Unexpected and unpredictable, COVID-19 has already made a huge impact on global economies and markets, including the currency market. It’s impossible to know the extent of the volatility that lies ahead, which is why it’s best to take a risk management approach to your currency exposure. TFG heard from SCB’s Erin Harding.

How have the global markets reacted?

The stock market has suffered in the past couple of weeks, with the FTSE 100 closing at an 8 year low just a few days ago. The Dow Jones Index and the DAX also dropped lower, despite co-ordinated measures from central banks. Fears of a global recession have started to manifest, with estimations that 25 million jobs could be lost worldwide.

Economic contractions usually happen gradually, giving policymakers and businesses time to adjust. The coronavirus pandemic, however, has forced economic activity to grind to a halt and made it difficult to predict how the economy will fare over the next year. We’re only just beginning to see the toll it is taking on the global economy, and upcoming economic data will reveal more about the damage that has been done so far.

The first set of UK data illustrating the initial effects of the coronavirus was released this week, with both manufacturing and services falling dramatically into contraction territory. In the US, recent unemployment data showed a record rise in jobless claims. The figure came in at 3.283 million, almost five times the previous historic highs.

Despite this, signs that China is beginning to emerge from the crisis is starting to have a positive impact on the global markets.

How has the Bank of England reacted?

So far, the Bank of England has made two emergency cuts to interest rates, which now stand at 0.1%. It’s also introduced a fresh batch of quantitative easing and it’s thought that officials will announce further measures.

Just three days into his new job, Governor of the Bank of England, Andrew Bailey, warned that Britain faces an economic emergency. He acknowledged that events had moved rapidly since the Bank decided to make the first emergency cut and also fired warning shots at the City, urging firms not to pay large bonuses and dividends if they take official help. The Governor added that City traders should not “exploit” the situation by betting against businesses affected temporarily by the crisis.

Bailey also advised businesses to consider the support available to them before firing staff due to the coronavirus. At the end of last week, the government announced a commitment to pay companies 80% of staff wages up to £2500.

What’s happening with the pound?

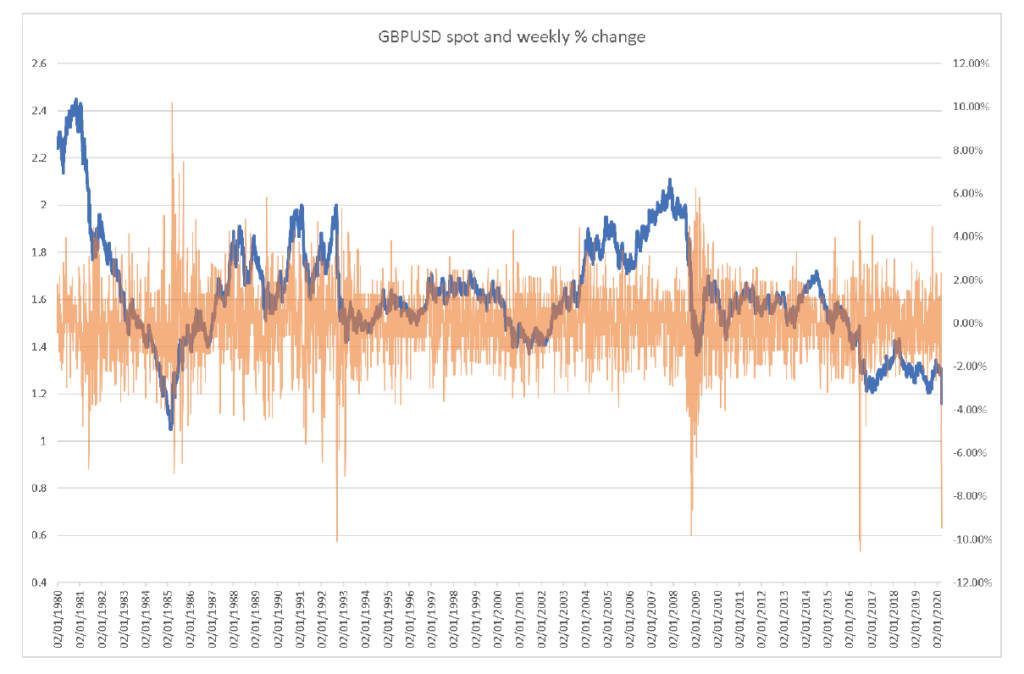

It’s safe to say that the pound has been overwhelmed by the coronavirus crisis, falling to a 35 year low against the dollar and performing weakly against the euro. Because the UK has a larger trade deficit than, say, the Eurozone, the mechanics are such that the pound will tend to fall by more than other currencies, such as the Euro or Swiss Franc, in times of crisis.

GBP/USD

The dollar, on the other hand, tends to strengthen in times of crisis due to its ‘safe haven’ status and it could be said that demand for the greenback is driving market movements. This is partly why we’ve recently seen sterling weaken so significantly against the dollar. As Andrew Bailey summed up, however, there is no “single story” to the pound’s decline.

GBP/EUR

The pound has mostly suffered against the euro recently, whilst the single currency has benefitted from coronavirus related developments due to its status as a ‘funding’ currency, causing it to strengthen at times of market stress. However, as we’ve seen, this does not mean that this pairing is immune to volatility.

GBP/AUD

Thankfully, it’s not all doom and gloom for sterling. Due to Australia’s close connection with China and the unexpected outbreak of COVID-19, the GBP/AUD position reached its highest level since the EU referendum.

The unpredictable nature of this virus and its impact is having a mirrored effect on the currency markets, which is why we’ve seen heightened volatility recently. As the chart below suggests, if we look back at other significant events that had a similar effect on the markets, sterling eventually stabilises after a period of volatility and begins to appreciate. However, this crisis is unlike anything experienced in modern memory, so it’s difficult to forecast exactly how the pound, and other currencies, will move in the coming hours, days and months.