Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn, PodChaser

Season 1, Episode 37

Host: Deepesh Patel, Editor, Trade Finance Global

Featuring: David Howes, Global Co-Head, Financial Crime Compliance, Standard Chartered Bank

Money fuels serious crime, including drugs trafficking, human slavery and terrorism. Managing financial crime risk while keeping up with the speed at which trade finance and payments technologies are emerging presents a huge challenge for banks around the world. TFG heard from Standard Chartered’s Global Co-Head, Financial Crime Compliance, David Howes.

Deepesh Patel (DP): David Howes, thank you for joining us on Trade Finance Talks. So, 30-second elevator pitch from each of you, who are you, where are you from, and what do you do?

David Howes (DH): Thanks Deepesh! My name is David Howes, I am the Co Head for Financial Crime Compliance at Standard Chartered Bank based in London.

We are an international bank with a presence in over 70 markets that exist to drive commerce and prosperity, and my mandate is championing our mission in support of that, which is partnering to lead in the fight against financial crime.

DP: Know Your Customer, Anti-Money Laundering and Counter Terrorist Financing policies are certainly at the front of mind for trade banks around the world, and in our recent 2020 predictions report, every single respondent mentioned one of these points as a challenge for the decade ahead. What’s your view?

DH: Well it’s been 50 years since the Bank Secrecy Act in the US, 31 years since the Financial Action Task Force (FATF) was formed, 21 years since the US Senate investigations on money laundering in private and correspondent banking were initiated, and we’re now onto the fifth European Union Money Laundering Directive. It has also been 20 years since the Wolfsberg Group was established.

Fast-forwarding to today, in 2020, it is estimated that financial crime will be at $5.8 trillion USD per year, and we’d expect that less than 1% of those criminal proceeds would be seized by authorities around the world.

So this is not a policy success when one considers the billions of dollars of private sector investment into AML policies over that past years, but I am convinced that with the use of today’s technology and big data, it could be. I’m happy to take a safe bet that the ‘why’ of AML is not going to go away. The challenge for all of us is to get more effective at the ‘how’.

Coronavirus and Financial Crime

DP: Great, thank you, David, I’m actually going to jump straight into an immediate challenge on doorsteps. Are we seeing an increase in crime as a result of the uncertainty around COVID-19?

DH: I think the most obvious area that we’re going to see an increase in threat in the fraud space. Sadly, there are actors out there who are going to seek to capitalise on what they see as an opportunity to exploit consumers in particular.

There has certainly been a significant increase in phishing attacks in trying to persuade people to part with their credentials which could open them up to major fraud risk.

If we look slightly further ahead in an environment where we’d expect to potentially see a major economic downturn that puts people and businesses under pressure, those experiences tend to correlate with increasing fraud risks as people stray to the wrong side of ethical behaviour in order to in order to keep themselves going. So we have a big challenge ahead of us.

The challenge for banks and for all legitimate players in the economy is trying to keep up with and prevent that from happening.

DP: We’ll start with the corporate customer, and the bank, before we move on to a regulator view. When it comes to clamping down on illegal activity within trade and supply chain finance, What is the most pressing trade finance compliance issue that you as a bank is focusing on in 2020?

DH: The front door to the bank needs to be protected through effective client due diligence at on-boarding.

Beyond that, I think that the issue most banks will or should be occupied with at the moment is: How do we increase the efficiency and the effectiveness of our trade anti-money laundering (AML) programmes?

There are currently many manual checks on the documents that accompany the transactions the bank’s process in trade and this really is not as effective as you’d want it to be, due to the volumes of documents, the manual nature and the people resource effort involved.

Furthermore, as the world moves towards ‘Open Account’ based trade, there is less information available to the bank to support a risk assessment.

Therefore we are faced with a two-fold challenge: (1) how can we turn the plethora of unstructured data that we hold into structured data, and, (2) how do I use other elements or information to assess transactions that have little to no data, but are still trading?

We have to look at ways of working with new technology and create new data sets to rethink the assessment of risk.

We’re also seeing sweeping changes within international trade itself, such as the new technological developments and fintechs who are entering into the market and spinning off data at an accelerating rate.

