Blockchain consortia provide a long-awaited ray of hope for the inefficiency-riddled trade finance industry, moving it one step closer to its long-awaited goal of digitalization. But have these consortia been effective in making trade finance truly digital?

The $18 trillion International trade market has been undergoing a major transformation following the COVID-19 crisis. The pandemic has accelerated digitalization efforts, driven to the forefront out of a necessity for business continuity. Trade finance is an inherently complex, manual, paper-based, error-prone, and fraud-vulnerable industry. There has been an increase in the numbers of frauds and litigations over several years dealing with issues such as email and SWIFT becoming compromised, double financing, and fake invoices to name a few. An increase in the instances of cyber-attacks and a lack of robust cybersecurity mechanisms has made banks and corporates hesitant to dive headlong into trade digitalization. Trade-based Money laundering (TBML) through under- and over-invoicing has been a tremendous challenge for banks. In addition, there have been ever-increasing cost pressures along with high regulatory burdens for banks due to stringent Know your customer (KYC) guidelines and Anti Money Laundering (AML) compliances.

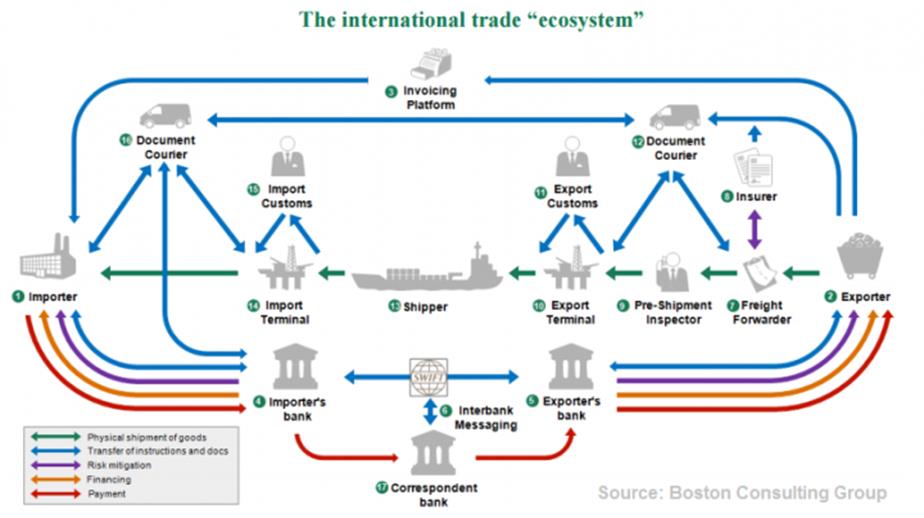

A typical trade transaction involves the movement of not only goods, but also documents, instructions, and money between several stakeholders including exporters, importers, banks, shipping companies, insurance companies, and freight forwarders. Addressing the inefficiencies in international trade will free up the countless hours and sleepless nights that are involved in the reconciliation, auditing, and settlement of transactions that often need to be updated in several data siloes.

The complex nature and multi-party ecosystem have led to a slower pace of change for trade finance digitalization initiatives in the past. The International Chamber of Commerce issued its eUCP guidelines for electronic presentation of Letter of credit documents in 2002 and Bank Payment Obligation (BPO) in 2013.

Despite the efforts, these guidelines were unable to reap the expected benefits. Trade finance has been constantly evolving since the Phoenicians founded maritime transport on a commercial scale in the 15th Century and emerging Technologies will play a key role in a digital transformation of trade finance in the years to come. One of such promising technology is blockchain, a type of distributed ledger technology (DLT) that will play a vital role in achieving paperless trade.

