There are several indicators to suggest that commodity markets, especially oil, gas, and metals, will continue to boom over 2021, which will have important implications for Africa’s extractive sectors and trade. An anticipated economic recovery in China will drive demand for hard commodities, while COVID-19 vaccine rollouts in North America, Europe, and other developed markets are fuelling investor confidence. Most importantly, expansive global monetary and fiscal policies have created a flow of ‘hot money’ that is again being directed to developing markets, such as Africa, in an apparent repeat of the aftermath of the 2008 financial crisis. This trend has led some to anticipate another commodity supercycle and raised concerns over the implications for an African sustainable economic recovery after the pandemic.

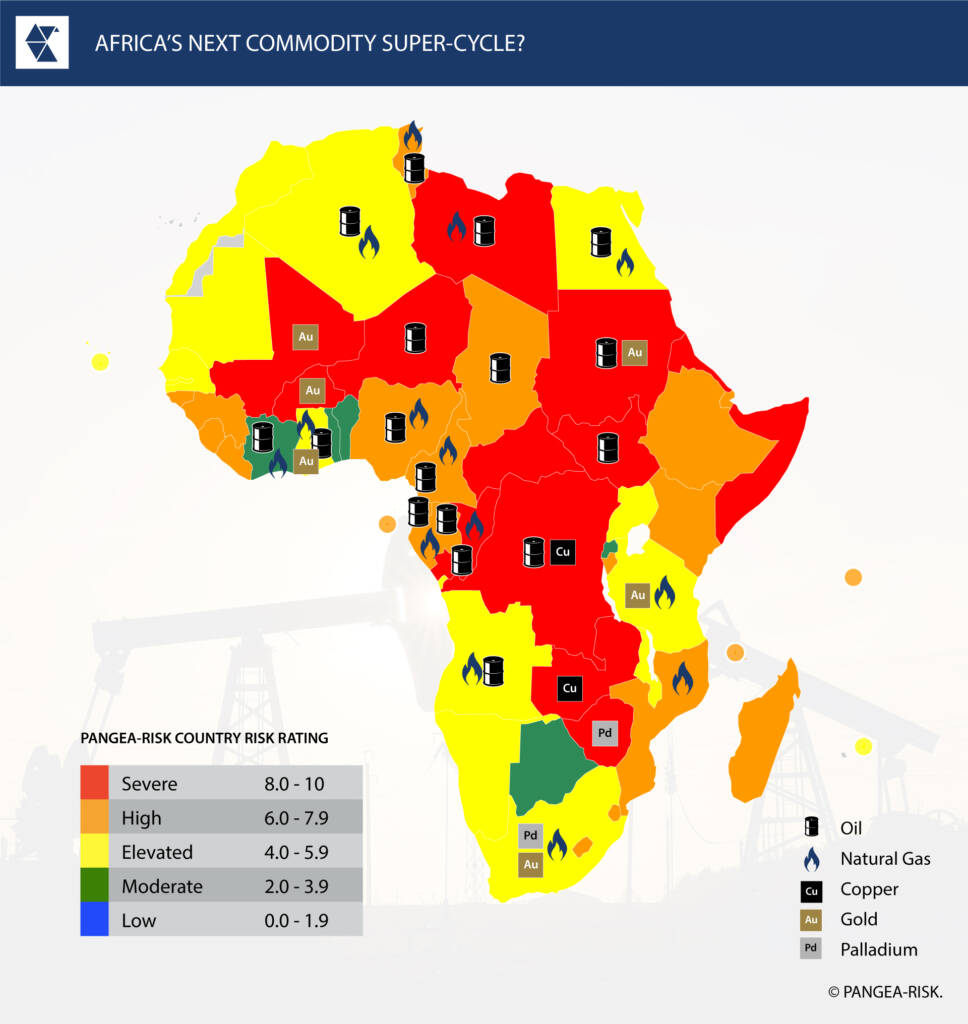

While oil prices dropped by 20 percent over the course of last year and remain below pre-pandemic levels, crude has recovered by 293 percent since its 21year low in April 2020. Similarly, liquefied natural gas (LNG) prices have recovered by over 727 percent since the troughs of the pandemic. Metals even outperformed these rates – copper prices reached an eight-year high after increasing by 26 percent in 2020. Other top-performing metals include palladium, gold, platinum, iron ore, and bauxite (for aluminium). All these commodities are important foreign exchange earners for African markets with significant growth potential for trade after the pandemic. However, there remain several questions over the extent of the next commodity supercycle – if that is an accurate term, as well as the potential to increase intra-regional trade under the new continental free trade agreement, and the impact on loan servicing for many debt-distressed African countries.

