Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn, PodChaser

Season 1, Episode 19

Host: Deepesh Patel, Editor, Trade Finance Global

Featuring: David Morrish, Relationship Director, The London Institute of Banking & Finance

Charles Woodgate, Relationship Director, The London Institute of Banking & Finance

TFG heard from David Morrish and Charles Woodgate from the London Institute of Banking and Finance, ahead of their annual conference, the World Conference for Banking Institutes (WCBI). Given times of unprecedented change within global trade, we discuss what this means for trade-related education, as well as the current diversity and gender challenges within the trade.

Deepesh Patel: I’m Deepesh Patel, Editor at Trade Finance Global.

Today we’re talking about an issue which is close to our heart: the education in the trade finance space. Every day we hear about the MSME and SME trade finance gap, which currently stands at around 1.5 trillion US dollars. However, as an industry, education in a space of unprecedented change, complexity, technological innovation is so important. The trade finance skills gap, that is, the shortage of knowledge and the free information on the nuances of cross border trade, is something that we need to address. If trade really is an engine for economic growth and wealth creation, then where is the education?

I’m delighted to be joined by David Marsh and Charles Woodgate from the London Institute of Banking and Finance. We’ll be discussing trade, finance, education, the agenda on diversity, gap and trade, and how we can move forward. Charles, David, thank you for coming.

David Morrish & Charles Woodgate: It’s a pleasure and good to see you,

DP: David, in no more than 30 seconds, can you introduce yourself and tell us what you do at the London Institute of Banking and Finance?

DM: I’m a Relationship Director with the London Institute of Banking and Finance, with responsibilities for the development and promotion of trade finance and transaction banking qualifications. These cover a vast range of topics within the trade finance sphere. The best-known course is our Certificate for Documentary Credit Specialists (CDCS®).

CW: I’m Charles Woodgate. I’m also a Relationship Director, doing pretty much the same as David, but taking over from him as he comes to the end of his long career in the sector.

This is Why You Need to Know about Trade Finance

DP: Thanks, David and Charles. Let’s jump straight into the title of this podcast: Is trade finance sexy? So, I talked to a number of people within our space, from disruptors and innovators to structured finance experts, blockchain enthusiasts, commodity traders, rule makers and economists, and every single person has one thing in common in our industry: they live and breathe trade and they love what they do. It’s what wakes them up each morning. So what do you enjoy so much about trade finance? And is it attractive for young people, in your opinion?

DM: Is it sexy? Well, I guess you’ve got to decide for yourself. But the thing I love about trade, and it does excite me, is the fact you actually deal with a real economy.

There’s a fantastic buzz when you go and sit across the desk and meet a small- to medium-sized business. It’s good to talk about dipping their toes into the export market and try and talk to them about what the features are, what the risks are, etc.

David Morrish, Relationship Director, The London Institute of Banking & Finance

Let’s say you’re talking about the real economy, it’s goods being made, goods being put on a ship, goods being insured or financed, the means of settlement decided upon and, with a buyer somewhere in a far-flung corner of the globe, having those goods delivered and making payments on time. Like I say it’s the real economy.

CW: Yes, as David says, I see the real economy. I think you’re also making a real difference to people’s lives. Both in this country, and in emerging markets, you are creating jobs and opportunities. To give an example, in my previous career, we were working on a project in Ghana with generators that generate electricity for solar panels. So you leave them out in the sun and in the evening they generate light, so the children could come home from school and read their textbooks. That makes a huge difference. You’re allowing young children to be better educated to read books, and that can change lives.

And for young people out there in the UK who are considering a career in trade finance…well, I don’t know about you, but when I was young I was very idealistic. I wanted to change the world and through this job you can, albeit in a very small way.

Charles Woodgate, Relationship Director, The London Institute of Banking & Finance

