Interviewed by:

Deepesh Patel, Editor, Trade Finance Global

Digital Ledger Payment Commitments (DLPC) – the holy grail for standardisation?

It’s no surprise that trade instruments (from Documentary Letters of Credit to Promissory Notes) have been earmarked for end to end digitalization using blockchain and distributed ledger technologies (DLT). Yet since 2015, a plethora of networks, consortia and platforms have come to the market, each offering various push and pull strategies to integrate into the legacy back-office systems of trade finance banks and financiers.

With several DLT networks addressing some of the issues around (1) communication between parties, (2) avoiding replicated data and (3) complying and co-existing with back-office providers, interoperability remains a key obstacle. The interoperability challenge, that is, DLT to DLT communication, dealing with universal data models and semantics, as well as the integration with other technologies, needs to be addressed.

The BAFT Distributed Ledger Payment Commitment (DLPC) is a potential solution allowing for digital representations of payment commitments on a distributed ledger. Last year, BAFT published its DLPC Technical and DLPC Business Best Practices, and with live transactions that leverage the BAFT DLPC Best Practices now imminent, TFG caught up with 3 of the BAFT DLPC Working Group captains to get under the skin of the DLPC, and benefits it could bring to trade finance.

The interoperability challenge

Deepesh Patel (DP): Samantha, what’s the problem statement here, and from your perspective, do you believe that the interoperability challenge has hindered the digitalisation of trade finance?

Samantha Pelosi (SP): The interoperability challenge has slowed the industry’s adoption of digital trade finance solutions, rather than hindered the digitization of trade finance. Laws – categorizing trade finance instruments as negotiable instruments and defining negotiable instruments as paper documents with bearing a wet signature – are the real hinderance to the digitization of trade finance.

International trade and trade finance are known to be slow, cumbersome, and risky. Each trade deal may involve multiple paper documents, copies of those paper documents, public and private sector parties, jurisdictions, laws and regulations, and languages. The industry has attempted to simplify this process before, by building digital platforms allowing key parties to transactions to access and use digitized trade documentation (or data lifted from the documentation). I understand that the uptake of these solutions has been low because they were not user friendly for corporate importers/exporters and did not integrate well with the back-office technology systems of the banks.

Over the last 4-5 years, bank consortia and tech providers have embraced the characteristics inherent in blockchain/distributed ledger technology and have decided to use it to “leapfrog” forward the digitization of international trade and trade finance. Each solution built, however, has been designed to perform the same process in a different way, on a different platform, and/or using a different type of distributed ledger technology. Unfortunately, an archipelago of digital islands has been created, where no solution can interoperate with another. The BAFT DLPC helps to overcome the interoperability challenge by standardizing the most important part of a trade finance transaction – the payment commitment. Interoperability allows multiple solutions to compete in the marketplace and to scale through the network effect.

DP: Rebecca, can you give a quick introduction to SkuChain, and also, how can the DLPC help?

Rebecca Liao (RL): Sure, Skuchain is a blockchain company that provides an end-to-end platform for trade and supply chain. We offer cash flow to suppliers at much lower financing terms and enable them to securely share their data with field-level encryption for granular data privacy. The large buyers on our platform in turn achieve visibility, agility and control in the deep tier to satisfy rapidly changing consumer demand and mitigate supply disruptions. Our customers are primarily in the mining and minerals, electronics, apparel and agriculture spaces. Since COVID-19 hit, we have also been helping government agencies procure critical medical equipment.

The BAFT DLPC is the critical standard that allows trade finance on the blockchain to scale. The blockchain landscape has become relatively fragmented, so interoperability between networks and protocols is especially important. Technical interoperability is a solvable problem between discrete blockchain networks. However, the ability of parties on different blockchains to transact with one another requires a standard form of payment commitment. That is what the BAFT DLPC has achieved.

DP: Alisa, given your role not just at R3, but also championing the digitalisation of trade finance across a number of initiatives, why are best practices needed?

Alisa DiCaprio (AD): Standards are the framework that ensures interoperability. They are particularly difficult to achieve in international trade due to the cross-jurisdictional and cross-industry nature of the ecosystem. However, there are some successes where countries agree to multilateral or regional rules and where industries create their own globally recognized standards.

Blockchain is at a unique position. While the applications may differ across entities, there is no country that is not looking at the technology. This is why if we can build a standard trade framework across blockchain implementations, it could create the global infrastructure that is very difficult to construct ex-post.

DP: Samantha, given BAFT published the proposed specifications back in May last year, what was the industry response and what has changed since?

