As we enter the acute phase of the COVID-19 crisis, it is crucial to facilitate bank lending to the real economy businesses and support trade flow, therefore contributing to the European economy being competitive and standing strong once again.

The International Trade and Forfaiting Association (ITFA), the Bankers Association for Finance and Trade (BAFT), the Berne Union, the International Association of Credit Portfolio Managers (IACPM), the International Underwriting Association (IUA) and Lloyd’s Market Association (LMA) today wrote to European Union policymakers about the importance of facilitating bank lending amid the COVID-19 crisis.

The industry body representatives have jointly welcomed initiatives to reconsider the provisioning requirements for loans covered by Export Credit Agencies and other publicly guaranteed loans amidst the COVID-19 crisis.

Importance of the private credit insurance market

The 5 associations highlighted that the private credit insurance market also provides important support to economic activity within Europe through facilitating bank lending in the same way as public sector Export Credit Agencies.

Like Export Credit Agency cover, private credit insurance supports a wide range of short, medium and long-term bank lending, including trade-related, asset-backed and corporate loans, for activities across the entire European Union and worldwide. It was also noted that multilateral agencies also play an equally important role as official Export Credit Agencies.

Tod Burwell, President & CEO, BAFT told TFG: “Global lockdowns in response to COVID-19 have created damaging economic consequences for buyers and sellers both. Much has been done to enable public sector export credit agencies to support companies at this stressful time. Offering the private market tools available to the public sector is critical given the increasingly important role that private credit insurance plays in improving access to capital and liquidity.”

Development banks step up. Listen to our podcast with Steven Beck, Head of Trade Finance at Asian Development Bank, discussing state aid and support to FIs and banking partners in response to the COVID-19 crisis. Listen now.

Trade needs trade finance, which needs private credit insurance

The World Trade Organization reports that 80% to 90% of world trade is in some way reliant on trade finance.

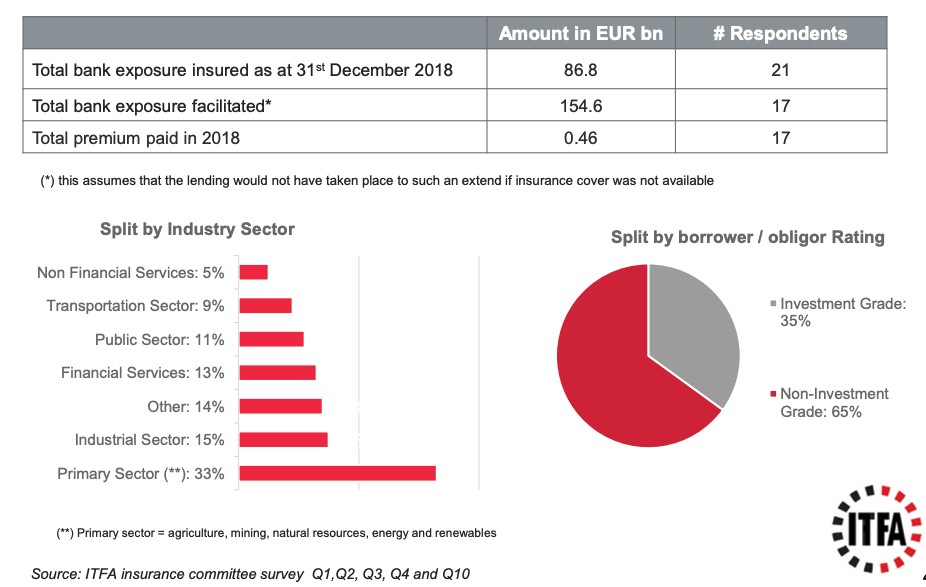

Private credit insurance plays a significant role in trade financing, particularly in Europe. A survey was conducted in 2018 among ITFA members. Based on the data representing approximately 25% of the market, it is estimated that the private credit insurance market as a whole facilitated EUR 600 billion of bank lending to the real economy in 2018. European banks are amongst the largest and most sophisticated financial institutions users of the product. Further information can be found here.

Vinco David, Secretary General of the Berne Union said: ‘Trade of goods and services needs bank financing. Credit insurance enables banks to provide this trade finance. In the current very challenging environment I much welcome the joint efforts of public Export Credit Agencies, multilateral institutions and private sector insurers to continue supporting exporters and their financiers. This is not only important now, but also in the expected recovery phase.”

