Tradetech

Content

Women in Trade 2021 – Tradetech

Anastasia McAlpine, Finastra

Why did you choose a career in this sector?

Finance has always been a passion of mine, with Trade and Supply Chain Finance giving an opportunity to understand real businesses and help real people. Trade touches every bit of our lives, sometimes in not so obvious ways, in our personal and work relations, as well as on domestic micro- and global macroeconomic levels. Throughout my career, it brought an immense sense of satisfaction seeing businesses succeed at supporting each other in their supply chain, and helping to create a more appreciative and financially sustainable ecosystem – as well as seeing globally distributed products reaching the shelves of local shops. Early in my career, I remember going to the Waitrose supermarket at Canary Wharf, London, after work and feeling the joy when passing a shelf full of colorful tea boxes, finding the brands we just helped.

The tea would come from all over the world, starting its journey from local smallholder tea farmers with whole communities relying on this production. I think this is what sealed my choice in this field.

Over the years I also have met and worked with many amazing people, who guided and inspired me. I am very grateful to be a part of this fantastic community and to continue supporting the Trade Finance digital transformation journey at Finastra.

Is now an exciting time to be in trade? Why?

Trade and supply chain finance are evolving at speed. International events, such as the pandemic, Brexit, trade wars, and many more, have highlighted the vital role that trade plays in the global ecosystem.

The ICC has estimated a staggering US$ 5 trillion of trade credit will be needed to bridge the trade financing gap post COVID-19, especially impacting SMEs. In addition, there is a growing pressure on local regulators and central banks to fast-forward digitisation through the adoption of paperless trade in times when many offices are closed and businesses must be supported remotely. Reliance on digital channels for business and client interaction is at its highest.

There is a need for a change, and there is an opportunity to deliver this change today. Leading the Product Management team at Finastra, one of the world’s largest global financial technology providers, I see a lot of potential in helping banks and their corporate customers achieve full business potential through transformative and smart solutions. Digitalisation, Artificial Intelligence, and automation are no longer just buzzwords but are realities for the Trade and Supply Chain Finance industry – all underpinning the global recovery and trade growth.

On International Women’s Day, what is the most important message you want to send out to women who are managing their careers?

Find what you love, what inspires you in your professional life, and go for it. Being passionate about what we do is one of the key ingredients for success. It helps to take on challenges while enjoying the process. We are also surrounded by colleagues and friends, men and women, and their support is vital for your success as much as your support is vital for theirs. Be open to accept help (you cannot do it all alone!) and don’t forget to give back, especially when it comes to women who are starting out in their careers and can benefit greatly from positivity and words of encouragement alone.

I feel fortunate and thankful to my team and colleagues at Finastra for their support every day. Working with people from different backgrounds, regions and cultures in an environment where fairness is championed, helps me grow both professionally and personally. I encourage all women not to be afraid and be open to new opportunities.

Izabela Czepirska PhD, Komgo

Why did you choose a career in this sector?

I have always been passionate about global economics, geography and how countries transact with each other. Without even knowing that this is what trade finance is all about, I was drawn to the perspective of utilizing development economics, finance and technology, which later found application in my career.

Having worked in the world’s last truly global bank: Citi, for almost a decade and simultaneously completing a PhD dissertation around technology in finance, I was able to appreciate the increasing importance of digitalization in trade finance.

The acceleration of the digital transformation agenda caused by Covid-19 translates to more FinTech companies offering technology solutions in partnership with trade finance providers to make the industry safer, automated, more efficient and less reliant on paper. Now at Komgo, I can appreciate it even closer, as I manage one of the digital trade finance products allowing banks and corporates to connect digitally and transact securely.

I find the intersection of academic, banking and FinTech landscape fascinating. We live in exciting times as nobody really knows how exactly trade finance is going to evolve, so it is great to watch the change from different angles and to be part of the transformation.

Do you find that there is a gender gap at the top in trade?

Trade finance industry has traditionally been dominated by men, especially in banking. Despite banks’ recent efforts to promote gender equality and implementing various programmes, women are still leaving finance after a few successful years in the mid-management level roles, making up as little as 11% of director and managing-director roles in finance according to studies.

The gender gap at the top can be narrowed by a combination of 3 strategies: Hire More, Promote More and Lose Less. A lot of institutions seem to be focusing on promoting more women to fit the prescribed ratios and to even out the status quo while making the numeric results most visible. In order to achieve the desired balance at the top, challenges in both attracting and retaining female staff should also be addressed, however. Within the ITFA Emerging Leaders Committee, we are working to increase the proportion of fresh aspiring talents entering into the trade finance industry by making it an attractive and dynamic career choice to students. By having an equal men and women representation in the Committee coming from different backgrounds, we are sending a message to the future talent about trade finance accessibility to all.

Claire Thompson, Mastercard

What does your role entail and what aspects do you like most?

