How has China performed in terms of economic growth and trade over the recent years?

Economic growth:

Gross domestic product is the level of production of the economy and its rate of growth. It is the market value of all final goods and services produced within a country in a given period. The main components of GDP are consumption (C), Investment (I), Government purchases (G), and Net exports (X). The Chinese economy advanced 6.0 percent year-on-year in the September quarter of 2019, slowing from a 6.2 percent expansion in the previous quarter and compared with market expectations of 6.1 percent. It was the weakest growth rate since the first quarter of 1992, amid persistent trade tensions with the US, weakening global demand and alarming off-balance-sheet borrowings by local governments.

Balance of payments:

China’s external position is extremely solid. The current account has recorded a surplus in every year since 1994. The capital account followed suit and only recorded two deficits in the last 20 years. As a result, China’s foreign exchange reserves skyrocketed to almost USD 4.0 trillion in 2014. The current account surplus reached its peak in 2007, when it represented 10.1% of GDP. Since then, however, the surplus has since narrowed as the currency strengthened and domestic demand increased.

China’s trade structure:

China has experienced uninterrupted trade surpluses since 1993. Total trade multiplied by nearly 100 to USD 4.2 trillion in only three decades and, in 2013, China surpassed the United States as the world’s biggest trading nation.

The opening of the country and the government’s massive investment programs have prompted the country to become a major manufacturing hub. As an economy highly integrated into the global trade system, the country benefited from a steady improvement in its terms of trade since 2000.

Moreover, the country has engaged in several bilateral and multilateral trade agreements that have opened new markets for its products. In 2003, China signed the Closer Economic Partnership Arrangement with Hong Kong and Macau.

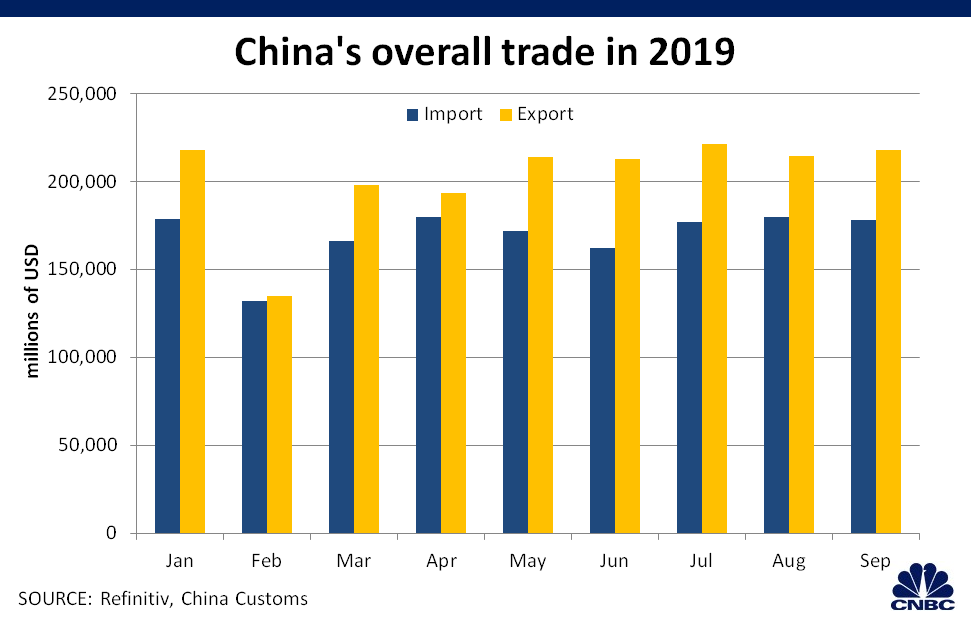

Exports and imports from China:

Electronics and machinery make up around 55% of total exports, garments account for 13% and construction material and equipment represent 7%. Sales to Asia represent over 40% of total shipments, while North America and Europe have an export share of 24% and 23%, respectively.

Supply of imports into China is mostly dominated by Asian countries, with a combined share of around 30% of total imports. Purchases from Europe and the U.S. account for 12% and 8%, respectively.

How is monetary and fiscal policy conducted in China?

China’s fiscal policy:

Fiscal Policy is any government action which affects the timing, magnitude and composition of government revenue or expenditure. It is the way the government manipulates revenue and expenditure to achieve its aims and is carried out by the central government through the annual budget. The instruments of fiscal policy are taxation and government spending, as a rise or a fall in either acts directly on employment prices and output.

Before 1978, China had a highly centralized fiscal system, which mainly reflected the country’s planned economic system. The central government collected all revenues and allocated all the spending of the administration and public institutions.

In 1994, the government launched a bold fiscal reform in order to struggle against a rapid decline in the tax/GDP ratio, which dampened the government’s ability to conduct macroeconomic and redistribution policies. The result of this reform was a steady increase in revenues, which jumped from 10.8% of GDP in 1994 to 22.7% of GDP in 2013. While expenditures followed suit and increased at a double-digit rate in the same period, the fiscal deficit was kept in check.

China’s monetary policy:

Monetary policy refers to government actions which influence money supply, interest rates and availability of credit in the economy to achieve its economic objectives. The main weapon used to control the money supply is the interest rate set by the central bank and the interest rate transmission mechanism shows the effects of changes in the interest rate by the central bank on the economy.

Under the guidance of the State Council, the People’s Bank of China (PBOC) formulates and implements monetary policy, prevents and resolves financial risks, and safeguards financial stability. The PBOC’s main objectives are: ensuring domestic price stability, managing the exchange rate and promoting economic growth.

The Central Bank manages money supply through Open Market Operations (OMO), which are conducted with both domestic and foreign currencies and comprise repo and reverse repo, government securities and PBOC bills. The Bank also uses the reserve requirement ratio to influence lending and liquidity. Other instruments that the Central Bank uses to manage and adjust liquidity in the banking system are short-term loans, short-term liquidity and standing lending facility operations.

The agenda of China’s top authorities include bold reforms on interest rate and monetary policy management in order to adopt a more market-driven approach.

Has there been inflation in China over the recent years?

The inflation rate is the rate at which the average price of the good in the economy is increasing over time. Inflation only applies when there are changes in the general level of prices and does not describe a situation where there is an increase in the price of one product or service.

Consumer price index (CPI) is used to monitor changes in the cost of living over time. CPI is a measure of the overall prices of the goods and services bought by a typical consumer. China’s annual inflation rose to 3 percent in September 2019 from 2.8 percent in the previous month and above market expectations of 2.9 percent. This was the highest inflation rate since October 2013, mainly due to persistently high pork prices following an outbreak of African swine fever. Inflation Rate in China averaged 5.13 percent from 1986 until 2019, reaching an all-time high of 28.40 percent in February of 1989 and a record low of -2.20 percent in April of 1999.