TFG spoke to Charlotte Prior at Gulf International Bank about the implementation of Environmental Social and Governance (ESG), following on from the launch of GIB’s white paper: The incorporation of Environmental, Social and Governance (ESG) in the Trade Finance asset class.

One of the biggest challenges to the implementation of Environmental Social and Governance (ESG) is the myth that ESG investment is a drag on returns. Typical investors’ lack of knowledge of ESG has slowed its implementation. Compared to five years ago, 83% of advanced investors in Hong Kong said sustainable investing has become more important. 64% of them have increased their investments in sustainable investment funds as a result. In contrast, only 77% of less advanced investors had the same view with 53% of them increasing their sustainable investment. This suggests that experienced investors better understand the benefit of integrating sustainability into their investment portfolio.[1]

Article: What is Green Finance? An article with Sir Roger Gifford on the Green Finance Task Force. Read more.

“Trade Finance has an undeniable role to play in the development of a more sustainable world. Focusing on ESG factors also strengthens the Trade Finance sector. However, many challenges lie ahead due to the widespread and concurrent intricacies of the scarcity of data, existing limitations to the Trade Finance asset class and the need to overcome technical hurdles. Nevertheless, there is significant scope for Trade Finance to help achieve sustainability targets and to provide impactful results where most needed and problematic.”

Charlotte Prior, Gulf International Bank

However, dispelling a key myth regarding ESG will support its validation by all investors. Some investors and investment managers still view ESG investment with deep scepticism. That view, follows the narrative that ESG incorporation will limit the universe of investments and therefore the potential performance opportunities. Better transparency and reporting would help close the investor knowledge gap around ESG and create a virtuous circle encouraging investors to integrate sustainability into their investment portfolio.

Historically, ESG investing has mostly focused on managing portfolio risks. One delegate at a UNPRI workshop stated that ESG professionals and investors alike tend to speak only about risk, and not opportunities. Changing this focus to ESG as a source of sustainable competitive advantage which can stimulate market outperformance is gaining momentum with investors.

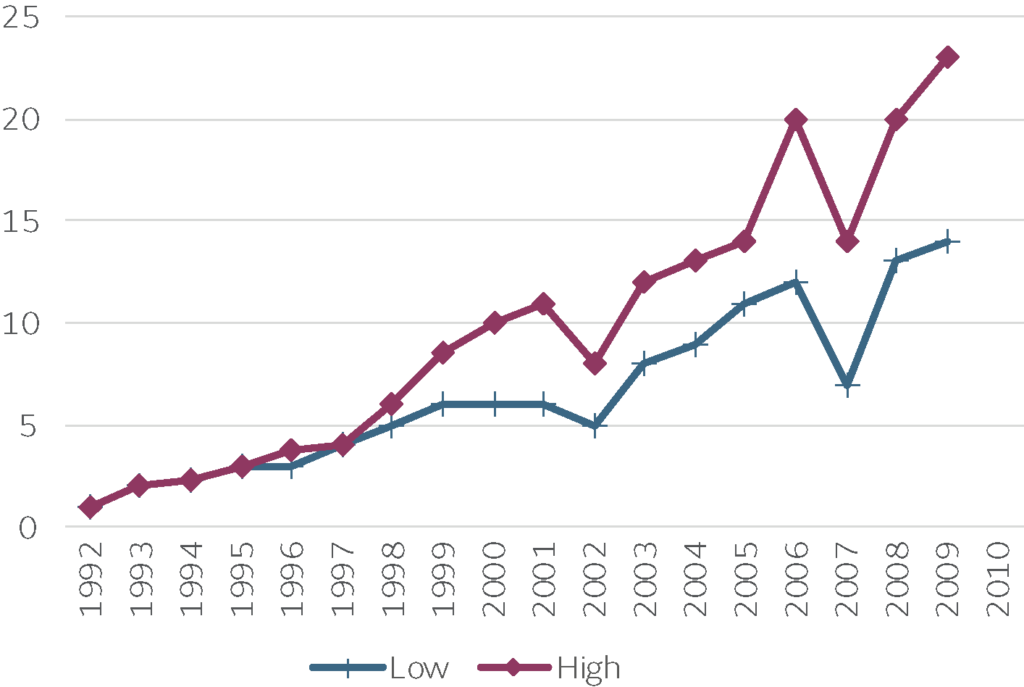

The Eccles et al (2012) study “The Impact of Corporate Sustainability on Organizational Processes” identified companies that had long-standing good practice in terms of sustainability (closely relevant to ESG). It underlined that, “High sustainability companies significantly outperform their counterparts over the long-term, both in terms of stock market as well as accounting performance”.[2]

The below graph shows how stocks of sustainable companies tend to significantly outperform their less sustainable counterparts. It shows the evolution of $1 invested in the stock market in value-weighted portfolios.[3] There are numerous studies documenting the long-term performance benefits of investing consistent with ESG principles.[4]

“There is still a big part of the investment community concerned that ESG will jeopardise returns. That concern is based on old information. – Jane Ambachtsheer, Global Head of Sustainability BNP”

The lack of indices measuring trade finance transactions causes a particular challenge for the trade finance Asset Class. The creation of trade finance indices will require some lateral thinking but is not insurmountable. Better reporting, transparency, and the development of indices will lead to improved access to information, meaning investor attitudes, values and beliefs will change. The rapid development of tradetech and fintech solutions will also make reporting of ESG factors a lot easier for the trade finance industry.

The growth potential of the asset class may accelerate as banks securitise pools of trade finance assets to provide a more liquid debt instrument to institutional investors. Within this context and the growing consideration of ESG factors for Asset Owners, there is an avenue for them to demand the incorporation of ESG considerations or clearly defined ESG outcomes into those securities. Sustainability is relevant to all companies as it helps to ensure their long-term viability. It establishes a triple bottom line that seeks to improve social and environmental value along with financial return.

We believe that sustainability does not inhibit—in fact, it improves— a company’s ability to create value.

As ESG gains further momentum in trade finance,

sector and country indices will be developed, allowing benchmarks to be

created. ESG in trade finance will then become more transparent, with

participants reporting more. These advances will change the attitude, values

and beliefs of smaller investors when considering ESG linked trade finance.

[1] https://esg.theasset.com/ESG/35221/survey-highlights-knowledge-gap-for-sustainable-investment-

[2] Eccles, R., I. and Serafeim, G. (2012) “The impact of corporate sustainability on organizational processes and performance”. National Bureau of Economic Research, working paper 17950. Available at: https://www.nber.org/papers/w17950

[3] https://www.hbs.edu/faculty/Publication%20Files/SSRN-id1964011_6791edac-7daa-4603-a220-4a0c6c7a3f7a.pdf

[4] Shedding Light on Responsible Investment: Approaches, Returns and Impacts,” Mercer, November 2009.