Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn, PodChaser

Season 1, Episode 7

Host: Deepesh Patel, Editor, Trade Finance Global

Featuring: Vineeta Tan, Managing Editor, Islamic Finance News

Islamic Finance, Sukuk and Shariah – An Interview with Vineeta Tan from Islamic Finance News at IFN Asia 2019

Deepesh Patel: I’m Deepesh Patel, Editor at Trade Finance Global.

With Islamic faith spanning nearly 2bn adherents today, experts around the world tend to agree Islamic Finance emphasises the two main principles around risk-sharing and ethical investment.

As TFG prepare for the Islamic Finance News Conference (IFN) Asia in Kuala Lumpar, I’m delighted to be joined by Vineeta Tan, who is going to give us a brief overview of the market and key trends, as well as share what’s in stock for the conference.

Vineeta is the managing editor of Islamic Finance News (IFN), the world’s leading Islamic finance news provider. Alongside this, Vineeta is also Managing Editor for IFN Fintech, the industry’s first and only publication dedicated to fintech for Islamic finance. Vineeta is a multimedia journalist with almost a decade of experience in journalism and the publishing industry, specialising in Islamic finance and fintech covering regions including the Middle East, Asia, Africa and Europe.

DP: Without further ado, please welcome Vineeta joining us today from Kuala Lumpur, Malaysia. Thank you so much for joining us on today’s podcast Vineeta!

VT: Hi, Deepesh. Thank you so much for having me today.

DP: In 30 seconds, please give us your elevator pitch! Tell us a little bit about yourself and Islamic Finance news.

VT: I’ve been a journalist for almost a decade now. I currently cover the global Islamic Finance industry, as well as the Shariah FinTech sector. IFN is a multi-channel digital platform which serves a global community with intelligence and news on this niche area of finance.

The Emerging Convergence of SRI, ESG and Islamic Finance

DP: Thanks Vineeta. Within the last 12 months or so, we have seen economic headwinds, a strong recovery of oil prices and the US-China trade war in full effect. Could you tell us what trends you have seen in the market, and how the Islamic Finance market has fared from these trends?

VT: I think it is important to remember that the Islamic finance industry – with its own unique peculiarities – does not operate outside of the wider finance industry. So the events you just mentioned, such as the US-China trade war and recovering oil prices do affect Islamic Finance as well.

In general, I expect moderate growth in the industry this year. As a young industry, we’ve enjoyed double-digit growth for many years now which I think is a testament to the levels of demand for Shariah-compliant financial services. However, this is also largely down to the fact we started from a very small base so any growth would be substantial.

This being said, as the market matures and liquidity is tightened we see that global momentum is slowing down. If we look at global Sukuk levels for example, these are expected to be low this year, but are expected to be on par with 2018 Islamic sukuk levels. For example, last year almost $115 billion were raised through Sukuk or Islamic bonds, and this year Standard and Poor’s expects a slow-down in Sukuk to between $105-$115 billion.

Talking of more Shariah-specific trends, I would definitely highlight the growing confidence of the ethical SRI, ESG movement within Islamic Finance. There is definitely a strong drive toward marrying the two in attempt to offer more compelling solutions to both consumers and investors.

Another rising trend of course is the emergence of technology developed to deliver Shariah-compliant financial services and products to the underserved and underbanked.

Islamic finance, Sukuk bond issuance and Takaful

DP: Great, we’ll go back to the technology trends a little bit later on. Going back to basics, please can you explain the difference between Islamic finance, Sukuk bond issuance and Takaful?

VT: So Islamic Finance in a nutshell is financing according to Muslim principles. This means any banking or financial transaction has to comply with the Qu’ran or the Hadith – meaning no interest or riba, no excessive uncertainties, no gambling or anything else haram whilst of course ensuring risk and profits are shared.

Within the Islamic Finance industry, we have different sectors such as capital markets which are of course largely represented by Sukuk bonds. We also have equity markets, asset management sectors and finally Takaful Insurance, which is basically Islamic insurance.

DP: Thank you very much, this sounds similar to Green and Socially responsible financing – are they differences here?

VT: It does sound very similar, and it loops back to my earlier point about the convergence of SRI, ESG and Islamic finance. The industry is currently aligning itself with a wider ethical finance movement because of the commonalities between the two streams of finance.

Islamic finance is, after all about social justice. It is about investing in the real economy but I would be careful to refer to them as the same because they are not.

Simply put, Islamic finance is a subset of ethical finance, much like Green finance. Now, a Green finance deal may or may not be Shariah-compliant, just as Islamic transactions are not necessarily green because Islamic finance practises are not all channelled towards sustainable energy.

At the end of the day, we have to see what is being financed. If it is for the environmental or sustainable energy projects, then yes it would be a Green Islamic finance deal. I would say that Islamic finance is all about financing for good, so there is a lot of common ground.

Going Green: Sukuk Bond Issuance

DP: Ok, understood. What would you say are the key accolades and achievements of the Islamic Finance industry within the past year?

