Estimated reading time: 9 minutes

Given that nearly 90% of world trade relies on some form of trade financing (such as trade credit insurance, trade finance, or guarantees), it’s important to understand the complexities of financing trade and the various products offered by financiers.

This includes taking a look at the pitfalls, challenges, and use cases for trade credit.

Trade credit definition

Trade credit is an agreement often used in trade finance between a buyer and supplier to purchase goods or services without paying for them upfront, but rather making payment at a later point in time.

Trade finance significantly increases the ability of importers and exporters to trade internationally, by providing financing and assisting to mitigate the risk of default in payments for goods or services.

There are many different types of organisations that provide trade finance, from smaller non-bank financiers (often called alternative lenders) to retail and high street banks, as well as public-backed institutions (export credit agencies, multilateral, and development finance institutions).

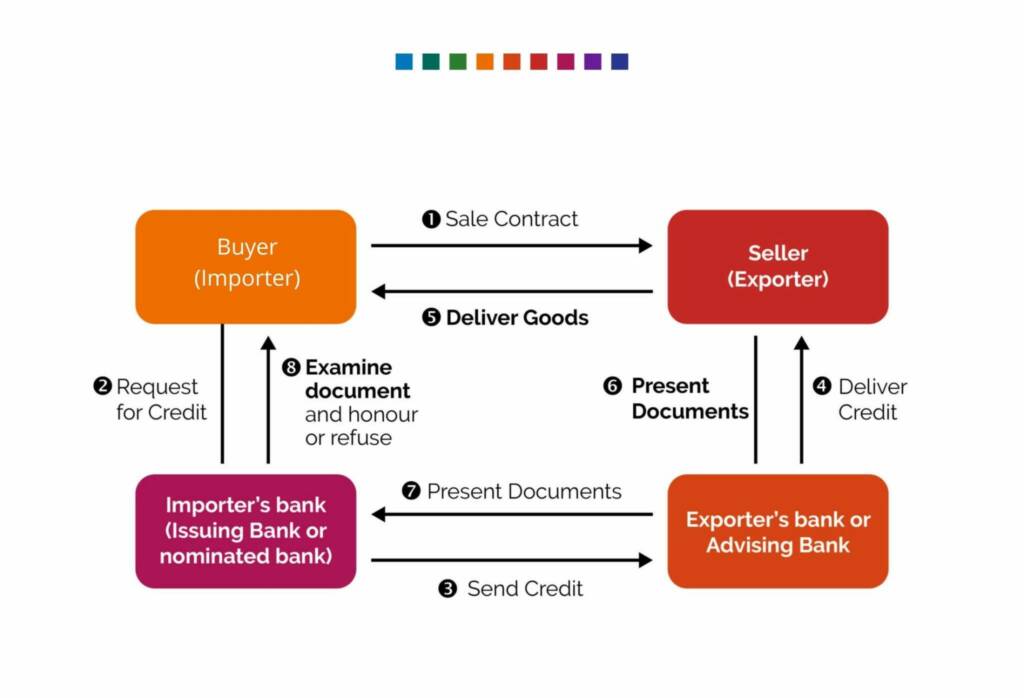

One of the best-known instruments in relation to trade finance is the letter of credit (LC).

An LC represents the promise of a financial institution to pay upon the seller of goods or services meeting the contract’s obligations.

The seller will usually require a buyer to provide an LC before shipment (from the buyer’s bank) in return for payment once the title of product ownership has passed to the buyer.

Trade credit products

Trade finance is the umbrella term used for the financing of goods or services that are moving across international borders.

There are several different types of products used by businesses in trade credit financing, including:

Letters of credit:

In today’s world, the LC is used as a standard and common practice for cross-border trade.

This is used especially in international trading, where buyers do not want to run the risk of payment upfront and losing deposit payments, along with suppliers wanting certainty of payment upon the provision of the ordered products.

Importantly, it reduces the risks when carrying out new lines of business.

Using an LC as a bank instrument will allow buyers to use their bank to play an intermediary role and provide a guarantee to the seller.

LCs provide comfort to the seller that they will be paid by the issuing bank (of the LC) upon delivery of the goods or title passing to the purchaser (according to the conditions set out in the LC).

