The 2008 recession caused callosal financial constraints on businesses all around the world, which resulted in the extension of payment terms – after all, an invoice paid in 60 days is better than an invoice never raised, right? Well, unfortunately, some payment terms reached as high as 120 days which just isn’t workable for smaller businesses. When goods are sold but not paid for, for such lengthy periods of time the result for a lot of businesses is the inability to meet their financial obligations. A large corporation turning over hundreds of millions across global markets can afford to pay for a significantly large order over a long period of time, but for the supplier this is often suffocating.

Invoice factoring is therefore beneficial for all parties – the business receives finances that would otherwise be tied up in future payments, allowing them to expand their short-term growth and meet demand they may have otherwise struggled to satisfy. The consumer market, therefore, benefits through a more diverse product range and increased competitiveness in the market. And the Factoring business also benefits through the presence of the initial discount applied.

Moving into 2019, the accessibility of trade finance is something at the forefront of global trade conferences and organisational talks. The necessity for technological advancements in the area is being echoed around the world. More specifically, digital Invoice financing is becoming much more popular. Online invoice factoring gave business immediate access to funds. There has been a significant increase in the amount of digital factoring services available to the market.

However, the businesses should first understand the eligibility for invoice factoring. There is a reported $1.5 Trillion Trade Finance Gap between the amount of trade finance necessary for optimal global trade, and the amount of finance currently being supplied. A largely sited cause for this was compliance constraints, however, a lack of awareness for many businesses could also contribute.

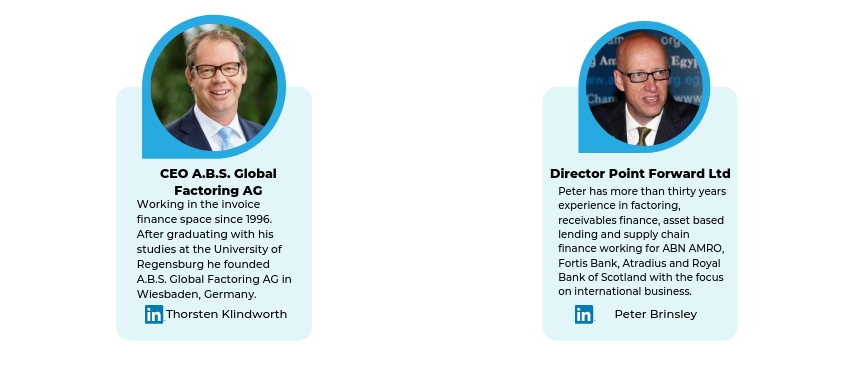

In this interview series, we heard from two Factoring experts and learned more about the use of this genius concept. TFG’s Persiana Ignatova spoke to Thorsten Klindworth and Peter Brinsley, who are members of World of Open Account (WOA).

Persiana: Thank you so much for doing this with us! To start off, please tell us about your involvement with the WOA community?

Thorsten: I had the pleasure of being part of the WOA community almost from the very beginning on. A.B.S. Global Factoring is one of the founding members of WOA and I am a member of the steering panel.

Peter: I’ve known and worked with Erik Timmermans for many years and was delighted to lend my support and expertise to his World of Open Account initiative as one of its strategic advisors. Reflecting my interest in emerging markets, I also facilitate the WOA Learning Lab “Setting up and Growing a Receivables Finance Operation”. It provides information about the issues and challenges that a would-be financier may face when they look to finance receivables. Areas such as what support is there in their market – legal, regulatory, structural – that can make them more confident in their ambitions. Level of knowledge of, say, factoring or supply chain finance is typically very low in new or early-stage markets and the Lab and the WOA site, in general, is a valuable source of information and an opportunity to find out how other markets developed, how they managed the risks and made a success of it.

Introduction to invoice factoring

Persiana: What is factoring? Can you tell us more about your experience in the factoring sector?

Thorsten: Factoring is a very smart way of financing open invoices. Instead of waiting for incoming payments from the debtor after 30, 60, 90 or even more days the user of factoring gets his money right away after submitting his invoice to the factoring company. Usually, the factor also takes over the risk for the default of the invoice and in many cases the whole administration work around the trade receivables. In other words – when you use factoring you transfer everything around the invoice to the factoring company and get your money within 24 to 48 hours. In Germany, the factoring industry is growing for years now. More and more SME companies use it and a bit more than 7% of the German GDP is financed by factoring. Other markets that we are active in follow on the same track. Factoring has become a modern way of financing invoices in Europe

Peter: I’ll answer this from the point of view of an emerging market where, typically, finance is traditionally secured by fixed assets such as land and buildings or large deposits. Factoring is an opportunity for trading businesses with few fixed assets to access finance through their receivables. It can open the door to switching from trading on an LC basis to open account. However, it requires a very different way of thinking from granting loans. Financiers have to have a full understanding of the underlying sales contract and the risks associated with the supplier, buyer and the receivable itself.

How to know if factoring is right?

Persiana: When is factoring right for a business?

Thorsten: Factoring is always right for business when you have a higher amount of outstanding receivables, mostly in the B2B sector. Our typical clients are SME companies with a yearly turn-over from slightly under EUR 1 ml. up to EUR 100 ml. Especially fast-growing companies are frequent users of invoice factoring since the financing volume grows congruently with them. But also export-oriented companies, start-ups or companies in and after a turn-around situation are among our clients. Very important for factoring is that the service or the delivery that is subject to the invoice has been accomplished.

Peter: It’s probably most suitable for growing businesses if they are factoring all of their receivables. The facility grows with their turnover.

Persiana: What is the most interesting part of your role within factoring?

Thorsten: There are a lot of interesting parts when you are active in the factoring industry. One thing is for example that you have a wide variety of different businesses which is everything in the industrial sector as well as wholesale, international trade and services. Every client and its business is in a way unique. Most SME‘s have entrepreneurs behind and most of them are fascinating people.

Peter: Working at all levels in a company from advising the Board on a strategy to working in Operations Departments on day-to-day tasks in risk management, collections and handling clients. My input can accelerate the process of getting new products to market.

Persiana: Can you share any stories or examples of how your company is making a difference to others, or how you’re making an influence in your sector?

Thorsten: As we are a family-owned business ourselves it is part of our DNA that we love entrepreneurial driven businesses or stories. For us it is very important to understand what the founder, the CEO, the entrepreneur or the MD stands for and where he is heading to. Our aim is to follow his vision and enable him to accomplish his goals. As the SME sector is dynamic and fast we also have set these adjectives as our major priorities in the day-to-day business: as a financial institution, we also want to be fast and flexible with our decisions and actions and be the close financial partner to our client that he needs in order to succeed with his business.

Peter: Egypt: on a recent project we introduced credit scoring models to automate and streamline the credit underwriting process. Recent changes in Egypt’s legislation and regulation around factoring (and leasing) nicely coincided with work we did with clients in Cairo on improved governance and risk management, such that financiers are now well-prepared to operate separate factoring businesses, as required by the new regulations.

Zambia and Malawi: I worked with International Finance Corporation (part of World Bank) delivering trainings on movable assets finance, introducing the idea of factoring to a very early-stage market and providing guidance on structuring receivables finance and the right credit approach to succeed. Point Forward (and WOA, through its connection) becomes a point of reference for financiers as they draw up plans to enter the market.