Quantum of insurance cover

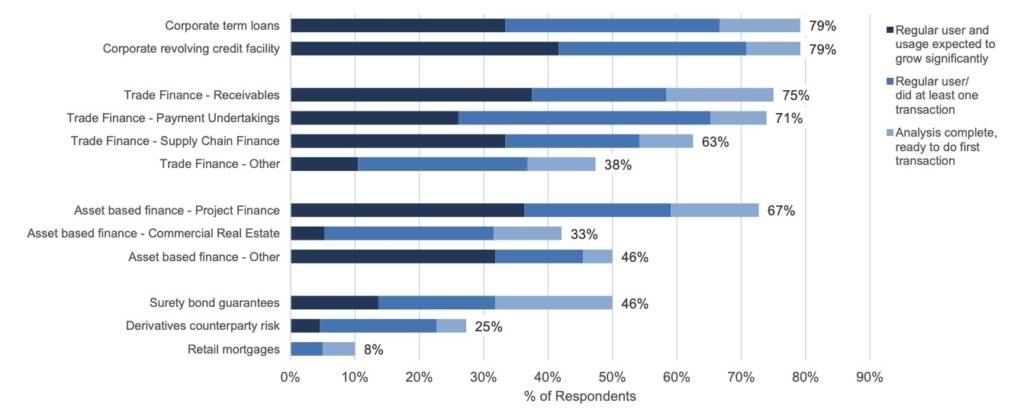

A survey conducted by IACPM has demonstrated that private credit insurance is the second most important risk mitigation tool for corporate exposures. Further information can be found here.

Usage of NPI for Credit Risk Management

Question: For which of the following asset classes has your bank used non-payment insurance to manage credit risk over the past 1-2 years, including today?

Credit insurance and its role in facilitating bank lending in the times of Covid-19. Key features:

- Credit risk insurance covers a bank (or corporate) against the default risk of an obligor (or debtor) and functions as an eligible guarantee within the CRR, recognised as such – see for example the EBA Single Rulebook Q&A (2014 768) [here] and EBA draft guidelines [here];

- Credit risk insurance is a tool which is used like Export Credit Agency insurance to provide credit risk mitigation in support of all forms of trade finance;

- Under the Solvency II rules, the bank as a policyholder is guaranteed a privileged senior position in case of the insurer’s insolvency;

- Credit Risk insurance contributes to the distribution of risk by banks, as part of prudent credit portfolio management, and reduces systemic risk due to sharing between banking and insurance sectors, which present low levels of correlation; possible contagion risks in case of economic downturn such as the current one are limited due to the diversified strength of general insurers’ balance sheets;

- Risk exposures in the insurance market are further mitigated through re-insurance, which helps to further assure the stability of the system – underpinned by the strict portfolio controls applied by insurers and reinsurers.

Sean Edwards, Chairman of ITFA, told TFG: “Some of the existing structural and regulatory issues in banking and insurance have acquired even greater importance because of the Covid19 pandemic.

“This cross-associational letter shows both ITFA’s convening power and our focus on significant issues for our members – even when they are not always aware of them.”

VIDEO: Development Finance – The Role of Export Credit Agencies, Trade Credit Insurers and Development Banks

TFG heard from development finance expert Diana Smallridge on the role of various institutions when it comes to financing trade, infrastructure and exports. Smallridge talked to TFG about the role of development banks versus Export Credit Agencies (ECAs), and Exim banks, discussing where government and multilateral support starts and trade credit insurance / private insurance ends.

Key recommendations to European Union policymakers

1) Understanding the complementarity between public and private sector risk transfer mechanisms

The industry associations noted that Export Credit Agencies within the European Union (as well as worldwide) are actively distributing credit risk to the private sector insurers and reinsurers, which further emphasises the complementarity between public and private sector risk transfer mechanisms.

2) Bring support or enlarge scope of action to private insurers

Given the extraordinary nature of the recently enacted State Aid Temporary Framework to support the economy in the context of the COVID-19 outbreak, the industry associations agreed that public guarantees can provide a valuable last resort solution (ultimate backstop) at a time when the short-term trade credit financing guaranteed by the monoline insurers may require backup. Member States and regulators should bring support and/or enlarge their scope of action.

In these exceptional times, it is vital that recognition is afforded not only to official Export Credit Agencies and other guarantees provided by public entities, but also to private credit insurers which are equally important supporters of bank finance to the wider economy. Multilateral agencies should also be recognised.

3) Allow flexible treatment of non-performing long-term exposures offered by the private insurance market

If serious consideration is given to allowing more flexible treatment of publicly guaranteed bank loans in respect of the non-performing exposures, it was asked to raise awareness in respect of the complementary and similar role played by the private insurance market and multilateral agencies in the context of regulatory treatment of non-performing medium to long-term exposures.