Diagram: The letter of credit process

Trade credit insurance and open account sales:

Many buyers demand that their suppliers provide them with credit (time to pay) following delivery of the product. Typically sellers provide payment terms of 30-120 days. In this case, we would say that trade credit is provided to the buyer.

A way to mitigate the risk of non-payment of the buyer is to use trade credit insurance. This plays a vital role if the buyer is new to the supplier or the buyer’s creditworthiness is not recognisable.

Banks and alternative lenders will also usually require trade credit insurance to be in place, prior to providing invoice discounting, receivables finance, or factoring services.

A trade credit insurer will usually not insure 100% of the receivables book (or a single receivable or invoice) but provide an advance of, say, 80% or 90% insurance cover against the receivable or invoice value.

Video: What is trade credit insurance? TFG exclusive interview with ICISA

Cash advances:

Cash-in-advance is is a high-risk method of finance for buyers.

A cash advance is usually a method of trade finance that is generally performed in domestic markets and with trusted business partners. It will also depend on the strength of the supplier and buyer, along with demand for a certain product.

Suppliers will always desire full (or a high percentage) of payment upfront (prior to shipment), but this is rare, as it places a lot of risk on the buyer.

The term cash advance is used where there is partial or full payment made prior to the shipment of goods.

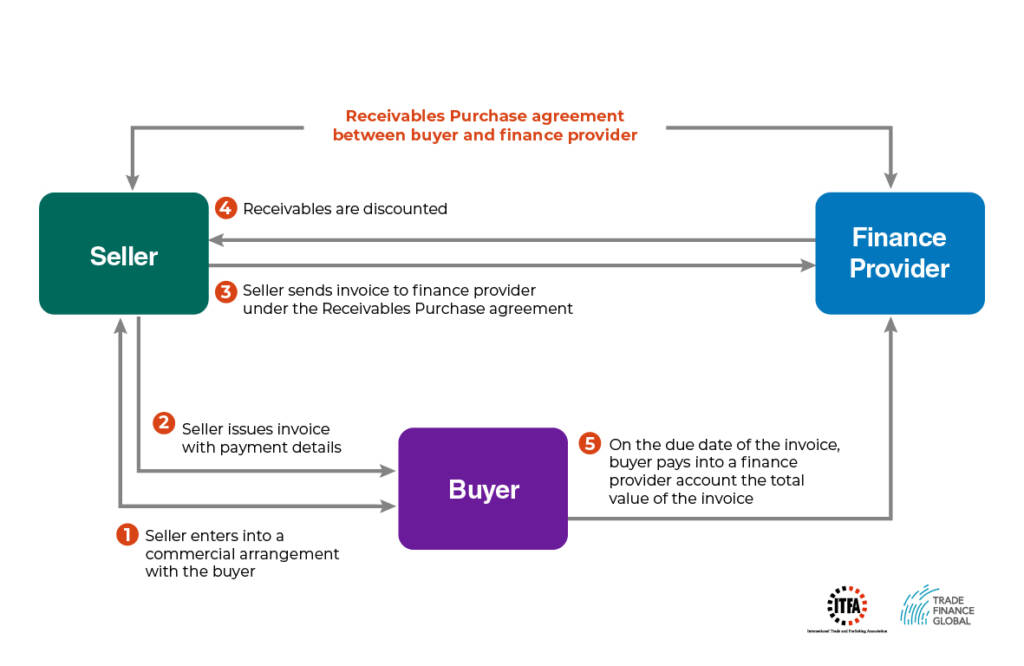

Receivables discounting:

The term receivables discounting includes post-dated cheques, bills of exchange, or invoices that can be discounted at a lower rate in order to return payment on an immediate basis.

Providing an advance against the value of an invoice or contractual obligation to pay, may vary from 60% to close to 100%.

Diagram: How invoice finance (receivables purchase) works

Term loans:

Long-term debt including loans, commercial mortgages, or overdraft facilities is generally offered both in domestic and international markets against the assets of a business owner.

These loans are usually provided for a set period of time.

