Basketball Receivables Finance

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContents

Basketball receivables finance is a common practice in the sports and entertainment world. An example area of where the product is used, is the National Basketball Association (NBA), being one of the significant and most innovative American sports leagues in the world.

The NBA generates its revenues from a combination of mediums such as ticket sales, merchandising, television broadcasting rights, and much more. It is mostly out of necessity. According to Forbes, the total revenue of the NBA reached a whopping $ 8 billion by the end of 2018’s season.

Basketball receivables

NBA has been around for decades as a big player, both in popularity amongst the masses and in finances. However, just like any other sports such as rugby and football, it has its own sets of challenges in the financial arena.

Key Challenges for NBA

There are numerous challenges that the NBA face in the financial sector. One of them is the popularity of the game and the players. As the game grows in popularity, so does its players. As the teams balloon in value, so do the participants, becoming global superstars.

However, one thing is for sure that not every team stays valuable all the time. It can be due to various reasons, such as a decline in ranking or losses. Teams can lose sponsorships and run over their financial budgets to meet the season’s marketing and other requirements of the players, stadiums, merchandising, etc. According to Forbes, Cleveland Cavaliers lost a lot of money on an operational basis in 2018. It declined by 4 percent in its value down to $1.28 billion.

Multiple Revenue Challenges

Another critical aspect of the basketball teams’ finances is the NBA’s specific revenue-sharing system. Similar to other sports, the NBA likes to share its non-basketball revenues amongst all the basketball teams nationwide. It is the NBA’s effort to address inequality across different markets within the US.

All teams pool together their eligible revenue, which then gets redistributed across all the teams from higher to lower leagues irrespective of their rankings. However, each team receives revenue that is equal to that specific year’s salary cap. It is usually found that this amount is not enough to meet all the expenses of the basketball team, squad, stadiums, etc.

Some of the other financial challenges in the NBA arise from various factors, such as trends of online streaming. Due to the development of technology and mobile devices, fans are moving away from their television sets to online viewing services. Thus, causing a drop in broadcasting monies. Although the current damage is not much of a concern for basketball or other sports leagues, it is inevitably approaching fast. In such circumstances, basketball receivables finance come in handy for the basketball teams to meet their financial needs.

What are Basketball Receivables?

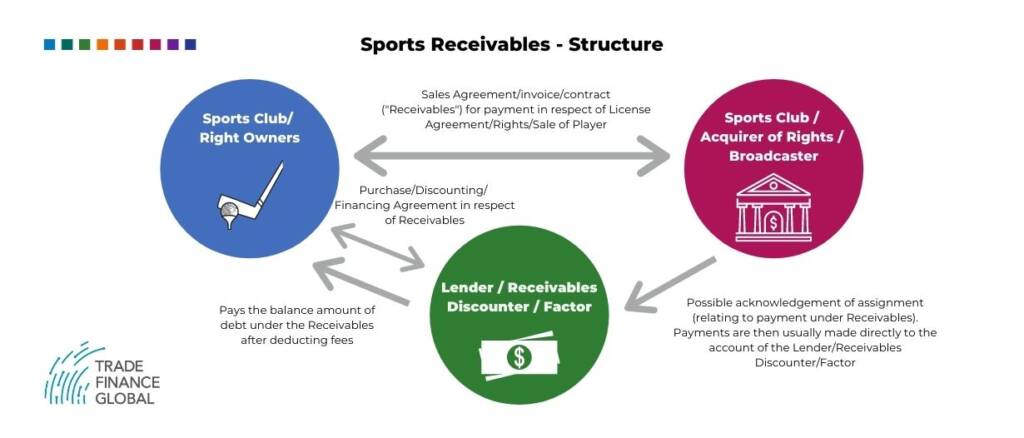

The terminology of financing receivables, or in this case basketball receivables finance, is an arrangement a sports team or club uses to get access to immediate cash from a lender, by using their accounts receivables or invoices as collateral. The lenders can be a bank, private sponsor, or private lending institutions.

Basketball receivables finance falls into two main categories, which are secured loans and sale of receivables. Lending institutions will often extend credit facilities to sports leagues such as basketball teams and provide them access to immediate cash, products, and services.

Basketball receivables finance allows the teams to use the cash or services to their advantage in the hour of need, and pay back the monies in the future. This extension of immediate credit may help basketball teams to meet their requirements, and might give them limited access to cash that they would have actually made in the future.

Basketball teams who wish to gain immediate access to certain services, products, or cash have two main options.

Secured Loans

In this type of sports receivables financing, a basketball team uses the balance from their accounts receivables as collateral for a loan. However, accounts receivables remain as a current asset on the basketball team’s balance sheet. The lending institution holds the receivables as security and as a guarantee for monies advanced.

Sales of Receivables

It is the most popular option in the basketball financial arena. A basketball team will partially or fully sell its accounts receivables to the lending institution. It is also called invoice factoring.

In this scenario, a basketball team may sell its pending invoices of money owed to the team by different borrowers and sponsors. The receivables may include upcoming potential prize and membership monies, along with merchandising or broadcasting monies due to the team. The lender may either charge a fee to extend the credit, or charge a fee related to a partial value of the outstanding invoices.