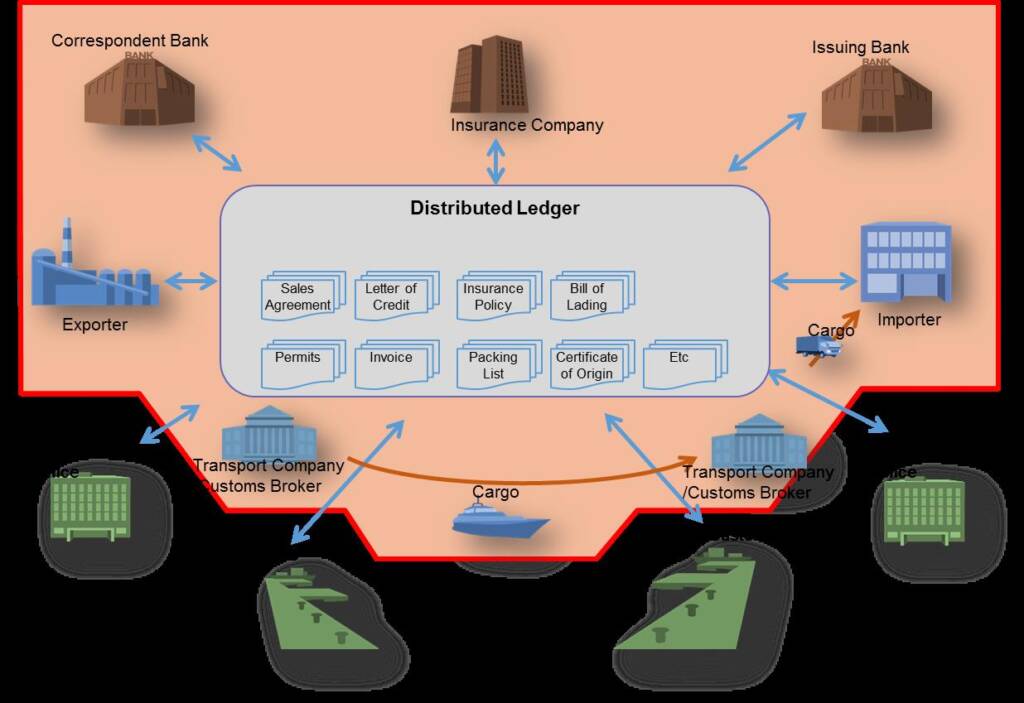

Blockchain is a decentralized and distributed ledger that permanently records transactions in an unbreakable chain. Blockchain reduces the requirement of duplicate recordkeeping, reduces reconciliation, minimizes errors and frauds and assists with the faster processing of trade transactions. By using this technology, all participants in trade transactions can have real-time information about the trade transaction, speeding up the inherently slow trade finance process. Considerable traction has been seen in the past few years in implementation of blockchain in trade finance. International Data Corporation predicts that the blockchain market will reach $16 billion by 2023. Blockchain has immense potential to make trade finance processes more transparent, efficient, and cost-effective while also serving as a foundational and collaborative technology to make trade truly digital.

Blockchain Consortia

In a bid to digitalize cross border trade processes and bring efficiency in trade finance, various blockchain consortia have been formed. These consortia are groups of companies formed with the common goal of developing objectives and standards for the blockchain while also driving economies of scale.

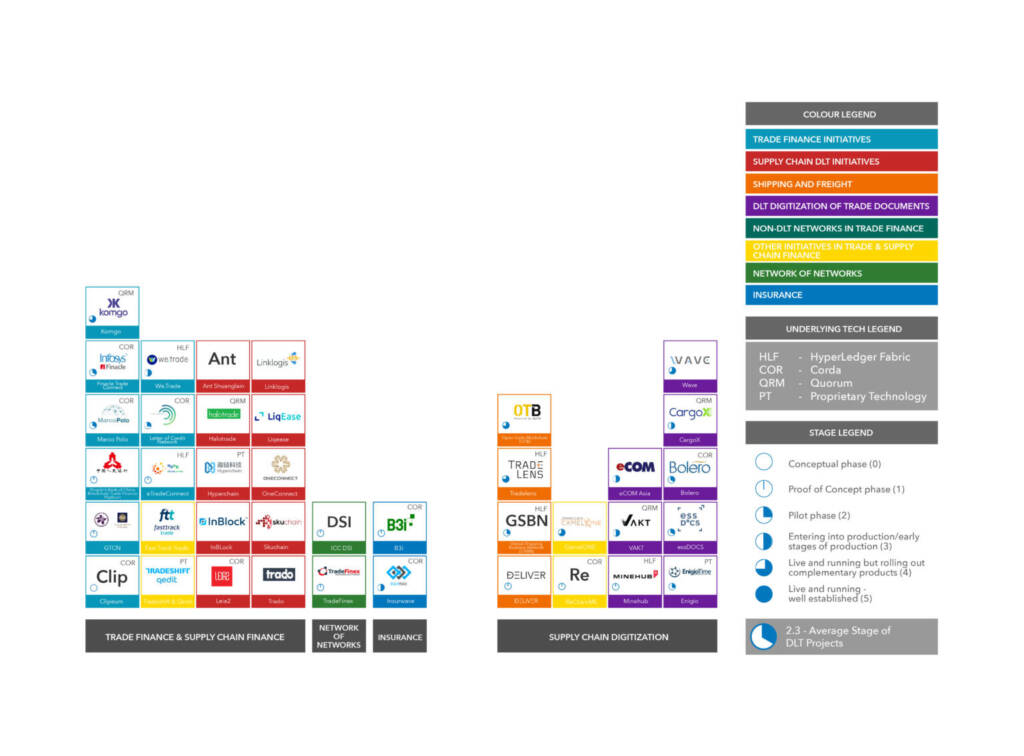

Consortia share development cost, distribute risk, and bring synergy through the collaborative efforts of all firms involved. They aim to drive the initiative for the adoption of blockchain in the industry, establishing standards, identifying use cases and developing trade finance solutions for commercial use. Not all consortia are the same. They are often based on different underlying technology platforms and offer vastly different solutions to digitalize trade in an assortment of niches. Many of the leading blockchain consortiums can be seen in the following chart and have been described in detail.