Trade loans:

Revolving debt facilities that can be used to pay suppliers (utilising various instruments) for specific trades, and using the underlying products as collateral.

Leasing and asset-backed finance:

This is when funds are borrowed against tangible assets, used in the operation of the business, such as property, plants, and machinery.

Finance is then used for the expansion of trade in relation to the business.

Advantages and disadvantages of trade credit

1. Enables business growth:

The two main impediments to growth for any international business are:

The ability to pay suppliers for the delivery of products or services, and

The risk of non-payment.

As a mode of short- to medium-term working capital that provides security on the stock or service being exported or imported, trade finance allows international businesses to better overcome these impediments.

In turn, this helps to enable business growth.

Trade finance allows borrowers to obtain a higher volume of stock orders from their end customers and benefit from economies of scale.

This additional liquidity enables businesses to benefit from higher margins as a result of the discounts they can acquire from bulk stock purchasing.

Trade finance mitigates the credit and default risk that suppliers hold, and uses banks or financial institutions to provide additional security so that larger orders can be fulfilled.

Irrespective of the nature or size of a business, trade finance focuses on the trade cycle and the underlying goods, rather than the primary borrower.

This allows small businesses to trade larger volumes more easily as the financing they receive will be based on the stronger credit of their end customers.

Manufacturers, traders, and distributors work in an increasingly global marketplace.

Encouraging financial flows into their network with the help of trade credit’s risk mitigation capabilities allows business owners to diversify their supplier network.

This intensifies competition and drives efficiency in markets and supply chains, leading to increased volumes of trade within a safer framework.

As trade finance is a form of capital that only relates to active trades of products or services, traders do not have to disturb their working capital to acquire financing.

This eases cash flow.

Improving cash flow means that those same businesses can use their capital to reinvest into the business, adding new and improved infrastructure, techniques, or business strategies.

This leads to faster business growth and ultimately focuses on risk mitigation.

Debtor payment deferrals and creditor challenges can negatively impact a business.

Trade-related credit facilities can ease this pressure and mitigate against some of the challenges that these bring.

What are the disadvantages of trade credit?

1. Product risk or quality disputes:

Quality disputes are something that buyers and sellers both want to avoid.

A seller usually provides contractual obligations such as warranties, agreed service levels, or ongoing maintenance.

The buyer will also try to mitigate some of the related risks, such as negligence during production or an unfavourable climate during shipping.

Quality is something that frequently leads to disputes between the parties, even after contracts are signed.

Ways to limit the risk of non-performance include using inspectors, quality certifications, or trade finance products such as bonds.

2. Manufacturing risk:

Sellers are usually required to cover the costs of any modification to a product until the buyer approves it, because modifications may make it impossible for the buyer to resell the product to its end customers.

This is because manufactured products are often tailor-made or have unique specifications.

3. Transportation risk:

Transportation risk is always present when goods are being shipped from a supplier’s location to the buyer’s.

Traders can reduce this risk by using cargo insurance and a reliable freight forwarder or shipping company.

If the buyer fails to insure the cargo in the proper way, then the insurance might not apply if there is product damage or issues relating to the carriage of goods.

4. Currency risk:

Foreign exchange rate uncertainty can have an adverse effect on all types of businesses and lead to a direct impact on profit margins.

It is important to understand the potential foreign exchange movements as they will have an impact on the underlying sales agreements when payment will not be made until the future.

5. Cost:

As with any debt product, trade finance comes at a cost.

Therefore, it is important to understand what the profit margins are on trades since trade finance is only charged on the specific trades carried out under the facility.

If businesses understand profit margins and costs, the financing cost can be built into the trade costing.

6. Complications:

Trade finance facilities can sometimes appear difficult to understand for first-time users.

Terms such as when permitted payments are possible, the structure of payment, and sub-limits, can mean that agreements may be lengthy.

Therefore, it is important to fully understand the facility that you are taking and the bank or alternative financier that you are working with.

Trade credit financing is a very powerful tool when used correctly.

It allows companies of all sizes to increase trade in a way that focuses on the underlying products being traded along with supplier and end buyer strength, as compared to standard basic term loans that only look at the underlying borrower and thus offer limited capacity for growth.