“Navigating uncertainty is how I’ll remember 2019.” Steven Beck at Asian Development Bank told Trade Finance Global (TFG) earlier this year. With many major players suffering from both domestic and international political relations, economies and global trade have been affected as a result. But was it all doom and gloom for 2019?

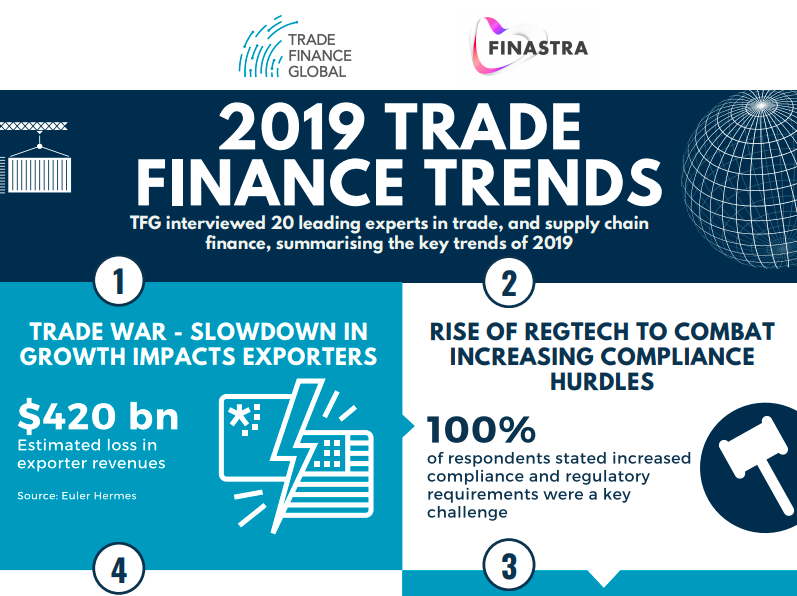

In partnership with Finastra, TFG spoke to 20 leading experts in trade, receivables and supply chain finance about the key themes of 2019.

Events such as Brexit, the US-China trade war, political unrest between China and Hong Kong dominated the headlines in 2019, have all had significant implications on global trade. However, it has not all been bad news – with increased levels of cooperation and technological innovation, the outlook for trade/finance moving into 2020 could be promising.

Below we summarised the key themes in trade, supply chain and receivables finance throughout 2019, from geopolitical tensions and economic growth slowdowns, to the sharp increase in fintechs partnering with banks, who are rethinking and transforming the way trade is being done.

1. Geopolitics Abound: The Roots of Change

At the root of the UK’s decision to trigger Article 50, and the US’ decision to elect Trump and an aggressive approach to trade relations, some could argue that 2019 was a year of “economic nationalism”.

“Economic nationalism is a modern form of protectionism, which has surfaced in many different parts of the world.”, which is a good way of summarising what has happened.

Zaki Cooper, Director of Business for New Europe

President Trump has been firm in his “America first” approach, recently addressing the United Nations General Assembly, ending his speech – “the future does not belong to globalists, it belongs to patriots”.

The uncertainty that has stemmed from these geopolitical disrupts have echoed throughout the global trading economy. On October 1st, 2019 the WTO released a report entitled “WTO lowers trade forecast as tensions unsettle global economy”, in which they said that escalating trade tensions coupled with slowing economic growth were the underpinning reasons for forecast decreases of -1.4% in merchandise trade in 2019 and -0.3% in 2020.

Granted, the US-China trade war has currently reached a potential phase 1 agreement with China announcing they will cut import tariffs for frozen pork, pharmaceuticals and some high-tech components starting from Jan. 1 according to WSJ, but recovery will take time to trickle through and reverse the slowdown in trade growth.

2. The State of Trade Fundamentally Changing

In this year’s annual report from the Director-General of the World Trade Organization, entitled ‘Overview of Developments in the International Trading Environment’, it was found that “Between mid-October 2018 and mid-October 2019, the trade coverage of import-restrictive measures implemented by members was estimated at USD $747 billion”, a 27% increase on the previous annual report’s findings of USD $588 billion.

WTO Director-General, Roberto Azevêdo went on to say: “102 new trade-restrictive measures were put in place by members during the review period, including tariff increases, quantitative restrictions, stricter customs procedures, and the imposition of import taxes and export duties.”