Tackling the Skills Gap

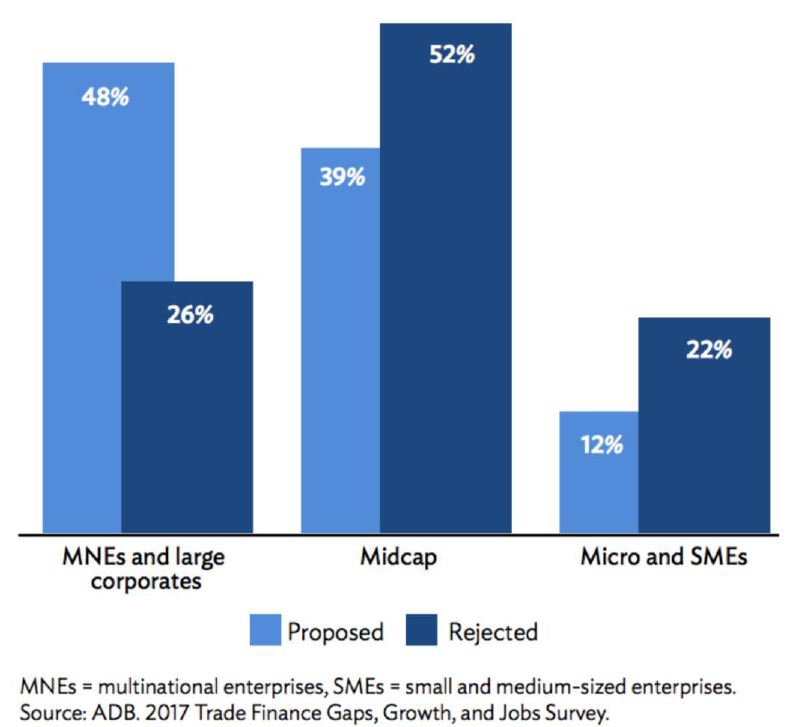

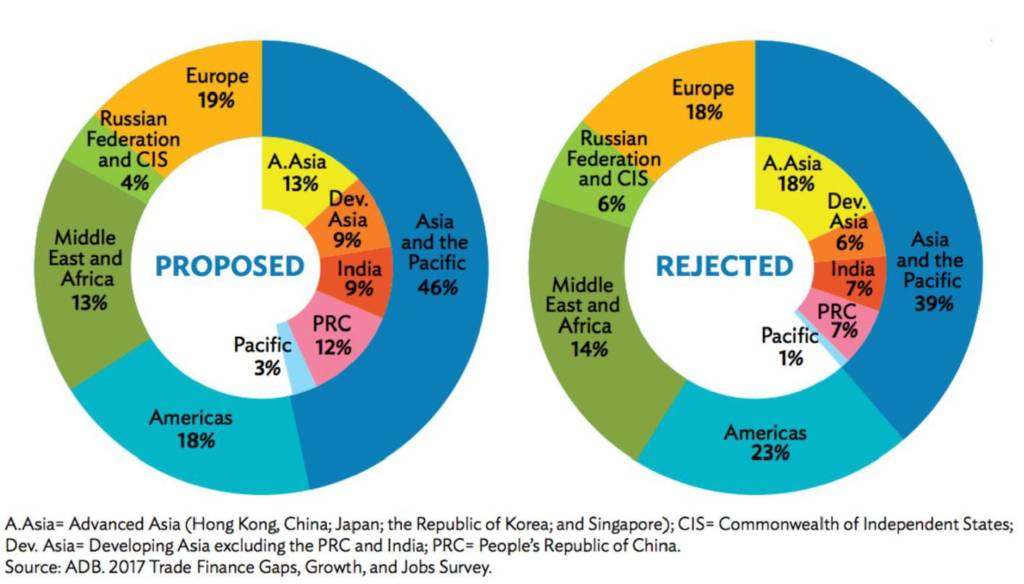

DP: Thanks, Charles. I think that’s a really good analogy to real-life trade and the real business of international trade. So earlier we mentioned the 1.5 trillion US dollar trade finance gap – does overcoming this necessitates education to close the trade finance skills gap?

DM: There is no silver bullet, of course, but closing that 1.5 trillion US dollar gap absolutely necessitates education. It is only a part of it, but it’s a really important part. Unless people are aware of what they can do, what the alternatives are, what the various methods of the settlement are, and the different ways of financing, they’re not going to get past that first barrier. I’m sure Charles has had the same experience, but I’ve seen it firsthand – where people won’t talk about trade because they don’t understand it. If you don’t understand it, you’re not going to get across all of the ways you can solve the various issues and the way finance can be raised, and risks can be mitigated. It doesn’t just happen by accident – it’s something that is planned, thought through, and ensures the right people get the right level of training and education in this very important sphere. You know, we’ve got one qualification, which is a Certificate in International Trade and Finance (CITF).

This is essentially designed so that anybody new to the business can get a full understanding of the vocabulary – understand the different methods of financing, settlement and regulation, even down to the supply chain finance, digitisation and so on. But it’s actually getting that message across so that people aren’t afraid of the subject. They can actually look at something and say “OK, I think I know a way to do this.”

