With the current macroeconomic and geopolitical climate, there are significant opportunities to enhance Anglo-Chinese relations. Brexit and the China-US trade war have fundamentally changed the chessboard. We heard from Mark Abrams, Head of Trade at Trade Finance Global.

Within the current macroeconomic and geopolitical climate, there are significant opportunities to enhance Anglo-Chinese relations. Brexit and the China-US trade war have fundamentally changed the chessboard.

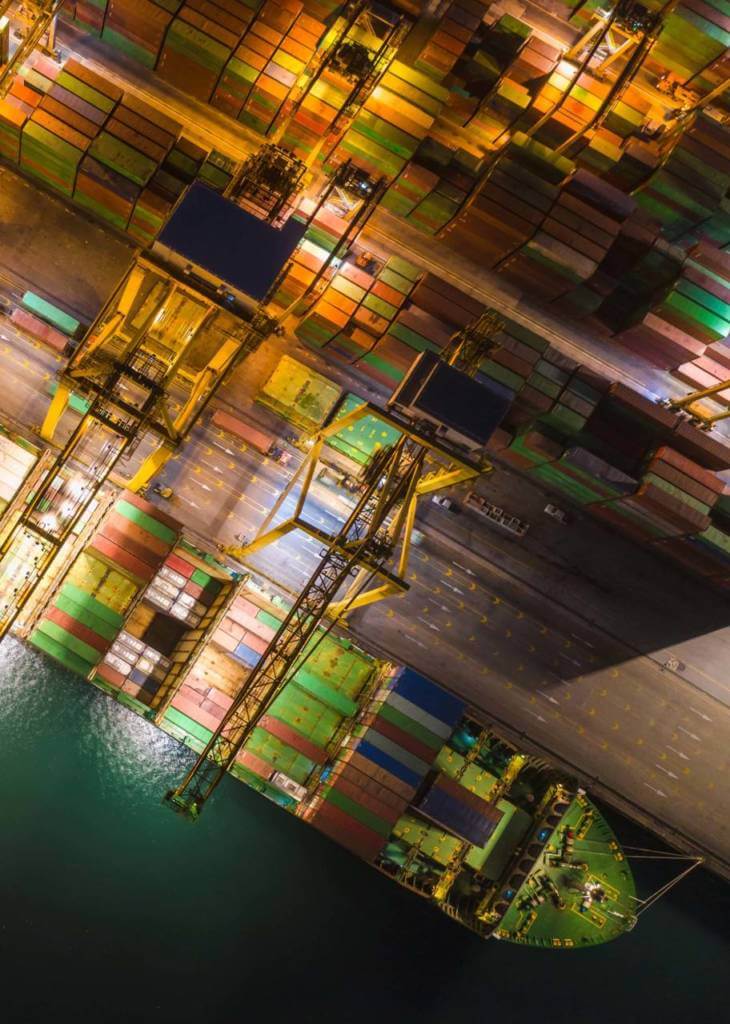

The $1.5tn trade finance gap needs to be addressed, taking into account the effects of digitalisation and innovations around structuring finance for international trade.

Bilateral trade between the UK and China presents significant opportunities for both markets when you look at the facts. With an estimated $77bn trade finance market for goods and services flowing in this trade corridor, most of which is currently done on open account terms, several opportunities exist around trade financing, technology and partnerships.

The UK is a leader in cross-border lending, with an 18% global market share, as well as a 37% global market share in foreign exchange trading. As a leading global financial centre, the UK retains its competitive advantage in financial and related professional services. The UK’s financial sector offers sizeable export opportunities, with an estimated $441bn worth of export in trade services to China.

Meanwhile, China is the world’s second largest economy and a leading trading hub, accounting for 30% of global trade. Over two thirds of trade financing ($6.3tn USD) comes out of the Asia Pacific region, with China leading this growth. With continued developments in opening up policy, looser export laws and the Belt and Road Initiative (BRI), engaging with Chinese businesses could be rewarding.

With the development of hugely complex global supply chains, as outlined in this paper, and numerous challenges around access to liquidity providers and working capital, there is a need to integrate technologies between bank finance platforms and corporates.

For the trade and supply chain finance community, innovations in non-recourse receivables financing and off balance sheet structures present new opportunities for corporates trading cross-border, and coupled with integrated systems and AI, China’s BRI presents a significant opportunity for UK corporates.

The political maelstrom in the UK caused by Brexit will not stop trade, technology or innovation, and no matter what the outcome of current geopolitical events are, global economies need cross-border trade in services, goods and commodities as well as a global workforce to thrive and succeed.

Want to find out more?