Levels of Imports/ Exports 2012 Q1 – 2019 Q1

Source: World Trade Organisation

Looking at world import and export levels, we can see world merchandise trade up 0.8% in the first half of 2019, compared to the same period in 2018. (WTO). This signals a significant “slow-down”, which is evidence of the above restrictions.

Although world GDP and economic growth may be positive, it is the rate of that growth that is causing concern off the back of global uncertainty.

Real GDP Growth: Annual Percentage Change (Source: International Monetary Fund)

The above image from the IMF shows the annual percentage change in Real GDP growth, split by Emerging and developing economies (red), advanced economies (blue) and the World economy (yellow). We can see that, since 2015, where world real GDP growth was 3.5%, it has fallen to 3%.

Slowing economic growth has resulted in weaker demand in many trade channels, fuelled by client uncertainty. With political trade tensions causing distress on supply chains, for example, market operators are forced to step back and re-evaluate their supply chains. When this is then linked back to economic nationalism, more specifically, a focus on domestic supply chains, we see an increase in the need for risk mitigation and better working capital .

“The levelling off in the global economic cycle in 2019, compounded by trade conflicts, has led to a slow-down in the growth of world trade. The global credit insurance business mirrors these developments and has likewise seen little growth in 2019”.

Vinco David, Secretary-General of Berne Union told TFG

3. Investment Appetite Decreased

“The trade dispute between the US and China, plus Brexit, have had a significant impact on trade throughout 2019. These have generated a level of uncertainty in the marketplace, which impacts both trade flows and overall investment.” – Iain MacLennan, Finastra

According to the OECD’s Foreign Direct Investment Statistics in October, foreign direct investment decreased 20% in the first half of 2019.

Direct Investment Statistics

Source: Bloomberg

The link between investment and trade, albeit substantial, can be quite complex.

Chicken or Egg?

It can be well understood by drawing upon OECD Science, Technology and Industry Working Papers 1999/03 ‘Foreign Direct Investment and International Trade: Complements or Substitutes?’ by Lionel Fontagné, who found that before the mid-1980s, international trade generated direct investment. Since then, however, the relationship has reversed with direct investment influencing trade. The paper also found that, based on an analysis of 14 countries, each $1 of outward FDI, $2 worth of additional exports will be produced

4. Fintech Cooperation and Coopetition in Trade Finance

On a more positive note, levels of cooperation and innovation within the ‘TradeTech’ market has had significant improvements on not only the micro-processes which build the platforms which facilitate trade finance for funders, but also the potential for that platform in the future.

Speaking to TFG, Iain MacLennan, VP Trade & Supply Chain Finance (Product and Engineering) for Finastra said: “We see much more maturity in the offerings from Fintechs as well as broader collaboration across the industry. With the use of open APIs, what were traditionally closed systems are now bringing in other capabilities to extend their offerings”.

Sukand Ramachandran, Managing Director and Senior Partner for Boston Consulting Group echoed this: “Innovation continued in the local market, with more players providing services into the receivables and supply chain financing market – both from the major banks and specialist funders”.

5. Blockchain: Moving from POC to Reality

Consortia, ecosystems and networks using DLT are appearing in all area’s of global trade processes, all attempting to reshape the way we currently trade through the introduction of blockchain-based technologies. TFG’s recent paper, in collaboration with the World Trade Organization and the International Chamber of Commerce highlighted some of these projects, concluding that whilst there is a lot of hype around DLT in trade, many are still at the early stages of real disruption, and that we are likely to see an evolution rather than a revolution in trade.

Cécile Andre Leruste, Managing Director for Accenture Banking, Europe told TFG ”Consortia are learning to become “tech players” alongside editors and providing a new scale to their partners, with the hope to generate new business and reduce costs.”

Blockchain, however, is not the only innovative technology that has changed trade in 2019. Dani Cotti, Managing Director, Centre of Excellence, Banking and Trade in Sales, TradeIX told TFG “We have IoT, machine learning and artificial intelligence which are facilitating Supply Chain Finance relationships with a lot of new features and scenarios being explored globally. While these technologies are still maturing, AI is of particular interest to companies that are doing Supply Chain Financing transactions.”