The African commodity bonanza – who will benefit?

PANGEA-RISK assesses that a recovery in African commodity markets will alleviate sovereign credit risks for some countries that remain dependent on their extractive sectors, but that a sustained economic recovery from the pandemic can only be achieved through economic diversification and sound fiscal and monetary policy. This means that several African markets will remain vulnerable to more external shocks even after the pandemic and that these countries will remain highly reliant on credit support for the next few years.

Africa’s largest oil producers are sizable exporters of crude, yet for many marginal exporters, such as Tunisia or Côte d’Ivoire, higher global oil prices will provide little additional balance of payment support. Moreover, some of Africa’s largest oil producers like Angola and Algeria are facing field depletion and falling investment in new fields due to high operational costs. Nigeria’s oil sector, which has the second largest reserves estimated at 36.97 billion barrels, is far better positioned than Angola’s following its government’s firm intention to pass the petroleum industry reform bill early this year.

Chinese demand for base metals is also boosting the price of copper and iron ore, although supply constraints in Chile, Peru, and Brazil are also driving factors for price hikes. Iron ore, which is produced in sizable quantities by countries such as South Africa, Mauritania, and soon also Guinea, has seen its prices skyrocket by 121 percent in the past eight months. Copper prices were at a three-year low in April 2020 and then increased by 67 percent to an eight-year high by the end of 2020. However, unlike iron ore, copper prices are set for a sustained price growth trajectory in 2021. This will have major implications for Africa’s two largest copper producers, namely the Democratic Republic of Congo (DRC) and Zambia.

The world’s most important commodities have surged from lows in 2020 to eight- or nine-year highs in recent months. Less than half of Africa’s 54 countries are major exporters of commodities with prices that are currently boosted by increased global demand. There will therefore be several speed tracks for Africa, with some countries growing at much faster rates than others, while a few countries are likely to remain in recession this year. Some of the fastest growing markets in Africa this year according to the IMF will be those with diversified economies, such as Mauritius, Djibouti, Rwanda, and Côte d’Ivoire. The World Bank expects Kenya’s GDP to expand by seven percent, which would make it one of the fastest growing economies this year, despite little reliance in its nascent oil production or small mining sector.

The current commodity price trend may not be an actual super-cycle, since most of the price rises over the past eight months are due to supply constraints rather than a protracted global uptick in demand, which would define a super-cycle. Nevertheless, some metals could be entering their own super-cycle. Demand for metals needed to build renewable energy infrastructure, batteries, and electric vehicles, would be boosted by the fight against climate change. This scenario would be good news for major platinum producers such as South Africa and Zimbabwe, as well as South Africa’s palladium sector.

African free trade rolls out

On 1 January 2021, the African Continental Free Trade Area (AfCFTA) came into force and African countries began officially trading under the new continent-wide free trade area after months of delays due to the pandemic. The free trade area is expected to boost economic recoveries for Africa from this year, and the World Bank estimates it could lift tens of millions out of poverty by 2035. Despite entrenched protectionism in some states and other obstacles such as poor infrastructure, the AfCFTA has been given a new impetus by the pandemic. Full implementation of the deal may take several years, but initial steps towards its implementation may allow member states to double intra-African trade by 2025.

Intra-regional trade in Africa represented less than 20 percent of total trade in 2016. Such intra-African trade primarily consists of manufactured and agricultural products, which are sectors that are widely considered as scalable, in terms of volume and value. Moreover, the AfCFTA is expected to boost intra-African trade of extractables as well, which currently only account for 31 percent of intra-Africa trade compared with 66 percent of extra-African trade. In addition to an increase in trade, the AfCFTA will provide opportunities for value addition for extractives sectors such as mining and oil production, with the production of final or intermediate goods, for innovation and increased productivity through responses to the new competition offered by the open market, and for joint ventures with foreign companies looking for reliable partners in Africa. Combined, the AfCFTA is expected to contribute significantly to GDP and employment opportunities across the continent.