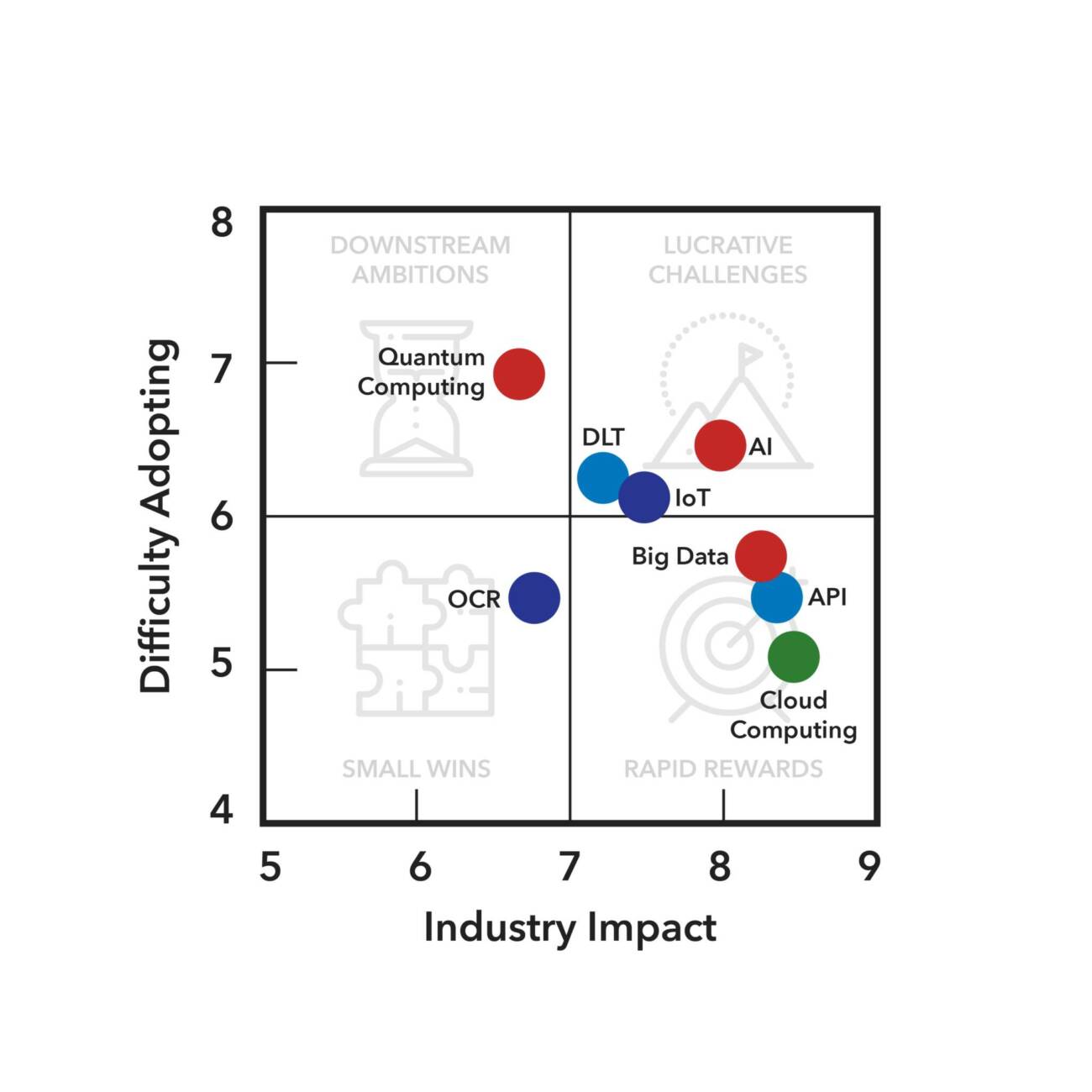

For more information about this diagram, visit our research methodology page.

Addressing DLT challenges

As noted above, there is a large number of projects and initiatives operating in the DLT trade finance space, resulting in a “digital island problem”, i.e. multiple DLT platforms that do not “talk” to each other, or that only talk to a limited extent. It is important to keep in mind that there is not going to be one network to rule them all. It is going to be a network of networks. Therefore interoperability will be key.