VT: If I were to narrow it down, I would say the Islamic Finance industry has put its money where its mouth is with the first green sovereign Sukuk. We had a discussion about SRI and green finance and spent years saying that a green Islamic bond makes so much sense. It makes sense not only for the Islamic Finance industry, but the general finance industry as a whole.

Finally, last year we saw the Indonesian government step up its game by becoming the first government in the world to issue a green bond that is also compliant with Shariah law. They also followed that up with a second issuance this year.

We also welcomed the first SDG Sukuk by HSBC – HSBC Amanah. It was a Sukuk which raised funds that addressed sustainable development goals (I think) aimed at health education and climate change. I think these are incredibly encouraging and positive indicators that signal a strong push towards financing for good.

I think it also illustrates the instrumental role Shariah-compliant financial instruments can play in the bigger narrative of sustainable finance.

The GCC M&A’s explained

DP: Thank you. Within GCC we also saw much consolidation within the industry, most notably an array of mergers and acquisitions within Abu Dhabi, The UAE and also Oman. Can you tell us what happened here?

VT: There are both internal and external pressures here. First of all, most of these consolidations make sense in terms of cost measures, especially from an Islamic banking perspective. Generally, Islamic banks are of smaller size and lesser resources. Furthermore, it is also an increasingly competitive market not only with the amount of contenders operating within the space, but also because economically, the climate has been tough and unfavourable for financial institutions.

We have seen the margins of these institutions squeezed, so by merging and consolidating the operations with market peers it gives the banks some more ammo, so to say, to grab a larger market share.

Islamic FinTech

DP: Thank you very much. Now, let’s take a dive into the technology aspect we touched on earlier. What are the biggest FinTech opportunities within the Islamic Finance Space? We’ve seen an explosion of tech in the last 18 months or so, with billions invested in Cryptocurrencies, asset management and real estate opportunities. What have you seen?

VT: We have definitely seen a lot more activity in the Islamic FinTech space. Now, of course not to the tune of billions being invested in crypto currency but it’s definitely a fast growing area.

There is a growing number of digital tokens claiming to adhere to Shariah law, but you will see concepts such as Islamic cryptocurrencies remain quite a divisive issue among scholars. Some are doing it the right way by getting official proclamation, validating the Shariah integrity of the digital asset.

We are also seeing regulators from key Islamic finance markets taking a more decisive stance on digital tokens. When you compare this to last year, it is a lot of progress – we are seeing the likes of Bahrain, Malaysia, Dubai all issuing regulations for cryptocurrencies, which also cover the Islamic finance space.

Crowdfunding and peer-to-peer financing remains one of the most vibrant verticals in the context of Islamic finance, not only in terms of regulations but also the numbers of players emerging. From Malaysia to the UK, the GCC, the US and Malaysia, there is a lot more activity.

Digital Investment Management Services is another hot area. We’ve seen Islamic robo-advisors popping up not only in Malaysia but also the US and a few more are in the making in Africa.

Finally, we are also seeing a lot more entrepreneurs going into the Islamic digital banking space. What is interesting in the context of Islamic FinTech, is a sizeable chunk of many of these new start-ups or initiatives are coming from non-traditional Muslim markets like the UK, US or the EU where the Muslim population is relatively scarce. And so, demand is not significant enough to warrant a brick and mortar Islamic financial institution.

What we’ve seen instead is Muslim Millennials are taking the opportunity to use technology to meet the demand. We are also seeing this same trend in Kenya, Africa where technology is being used to reach the rural population.

Fintech Unicorns in the Shariah Space?

DP: Very interesting. If you had your eyes on one company within the IFN FinTech huddle, in your opinion who are the ones to watch this year?

