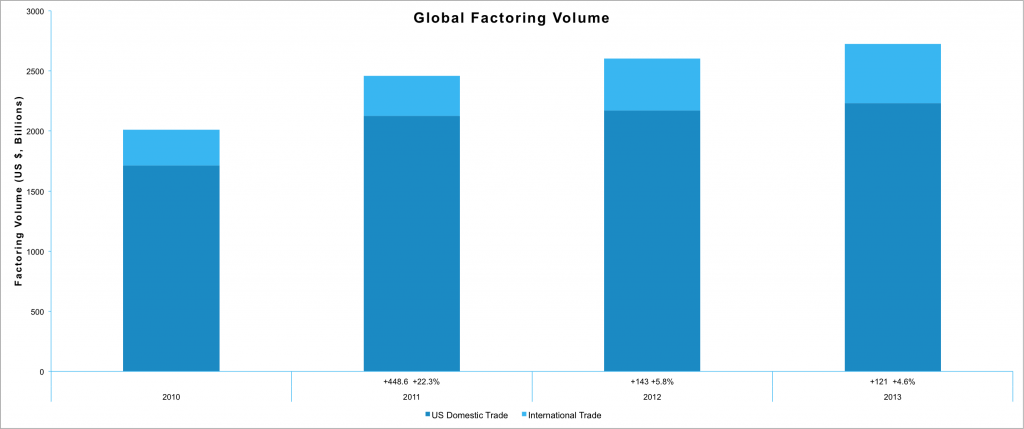

It is estimated that the worldwide amount of factoring in 2013 was $3.08 trillion, which is an increase of more than 5 percent from 2013, according to a report from Factors Chain International.

Historically, only certain sectors have used factoring, such as distributors, wholesalers, manufacturers and service firms with sales ranging from $5 million to $200 million. It is estimated that the international factoring volume in the US is now worth around $19 billion annually.

In relation to the import market, it is estimated by various sources that raw materials and capital goods make up around 60-70% of all imports. Therefore with fluctuating commodity prices and the greater availability of this source of finance, along with many markets keeping it as an unlicensed service (e.g. Brazil) the growth of use is set to continue.

What is Export Factoring?

Simply put, a seller or exporter can keep open accounts with buyers or importers by using export factoring facilities. When an order is shipped, the seller will often raise an invoice which may not be paid for up to 180 days. A export factor, or finance house can purchase this invoice up-front at a discounted cost (typically 90% of the value), paying 60-70% before the payment is received and the other 30-20% once the payment has been settled by the buyer/ seller. Export factoring is becoming increasingly common in global markets – and allows small businesses to compete and offer the full package without impacting cash flow or working capital.

Find out how export factoring works here, or, if you’re a business who exports or imports goods globally, you can find out lots of useful information and how we may be able to help here.