SP: In April 2019, BAFT published the DLPC Technical Best Practices and DLPC Business Best Practices with the subtitle “Proposed Specifications for Trial Use.” We believed that the industry would adopt the best practices only if they captured the basic information required for functionality, agnostic to platform, and set forth rules for legal enforceability. BAFT made the documents public and encouraged feedback by arranging a dedicated email to which comments could be directed. The BAFT DLPC Working Group also proactively approached trade finance and blockchain technical experts throughout the industry to determine whether the best practices do indeed meet the BAFT standard for usability.

The industry response to the DLPC best practices has been entirely positive. The working group is now revising the documents to improve clarity. For example, with respect to the technical best practices, we have inserted a defined terms section, changed the labels of certain data fields, added notes on the parties with authority to complete or change specific data fields, and updated process flow diagrams. Changes to the business best practices include a more detailed description of the DLPC lifecycle and more fulsome discussion of governing law. BAFT intends to publish the revised DLPC best practices (initial release) in May 2020 and expects that they will become the industry standard for digital payments on distributed ledgers. We recognize, however, that the industry is just beginning to implement distributed ledger platforms for trade finance and that BAFT will likely update the specifications periodically as advances are made.

Data storage under the DLPC model

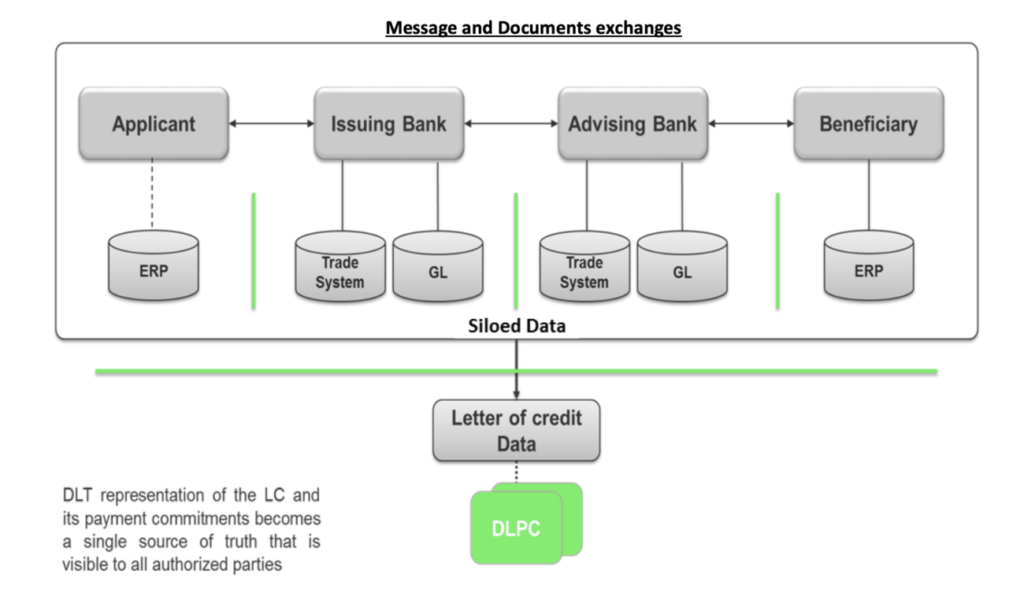

DP: Rebecca, can you talk us through how an LC and its payment commitments can become a single source of truth that is visible to all authorized parties?

RL: An LC (or any other trade instrument) can be signed by the transacting parties and placed on the blockchain, where members of that network can access it. Depending on the way the blockchain architecture has been designed, these trade instruments can be fully accessible to others in the network, accessible only to the counterparties involved or selectively obfuscated such that parts of the instrument are accessible to select members in the network.

Once a trade instrument is on the blockchain, its payment commitment is carved out as a DLPC and linked to the instrument. As a legal matter, a DLPC is a note and therefore a promise to pay in its own right. When attested to on the blockchain, parties are able to trust its authenticity since it has been signed and validated by all the required signatories on the network.

DP: Alisa, what’s the role of the DLPC in this, and how can we overcome the interoperability challenge?

AD: The game changer with blockchain is that it allows each party to know that what you see is also what I see. This can reduce errors from document checking and verification. A PO or an invoice is not committed to the ledger until it is been signed by the recipient.

The obligor for a payment commitment changes at different stages of the transaction. This makes it challenging to follow it through its lifecycle. Having a way to track it across entities would resolve this difficulty.

Payment Commitments

DP: Samantha, what’s a payment commitment and what are the current pain points?