Why these measures given the low default rates?

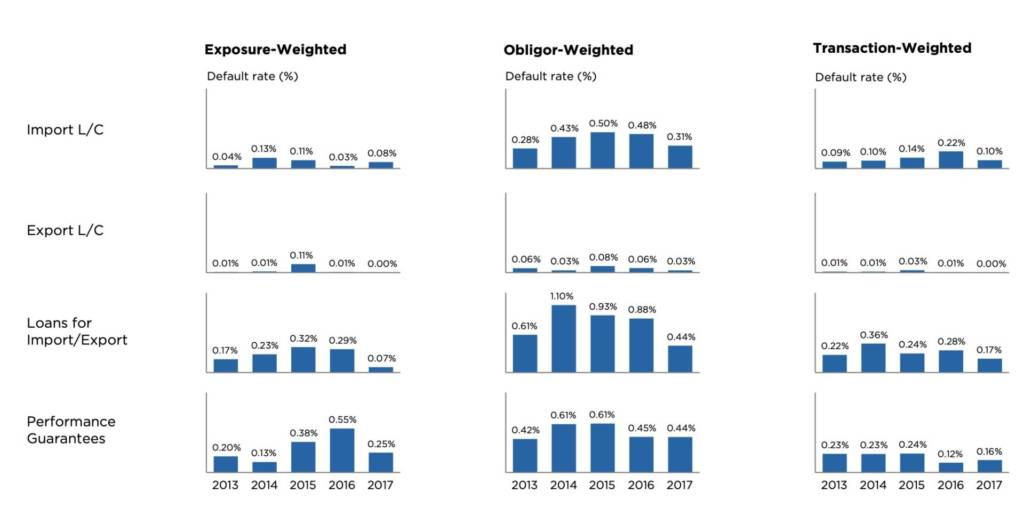

DP: Now let’s move on to a regulator view. Is the regulatory treatment of trade finance, in your opinion, fair for banks, given that trade finance, according to ICC’s latest trade register, is a fairly low risk asset class?

DH: Laundering money through the international trade system is well recognised as a significant risk. But that is not the same as risk in terms of trade assets.

In the sub-set of transactions that are financed by banks rather than directly by the importers and exporters, there is some opportunity to identify unusual activity. But with ever more trade being financed on open account terms, this opportunity is reduced.

So I have long taken the view that a different approach is needed to tackle trade based money laundering. Here is an analogy:

In the financial system, you have the banks providing the payment infrastructure, the major financial centres as the transit hubs, and the financial regulators overseeing this from within the government. In the trade system, you have the shipping lines and logistics firms providing the trade infrastructure, the ports as the transit hubs, and the border & customs authorities overseeing it from within the government.

If you want to solve laundering through the international trade system, you need to get those key actors engaged – the shippers, the ports and the border and customs authorities – in the same way that we are seeking to tackle laundering in the financial system through the banks and the financial centres and financial regulators.

This is an area whereby if we want to tackle TBML, we need a policy response that brings in the scope of the AML regime to those other actors, in the same way that the regime brings in scope from designated non financial business and professions such as estate agents for the laundering of assets through the property market, auction houses for laundering through art or antiquities and so on.

Fighting Financial Crime: Wolfsberg Group and the Wolfsberg Principles

DP: Let’s now talk about some of the global initiatives that are currently happening in the world of financial crime risk management. What is the Wolfsberg Group, and what are the Wolfsberg Principles?

DH: The Wolfsberg Group is an association of 13 global banks, including Standard Chartered, which aims to develop frameworks and guidance managing financial crime risks.

The first set of AML principles that Wolfsberg published were back in 2000, covering private banking. Since then, the group has gone on to publish a significant number of documents, whether that’s principles, guidance, FAQs or statements.

The common theme across the Wolfsberg Principles is that they are all intended to provide financial institutions with an industry perspective on what’s going to be effective in managing financial crime risks.

DP: Why are standards important in combating financial crime and can you give any examples of initiatives going on here?

DH: Standards are important, particularly when it comes to international finance and trade, because whilst it’s a cliché, its true that the system is only as strong as its weakest link. At Standard Chartered we have invested significantly over the last seven years.

