TFG spoke to Lakshman Sankaran and Sumit Roy of TradeAssets, about the enterprise blockchain technology they are building for the TradeAssets e-marketplace.

Lakshman has more than three decades of Banking experience specializing in Trade Finance, Outsourcing, Retail and Wholesale Operations. His last job was DGM and Head of Operations & Trade Finance with Commercial Bank of Dubai. He had similar roles at National Bank of Fujairah in Dubai and BNP Paribas & Canara Bank in New Delhi. He has special expertise in banking processes and systems enabled with blockchain technologies. He is a leader in Risk Controls, Compliance, Reengineering and System Implementation and worked actively in strategic projects along with Mckinsey, BCG, Accenture, Gap Intl. and companies like WNS, TCS. He is networked globally with international banks and well known in the trade finance world; Head of ICC UAE Banking Commission and Regional Chair of ICC Banking Commission, Paris, Member of GTR MENA Editorial Board, Vice Chair, Middle East Advisory Council of International Institute of Banking Law & Practice, USA, Country Correspondent – UAE, LC Monitor. Lakshman has a B.Com degree and PG Diplomas in Marketing and Export Management as well as CAIIB, CDCS.

Sumit is a global financial institutions specialist with 25 years of expertise in trade finance and international payment sales. He started his career with Price Waterhouse, working on software evaluation and management consultancy projects before moving to banking, where he worked in India, USA and the UAE for American Express Bank. More recently, he was a Managing Director in Deutsche Bank, responsible for institutions in Middle East and Africa.

Sumit has extensive experience in e-Products, primary and secondary trade finance, asset distribution, international payments and cash management. In over two decades in service, sales, product management and relationship management, he has successfully executed strategy to penetrate difficult markets, directly covered institutions, supported sales managers and managed teams with clients in Asia, North America, Middle East and Africa.

Sumit holds an MBA in Finance and a Master’s degree in International Management from the University of Texas at Dallas.