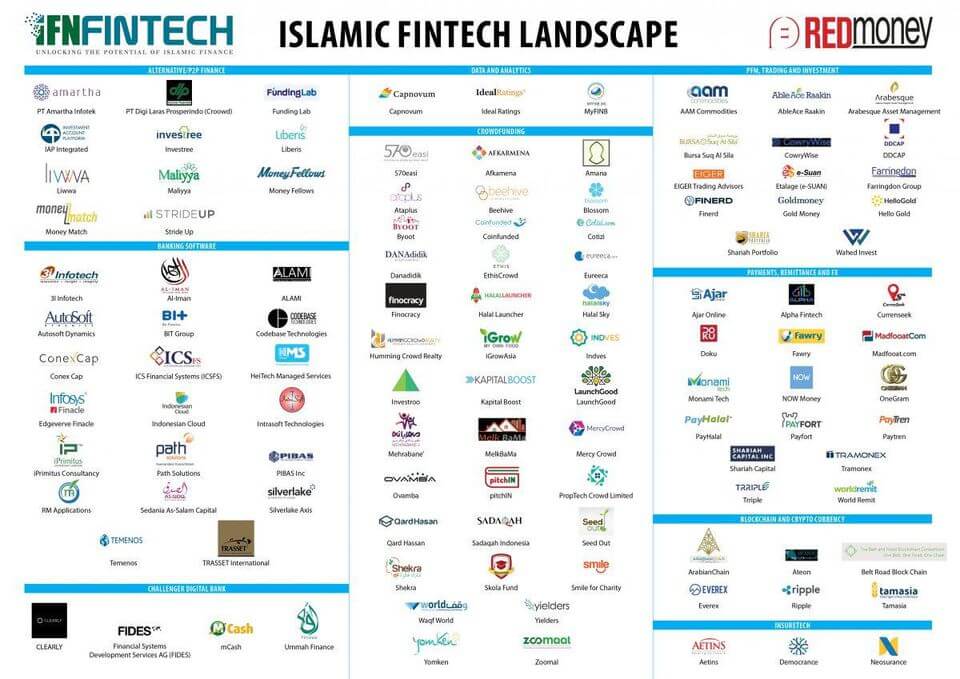

VT: So we’ve identified some 120 companies offering Shariah compliant FinTech products and services worldwide. We’re adding to this list as we continue to verify more start-ups that are operating in the space.

One thing we have to know about the Islamic FinTech area is that a lot of start-ups are in an early stage of their development. Maybe they are in series A or series B at most but we’re certainly not as “advanced” as the conventional space with a FinTech unicorn popping up here and there.

We do however recognise the strives that some of these start-ups have which are really impressive, and we do acknowledge their impact and efforts in the financial inclusion at the World Islamic FinTech Awards which was inaugurated last year.

As for start-ups to watch, we have a few of them presenting at the IFN Asian FinTech huddle this weekend at the IFN Asia Forum. This includes Wahed Invest, a robo-advisor from the US. We also have a digital savings platform: HelloGold from Malaysia, and also Global Start-up, which is a digital platform that channels Islamic donations to its charitable causes.

Standardisation in Islamic Finance

DP: Very interesting. Standardisation is regularly touted as a key driver for tech adoption and participation, as well as interoperability within many finance sectors. We see it so frequently within the trade finance space. For shariah compliant trade finance, as well as for the Islamic finance industry as a whole, do you see standardisation at the top of the agenda?

VT: Absolutely. In fact, standardisation has been at the top of the agenda for many, many years now. I know as an industry this is something we do struggle with especially considering there are different interpretations of Islamic Finance across different regions.

But I would say last year there was a case that highlighted, or drove the need for more standardisation – the Dana Gas Case. I’m not sure if you’re familiar with it, but through the court battle of this case we have seen Islamic Financial institutions coming together with governments, regulators and global Shariah standard setting bodies to try and put standardisation back to forefront.

What is more interesting, or what is more encouraging is that a few months ago we saw two major standard setting bodies AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) – which is one government accounting standard body – and IFSB (Islamic Financial Services Board) in Malaysia, coming together and signing an MOU. Both parties are going to see how a proposition can be reached that pushes standardisation back to the front of the agenda for the global industry. So this would for sure be a top priority for the industry this year.

Islamic and Shariah Finance in 2019

DP: Thanks, that’s very interesting! Moving on from that, what does 2019 look like for Islamic and Shariah Finance?

VT: I’m hopeful, but there are of course uncertainties. You’ve mentioned the trade war, we’re looking at increasing geopolitical uncertainties in the GCC, even here in Asia there are some differences politically. While all these have a part in the finance industry, we are remaining hopeful – I think there are a lot of bright spots.

FinTech is an extremely exciting area, and we do think that there are a lot of banks and also some financial institutions that are positioning themselves to be more digitally savvy.

We’re also seeing a lot more interest in new emerging markets, especially in North Africa and interestingly, several European markets. So these are optimistic signs. I think the Islamic Finance industry has tried to be a bit more optimistic, considering how niche the sector is. Also, we do have challenges to overcome; standardisation is of course one of them.

I think in general, we don’t expect the robust double digit growth numbers anymore because we’ve had them and I believe we’ve started to mature the industry. We are making great strides with encouraging numbers so I remain cautiously optimistic.

IFN Forum 2019

DP: Very interesting. Now, I think we are most excited about the FinTech’s to watch at the IFN Forum which is happening right now. What are you most excited about at the IFN Forum?

VT: Well I am most excited about the conversations and debates at the form which is taking place over two days. Last year we welcomed back some thousand delegates and, as always it’s interesting to see the kind of discussions that are held not only on stage but also from the audience. I think that also reflects a lot about how far we’ve come as an industry.

We’re getting a lot more questions and interest from geographies which is always a positive sign. Not only that, I think it’s also the networking and meeting peers that has helped this. Personally, for me it is about meeting industry players not only from Asia, because we have delegates coming in from the US, EU and GCC.

So there’s definitely a lot going on over the next couple of days, and we are expecting some interesting announcements; FinTech would definitely be a large theme driving the conversations. I’m quite excited to see what the key players are doing, how banks are presenting themselves in the era of digital finance and also how we can move forward with a discussion and effort in using Islamic financial instruments towards sustainable development goals.

DP: Thanks for Vineeta and I think your point on the Sustainable Development Goals and addressing those are so important. We’ve actually been discussing how the sector can really look to address the SDGs.

So look, we’re really excited about the IFN forum and I think you are too! Thank you very, very much for joining us on our podcast on Trade Finance Global, today. We’re really looking forward to the next few days. Thank you very much Vineeta.

VT: My pleasure.