At Standard Chartered, we have been quite public about some of our lessons learned, which I think is really important if you want to tackle some of these big challenges.

You need to look at risks quite broadly, rather than narrowly, so leading in tackling financial crime means working with other banks, policymakers, law enforcement, and regulators to seek to drive improvements in the effectiveness of a financial crime ecosystem as a whole.

A great example here is the work in The Wolfsberg Group to update our Correspondent Banking Due Diligence Questionnaire (CBDDQ) and related guidance material. This was initiated in part in response to the work of the financial stability board on correspondent banking derisking, where international banks have exited large numbers of respondents as the risks or costs fo servicing them have grown too great.

If FIs put in place processes to properly answer the questions in the Wolfsberg Correspondent Banking Due Diligence questionnaire, they will have – or will be building – a reasonable financial crime compliance programme.

In addition, and in the long term, these standards can make for a more effective and efficient due diligence process, with longer term positive effects on de-risking, access to finance, the development of trade and financial inclusion.

Risk-based priority approach and harm reduction

DP: What is a risk based priority and how can banks improve the overall “effectiveness” of the financial crime compliance regime?

DH: So, for me, a risk based priority approach to financial crime, which means putting resources against those actions, is the greatest way of achieving harm reduction. And when you look at the financial crime regime as a whole, we know today that’s not happening.

A significant amount of bank resource goes into what a colleague has described to me as ‘chasing the innocent around the system’.

A more effective system would target how to make better use of resources across both the private and public sectors and recognise that part of the purpose of a bank’s compliance programme is to provide highly useful information to government agencies in priority areas on which they are focused.

We should actively encourage banks to move resources away from built-up perceived good practices which do not really support any of the three pillars of an effective financial crime programme – compliance with law & regulation, risk based systems & controls, and provision of information to law enforcement.

DP: The Financial Actions Task Force (FATF) believes that just having reasonable legal frameworks in place for financial crime prevention was no longer sufficient for FIs. How can groups like Wolfsberg assess the effectiveness of an FI’s AML/CTF programme and why is this beneficial for governments and regulators?

DH: The Wolfsberg Group statement on effectiveness from December last year is a call to action for reform, and I am optimistic it is being heard in policy circles.

The US National Illicit Finance Strategy for 2020 includes efficiency and effectiveness as one of three strategic priorities; the UK has published its Economic Crime Plan in 2019 and is actively looking at its implementation; we have seen innovative work on public-private partnerships in a number of jurisdictions in Europe and in Asia-Pacific.

And at the international level, the FATF has in-flight a strategic review to bring greater focus on effective outcomes. I am more enthusiastic about the scope for change than at any time before.

In terms of what we can do to support that, I think its to engage in the dialogue from a system perspective rather than a bank perspective, and to encourage bold moves forward.

Useful article – David Lewis, Standard Chartered: How to Effectively Tackle Financial Crime in 2020: Refocusing on Effectiveness

Wolfsberg Group – Priorities for 2020

DP: What are the top priorities and opportunities with regards to both Wolfsberg and fighting financial crime from a bank perspective, in the next year?

DH: There are three main priorities here:

- At a policy level, we need to push ahead with the reform agenda in key markets. Where we are today is simply not good enough.

- At an industry level, identifying how to get more value from the investments in technology and people. Being compliant with regulation should not be the sole purpose of a financial crime programme – we have a duty and an opportunity to do more than that.

- At a predicate crime level I will pick two as they both have force multipliers:

(1) Raising the profile of illegal wildlife trafficking. It’s on the FATF priority list and what is fantastic about tackling this crime is that abhorrent and damaging in its own right; but also an effective way of mobilising people in going after smuggling networks that also support a range of crimes including slavery, drugs, arms and tax crimes that do not always themselves generate the same emotional response.

(2) Bribery and corruption. It’s the great enabler of so many other crimes. Reduce that and reduce it visibly and you create better conditions for taking on so many other societal problems.

DP: Thank you very much. I think partnership and collaboration is certainly something that we at TFG will be reporting on quite a lot in the next 12 months!