CW: You’re absolutely right. There’s nothing to be afraid of and nothing to fear but fear itself. As you say, there’s no silver bullet – there’s a multitude of solutions, with education and awareness being key amongst them. I think the trade gap is the widest in emerging markets, so this is where we as an institute need to focus – develop education and awareness in those markets, as well as the banking industry. But not just the banks, the FinTechs and challenger banks need to think about innovative ways to finance trade in emerging markets.

Talent Retention in the Trade Finance Industry

DP: Thanks, both. I think what we also see within the industry is talent being lost. Transaction banking and trade is one of the oldest finance professions, which is perhaps why there is a struggle to recruit and retain talent. Do you think this is the case, Charles?

CW: I’m not sure whether that’s why there is a difficulty in recruitment, but I think it’s important to spread the message to the younger generation. That certainly helps from a diversity perspective. I think retention is an issue because we have people in the trade finance industry with many years of experience, and it’s difficult to replace those people. But for our part, we spread the message through our undergraduates at university. We explain how a trade finance career would be beneficial to them, so they can spread the word – that’s the way to encourage recruitment within the profession.

Balancing the Gender Gap in Trade Finance

DP: So I’m going to hone in and talk about gender diversity. Now, particularly within trade finance, we have a low proportion of women in trade finance. In addition, women seem to enter a lower level of attainment on certain outcomes, such as the propensity to get promoted or their salaries. Charles, why do you think this is so?

CW: I actually think there have been a lot more women in the sector in recent years. I think if you go back 20 or 30 years, perhaps even before my time, it was a very white, middle class, middle-aged men kind of thing. But in recent years, I’ve certainly worked with some very professional colleagues of all genders, from all cultures and all nationalities. I think it’s becoming more and more diverse, which is a great thing. As an example, one of the guest speakers at the upcoming WCBIR conference is Kim Sank Young. David will explain further because he is more familiar than me.

DM: You are absolutely right. She’s a very good friend actually. We work very closely together in developing our qualifications and promoting them in Korea. She’s the chairperson of gender equality in banking and finance in Korea, and she heads up the Korean international finance institute. She’s been a real trailblazer in Korea, regarding promoting the role of women in management and in trade. She’s doing a great job – although there’s more work to be done of course. Just going back to your point Charles, being of a slightly older vintage, from my own experience, when I moved into the bank in the late 1960s, it was pretty much exclusively white males. That’s just the way it was at the time. But I am delighted to say things have moved on, at least in the UK, so it has become much more diverse. It’s one of the beauties of the job, frankly, that you meet people from all sorts of different cultures. Regarding gender diversity, there is more work to be done in certain parts of the world, but less so in the UK. I’m potentially going to be shut down on that, but it’s much more diverse than it used to be. Things have changed absolutely for the better.

DP: Thanks, both. I’m going to throw a surprise on you and challenge you a bit on that. In our last Trade Finance Talks, we spoke to Grave Lord, an associate professor and behavioural scientist at LSE. She said we often encourage females to have adult male traits to give them an advantage in work. The evidence suggests that females who adopt male traits suffer a backlash since both men and women have certain expectations about how women should act. They’ve seen that trade finance continues to reward these traits that are overrepresented in males and the job will always have more males. Do you think it is worth reassessing which traits are highly valued? I’d be very interested to hear your thoughts on that.

DM: I think it’s an interesting one. Let’s just focus on this in the context of trade finance. From what I’ve seen, over the years, I’m not certain I totally agree with that conclusion. Maybe it happens in different levels of management in different industries, and I know I am looking very specifically at the trade finance industry. Being good at this particular job, I think, is all about relationships, interpersonal skills, technical skills and probably a number of other things which I have forgotten. But essentially, for me, these are all gender-neutral. It is nothing about being male or female, it’s about being good and understanding customer issues. You know, sitting across the desk, as you’ve done many times Charles – as I have – with small- and medium-sized businesses, they don’t really care what your gender is or what your background is. What they want is somebody who actually knows what they’re talking about and has potential solutions to the issues they have. I don’t see the things you mention coming into play.

CW: I would agree with that, totally. The outlook on the coalface as it were, facing prospective clients and existing clients, its solutions people want and solutions are colourblind and gender-neutral. People want solutions that will help their business grow and enter new markets. That’s what we need to deliver.

Technology, Regulation and Education in the Trade Sector

DP: Thanks very much. Let’s move back on to education now. So, coupled with the gender and diversity issues, as well as a perception issue around trade finance as an industry, the industry itself is changing. Banks are consolidating their trade, treasury and supply chain finance operations. Corporates are demanding more flexibility for their suppliers, and technology is trying to bring down the cost of operations and allow for interoperability and less manual paperwork. This is a key time for trade-related education. Are you guys seeing the same?