As the Head of Global Trade for Mastercard’s Enterprise Partnerships division, I lead our work with major financial players, logistics providers and technology companies to build digital, sustainable supply chains. I am truly passionate about what we do to enable SMEs to trade globally and access affordable funding. It’s proven that companies who Trade internationally are twice as successful. Today SMEs are largely excluded from international trade, only 13 percent of SMEs trade cross-border from developing economies and in developed economies, such as Europe, it still only reaches up to 30 percent. The trade finance gap has also been significantly exacerbated by the pandemic and is now estimated at a striking $4-$5 trillion dollars.

By combining our assets and network with global funding and technology capabilities of our partners, we create new digital solutions and platforms that address these funding challenges and help create more inclusive, resilient, and sustainable supply chains. Leveraging our technological advancements, through blockchain and open banking to data insights mean that now more than ever we have tools and resource available to help companies to trade and prosper.

On International Women’s Day, what is the most important message you want to send out to women who are managing their careers?

UN Women recently stated that the global pandemic has set gender equality back 25 years. It’s true that women have been adversely affected over the past 12 months, with liquidity challenges and a lack of access to finance, women-owned small businesses especially have struggled to keep going, and while managing school closures women have been bearing the brunt of extra childcare while juggling work responsibilities. On International Women’s Day this year we should collectively recognise and celebrate the incredible resilience and strength that women have shown over the past 12 months. It’s our opportunity to use disruption as an accelerator for change, working together to curate a “new normal” that drives gender parity for women not only in trade but across all industries, walks of life and communities.

My message to women during such a tough period – It’s ok to not have all the answers and don’t lose sight of your personal goals. While managing safety and wellbeing for your family, friends and colleagues – don’t forget to take care of yourself. Your personal wellbeing matters and by giving it attention you will have greater strength to support others. Make time for your interests and check in on personal needs – whether exercising, changing career direction or enhancing responsibilities beyond the day job through volunteering or Board positions – don’t not losing sight of what matters to you, it will help you feel balanced, resourceful and improve your judgement.

Is now an exciting time to be in trade? Why?

Now more than ever we are experiencing a collaborative awakening where organisations are coming together to address vulnerabilities and inequalities exacerbated through the global pandemic. COVID-19 containment measures have had significant impact on trade, but they have been especially profound for small- and medium-sized enterprises (SMEs).

Representing 90 percent of all businesses SMEs are the backbone of the global economy, yet they consistently find it hardest to secure funding. It’s a situation highlighted over the last 12 months, where SME suppliers with working capital constraints have struggled to keep the lights on. While the past 12 months have been incredibly challenging, now is the time to leverage partnerships, technology and data insights to realise a more sustainable and inclusive new normal for trade. A future that makes the digital economy work for everyone, everywhere – and that’s a journey I am incredibly proud and excited to be part of.

Watch Claire speak at TFG’s recent Tradecast: Count us in! MSME inclusion in global trade

Rebecca Liao, Skuchain

In your opinion, why is it important that more women take up trade as a career in the near future?

Trade is becoming increasingly complex and fast-moving. For that, you need people who have high IQ and EQ, and many of those people happen to be women. The level of intellect and empathy needed to manage trade transactions and build trade infrastructure given all the legal, business and tech considerations requires people who can very easily understand other stakeholders’ perspectives and work out solutions accordingly.

How do we attract more women into careers within the trade?

Because trade is global, the hours can be tough if you are the primary caregiver for children in the family. (I don’t have children, but this is a well-recognised aspect of the job.) Work flexibility will help, but trade is about the deal, and deals do require vigilance and responsiveness to secure. It won’t be the easiest job for a talented professional to take on. Having acknowledged that, I think the biggest draw for trade and trade finance is giving women the opportunity to build something of global significance and bring out their unique ability as dealmakers.

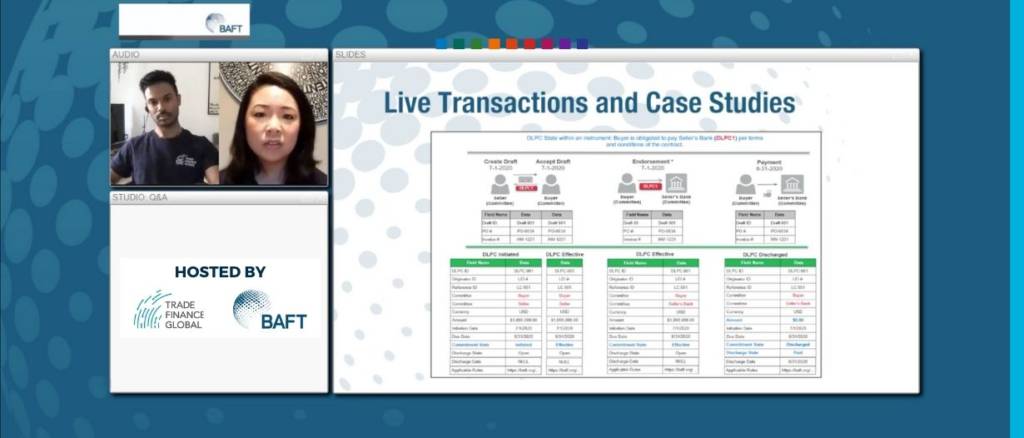

Watch Rebecca speak about the Digital Ledger Payment Commitment in a recent TFG Tradecast

Anat Elgrichi, Surecomp

Have you encountered any challenges in your career along the way to becoming who you are today?

