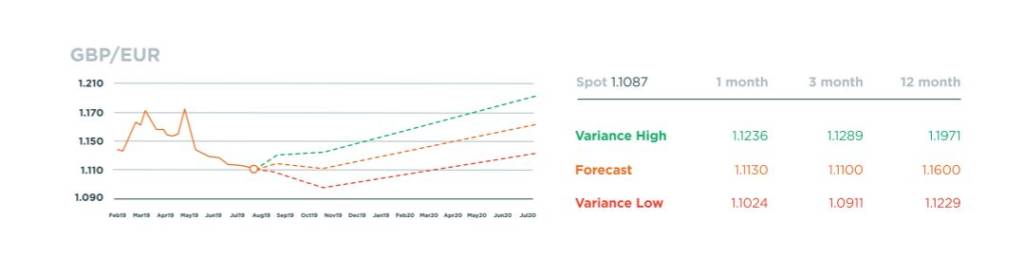

In July the pound continued its march lower as markets prepared for the prospect of a PM who would be more aligned with a no-deal Brexit outcome

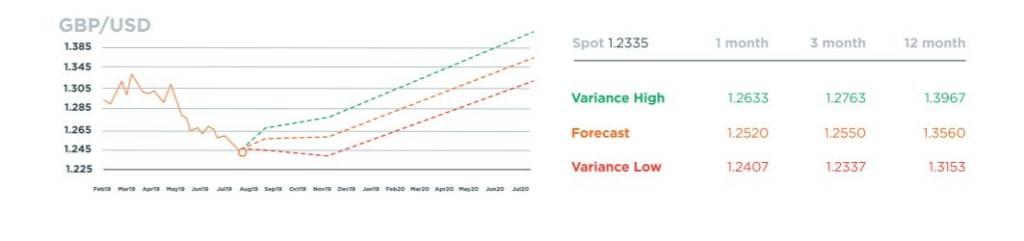

GBP / USD Rates in August 2019

Sterling rallied modestly once Boris Johnson was confirmed as the new PM, but later crashed to multi-year lows. Demand for the pound slumped as Boris asserted that the UK would be leaving the EU on October 31st come what may.

GBP / EUR Rates in August 2019

A worsening global macroeconomic outlook has led to central banks becoming more vocal regarding taking action in order to limit economic weakness. In July markets were starting to adjust to the prospect of developed economies turning more dovish in their outlook and decisions. The Federal Reseve are the forerunners for this change in policy direction and are expected to be followed by the European Central Bank and later the Bank of England.

EUR / USD Rates in August 2019

Trade talks between China and the US are ongoing, but progress is slow. Two days of talks in Shanghi were viewed as ‘constructive’, with the White House stating that the “Chinese side confirmed their commitment to increase purchases of United States agricultural exports” – but how or when that could happen is yet to be decided.

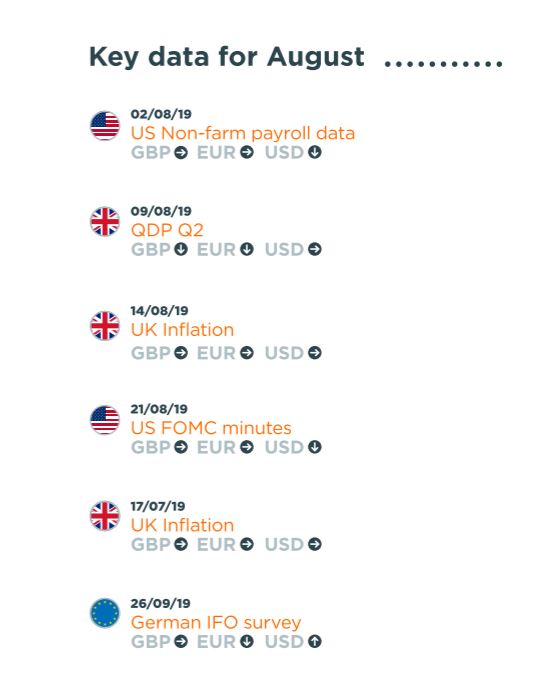

What are the market themes for August?

Brexit Negotiations

Brexit tensions have notched up significantly as new PM Boris Johnson starts his tenure. Although Boris says he wants a deal, he has also rapidly accelerated plans for a no-deal Brexit. Johnson has rejected the Irish backstop which the EU

is insisting on keeping in. This all sets the scene for volatility, and the pound is struggling. In Parliament the arithmetic is still not there to push through no deal as it stands. The likelihood of a snap general election has therefore grown. Feedback from the EU so far has also been decidedly stiff and the pound could be heading for new multi-month lows in the Autumn.

Central Bank

As expected the US Federal Reserve cut interest rates for the first time in 11 years by 25 basis points. The FOMC pointed to a number of reasons to justify the cut, such as increased trade uncertainty, slower global growth and lower inflation. However they also added a hawkish twist by not comitting to more adjustments, although we see further cuts ahead. The European Central Bank (ECB) are also lined up to deliver a stimulus package in September as growth conditions force their hand. The Bank of England will be reactive to Brexit developments.

US-China Trade War Impact

Markets had hoped that the restart of US-China trade negotiations last week would put the two sides back on the path towards a deal, and optimism was high after both sides spoke of ‘constructive’ talks. However this optimism may have been misplaced, with tensions between the two powers on the rise again after Donald Trump threatened to place fresh tariffs on Chinese exports, and a subsequent drop in the Chinese yuan stoking concerns of a currency war.