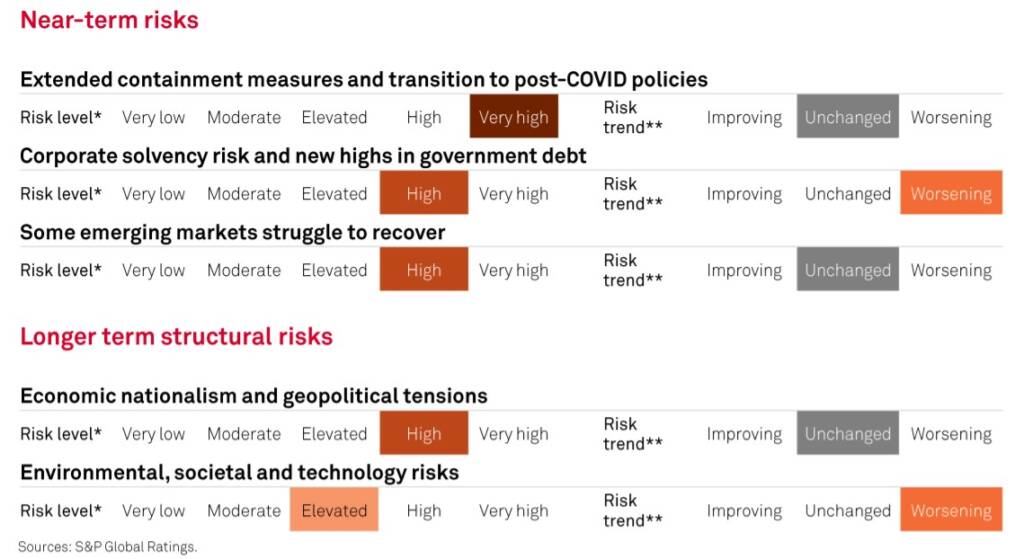

Global growth looks set to rebound sharply following the record contractions in the second quarter of 2020, and there will likely be record positive growth rates in many economies in the third quarter of the year. While the rebound is certainly welcome, S&P Global Ratings has this week said that improvements are not yet a cause for celebration.

The rating agency’s latest global credit conditions report concludes that the good news only goes so far. Economic momentum following the first wave of the COVID-19 virus has largely tailed off, leaving the next leg of the recovery to become far more difficult.

Upon the report’s release, Paul Gruenwald, global chief economist at S&P Global Ratings, says:

“While many economies will post impressive, double-digit GDP growth in Q3, don’t be fooled. We are still well below end-2019 levels of activity and there is difficult work ahead in ensuring a robust recovery and bridging to a sustainable post-COVID world.”

Macroeconomic and credit trends point to a widening gap in credit risks across regions and industries in the year to come. Some sectors appear likely to navigate the pandemic-led economic crisis with little or no effect on their creditworthiness: including technology, consumer staples, retail essentials, homebuilders, and health care. For others, including airlines, hotels, and auto to name a few, the credit damage will go well into 2023, in S&P’s view.

Banks, meanwhile, are expected to withstand pressure, but a K-shaped recovery may emerge.

Alexandre Birry, head of analytics and research, Financial services, S&P Global Ratings, says:

“Half-year results for banks only tell half the story. Banks have the capacity to act as shock absorber, but the recovery will be slow and uneven.”

At present, 30% of S&P’s ratings on banks carry a negative outlook (indicating the likelihood of a near-term downgrade on an entity is 50%). This compares to 37% of non-financial corporates that currently carry a negative outlook. The degree of contagion to the banking sector will depend on the time it takes for economies to recover and the effectiveness of the economic policy mix during this transition period, until demand from the private sector returns to levels sufficient to take the baton from public funds.

Financing conditions, nonetheless, remain supportive at present. Corporate bond issuance has reached a record US$4.5 trillion for the year to date, 29% higher than this time last year. Renewed fears of market volatility have pushed many corporates to frontload bond issuance ahead of the U.S. elections. S&P has identified that a “K-shaped recovery” applies to the divergence between stronger issuers benefiting from ample access to liquidity, and companies at the lower end of the scale (rated ‘B’ and below), where over half of the downgrades and all defaults took place.