TFG spoke to the author of ‘Digital Ecosystems within Trade Finance’, a BCG, SWIFT and ICC report on the state of networks and consortia, the key problem points within trade and trade finance, as well as the current barriers in terms of digitalisation both from a corporate and bank perspective. Deepesh spoke to Sukand Ramachandran at BCG about how global trade is changing and the role of digital ecosystems within this.

Featuring: Sukand Ramachandran, Managing Director & Senior Partner, Boston Consulting Group

Host: Deepesh Patel, Editor, Trade Finance Global

Sukand: My name is Sukand Ramachandran. I’m a partner and BCG in London. And amongst other things, I lead the trade topic for us globally.

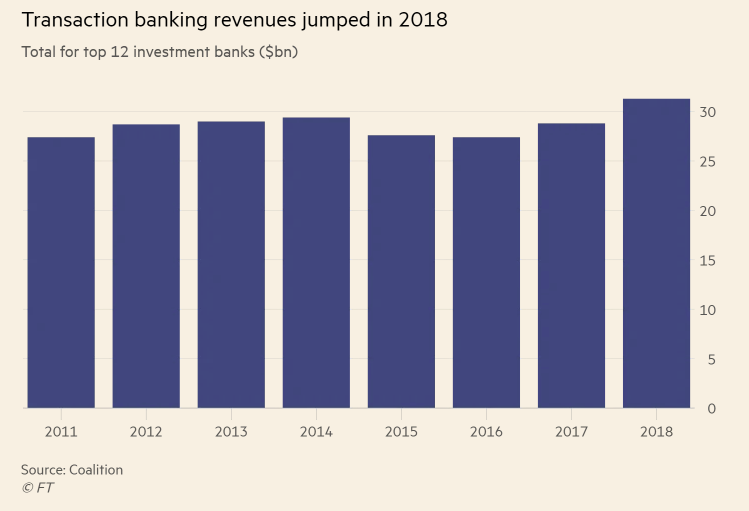

Deepesh: Great. So trade, what a year we’ve had, it seems to have slowed down in growth, yet we see several reports about trade finance revenues from the bank’s continuing to grow. What’s causing this?

Sukand: Well, there are multiple things happening and it’s not one force. So globally, trade in general, before you get into the financing of it, has seen its ups and downs, mainly because of the various trade tensions. But that’s offset by the fact that there are more and more supply chains, which are global, not necessarily from developing markets through developed markets. It’s actually a lot of it happening intra emerging markets, intra ASEAN. So that’s giving a positive boost to offset some of the declines from trade tensions and the like, then even come to banking and look at revenue pools from a banking perspective – so you get some ups and downs as a consequence of volumes coming from trade flows, but there is a little bit of margin compression. Basically get more banks competing for the same volumes. But it’s a little bit, but it’s on the material. And we expect that to recover back in the next 8 to 10 years.

Yeah. Okay. So I guess digging into the trade finance products themselves? How is the demand for these products changing? And where do you expect that change into?

So we know the secular trend from documentary trade moving towards more open account trade activities, we don’t see open account being the only answer in the future. We expect documentary trade to remain. I think we were exchanging some information with the SWIFT guys recently. I think there is an asymptote of somewhere between 12 and 14%, depending on how risky the market economics are, of documentary trade in terms of volume, activities still in there.

So we actually expect the transition towards a more open account economy and more supply chain financing as a consequence. Documentary trade is still going to be there. And then as and when regional tensions arise, you will get little spikes of documentary trade.

Yeah, and one of the things which people don’t understand or notice is the second-order effects of – as you have participants, like the Asian Development Bank trying to enable SME financing, as more and more SMEs come into the global supply chains, there will be a bit more doc trade, because the risks are unknown, people will want more protection, especially when it comes to developing markets or developed markets, SME trade. So we’ll see quite a lot of little transitions, the totality of it is, there is still growth in the market.

Very interesting. Talking about the recent report, which we covered, just this week on digital ecosystems within trade finance, we’ve discussed some of the pain points there. And it’s great that you’re talking about the non distributed ledger technology initiatives, as well as the DLT consortium, and networks, what are the key trends you’re seeing in the market?

