Three months into 2020 and the world is suffering from an officially termed Pandemic, global markets are experiencing prices not seen since the December of 2008, fuelled in part by the all-too-familiar virus but also by an oil price war that is again fuelled by the effects of the Coronavirus.

“Little over a decade ago the financial system was a part of the problem – this time, it gets to be a part of the solution.” – Mark Carney (2020)

On March 3rd, the US Federal reserve cut interest rates by 0.5% to a range of 1 to 1.25% in response to the knock-on effects of Coronavirus on supply chains that has in turn put the global financial market into to turmoil.

The morning of 11th March the Bank of England announced an emergency rate cut of 50 points to 0.25%. This is the lowest the UK’s base rate has been since October 2017. In an official release, the Bank’s Governor Mark Carney said the cut was to “bridge across the economic disruption caused by Covid-19”.

As part of this monetary stimulus announcement, the Bank of England also announced the “Term Funding Scheme with additional incentives for SMEs (TFSME)” – a fund that is intended to work in harmony with the interest rate monetary stimulus and encourage lending specifically for SME’s, and is promised to provide “in excess of £100bn in terms of funding”.

At a time where global production is slowing, the facilitation of SME funding could play a huge part in how the UK weathers this storm.

Further developing the volatility of the day, in the afternoon on the 11th the UK’s Chancellor of the Exchequer, Rishi Sunak released his budget which included multi-billion pound allocations to the NHS and emergency services to properly combat the pandemic, alongside increases to the threshold for national insurance contributions.

“Up to a fifth of the working age population could need to be off work at any one time, and business supply chains are being disrupted around the globe. This combination of people being unable to work and businesses being unable to access goods will mean that for a period our productive capacity will shrink.” – Rishi Sunak in his Budget Announcement (2020)

Just a few hours ago, President Trump banned travel from mainland Europe to the United States for 30 days, starting from Friday.

Below TFG explore the market conditions that have led central banks to behave and intervene the way they have, and what the stimulus could mean for the global economy/ trade finance landscape.

Some Context

Why has this happened? Although the ‘epicentre’ in these situations is often a series of linked instances that each contribute toward a larger picture, there are some distinct series of events that have lead the global economy to this point. With Coronavirus (official name COVID-19) now recording over 120,000 cases worldwide, nations are closing their doors and encouraging self-isolation where necessary. Italy, for example has enforced a nation-wide lock down, advising all people to stay at home unless necessary. They have also paused any mortgage payments due during the lock down, understanding the inability to work results in an inability to pay bills.

The result of people staying home and not working? Economic slow-down. Of course, this is a necessary price to pay for the well-being of everyone, however the effects are present nonetheless.

Economic slow-down, particularly in China has resulted in a lack of demand for Oil ( as China are the world’s biggest importer of oil) which has later developed into a price war between Saudi Arabia and Russia – each trying to flood the market with excess supply. The weak demand for oil, among other variables resulted in collapse of a deal between OPEC and allies – this, alongside Coronavirus related supply-chain affects resulted in market turmoil.

