Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn, PodChaser

Season 1, Episode 57

Host: Deepesh Patel (DP), Editor, Trade Finance Global

Featuring:

Kristine Siebel, Vice President, Trade Commodity Finance Operations, Societe Generale & Chair, Standby Letter of Credit/Guarantee Committee, BAFT

Normand Girard, Director, Global Trade Operations, BMO Financial Group & Chair, Commercial Letters of Credit Committee, BAFT

Stacey Facter, Senior Vice President, Trade Products, BAFT

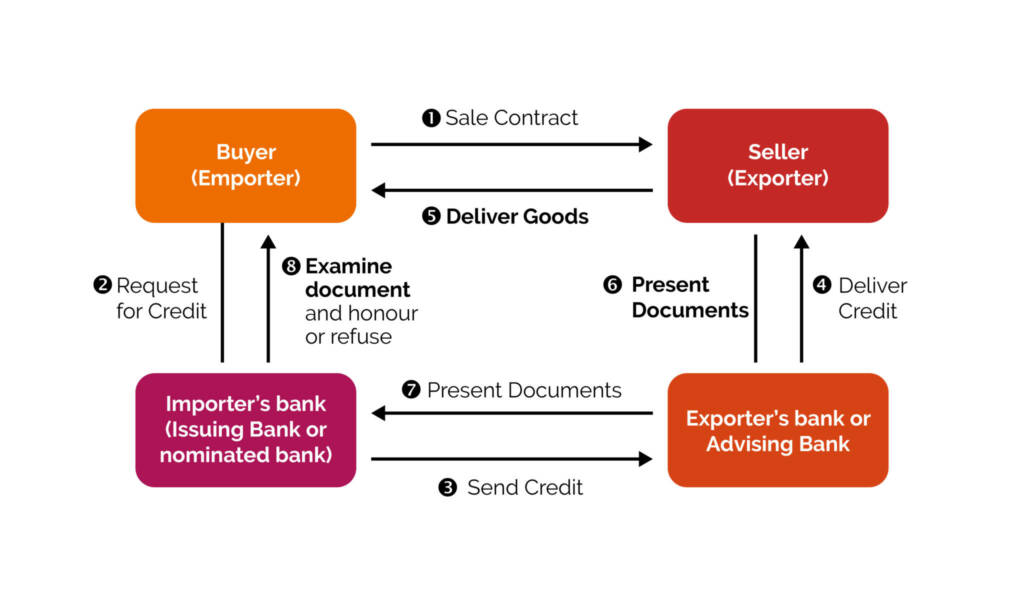

We take a dive into the world of Letters of Credit (LCs) and Standby Letters of Credit (SBLCs) – some of the essential tools in cross-border trade transactions. An LC is a payment undertaking that a financial institution issues on behalf of a buyer. There are many different types, and in this podcast, TFG gets an overview on Commercial Letters of Credit and Standby Letters of Credit (SBLCs).

This podcast was produced in partnership with BAFT

Here is what was covered on this podcast:

- An outline of the main activities of BAFT’s Commercial Letter of Credit Committee

- What a Letter of Credit is, and where it sits within documentary trade

- The role of Letters of Credit play in international trade

- International rules governing Letters of Credit (UCP 600)

- The benefits of Letters of Credit to buyers and sellers

- Case study: how a Letter of Credit works in practise

- Letters of Credit versus Open Account finance (such as receivables finance and supply chain finance)

- The difference between a Standby Letter of Credit (SBLC) and it works

- The difference between SBLCs and Bank Guarantees

- The main types of SBLCs and the most commonly used SBLCs in the market

- The digitalisation of Letters of Credit

Resource Hub