New technologies such as Optical Character Recognition (OCR) are transforming the way in which businesses are operating. Featured in TFG’s 2018 Fintech Trends, OCR is a way for institutions to remove the manual data entry and move closer toward automation and as a result, more efficient processes and lower costs.

6. Rise of RegTech to combat compliance

From a regulation and compliance perspective, every single respondent told TFG that 2019 was a year of brought a year of heavier compliance and pressure from regulators, particularly in areas around know your customer, trade-based money laundering and counter-terrorist financing.

Yet the unintended consequences of such regulation on banks were continued to be experienced amongst correspondent banks and MSME’s, particularly in emerging and developing economies (EDE’s), as reflected by the ICC’s reports of the USD $1.5 trillion trade finance gap.

International Trade Centre’s Ms. Arancha Gonzalez Laya told TFG “MSMEs rely a lot on Tier 2 and Tier 3 banks for trade transactions, payments and access to foreign currency. International correspondent and clearing bank de-risking measures started after the crisis have not yet been reversed.”

The rise in open account, non-bank financing channels and digital technology risks marginalizing Tier 2 and Tier 3 banks, or putting them out of business – Who will set professional standards and provide quality banking services when they are gone?

RegTech to the Rescue?

Organisations such as IFRS, a not-for-profit that aims to “develop standards that bring transparency, accountability and efficiency to financial markets around the world”, are just one example of these so-called ‘RegTech’ companies that are utilizing the latest technology to properly enforce regulations on industries.

Deloitte are collating a “RegTech Universe”, listing each notable operator and their speciality as they are born. Currently, they have 347 RegTechs registered:

- 28 are in the transaction monitoring industry

- 47 are in regulatory reporting

- 48 are in risk management

- 83 are in Identity management and control

- 141 are in the compliance arena

This is an important challenge for compliance and regulations. With a technological landscape that is evolving as quickly as it is, regulations and their implementation often carry a lag. Nevertheless, innovative technology is being utilized to increase efficiencies.

7. TradeTech: A Renaissance from Asia

“We are also seeing fintech developments that started in other areas such as payments coming into the trade space, for instance, entity or network relationships” – Iain MacLennan, Finastra

Blockchain and DLT networks have already made a monumental difference in the landscape of finance and trade. Each offering their own unique transformation of old methods, that promise greater transparency, efficiency and accessibility. These fintechs are arising in all kinds of areas within trade/finance.

One example is unicorn company Ant Financial, part of the Alibaba group who use blockchain to “help global consumers and small-and-micro enterprises gain access to inclusive financial services that are secure, green, and sustainable, creating greater value for society and bringing equal opportunities to the world.”

KPMG and H2 Ventures released a 2018 Fintech 100 report, which features the leading 50 ‘established’ fintech companies across the globe, alongside the most “captivating” 50 ‘emerging stars’, who bring new, exciting products and solutions. The report successfully highlights the reach of the Fintech market, listing companies such as Monzo, Number26 and Starling Bank who operate as digital banks or “Neo-banks” – the dominating industry in the report (34 Fintechs), along with lending with 22, wealth management with 14, and insurance with 12.

“Technology has become an enabler of faster, more effective and efficient compliance, with recent success around AML (with Regtechs such as Quantexa, ThetaRay and Ripjar).”

– Cécile Andre Leruste, Accenture

Such fintechs are all using big data and artificial intelligence to enable their clients to make better decisions, analyse risk better and also detect financial crimes more efficiently. We don’t anticipate a slowdown in TradeTech in 2020.

8. Uncertainty: The biggest certainty of 2019

2019 has proved to be quite the uncertain year, but not necessarily by the same definition explored above. Yes, there has been uncertainty around the individual trading elements and the political landscape which governs it, but more specifically to trade finance we’ve seen a mix of positives and negatives, leaving many unsure on the environment moving into 2020.

There have, of course, been geopolitical unrest which has echoed through the majority of economic areas – trade, investment, employment etc. But as we have seen above, and heard from the industry experts quoted there has been a significant level of cooperation, innovation and shift in consensus.

With a more unified, ‘greater good’ focus from some of the world’s leading institutions, alongside a particular sense of grit from new companies coming in with revolutionary technologies, 2019 could be seen as positive as we move into 2020. There is no doubt that the collaboration and coopetition witnessed in 2019 will continue and develop further, leading to more efficient firms, more transparency in the market and a more sustainable environment.