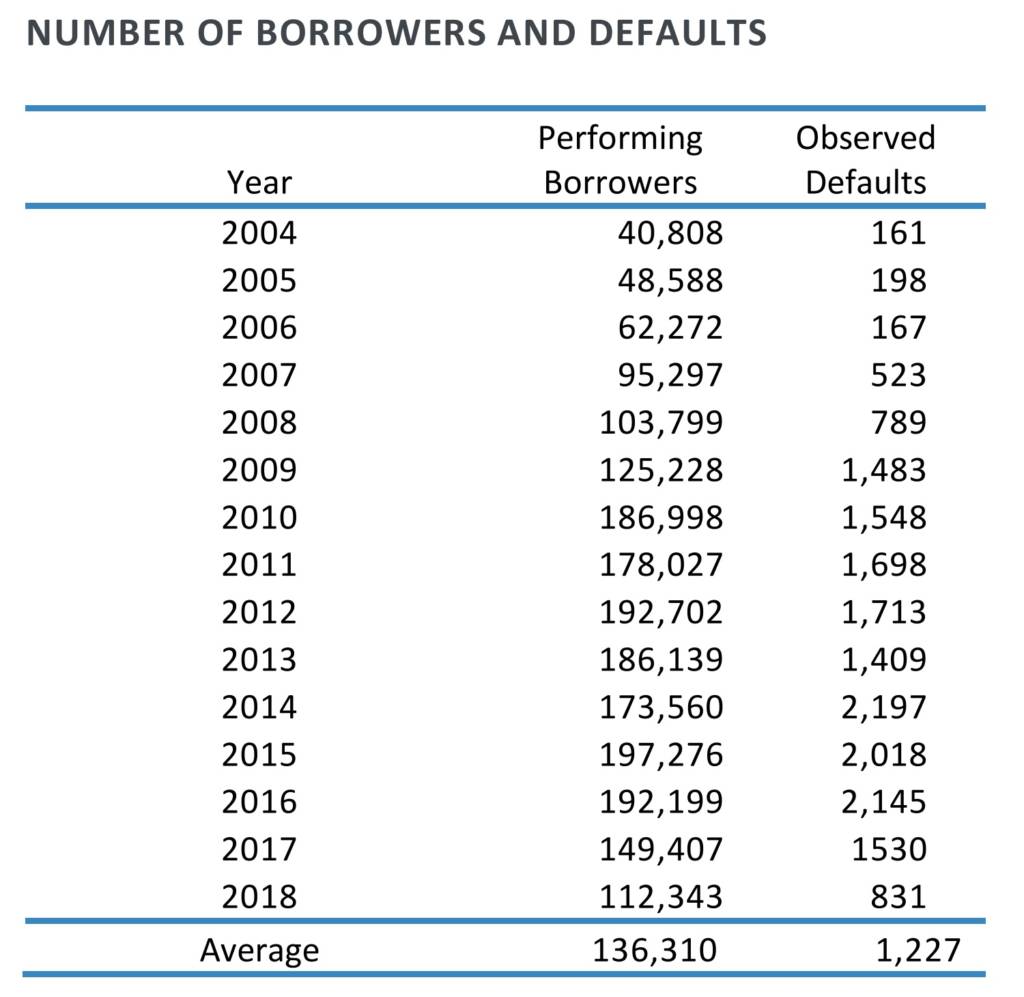

Default ratios among bank loan portfolios have been steadily decreasing since 2016 – dropping from 1.12% to 0.73% in 2018, according to a new report from Global Credit Data (GCD), a not-for-profit data-collection initiative jointly owned by more than 50 leading global banks.

Data from the report, which is designed to help banks benchmark their Probability of Default (PD) estimates against industry peers – and analyses long-term internal observed default rates and internal rating migration matrices from a portfolio of 26 leading financial institutions over a period of 15 years – show that bank loans have been performing well in recent years, but the figures are also consistent with fears of a corporate debt bubble.

