In one way, there’s never been a period like this in any currency trader’s memory. In another way it’s business as usual.

We thought negative interest rates were quite something; but a negative oil price?! Fresh new calamities face us every day. From the fastest rise in jobless claims to the fastest fall in monthly GDP, to disposable income set to fall by 20% and pubs closed until Christmas, the bad news keeps coming. But what about currencies?

Here the story has been less dramatic. After the initial collapse in the pound to a 35-year low against the USD and 11-year low against EUR, we’ve seen a recovery to a level slightly above the average since the Brexit vote.

What comes next?

The short answer is that no-one knows. At Smart we don’t believe in forecasts which is a core focus of our Quarterly Forecast which you can download [here]. All we know is that the pound will move, probably rapidly and possibly quite soon, but no-one really knows where.

Currency movements are based on economic, political and (these days) health news, and predicting these at the moment are absurd, with the Prime Minister just out of intensive care and the economy in cold storage.

The longer answer is that we’re as fascinated as the next person as to where the pound will go next. Hence every quarter we show the forecasts of major banks and financial institutions across the world, along with an average. Here is what our Q2 forecasts are saying.

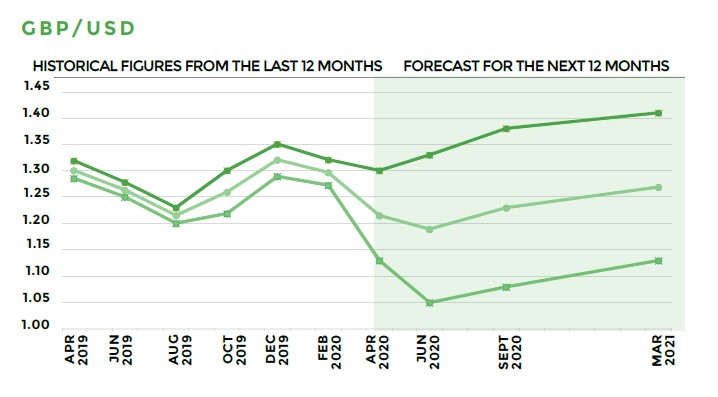

GBP/USD

The most bullish predictions for GBP/USD by July are a recovery to above pre-Covid levels of $1.33. While the majority of leading banks had sterling trading in the mid-$1.20s, some institutions are far more pessimistic. Some predict that for your next trip stateside in the summer (well, maybe…) you’ll only be getting $1.05 to the pound at the interbank rate.

This pessimism is reserved for the immediate future, however, with average predictions all recovering for the 6 and 12-month period. Even so, the most optimistic forecasts are for just tipping $1.38 by the autumn, far below pre-Referendum levels.

By then we run into other crucial factors, most notably the US Presidential election and Brexit. Although the greenback may have crashed on Trump’s surprise election win in 2016, the US economy was performing well pre-coronavirus and it remains to be seen who will get the benefit or blame if it’s still in trouble by the election. The markets will at least be reassured that far-left candidates are off the Democrat ticket.

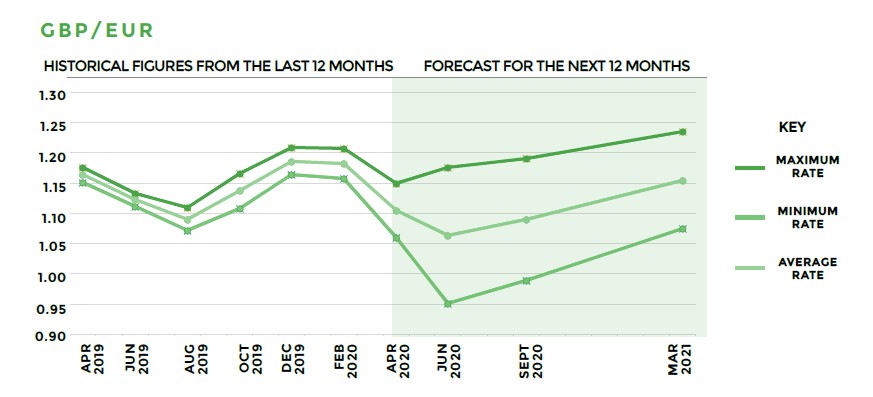

GBP/EUR

Before he was elected Tory leader, Boris Johnson said in response to Brexit-based fears for sterling: “the pound will go where it will”. According to some analysts, where it will go is to its lowest level ever in the next three months, some distance below parity against the euro to around €0.95.

Not everyone is quite so bearish, with the average high stretching as high as €1.1765 but settling at an average of €1.11.

You have to sympathise with analysts attempting to predict GBP/EUR. There’s a lot to unpack. Although almost the entire eurozone is in lockdown and has been for weeks, the euro hasn’t suffered as far as you might think. That’s because thanks to its low interest rates it is a “funding currency”, which investors buy as they sell equities, keeping the currency strong against sterling in the early days of the crisis.

The longer-term risk is that Covid 19 is even worse for southern European countries than the global financial crisis – and Spain and Italy have only just recovered from that. Could they now end up in a fiscal straight-jacket and economic calamity like Greece?

In our forecasts the predictions for the pound are pretty dire for the summer. No surprise there, the sharpest post-Referendum dips in sterling have tended to be in high summer. But while the spread in average predictions for GBP/EUR in July stretch by some 25% from €0.95 to €1.17 and by September from €0.99 to €1.19, by next spring the predictions are not only higher but diverge far less too. The most bearish is €1.07 and the most positive is €1.23.

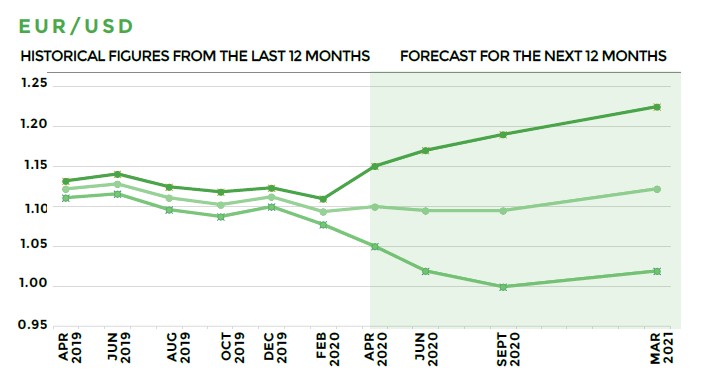

EUR/USD

There is a point of view that the euro has been undervalued against the US dollar for some time.

The first days of the crisis saw EUR/USD moving at record levels. The euro strengthened by 6% over two weeks, then fell by even more before settling at around $1.08, its lowest level for three years.

The median prediction in our forecasts is for it to stay trading at this level over the summer before recovering to above $1.10 by next spring.

At the extremes, however, whereas our other pairs show a narrowing gap by autumn and then year-end, EUR/USD gets wider. The spread is anything from parity to $1.20 by September, although all the predictions are for the euro to strengthen in 2021.

What you can do

Policymakers and central bankers on both sides of the Atlantic are facing unprecedented challenges – although if they didn’t model for a pandemic that’s been on the cards for decades you have to wonder why not – and the range of potential outcomes are so huge, that any kind of prediction is impossible.

Moreover, the variance in predictions is so wide as to be meaningless as a tool in planning for significant payments and income across borders. Which is why we need to talk about hedging strategies….

If you are considering or attempting to base your business budgets or plans on the forecasts, please think twice!

SCB’s Quarterly Forecast highlights the danger of relying on forecasts. Your business may or may not get it right when basing decisions on major banks forecasting abilities.