Market Effects

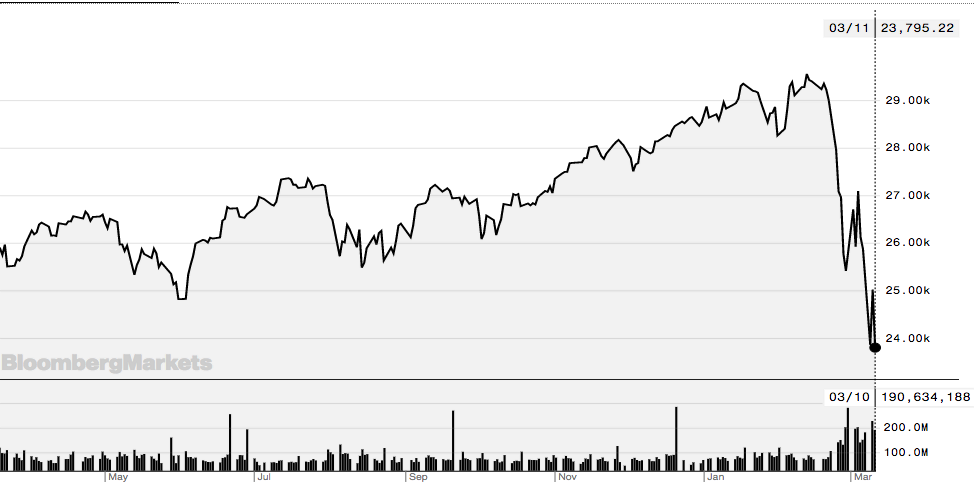

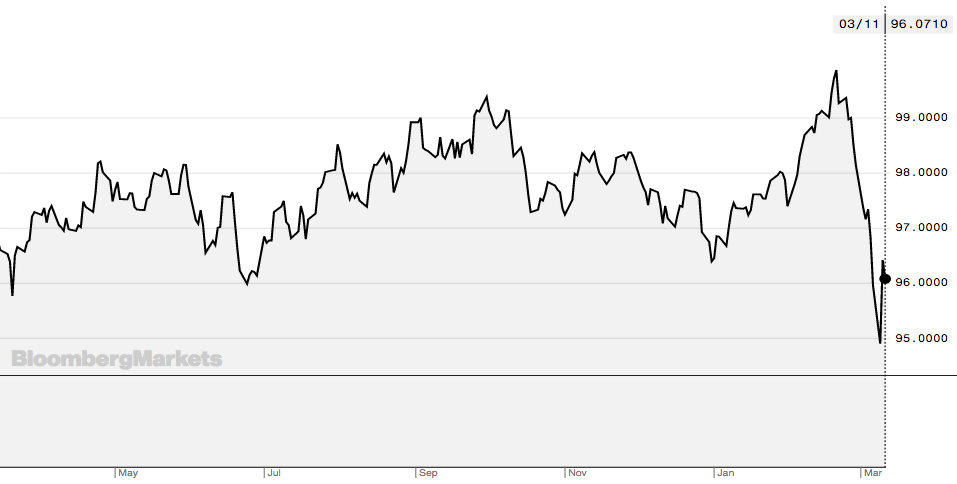

Year-to-date, the Dow Jones Industrial Average is down -18.3% to 23,584.65 (Figure 1.1). The S&P500 is down -15.6% to 2,749.73 (Figure 1.2) and the Dollar Index Spot is down -0.8% (Figure 1.3).

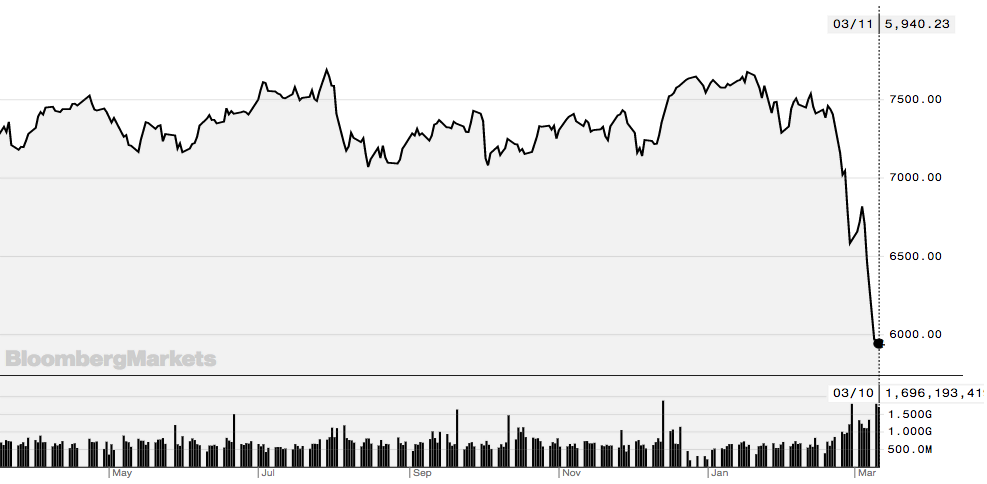

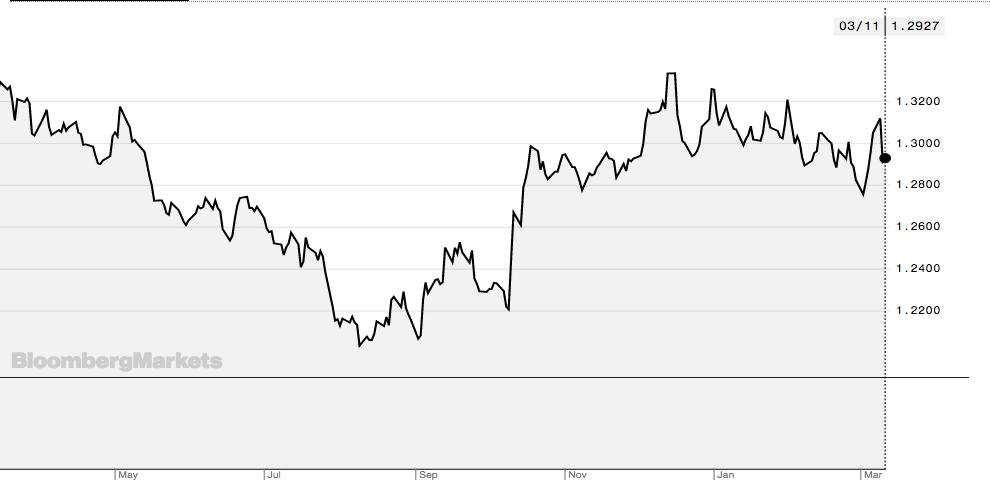

On this side of the Atlantic, the UK FTSE 100 is down -21.8% since 2nd of January (Figure 2.1). Following suit is the FTSE 250, which is -20.4% down (figure 2.2) and the GBP down – 0.3% year-to-date (figure2.3)

Given that the above indexes are often indicative of the respective country’s overall performance, the global economic became bleak – hence the emergency monetary stimulus from the US and UK central banks.