Part of being a leader involves developing the skills to navigate multiple dimensions, while there is often friction and resistance to change. Achieving success for me has meant learning the art of bringing together people, technology and processes to work in harmony for the greater good of the company.

There will always be someone who doesn’t believe in you, who questions your judgement, presents obstacles, thinks you are too young, too technical, not technical enough or perhaps even the wrong gender – but I’ve always looked for the one who tells me I can, who’s believed in me, given me the chance and space to shine.

As a woman, I believe I bring a great deal of sensitivity, pragmatism and empathy to the table while leaving the ‘ego’ at the door. Some may say sensitivity fuels weakness, but the opposite is true in my mind. A sensitive leadership style has proven an extremely effective tool to motivate others, overcome challenges and progress my career. I feel empowered as a woman, I am true to myself, I believe in myself and challenge female colleagues to feel the same.

Is now an exciting time to be in trade finance? Why?

These are very exciting times for trade finance; we are seeing transformation on a tectonic scale which presents both huge opportunity for banks and the challenge of immense agility. As a result of the pandemic, we have seen an unprecedented explosion in e-commerce, an acceleration in process digitization and the rise of game-changing technologies such as blockchain and AI. Being in trade finance right now means being at the coal face of these changes, having the opportunity to drive innovation, agility and value in this fast-moving environment.

I’m not aware of any other industry experiencing such dramatic change, made even more exciting by the fact that trade finance is traditionally such a physical, paper-based business, and that these are changes that probably should have been made a long time ago. The new norm of remote processing without any human contact has driven banks and regulators to the realisation that it really is time to take action. And while it will still take time to see transformation on a global scale, to set the new standard in trade finance digitisation, change is happening and I’m very excited to be a part of it.

Louise Taylor-Digby, SWIFT

How do we attract more women into careers within the trade / trade finance industry that has traditionally been dominated by men?

We can attract more women into careers in trade by addressing inequalities head on. We all have a role to play, it is not an unwieldy task reserved solely for the c-suite.

We can start very pragmatically by asking ourselves – how visible are the women in our teams? Do we give them the opportunity to speak up on calls, be visible with clients or at the industry level? Is our scheduling mindful of caregiver commitments (that typically fall disproportionately on women)? For women already in trade – what are you doing to support other women?

We also shouldn’t underestimate the importance of having male allies. The ethos underpinning the UN’s HeForShe movement is key: men have to visibly stand up and contribute with concrete action and behavioural change. Men up and down the organisational hierarchy can role model the change.

Leaders have an opportunity to review their policies and processes, and take action, including

- Addressing unconscious bias in hiring/promotions ;

- Tackling gender pay gaps ;

- Bolstering flexible and parental leave policies.

Gender equality is critical for business. It is not simply about inequality being unfair. It is bad business, as countless studies and commentators have shown. Diversity and inclusion presents a huge opportunity for trade and beyond.

On International Women’s Day, what is the most important message you want to send out to young women thinking about their careers?

My message would be one of hope and fierce determination; anything is possible – do not let anyone tell you otherwise. Your gender does not define your potential.

I would counsel young women to be prepared. Inevitably, knockdowns will happen. Take time to reflect but do not let them deter your spirit. You will come to learn more from challenges than successes.

Invest in yourself and not just in terms of technical skills. Nurture your voice; foster your resilience and so-called soft skills (arguably, they should be hard skills!). –And whilst we hear that a lot already, never underestimate the benefits of work–life balance.

It may be tempting to follow job titles, but I would advise instead to consider following good leaders. Find mentors (plural) and keep in mind it does not always need to be formal. Take the time to talk, and think, things out. Never stop learning.

I would urge young women to be the change. Do not allow being the only woman in the room to deter you. Know that there is an army of us with you, as you become the change. So, where it’s due, ask for the salary raise, the promotion. Speak up, stand up, and support other women in doing the same.

Gladys Tejura, Tinubu Square

Why did you choose a career in this sector?

I started my career in the capital markets and having seen the excitement in the stock markets after the liberalisation of the Indian economy, the trade finance segment was a natural progression for me, as it was a related field. Credit insurance was a new offering in the Indian insurance sector and the challenge it offered to develop the business was very satisfying.

Have you encountered any related challenges in your career along the way to becoming who you are today?

In the initial stages, women participation in this segment was minimal. There have been a number of challenges from being the only woman

in the office to sitting opposite customers who found it difficult to accept a woman challenging their trade decisions. These situations strengthened my resolve to find the right solutions for my customers thus winning their trust and confidence.

Sponsors & Partners

Learn MoreMore about Women in Trade

- WITTP Over The Years

- Topics

- Podcasts

- Videos