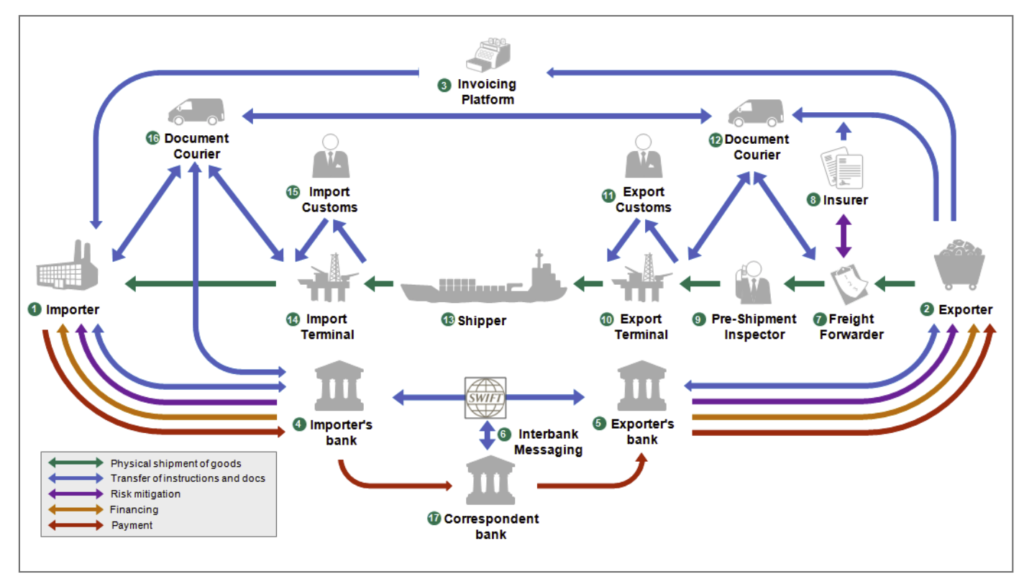

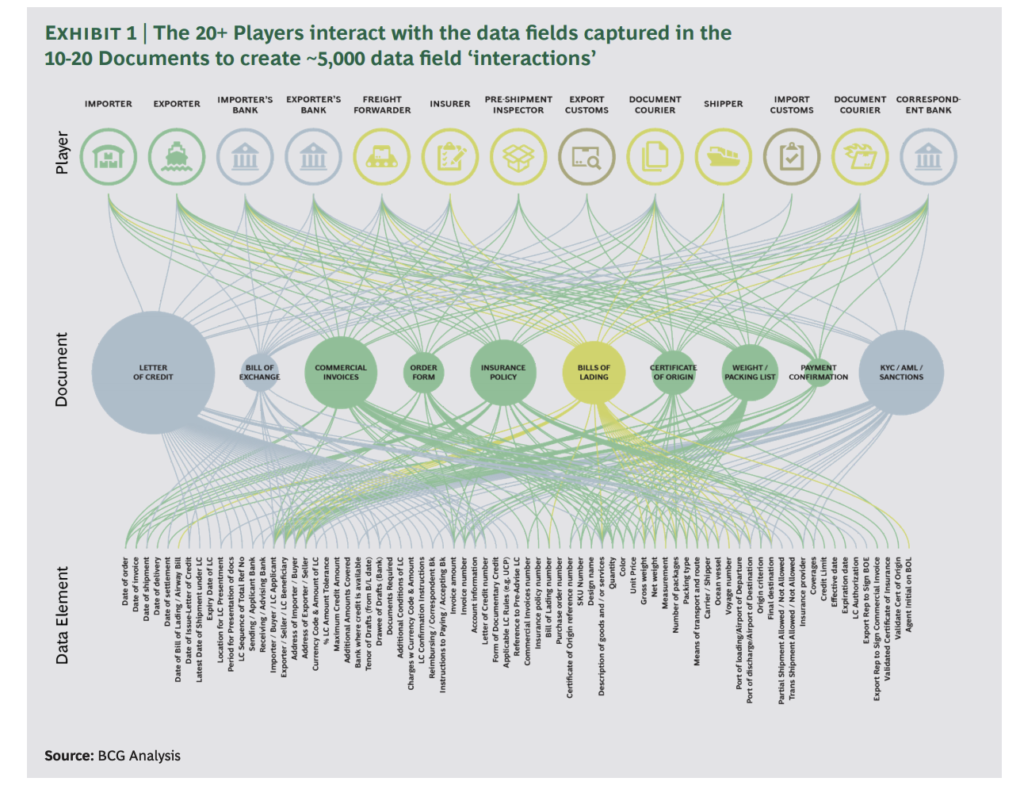

So I think everybody’s on a relentless drive towards efficiency and optimization. So digital is a core part of the solution space. The challenge in trade is it’s not a single party or two-party transaction, it’s a multi-party transaction. Even within the banking domain, there are multiple banks in the world. And then you add on the fact that there are shipping agents there are insurance companies that are customs agents, so the number of parties in more than a transaction, are quite material. Because there are many, many parties involved, and they all have very many different bilateral and multilateral ways of exchanging information, there is complexity in the process.