The World Economic Forum identifies business models, platforms, and infrastructures as the three key layers to DLT interoperability. To ensure industry-wide value maximization, firms and groups developing DLT solutions need to ensure that their solutions are designed from a standpoint that puts interoperability first and that establishes connectivity across each of these three layers. Efforts also need to be made to develop global standards. Various organizations are working towards creating standards for DLT in trade, both general (e.g. the Digital Standards Initiative (DSI) of the International Chamber of Commerce (ICC) and the United Nations Centre for Trade Facilitation and Electronic Business (UN/CEFACT)) and specific (e.g. The Bankers Association for Finance and Trade (BAFT)’s distributed ledger payment commitment (DLPC)). Ensuring that the standards being developed are widely accepted and span the entire supply chain will be of critical importance for the success of DLT projects in trade and trade finance.

“There is not going to be one network to rule them all. It is going to be a network of networks.”

The future trade finance infrastructure must be truly inclusive, with low barriers to entry for digitalization. It is of primary importance that information essential to transactions can be shared in a secure way, perhaps through digital documents. Within shipping, mining, banking, purchasing and other fields, there is a large number of industrial parties with different specialized platforms, each of which has its own rulebook. For these to communicate effectively, a standardized rulebook of rulebooks and a standard of standards are needed. The world is not static, and all transactions are unique, meaning that there will always be transactions requiring their own documentation even if most documents can be standardized. For this, developments in artificial intelligence (AI) may come to be important.

A handful of significant challenges in the realm of DLT for trade finance lie in the legal arena.

First is the uncertainty surrounding the recognition of electronic signatures and electronic documents. Only around 60 countries have established laws and standards regarding electronic signatures and digital transactions.

Second is the general absence of legal recognition of digital negotiable instruments. To remedy this, the United Nations Commission On International Trade Law (UNCITRAL) has developed a Model Law of Electronic Transferable Records (MLETR), which aims to enable the legal use of electronic transferable records both domestically and across borders. The UNCITRAL MLETR provides a legal framework for the electronic/digital transfer of documents and negotiable instruments in electronic/digital form, using DLT that would provide harmonization if adopted by key nations in trade and finance. Released in 2017, the UNCITRAL MLETR has to date been adopted by only two countries, the Kingdom of Bahrain and Singapore. Recognition of the legal validity and enforceability of electronic signatures and of documents such as electronic invoices is also being discussed in talks conducted by a group of WTO members in the context of the WTO Joint Statement Initiative on E-commerce.

Due to the antiquated laws and regulations of many countries, firms are forced to establish creative digital workarounds each time they seek to make a transaction in a new country. This adds immense complexity to the overall process and risks reducing, if not outright eliminating, the effectiveness of DLT until such outdated policies are addressed and revised. However, to overcome this problem, it will be important to find the right balance between over-regulation and under-regulation. Most people are of the opinion that some regulation is necessary so there is a need to get the balance right. The current pandemic has highlighted the need to revise legislation to allow and promote digital trade. Many countries are currently in the process of adopting a technology-neutral approach to their substantive law.

For MSMEs, another challenge is that the solutions created may not meet their specific needs. Due to the large upfront investment involved in creating functioning DLT networks, many of the products are naturally geared towards servicing big-ticket and high-volume customers, which offer the greatest potential return on investment. Since most of the products offered are limited and seem to be tailor-made by the original request, there is a risk that MSME-specific needs will be forgotten in the ensuing chaos. In order to overcome this, it will be critical that the handful of DLT-based initiatives currently focused on MSMEs, such as we.trade, remain committed to this market segment. Otherwise, MSMEs will be forced to contend with solutions that are not geared to their unique needs.

An additional consideration with regard to DLT as a connectivity technology is any legislation surrounding data protection and privacy. As DLT can be made tamperproof, there may be difficulty removing information placed on the system. Privacy laws, banking secrecy and corporate secrecy are all issues that may arise if data that are subject to regulation are published on a DLT-platform. To promote accessibility for corporates, DLT systems should establish connectivity and transparency only between the relevant parties. Last but not least, advances in quantum computing, while opening new opportunities, could also, in the long term, represent a threat to DLT, the resilience of which relies heavily on encryption and algorithms. Important efforts are underway to develop post-quantum algorithms.

Publishing Partners

- Tradetech Resources

- All Tradetech Topics

- Podcasts

- Videos

- Conferences