CW: We certainly are, because we are constantly updating our qualifications to keep up with current trends. For instance, our CITF qualification certificate in international trade and finance has a digitalisation module in it, which is very recent. That’s an example of how we update our qualifications.

DM: Yes, absolutely. We talk to our partners routinely and obviously keep close to the industry itself, including reading Trade Finance Global, which is always very informative. If we don’t do that, then qualifications cease to be relevant and current. So we have to keep close. Just as a general point, the changes in trade, like many other industries, have been widespread over the past 50 years. You have to make certain that your knowledge is current. Are we at a tipping point, in terms of technology and the potential for blockchain and so on? Actually, I really hope so. The industry is far too dependent on paper, there’s a wonderful opportunity out there. But we shouldn’t be afraid of it, we should embrace it. As I touched on earlier, it will be just another step in the development of international trade and the rationalisation of the way that we do things. But it’s not new. It’s been happening all the time. I’ve been in the business for decades, so let’s embrace it.

World Conference of Banking Institutes, September, London

DP: Thank you, David. So, moving on from this unprecedented change is the theme of the World Conference of Banking Institute on the 16th and 17th of September. TFG are media partners at the conference. So we’re delighted to be there and we’re delighted to hear some of the keynote speeches there. What are you most excited about? And don’t say seeing me!

CW: Well, I would say seeing you Deepesh! That would be quite exciting. But certainly seeing David, because his panel on the future of blockchain will be absolutely fascinating. He just referred to blocktrain previously, and it could be revolutionary, we will see.

DM: Again, I really hope so. Part of my role over the years in international trade was managing trade operations with people involved in checking mountains of paper to do with documentary credits and demand guarantees. These are skills you will still need of course, but the potential to eliminate mountains of paper has got to be grasped. I think I read in the 2018 ICC global survey, that in international trade, there’s something like 4 billion pieces of A4 paper generated each year. I don’t actually know how many trees that is, but it’s a lot. And the potential to actually make inroads in that and make the process slicker, smoother and less risky is just fantastic. Of course, the vast majority of people that will be at the conference will be banking practitioners from right around the globe and they will be most interested to hear what thought leaders have to say about sustainability, anti-money laundering, cybersecurity and the challenges in trade. We could have a whole new podcast on that one particular subject at the moment. But there is so much there to talk about over a two-day period – it’s going to be an excellent two days and I am really looking forward to it.

Entering the World of Trade Finance

DP: Thanks. The blockchain for trade finance piece is something particularly close to our hearts as well. Even we find it hard to keep track of all the different networks and consoles and all the changes that are going on. Actually, we announced some news this morning about a recent update of a bank within one of the consortia, so it’s very exciting and I am really excited to be there. So guys, thank you very much for coming today and sharing some of your very interesting insights about why education within the trade finance sector is so important. I am going to end with one final question and it’s actually for some of our younger listeners who might be attempting to dip their toes into the world of trade, finance and transaction banking. What advice would you give to any young person who is considering entering the world of trade and trade finance today? David, I’ll start with you.

DM: Right, what can I say, this is something very close to home – I’ve got a member of my own family that’s actually trying to take the plunge at this very moment. That’s potentially because of my influence I guess, but it’s just a fascinating subject. I’ve had a long and very happy career. I’ve met some brilliant people and hopefully played my part in international trade. There’s been a lot of foreign travel around the globe. I come back to my earlier point – you’re talking about real business, real physical trading, involving the movement of goods and manufacturing. As Charles was touching on earlier, the face that someone at the end is getting a real benefit from what you’re doing. It’s a wonderfully interesting subject, with great people, and it is very challenging and dynamic – it’s changing all the time. What I can I say is if anyone listening is thinking about moving into this particular career of trade finance, give it some serious thought. Don’t take my word for it, do some research on it. But like I say, I’ve had a very long and enjoyable career in this particular field.

CW: Yes, I don’t really want to repeat what David said. I mean, it is a great opportunity. And you are dealing with real people, real banking, the real economy, and you can make a real change.

DP: Thank you very much. I couldn’t agree with you more. We will continue to showcase some of the exciting careers within the trade finance sector and beyond just to show how quickly it’s changing and how some of those careers impact real businesses and the real economy. So, Charles, David, it’s been an absolute pleasure having you here today on Trade Finance Talks. Thank you for joining us, and we look forward to seeing you in a few weeks time at WCBI.

CW & DM: Thank you very much.