The good news is, there are enough legal standards at the moment, which allow you to do the global trade – you look at, if you look at basically how it works, you’re often surprised with the sheer amount of paper which travels through the ecosystem. Now what we’re saying is, in the future, we would want most of this to be digital because there’s no reason this can’t be reached.

The challenge you’re going to have is how do you agree on a set of digital standards to exchange this information. And I think part of the value of these ecosystems developing is as you develop ecosystems to get you to pull in multiple parties into the ecosystems and the ecosystem for defining data standards. But equally, if you see the report we also call for: don’t create the ecosystems as little islands, with different parties cooperating, we need the ecosystems to cooperate with each other as well, because that’s the only way you get to a global standard. Right. And we don’t believe trade is going to be driven by one player or one dominant standard unless it’s underwritten by somebody like the ICC or the SWIFT. But what we will expect all these ecosystems to do is to develop and cooperate progressively towards a common standard.

I couldn’t agree with you more. Going back to the key pain points within the digitization and the paper-heavy documentation and process within trade finance. Is DLT actually addressing those pain points, or are we covering up the wider problem? Because we tried to digitise trade for the last two decades?

Yeah, so I think DLT helps in some places. And it’s equally sometimes and, you know, overhyped technology. If you went back to Sibos five years ago, or something like that, or even four years ago, Boston and Singapore – DLT was the story. And it was the sort of the solution which is going to solve world hunger, almost like anything and everything was solved by DLT. I think we got to a more balanced view of what DLT can allow.

I think there are inherent technologies in it, like the ability to have a distributed ledger, not necessarily having full replication, and the ability for you to automatically trigger smart contracts when events happen in a particular transaction lifecycle. Those parts of it are very valuable. But equally, as something like the Trade Information Network is proving without being in blockchain technology. I don’t need blockchain to solve for this. I can have a centralised register, you all subscribe to which will solve for some of those pain points. The important thing is not about technology. It’s about people cooperating on a common set of definitions and standards, and being willing to open up the ecosystem for more and more participants. So that you reduce the friction of having bilateral and multilateral discussions.

Okay, great. So what does the future look like? What do you think are the key things that need to happen to enable fully digital trade?

Well, there is a positive view. And then there is a sort of slightly pessimistic view. The glass half positive view is, as these ecosystems set up and start realising the benefit of being a bit more open and being more inclusive for participants and you can pull more and more people into common ways of interactions and standards and you will reduce the friction costs of interacting with each other, which is quite an important part of trade. Right. And multiple different ecosystems will learn how to transfer information between the ecosystems so then you can get interoperability and standardisation.

So my senses and somewhere in the next 5 to 10 years, you’ll start getting more and more activity, very digital, digitally initiated through to digitally fulfilled, but going through very, very different pathways. It won’t be as simple I send it to you and it’s all digital, it’s possibly going through quite a lot of ecosystems before it gets to you – with all good checks and balances built and as a consequence. The slightly pessimistic view is if one of the reasons 20 years ago, I would say even though many, many banks and bank consortia have been coming together to try and digitise trade – the reason they haven’t succeeded is somewhere in the way you start getting defensive.

And you say, look, I need to protect this because I have some competitive advantage – therefore, I’m not going to allow other participants to participate in this. Inherently, the moment you do that, you restricting the share of global flows, which is going to be coming through this ecosystem, the moment you do that, it’s no longer going to be driving a standard, even if you’re the biggest trade bank, or the biggest shipper, or the biggest customs, or the biggest support – you’re still a very small part of global trade. Right? In terms of total activity. So you need the openness, and the willingness to embrace openness and bring more and more participants and then, through multitudes of the ecosystem doesn’t have to be one consortium or one ecosystem. But you need openness for all of them. And the interoperability for digitisation to happen. The reason we haven’t achieved in the last 20 years is that somewhere, people said, this is my platform, I want to use this and he closed it down. The moment you closed it down, you’re not going to get acceptance.

Great. So the Future is Open?

The future is going to be more open, more common standards. If you do that. It’s going to be more digital and less painful. Yeah.

Great. Well, Sukand, thank you very much for joining us on Trade Finance Talks today. Live at Sibos.

Thank you, Deepesh, have a good Sibos.