We heard from Steven Beck, Head of Trade Finance at the Asian Development Bank, giving his musings on 2019, a year of uncertainty in trade, and what 2020 might bring for trade and supply chain in Asia.

In this 2020 interview series, TFG spoke to 20 experts in trade, receivables and supply chain finance.

An Interview with ADB

Name: Steven Beck

Position: Head of Trade and Supply Chain Finance

Organization: ADB

Interviewed by Nikhil Patel (NP), Analyst, Trade Finance Global

2019 – Navigating Uncertainty

Nikhil: In 200 words, what were the key highlights and opportunities of 2019 from an industry perspective in trade, receivables and supply chain finance?

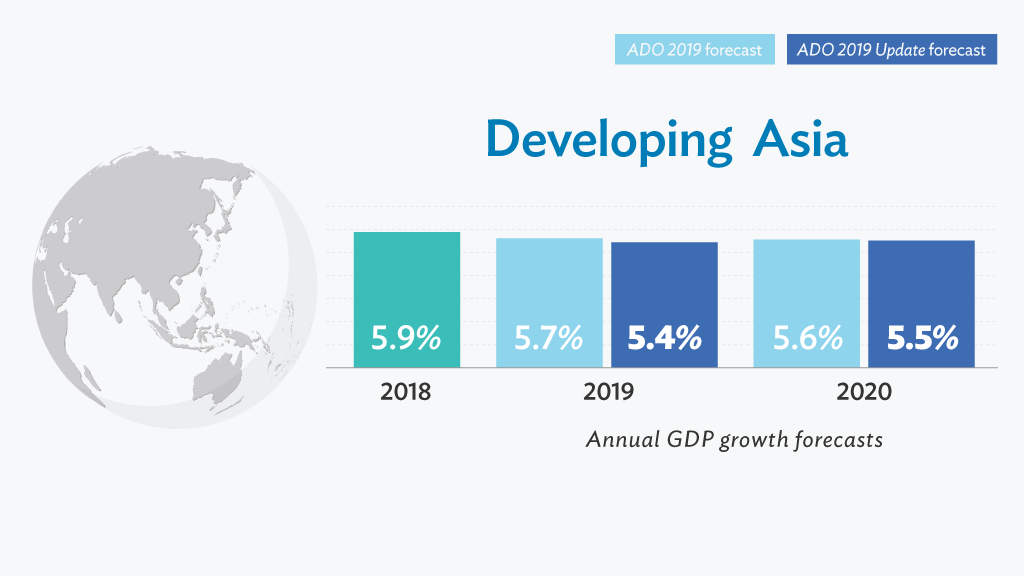

Navigating uncertainty is how I’ll remember in 2019. Uncertainty around trade, wondering how growth will suffer if we’re headed down from the top of an economic cycle. Social and political issues also fed into uncertainty and contributed to dampened economic activity. That said, growth proved more resilient than I feared would be the case.

In some ways, this uncertainty was reflected in our business. While ADB’s trade business did 5% more transactions than in 2018, the dollar value of 2019’s 4,700 transactions was down to $5.5 billion from $6.2 billion the

previous year.

For our fledgeling supply chain finance business, our focus in 2019 was to place the business on a more solid footing with clearly defined risk acceptance criteria and internal strategic alignment with risk management. We’re ready to take this business to the next level in 2020.

On tech, AI replaced Blockchain as the most talked about technology in 2019 that could influence the trade and supply chain finance business, drive efficiency, and address problems.

In 2019 ADB’s trade finance business automated internal procedures. This resulted in faster product delivery for clients, and we’re planning more innovations in 2020.

NP: What are your top predictions for trade, supply chain and receivables in 2020?

Ongoing trade tensions and decoupling of value chains will add to intra-Asian trade growth, already fueled by high growth rates compared to the rest of the world.

2020 Predictions in Trade and Supply Chain Finance – An ADB Perspective

NP: In 200 words, what are the biggest challenges in trade, receivables and supply chain finance you predict for 2020?

The conscious or unintended consequence of deterring economic activity, including value chains and the free flow of goods and technology on a global basis, will have adverse consequences for the world. Decoupling is a threat to global trade, prosperity, and possibly even peace.

It’s incumbent on all of us to ensure that this scenario does not happen. Creating global digital standards and protocols – I refer to the Digital Standards Initiative below – to drive interoperability, the interconnectedness of systems and platforms on which trade will move in the future is important to ensure global trade continues to deliver peace and prosperity.

Trade-based money laundering will become an area of increasing focus. The industry will need to work closely with regulators to address concerns and improve our ability to detect and prevent crime in our transactions. Decoupling inhibits international cooperation and creates more space for bad actors to use the financial system. ADB, an active member of the Financial Action Task Force’s (FATF) Trade-Based Money Laundering (TBML) Working Group, is well-positioned to play a convening role and will continue to do so.

Making choices about what IT initiatives to undertake and purchase will become even more difficult. Technology becomes obsolete quickly. It requires tremendous resources and operational upheaval to implement. Inter-operability always an issue.

NP: What are the key priorities for ADB in 2020?

- Deliver excellence in client service

- Innovate supply chain finance transactions

- Kick off the Digital Standards Initiative in partnership with Government of Singapore and International Chamber of Commerce

- Lead initiatives to tackle challenges in anti-money laundering and counter-terrorism financing

NP: What’s your top prediction for a technology that you think will truly kick off / have the most success in 2020?

Artificial Intelligence. Why? Because human intelligence needs all the help it can get!

Read our trade finance 2020 predictions here