Challenges facing Blockchain Consortia

- Governance is a fundamental concern for many blockchain consortia. It comprises the set of rules that govern the collaboration, decision-making authority, onboarding, withdrawal, rejoining of members, revenue sharing, standards, fees, data privacy, and dispute resolution. Consortia must find a way to be neutral to all members. Only trusted and neutral governance will truly be able to foster the growth of blockchain consortia.

- Setting up of consortia involves considerable upfront investments, both in terms of the capital required, but also in the immense development work ranging from conceptualization, to proof-of-concept, to a pilot run and more. In most instances, any upfront investments will take years before any returns are seen. A sustained absence of desirable results could lead to weak consortiums to falter out of the market, creating a more consolidated ecosystem. Smaller players in the blockchain consortia space may choose to merge with larger players to quickly experience the benefits of economies of scale. Much like the natural world of Darwin, only the strongest will survive.

- Interoperability is crucial in the crowded space of blockchain consortia. While interoperability has been seen in various consortia operating with the same underlying technology, interoperability among different technology platforms remains a challenge. One such example of interoperability is the European-based we.trade Consortium which collaborated with Hong Kong-based eTradeConnect. With similar functions and the same underlying technology, these consortia have been able to come together and develop a global network of networks.

- Some Blockchain consortia have been experiencing a slower than anticipated pace of development. In many instances, this is due to the non-committal approach that many member banks have exhibited; joining simply to avoid missing out while neglecting to be actively involved in the execution. Many of the consortia formed have only completed pilots in a very controlled environment, realizing that scaling up has become a challenge due to the inherent complexity in trade finance.

- Blockchain consortia lack a degree of standardization making integration with legacy systems and other networks difficult. Standardization is the biggest hurdle in the interoperability of various blockchain platforms. A Network-of-Networks could solve the issue of standardization by bringing all the players on a common platform irrespective of their underlying technology. The Digital Trade Standards Initiative (DSI) launched by the International Chamber of Commerce (ICC) and TradeFinex is an example of such a Network-of-Networks.

- Current Blockchain consortia only offer a limited range of trade finance solutions such as open account, letter of credit, standby letter of credit, receivable financing, and payable financing. Oftentimes, each focuses only on a very specific use case and is unable to provide the entire gamut of trade finance solutions under a single umbrella. The complex blockchain-in-trade-finance ecosystem, with various consortia offering different services in different regions, can make it difficult for corporates and banks to choose which to join.

- The entire consortia structure relies on rivals being able to work together towards a common solution. Cooperation and collaboration among competitors is one of the most challenging tasks for Blockchain consortia. Data privacy and data confidentiality also play a key role in maintaining trust and neutrality within the consortia.

- There has been a low rate of adoption by banks as banks are following the wait and watch policy and are reluctant to join consortia. Once blockchain consortia attain maturity, the industry can expect an exponential increase in the rate of adoption.

- The legal and regulatory frameworks also pose a hindrance in the application of blockchain in digitalizing global trade finance. Different legal jurisdictions can have vastly different regulations surrounding paperless trade. The ICC guidelines on digital trade can provide an impetus to resolve the legal and regulatory issues.

- Due to the outbreak of COVID 19, the World trade organization predicts that world trade will decline between 13% and 32% in 2020. This would impact the expansion plans of blockchain consortia due to reduced trade volumes in the short-term but will likely not have any adverse impact on the growth of blockchain consortia in the long-term.

PODCAST: Rewiring Trade Finance – TradeIX’s Dave Sutter on the Evolution of Networks and Consortia (S1E11)

Way forward

Increased participation of new members in consortia will raise the utility of these platforms and bring economies of scale. Over time, network effects will lead to a mass adoption and will bring blockchain to a global scale. Blockchain consortia could achieve mass adoption through low entry barriers to entry, seamless integration with enterprise resource planning (ERP) systems, and legacy system.

Increased engagement with regulators will assist in setting up a strong legal and regulatory framework to foster the growth of Blockchain consortia. The ICC has been proactive in setting up a digital roadmap and has issued various guidelines for an electronic presentation like eUCP version 2.0, eURC version 1.0, URBPO, and ICC digital trade roadmap. Blockchain consortia need to pass the litmus test and to be the catalyst for change using conducive technology to implement digitalization initiatives.

Blockchain or Distributed Ledger Technology alone will not be sufficient in digitalizing trade finance. Only through collaboration and interoperability with other key technologies like Artificial intelligence(AI), Robotic process automation (RPA), and the Internet of things (IoT) will the path from paper-based to paperless trade truly be paved. Conscious efforts of all the stakeholders in global trade including World Trade Organization (WTO), International Chamber of Commerce(ICC), central banks, FinTechs, corporates, financial institutions, shipping companies, and insurance companies will be needed to reduce the friction in global trade and to achieve the long-awaited goal of digitalization in trade finance.

This article was written by a member of TFG’s 2020 International Trade Professionals Programme. Find out more here.

Disclaimer: The views that have been expressed on this page are that of the author, which may or may not be in line with their company, Trade Finance Global or London Institute of Banking and Finance’s view.

Type a message