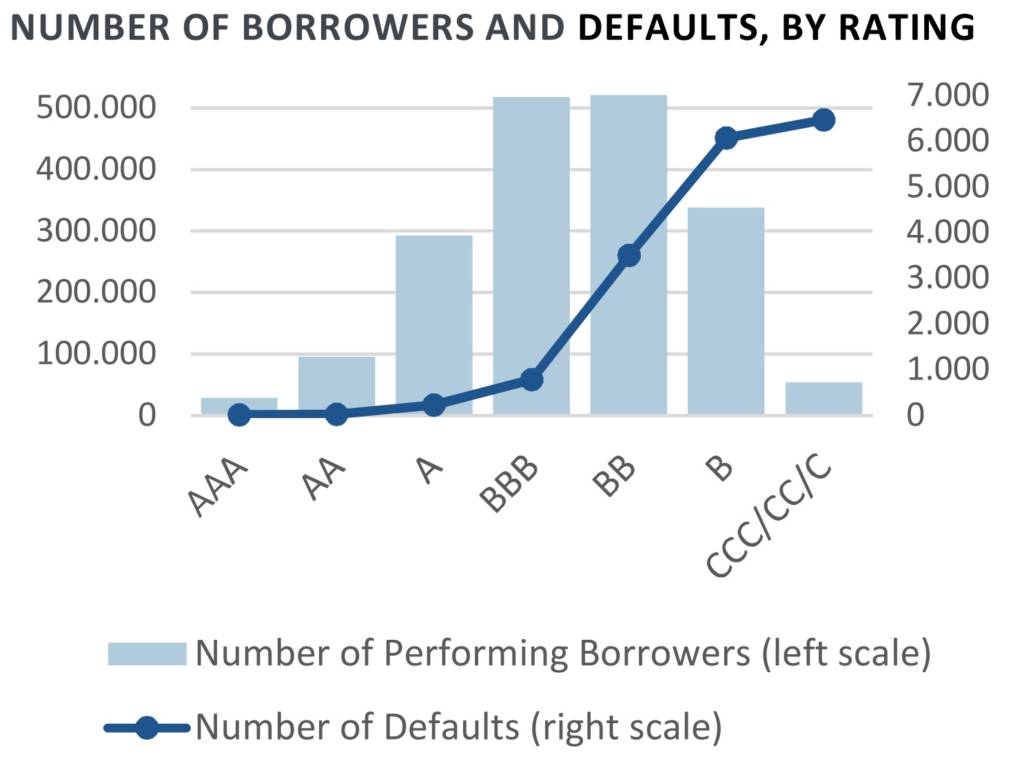

An influx of newly issued corporate debt (so new as to be unlikely to already be defaulted) can have the effect of driving default ratios down, while, in practice, if this debt is issued by lower-rated companies, the underlying risk of default may well be increasing.

“While the numbers look good, there remains a risk of a credit bubble developing, as these historically low default rates could be explained by easier access to funding and higher debt levels, permitted by historically low rates and the necessity for banks to find yield,” says Richard Crecel, Executive Director, GCD. “This is the calm before the storm – the quality of global debt seems to have slipped toward highly leveraged non-investment-grade companies and weaker covered instruments. The next default spike, whenever it occurs, could be significant.”

While banks will need to take steps to address these risks, the report shows that GCD member banks have been historically strong in this respect.

“Our data show that banks’ internal PD estimates used for regulatory purposes are typically conservative when compared to realised defaults,” says Daniela Thakkar, GCD Membership and Methodology Executive. “Average PD estimates over the last 15 years stand at 1.63% compared to an average default rate of 0.90% over the same period.”

“To maintain this level of prudence and keep track of changing default risks, banks will need to continue benchmarking their PD-related calculations against industry peers. Traditionally, banks have compared their estimates to external benchmarks such as those produced by credit rating agencies (CRAs), but the GCD PD report provides a valuable and bespoke alternative.”

The report includes data designed for benchmarking key risk processes within banks, including PD rating scale calibration, PD model calibration, regulatory and economic capital calculation and stress testing, among others. While CRA benchmarks are typically based on bonds, this study provides a bespoke alternative to CRA reports – comparing the same instruments to provide a more accurate representation.

“The observed default frequencies of the GCD dataset are based on a broader dataset, and are less volatile, than CRA default frequencies,” adds Richard Crecel. “We would encourage all financial institutions to supplement their benchmarking work with the GCD dataset. This will enable them to anonymously compare their PDs and observed default rates with their peers in the most accurate way.”