Africa is the second largest continent in the world and is blessed with abundant natural resources. However, political risks and macroeconomic uncertainties have hindered the continent’s potential of reaching the forefront of global trade and economic development.

Why Is Political and Macroeconomic Stability Important?

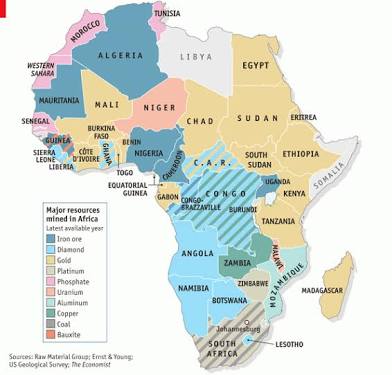

Africa has an estimated population of 1.3 billion people (United Nations) and an estimated 30% of the world’s mineral reserves (AfDB). This combination of human and natural resources should ordinarily place the continent at the top of global trade. Sadly, this is not the case. According to the Africa Trade Report 2019, a publication of AFREXIMBANK, Africa’s contribution to global trade was a mere 2.6% in 2018.

In a world where there is continuous interdependence by countries on one another, trade is extremely critical to economic growth. International trade is highly influenced by the political situation and macroeconomic policies of the importing or exporting country. Events such as war, terrorism, political unrest, border closure, foreign exchange crisis, corruption, and poor infrastructures, among others can easily disrupt trade. In Africa, many countries are plagued by the aforementioned events and these have a devastating effect on their capacity to grow.

The factors listed above make it difficult for Africa to attract the needed investment from other parts of the world and increases the cost of doing business. It is also a major hindrance to Intra-Africa trade and investment. In a report by the United Nations Conference on Trade and Development (UNCTAD), Intra-Africa exports represented only about 16.6% of total exports in 2017. This is abysmally low compared to 68.1% in Europe, 59.4% in Asia, and 55% in America. While the share of Intra-Africa trade is worrisome, it is hardly surprising considering the nature of the goods exported. Most African countries import finished goods which are hardly available on the continent while they export primary commodities.

Political Risks and Macroeconomic Policy Uncertainties in Select African Countries

According to Investopedia, “Political risk is the risk an investment’s returns could suffer as a result of political changes or instability in a country”. Macroeconomic policies, on the other hand, revolve around monetary policy (money supply, interest rate, etc) and fiscal policy (majorly taxes and government expenditure). Some of the political risks and macroeconomic policy issues prevalent in Africa include:

- Terrorism e.g Nigeria, Somalia, Kenya

- Wars e.g Democratic Republic of Congo, Libya, Sudan

- Political violence and unrest e.g Algeria, Ethiopia

- Foreign Exchange (FX) Restrictions

- Expropriation e.g Zimbabwe

- Weak institutions

- Trade tariff

- Corruption

- Frequent change in government and inconsistency in government policies

The effects of the aforementioned risks and policy issues are evaluated below with respect to Nigeria, Democratic Republic of Congo, South Africa and Rwanda.

Nigeria

Nigeria is the most populous country in Africa with an estimated population of about 200 million in 2019 (Worldometer). Nigeria’s GDP growth rate was 2.27% in 2019 according to the National Bureau of Statistics. Nigeria operates a predominantly mono-economy with Oil as the major export product and this accounts for about 90% of the country’s foreign exchange revenues. Despite her dependence on Oil, Nigeria has a great capacity to produce and export other agricultural products notably Cocoa, Cotton, and Sesame seeds but the agricultural sector has suffered neglect due to the revenue generated from Oil. This lack of diversification has left the economy highly vulnerable to shocks in the global Oil market.

Election poses a significant risk of political violence for the nation which often limits investment in the Nigerian economy as investors are wary of investing during this period. There is also usually a high level of capital flight during election years due to the uncertainty around this time. Nigeria has had a smooth transition in government since the country returned to democracy in 1999 but the confidence level has remained low especially in election years and this has a negative impact on trade and investments.

The existence of terrorism by groups such as the Fulani Herdsmen and Boko Haram in the North Central and the North-Eastern parts of Nigeria affects the perception of foreign investors about the general security of the country which hinders investment in critical sectors including trade.

Nigeria’s dependence on Oil also means that there can sometimes be restrictions on foreign exchange (FX) repatriation especially when the global Oil market is in crisis. As Nigeria has a huge potential for growth especially in agricultural exports, favourable macroeconomic policies to diversify the economy should make Nigeria less risky to invest in as there will be other avenues to generate foreign exchange and this should boost trade.

Democratic Republic of Congo (DRC)

The Democratic Republic of Congo (DRC) is the largest country by land mass in Sub-Saharan Africa and had a population of 84.07 million in 2018 (World Bank). The country is blessed with abundant natural resources including copper, gold, cobalt, diamond, among many others. Nonetheless, about 72% of the country’s population was living in abject poverty in 2018 (World Bank).

Why is a country blessed with such an abundance of natural resources poor? The reason is not far-to-seek. A series of wars, political upheavals, poor regulatory framework, weak institutions, high level of corruption and illegality has reduced a country with so much trade potential to poverty. The influence of foreign countries and international organizations cannot be ignored as they have exploited the weak system in DRC to their advantage and looted the country greatly. It seems profiteering is so much easier in the midst of political and economic chaos.

Despite the aforementioned challenges, DRC still retains a strong potential for growth. The untapped mineral resources are estimated to be in excess of $24 trillion as of 2009 (United Nations). The mining industry is obviously very vital to the growth of trade in the country. However, political risks have to be stopped with deliberate macroeconomic policies. These policies must be focused on improving the infrastructures, institutional system as well as human capital in order for trade to grow significantly and be of benefit to the populace.