“Indicators of financial market uncertainty have reached extreme levels” – Mark Carney

Global Economic Reactions

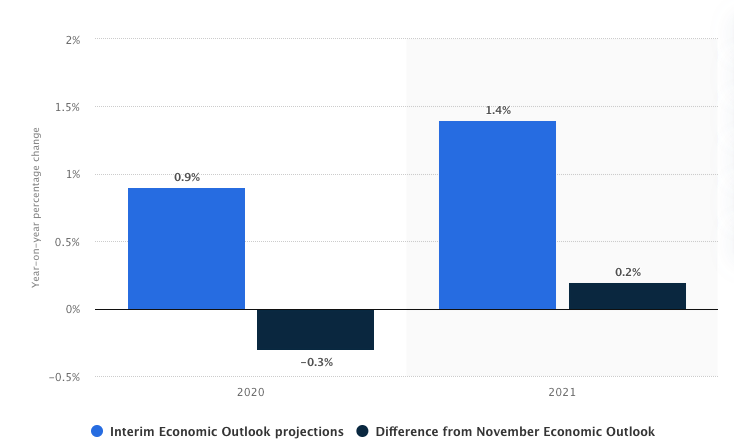

In the below graph from Statista, we see forecasted impact of the coronavirus COVID-19 on real gross domestic product (GDP) growth in France from 2020 to 2021.

The above shows an adjustment of -0.3% to the forecasted GDP of France for 2020. Given that in 2017 French GDP surpassed €2.5 trillion, 0.3% reduction roughly equates to 7 billion worth of lost GDP.

The whole of wider Europe is facing a downturn not dissimilar from that experienced in 2008 according to Christine Lagarde, President of the ECB. Because of the pressures mentioned above, the ECB are expected to announce monetary relief measures within the week – which many believe will also be a mixture of interest rate manipulation and structured lending facilitation.

Europe must be cautious with interest rate movement, however. Current rates are already negative, at -0.5% – an approach that has proved controversial. The ECB has long been pleading member state governments to increase public spending, as monetary policy is but a temporary measure and many believe is approaching its limits.

Reported on Bloomberg, HSBC economist Simon Wells said a European recession is “unavoidable”.

As mentioned, the delivery of the UK’s round of monetary stimulus is slightly different to those seen within the past decade or so. On top of interest rate reductions, aimed at increasing bank-to-business and bank-to-household lending to prop the economy up during this time of decreased activity, they have put together a fund targeted toward SME financing– the TFSME.

Mission Statement of the TFSME

According to the Bank of England’s release, the Term Funding Scheme offers “four-year funding of at least 5% of participants’ stock of real economy lending at interest rates at, or very close to, Bank Rate” over the next 12 months. It’s objectives are presented in 4 summarised points:

- Reinforcement – it is planned to mitigate the pressures and maximise the effectiveness of the Interest rate cut.

- Insurance – through the provision of cost-effective funding, it will provide insurance against adverse conditions in the bank funding markets.

- Incentive – give banks a reason to support further lending to SME businesses that would typically fall victim of the credit contractions that follow events such as those as of late.

- Incentive pt. 2 – give banks a reason to provide credit to businesses and households, again to help mitigate pressures felt during economic conditions such as these.

Eligibility

As stated on the Bank’s official release on the fund, it states that only those that are participants in the Bank of England’s Sterling Monetary Framework (SMF) and also signed up to access the Discount Window Facility (DWF). Those that are currently not signed up to the above initiatives can still apply, following regular eligibility conditions.

Alongside documentation etc., applicants will also need to ensure any collateral being drawn upon matches eligibility criteria:

- Eligible collateral consists of all “all collateral currently eligible in the SMF: Level A, B and C collateral sets” – however the Bank does reserve the right to reject any collateral for any reason.

- Any eligible collateral must also be pre-positioned before drawing upon.

- The Banks valuation of the collateral will be binding.

Allowance

Successful participants of the TFSME group may draw upon the “Borrowing Allowance”, which is the combined amount of the Initial Allowance and Additional Allowance:

- “Initial Allowance set at 5% of Base Stock.

- The Additional Allowance is equal to the sum of the following, subject to the points below:

1) one

times Non-SME Net Lending over the Reference Period to UK resident: households

(excluding UBs), Large Corporates, and NBCPs that are not part of the TFSME

Group; and

2) five times Net Lending to SMEs over the Reference Period”

Silver Lining

Of the global $1.5 trillion trade finance gap, the Bank of England suggested that UK SME’s account for a £22bn trade finance gap (Bank of England, 2019), meaning that the above fund should theoretically bridge the gap substantially, improving the global trade gap at the same time.

When we tie this expected improved performance in with the current suffering global environment, we begin to gain a better understand of the Bank of England’s wholesome, collaborative plan. SME financing has long been an issue economies need to face – in the UK SME’s account for 60% of private sector employment and generate approximately 50% of GDP. Amidst all of the economic unrest experienced this week and throughout 2020 so far, perhaps SME’s can be utilized to prop up the UK economy in this time of need.