With a global pandemic, Brexit talks and economic concerns to contend with, you may be wondering, what’s next for the pound?

This week, sterling managed to reach a four and a half month high against the dollar. However, with Brexit and the economy driving the pound’s movements, the overall outlook remains uncertain.

Brexit negotiations have made little progress over the past few weeks and with the deadline looming, there’s concerns that ‘no-deal’ could be a possibility. Despite economic data showing some improvement, reports that the UK’s economic recovery is lagging behind other countries have worried investors.

Can we trust the forecasts?

As well as Brexit and the economy, the pound is influenced by a host of other factors. So, there’s a lot to consider when trying to predict sterling’s movements. It’s safe to say that no one, not even the banks, can really know where the pound will be by tomorrow, let alone by autumn or in 12 months’ time.

Nevertheless, Smart Currency Business have collated predictions from major banks and highlighted key factors which may influence the pound, euro and dollar in their latest quarterly forecast. It certainly makes for interesting reading, not least because the forecasts show a huge disparity.

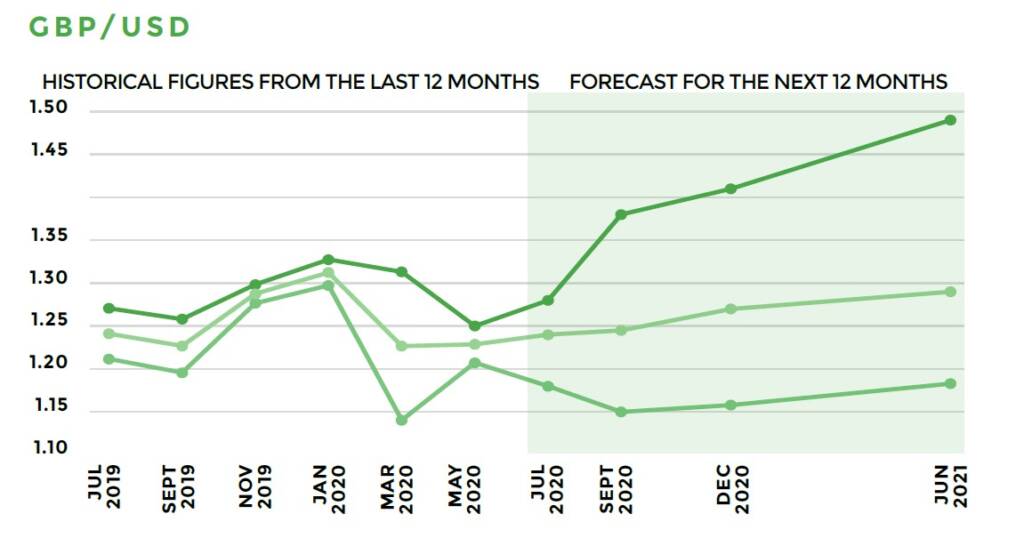

GBP/USD

The most optimistic prediction by September is a recovery to $1.38, then rising to pre-referendum levels of around $1.49 over the next 12 months. While the majority of leading banks had sterling trading in the mid-$1.20s for the coming months, some institutions offer a more modest prediction of $1.15 to $1.20.

At the beginning of the pandemic, the dollar had mostly been impacted by its safe-haven status. Investors turned to the dollar in times of market distress, giving it a boost. However, the markets have stabilised recently due to fiscal and monetary support from central banks on a global scale. This has meant that the dollar is influenced less by its safe-haven status. Worries over US infection rates, US-China tensions and the economy have, therefore, started to weigh on the dollar.

By the time September comes around, the Presidential election could be a major factor in determining the dollar’s movements. Democratic wins in the White House and Congress in the November election could result in more redistributive policies and a rollback of Trump tax cuts. We may also see a scaling back of deregulations that might weigh on US growth outlook and, thus, the dollar.