SP: A payment commitment is a legally enforceable obligation to pay a sum of money. In trade finance, the commitment is usually embedded in a “negotiable instrument,” as defined by law. The only major pain point for banks financing trade is the treatment of such commitments under the law of several key nations. The statutory and case law of those national recognize and have a supporting framework for instruments that are written documents with a wet signature. The law does not address digital or digitized commitments, leaving uncertainty about their enforceability in a court of law.

DP: All, can these payment commitments be recorded on the DLPC, and what are the advantages?

AD: Most of the large-scale trade finance blockchain projects today have some form of a payment commitment or undertaking. The exact architecture and definition differs between projects. Having some continuity is helpful.

RL: A DLPC is itself a payment commitment. It offers three levels of improvement to paper-based payment commitments. First, by digitizing the payment commitment, the DLPC offers greater efficiency to trade payment processes, which ultimately lowers the cost of these transactions and increases their velocity. Second, by placing the payment commitment on a blockchain, the DLPC offers a single source of truth for the payment commitment that can be trusted by financial institutions, counterparties and others on the network who need to reference it. Third, by acting as a standard across blockchain networks, the DLPC allows counterparties who are not a part of the same network to nevertheless engage in transactions involving the same payment commitment without having to do a costly infrastructure integration with other networks.

(SP): Distributed ledger technology allows for the recordation of a payment commitment as well as its transfer between two parties. It should be considered a “digital asset,” with value.

Going Paperless

DP: Samantha, negotiable instruments as defined by the Uniform Commercial Code and Bills of Exchange as defined by the Bills of Exchange Act explicitly requires paper documentation. So where does the DLPC start and stop when it comes to digitalizing trade?

SP: BAFT recommends that parties choose Delaware law to govern the BAFT DLPC, because it recognizes “electronic” negotiable instruments as valid and enforceable. The BAFT DLPC Business Best Practices provide “rules” for adopting parties, which a court would equate with a contractual agreement. A court would resolve a dispute between the parties to a DLPC regarding the interpretation of the rules or validity of the payment commitment by referring to the text of the rules and Delaware case law on contracts. The provisions of legal statutes, like the Uniform Commercial Code or Bills of Exchange Act, would not control the outcome of the case.

DP: Rebecca, given SkuChain’s role in enhancing buyers’ visibility into their inventory and control to then provide supplier financing, how can the DLCP best practises both accelerate SkuChain’s go-to-market, also your key clients?

RL: Skuchain’s customers are large buyers who have vast supply chains. Using our platform, they are able to offer their suppliers financing at their own low cost of capital by logging a payment commitment on the blockchain tied to a purchase order or approved invoice. This already represents an improvement to non-blockchain-based supply chain finance solutions. What the DLPC offers, however, is scalability of this financing to include suppliers and banks who may have built blockchain networks of their own and do not have the bandwidth to integrate with other individual networks or satisfy multiple different legal structures for payment commitments. To give a concrete example, a buyer can originate a DLPC on our platform, which we can keep in network or send to another network, such as Corda, where it can be picked by a bank or another counterparty for financing.

For some enterprises, the financing is the end objective. For those buyers who would like to receive more data from their suppliers regarding movement of inventory, stock levels, production schedules and the like for greater visibility and control, the financing enabled by DLPC provides suppliers the crucial monetary incentive to offer that data.

One standard for all

DP: Rebecca, so why does DLPC facilitate interoperability and why has Skuchain chosen this BAFT standard for upcoming transactions?

RL: The ability of parties on different blockchains to transact with one another requires a standard form of payment commitment backed by a legal framework. Otherwise, technical interoperability will break down at the business and legal level. The BAFT DLPC is the first, and currently the only, global standard for payment commitments on the blockchain. We started the initiative to create a DLPC two years ago with BAFT, R3, other blockchain companies and 18 of the largest international commercial banks in recognition of the fact that a standard was necessary for trade finance to really scale on blockchain.

The BAFT DLPC Business and Technical Best Practices are the result of a year’s worth of input from practitioners, technologists, lawyers and other stakeholders in the global trade finance community. As Skuchain has put the DLPC into practice, both our enterprise customers and the banks have been readily receptive to its use in recognition of its industry backing and substantive strength. In May, BAFT will publish an updated version of the best practices to reflect industry input and implementation feedback. Over time, the BAFT DLPC has only grown more robust, and we look forward to working with BAFT, R3 and others to increase its adoption throughout the industry.

DP: Alisa, with live transactions going ahead in May, what are the key outcomes that you’d like to see coming out of the DLPC in the coming months?

AD: We are excited to have Skuchain offer this functionality as a Cordapp on the Corda Network. Skuchain is part of a growing ecosystem of legal entities either participating and/or offering Cordapps on the network.