Paris, 28th May 2019. The International Chamber of Commerce (ICC) Banking Commission has today released a whitepaper urging the trade finance industry to work together to ensure that regulation does not hinder the availability of trade finance and remains relevant in a digital landscape.

- Regulation and compliance requirements, while well-meaning, have led to the exacerbation of the US$1.5 trillion trade finance gap.

- While work to date between industry and regulatory bodies has been successful, industry- wide collaboration and lobbying remains necessary to ensure the fair regulatory treatment of trade finance.

The International Chamber of Commerce (ICC) Banking Commission has today released a whitepaper urging the trade finance industry to work together to ensure that regulation does not hinder the availability of trade finance and remains relevant in a digital landscape.

Banking regulation and the campaign to mitigate the unintended consequences for trade finance

The milestone report, titled Banking regulation and the campaign to mitigate the unintended consequences for trade finance, takes a close look at the regulation and compliance requirements that have come into force since the 2007 financial crisis and the industry’s subsequent efforts in promoting their fair treatment of trade finance instruments.

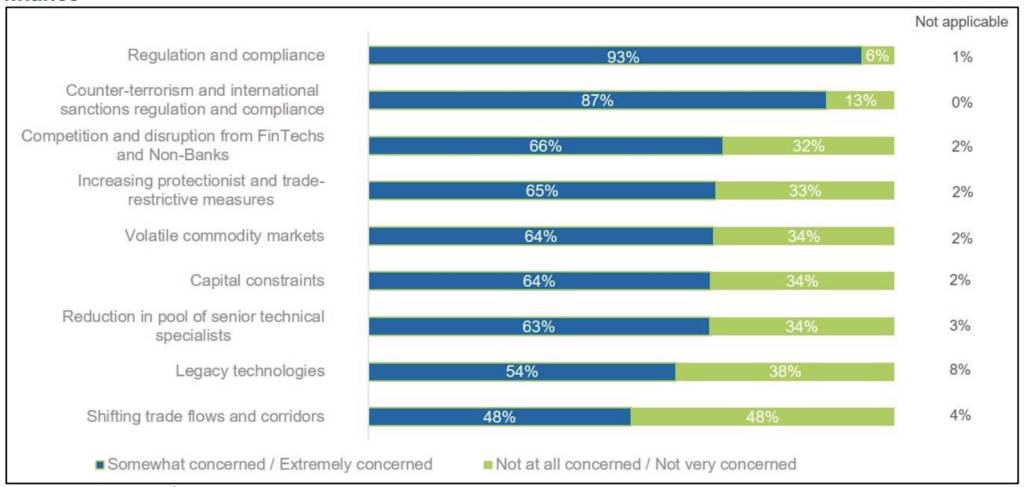

Figure 1: Banks’ main obstacles to growth and concerns relating to the provision of trade finance

While well-meaning, these requirements have unintentionally led to the exacerbation of the US$1.5 trillion gap between the demand and supply of trade finance, which has especially impacted those most in need of financing, particularly in emerging markets.

“Clarification and harmonisation of regulation are fundamental to mitigating the serious threat that de-risking poses to the financial system,” says Olivier Paul, Director, Finance for Development, ICC. “ICC, for its part, is proactively working with regulatory bodies worldwide to promote the fair treatment of the industry and increase access to the market.”

The report examines a number of areas where successful lobbying has led to improved treatment of trade finance instruments, notably:

- The amendment of Article 55 of the Bank Recovery and Resolution Directive (BRRD), allowing banks to apply for a waiver with the Single Resolution Board if they consider there to be obvious explanations that justify not applying the rule.

- The reduction in Net Stable Funding Ratios (NSFR), allowing for more competitive rates in comparison to other jurisdictions.

- The exoneration of the leverage ratio for some export credits extended by commercial banks and covered by official export credit agencies.

Paul adds: “Despite the progress achieved to date, significant work remains to be done. With regulatory adoption and implementation processes taking up to a decade, it is essential that discussions take place from the earliest of stages if we are to effect efficient and meaningful change.”

The report also outlines how digitalisation could help to increase cost and time-efficiency, aiding the fulfilment of compliance and regulation requirements. Distributed ledger technology, for example, could help make transactions more secure, by giving more power to banks and regulators to trace and evaluate financing, in turn alleviating some risk.

Read the report here.