Estimated reading time: 7 minutes

In the world of Distributed Ledger Technology (DLT), a new term has emerged and gained considerable popularity in recent years: DeFi. What exactly is this new fangled acronym and why has it generated such considerable buzz in recent years?

DeFi explained

DeFi, short for Decentralized Finance and also referred to as ‘Open Finance’, is a set of DLT-based financial services and applications intended to augment or replace the currently existing financial system (comparatively referred to as ‘Centralized Finance’).

As those familiar with DLT, colloquially referred to as Blockchain, and its various applications are already well aware, one of its greatest promises and drivers of value is the notion that it facilitates decentralized peer-to-peer transactions without the need for a third-party intermediary and their associated fees. By bringing this technology into traditional finance system activities like payments, borrowing, or investing, DeFi has the potential to create new avenues to access these services.

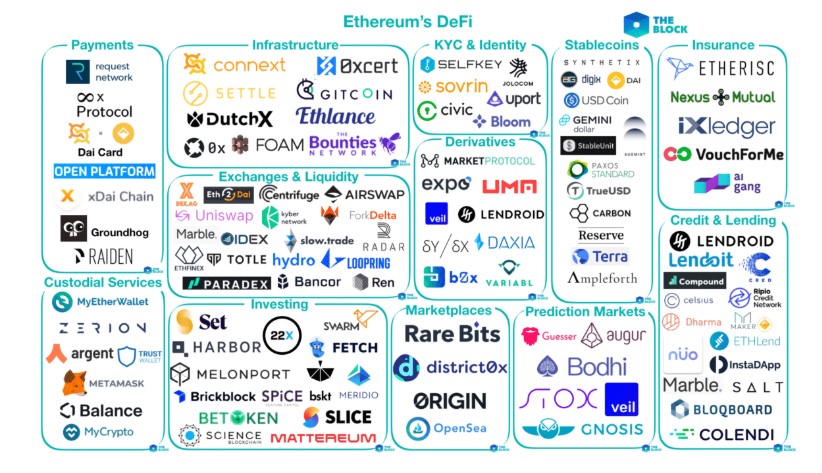

As the image above shows, there are already many initiatives making headway in the various sub-sectors that comprise the broader DeFi landscape. These particular initiatives have been built on the Ethereum network, but others have been created that exist on other permissionless blockchains such as Bitcoin. By using Permissionless networks, DeFi creators are able to make their services accessible to anyone as long as they have a device and an internet connection.

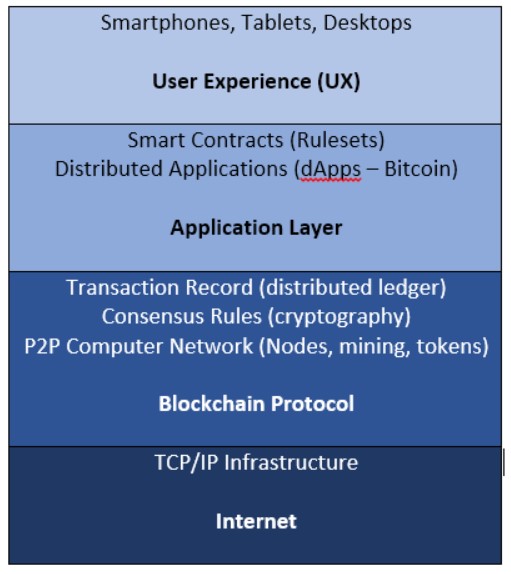

To fully understand this, it is important to understand the nuance in the way terms like Bitcoin and Ethereum are used. The term ‘Bitcoin’, for example, is used to describe both the Coin (a part of the application layer) that is exchanged as well as the network (a part of the protocol layer) that the coin is exchanged on. When it is said that a DeFi application uses Bitcoin, this means that it is a separate application in the application layer which operates on top of the underlying Bitcoin Network Protocol. In effect, this can help to shield DeFi services from the immense volatility that discourages some from recognizing Bitcoin as a viable store of value.

DeFi for Shipping and Logistics

In a simplified way, this can be thought of like the parcel delivery system. DHL, Hermes, and UPS all have vast pre-existing delivery networks. An ecommerce store looking to ship to a customer would likely choose one of these networks to deliver their product, rather than building their own. To draw the comparison, you could say a store (application) runs on the DHL (Bitcoin) network. To extend the analogy, just because one store (the Bitcoin Coin) operating on the DHL network has an unfavourable feature like bad customer service (price volatility), does not mean that another store (DeFi application) will also have this.

So we know that Decentralized Finance is putting financial applications on a blockchain and shifting traditional finance products to the open source and decentralized world, but what are the implications of this?