The Democratic Republic of Congo is now under a new leadership as Felix Tshisekedi became President in 2019. The task of fixing the nation is no doubt daunting but if there is a strong willingness and commitment to build strong institutions, infrastructures and operate with transparency, their export potential should be realized and this should boost other sectors.

South Africa

South Africa is one of the leading emerging economies in the world and had a population of about 57.78 million in 2018 (World Bank). South Africa is a strong exporting country as they have a huge reserve of natural resources such as gold, diamond, coal, Iron ore, Platinum, among others. The country also has a good number of agricultural exports as well and these include corn and wheat.

South Africa has her own share of political risks with violence, crime, inequality and corruption as the main ones. Since the end of Apartheid in 1994, South Africa’s economy has grown significantly and trade embargoes and restrictions on the country have also been lifted but some of the issues still persist. Frequent xenophobic attacks on foreigners especially those from other African countries, corruption scandal with a recent one involving their former President, Jacob Zuma, crime and violence have succeeded in marring the reputation of the country in the international scene.

The potential for South Africa’s trade to grow is immense as they have good infrastructures and a robust financial system. However, institutions have to be strengthened and more focus has to be placed on improving their refining capacity of mineral resources before export.

Rwanda

Rwanda is a small country in East Africa with an estimated population of about 12.3 million in 2018 (World Bank). The major exports of the country include coffee and tea. Rwanda is highly import-dependent and had a trade deficit (excess of import over export) of $1.39 billion in 2018 (Statista).

Despite being a small country, Rwanda has experienced her fair share of violence with the genocide in 1994 ranking above others as some 800,000 people were killed within 100 days and millions displaced (U.N). The country is also susceptible to ethnic tension and clashes.

Things have changed considerably in Rwanda in the past few years as the President, Paul Kagame, has been working hard to restore the confidence of investors in the country. The country is also enjoying a great level of peace now. These reductions in political risk coupled with favourable macroeconomic policies have put the country on the path to growth.

Rwanda is not so rich in natural resources but their focus has been on building a robust infrastructure, creating a conducive environment for investment and attempting to produce finished goods in the country for exports. This is already yielding some results as the real GDP of the country grew at 8.7% in 2019 (AfDB). There is still a long way to go for the landlocked country but they seem to be on the right path and the early signs are promising.

Choosing The Lesser Of Two Evils: Political Risks Vs Macroeconomic Policy Uncertainties

Africa presents a viable investment opportunity for investors who are looking to emerging markets and developing countries. Africa has a huge population which has a strong effect on labour cost and the continent is also blessed with abundant natural resources. However, many of the countries on the continent are also plagued by political risks or macroeconomic uncertainties and in some cases, both. How then should an investor determine which of these countries to invest in? The simple answer is that ‘It depends’.

In a research carried out by Giovanni Pagliardi and Professor Francois Longin and published in the ESSEC Business School KNOWLEDGE, it was discovered that it is important to disentangle the risks and the uncertainties in order to determine which is more prevalent in a certain situation. In other words, it is not just enough to know about the political risks and the economic uncertainties, it is important for investors to determine which of them has the greatest impact on their line of business.

In Africa, the extent of political risks can vary largely even within a country. For instance, in Nigeria insurgency and terrorism can be found in some parts of the country but not in others. This implies that those who are willing to invest in areas removed from the volatile part of the country might not be at risk but even then they will need to examine the consistency of the macroeconomic policies in their preferred segment in order to be able to make an informed decision.

In essence, companies looking to invest in Africa must evaluate which of political risks or macroeconomic uncertainties is most important to them and choose accordingly as long as both are not tending towards the same direction.

Sailing Safely Through The Risks

While it is almost impossible to completely eradicate risks, there are various ways by which companies willing to invest in Africa can manage and mitigate their risk and these include:

- Adequate Research and Consultation – The importance of due diligence cannot be overemphasized for any investment at all but this is even more so when it is a cross-border investment. This is due to a variety of factors including the asymmetry of information, lag in information about a country’s crisis and also the difficulty in testing or checking the character of a counterparty in the country of interest, be it governments or trade partners. A robust research will also help to identify the existence of any bilateral or international treaties from which an investor may benefit.

There are companies who specialize in the evaluation of political risks such as EXX Africa, Eurasia Group, among others and it is advisable to consult with them before making investments.

- Trade Credit Insurance – For companies willing to engage in trade, especially export with any African country, there is the option of purchasing trade credit insurance which can help to mitigate risk by providing cover in the event of a loss. Obtaining trade credit insurance is not cheap but it is far worse to lose the entire proceeds from a trade transaction. There are companies who specialize in providing insurance against political risks and uncertainties and they include the African Trade Insurance Agency, Euler Hermes, Credendo, AIG, among others.

- Negotiation with Foreign Governments – This is especially important for companies who are willing to invest in a very volatile country. It might be important to negotiate with the foreign governments and enter into agreements where necessary to forestall expropriation, nationalization or even inability to repatriate profits.

- Diversification of Investment – Since most of the countries in Africa are developing nations with the attendant risk of political and or macroeconomic uncertainties, it is important for companies to diversify their investment across countries and sometimes, industry to avoid being caught unawares in the case of an unexpected political upheaval or economic crisis.

What now for Africa?

Political risks and macroeconomic uncertainties have hindered Africa’s growth in trade and economic development for many years. If Africa is to realize her trade potential, the leaders have to make a conscious effort to reduce the political risks. They must also be willing to implement far-reaching reforms across all the segments and institutions of the economy. These would help to boost the confidence of potential trade partners and attract much needed investment.

This article was written by a member of TFG’s 2020 International Trade Professionals Programme. Find out more here.

Disclaimer: The views that have been expressed on this page are that of the author, which may or may not be in line with Trade Finance Global or, LIBF’s view.