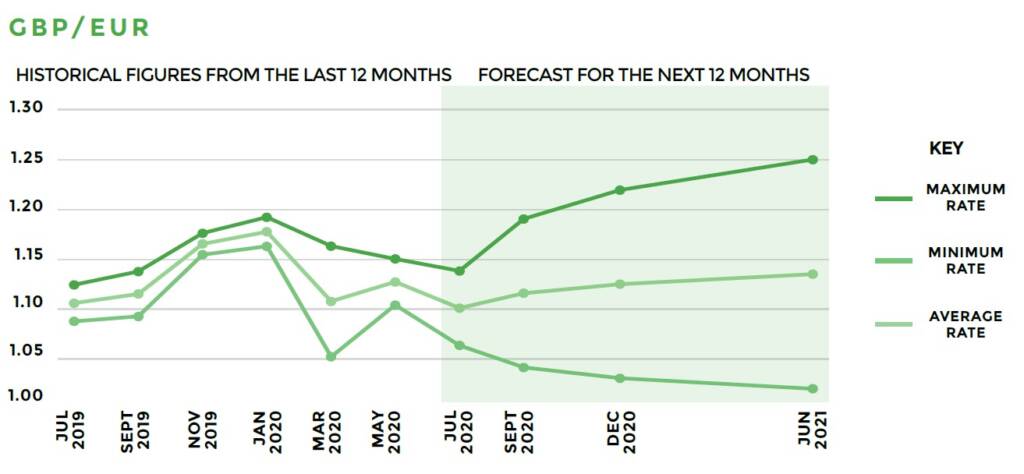

GBP/EUR

According to some analysts, GBP/EUR could reach around €1.04 in the next 3 months. Not everyone is quite so pessimistic, however, with predictions stretching as high as €1.19 but settling at an average of around €1.12.

It’s likely that the pound will continue to respond to Brexit headlines. There have been reports that we could see either a ‘no-deal’ or a very basic, ‘Australian’ style deal – any further suggestion of these outcomes is unlikely to fare well with the pound.

Decisions from the Bank of England could also come into play. There has been speculation that the BoE could cut its official interest rate to negative territory. If a second wave is avoided and the economy continues to recover, this may not happen. However, one cannot completely rule out a negative base rate over the next quarter or two and sterling could respond negatively to this.

The euro, meanwhile, has recently gained momentum due to the agreement between EU member states over the coronavirus recovery fund, which is designed to help EU countries that are struggling due to the coronavirus crisis. This deal is not only positive for the economy but also shows that the union itself is strong, and the single currency could continue to strengthen on this basis.

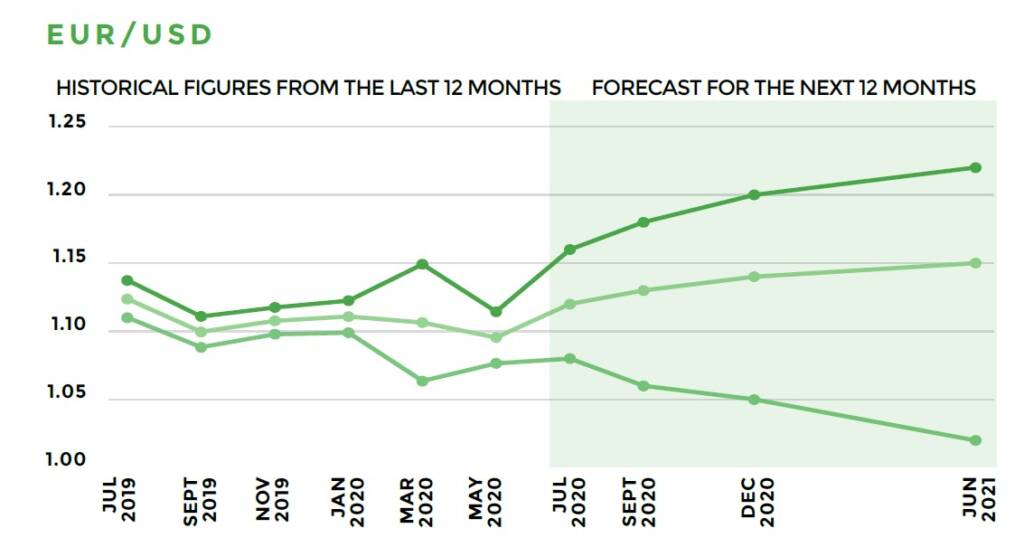

EUR/USD

Predictions for EUR/USD show a huge disparity. According to these forecasts, we could see anything from $1.05 to $1.20 by the end of the year. However, the average for the next 12 months stays around the $1.15 mark.

After the European recovery fund was announced, the euro went from strength to strength against the dollar, hitting its highest level in 2020 and rising above $1.15.

There are predictions that if the euro continues to strengthen, it could even eventually replace the dollar as the reserve currency of choice. However, there are a few factors that will stop that from happening just yet.

For now, rising infection rates in the US and the impact that this has on the US economy are impacting the dollar, whilst signs of economic recovery in the Eurozone are likely to help the euro.

What you can do

Policymakers and central bankers on both sides of the Atlantic are facing unprecedented challenges. The range of potential outcomes is so huge, that attempting to make any kind of prediction about rates is an impossible task.

So, tread with caution if you decide to use these forecasts as a tool when planning for significant payments and income across borders. If you are considering or attempting to base your business budgets or plans on the forecasts, please think twice!

Instead of trying to predict the future, why not protect your business from any possible currency fluctuations? Smart Currency Business can put a risk management strategy in place, which will ensure that your business is safeguarded against volatility.