The Benefits of DeFi

According to an infographic put together by Visual Capitalist, there are five major impacts that DeFi will have in its quest to help shape the global financial system for the better:

- Wider global access to financial services. Currently, 1.7 billion adults worldwide remain unbanked and have zero access to a financial institution. Decentralized Finance should help to tear down the status, wealth, and location barriers to prevent global access to the financial world most developed nations take for granted.

- Affordable Cross Border Payments. By eliminating the need for certain intermediaries, DeFi services are predicted to lower the average global remittance fee from its current, often prohibitively expensive 7%, to a much lower 3% average.

- Improved Privacy and Security. Data breaches at centralized institutions, like the May 2019 breach of First American Financial exposed approximately 885 million personal and financial records. By definition, a decentralized system does not have a centralized single source of failure that would allow for this type of breach to occur.

- Censorship resistant transactions. A (full) DeFi system cannot be censored or shut off by governments or large corporations. A system such as this can bring a sense of stability and an alternative option in nations where existing governments and financial institutions may be corrupt or untrustworthy.

- Simple apps. In efforts to bring their services to the mainstream, developers of these new DeFi applications will focus on creating a smooth and intuitive user experience to allow any user to take full advantage of the new system that is being put in place.

While each of these benefits are powerful in their own right, their combination can really bring profound implications. Consider the situation of an unbanked farmer in rural China and his daughter who sends him money every month from her job in the USA. Under the current system remittance fees gouge 7% of the funds she sends. In addition to this, the farmer’s inability to access the financial markets prevents him from investing any savings into interest generating securities, forcing him to passively sit by as inflation slowly eats into those savings. Enter DeFi. Now, not only is the farmer able to receive a larger portion of the money his daughter sends due to lower fees, but his easy-to-use smartphone app allows him to securely invest this extra money, generating a return on his savings that outpaces inflation and will afford him a hearty retirement.

The Dark Side

It can’t all be sunshine and rainbows for DeFi. Despite all of the promises and benefits, there are still some considerable challenges that lie in the path. We have identified 3 major challenges that DeFi needs to overcome:

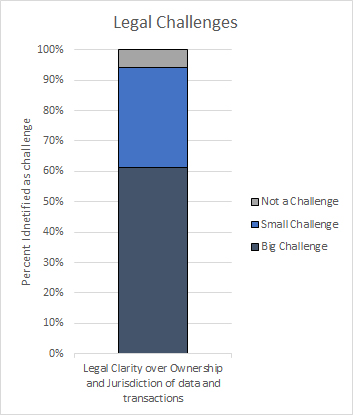

1. Legal environment. As it stands the legal financial system is deeply intertwined with the legal system in many countries of the world. As a result of this, any attempt to draw the financial system away from this interconnected setup will create a series of legal challenges that will need to be addressed in order to achieve wide scale adoption. The TFG Whitepaper “DLT in Trade: A Reality Check” examines some of these challenges in depth.

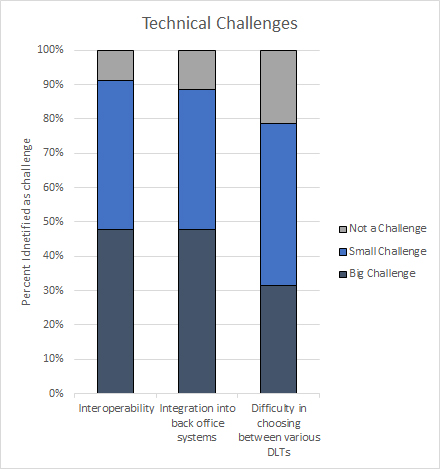

2. Lack of interoperability between chains. A potential issue that was also covered in depth in our DLT in trade whitepaper is a lack of interoperability between chains. In the permissionless world of DeFi applications a lack of interoperability between chains means that an application built on one chain, say the Ethereum Blockchain, cannot easily transact with an application built on a different chain, like the Bitcoin blockchain. While there are some bridging chains and protocols that allow.

3. Transaction Speeds. A commonly cited drawback for blockchain based applications is their limited transaction throughput. The Bitcoin and Ethereum networks can each process 7 and 25 transactions per second respectively, but these numbers pale in comparison to Visa’s 24 000 transaction per second throughput. Overcoming the issue of speed will be a crucial challenge for DeFi to overcome if it is to scale.

VIDEO: ECB’s Steve Mersch on DLT and decentralised finance in central banks

Conclusion

Decentralized finance may be the next big disruption to the financial system. Powered by blockchain technology, this new wave of applications and services will help bring financial services to the underbanked, reduce transaction costs, and enhance security all while providing users a seamless experience from anywhere in the world. Like any new technology, it is important to take a step away from the hype and critically examine the challenges that lie in the path to mass adoption. For DeFi, these include challenges reach into the legal sphere, and touch on interoperability as well as transaction speeds. Only by addressing and overcoming these challenges will DeFi reach the potential that seems to be all the buzz in the blockchain-verse.