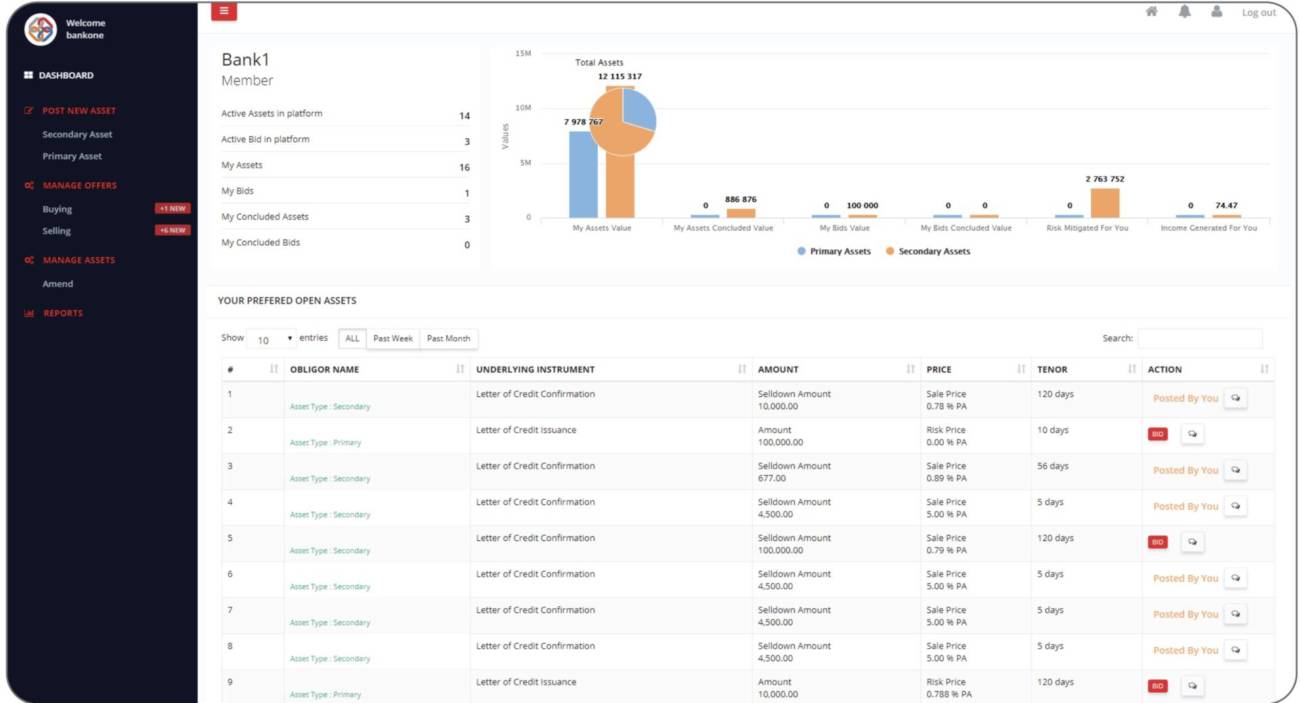

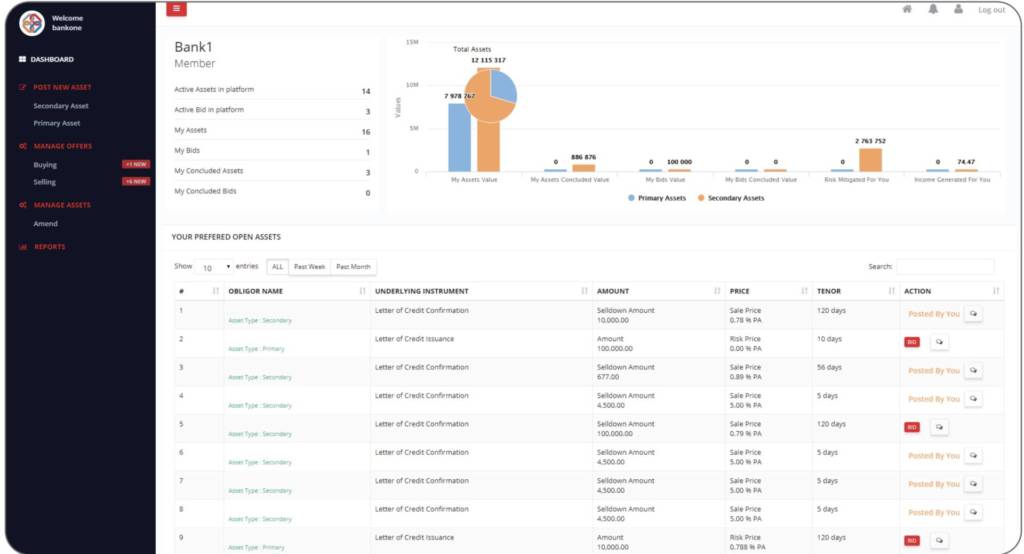

TradeAssets is the first e-marketplace for banks of its kind. The platform enables member banks to list assets for sale and allows other member banks to bid for and buy these assets thus creating a digital ecosystem which is efficient, convenient, profitable and secure.

TradeAssets is built on Blockchain Hyperledger fabric 1.0, a blockchain implementation hosted by Linux foundation, providing an enterprise – grade foundation for transactional applications.

We wrote a more in-depth piece on how TradeAssets is digitalising the secondary trade finance ecosystem with it’s e-marketplace. Read the full article here.

How is TradeAssets using technology to disrupt, enhance or grow international trade?

TradeAssets is a digital ecosystem where banks in all corners of the world are connected 24/7 without any barriers. The use of this ecosystem not only enhances profitability and mitigates risk for banks, but it has a very strong impact on global trade as it gives the banks the opportunity of facilitating more transactions. Another important social impact of the platform is that it helps connect banks in developing nations to commercially stronger banks thus providing an impetus to multiple economies. Apart from disrupting the way banks are connected to each other and how they do business with each other, it is moving a global process worth trillions of dollars from a very traditional, manual process into a digital, e-marketplace. While there are companies trying to digitize issuance of trade finance, the TradeAssets ecosystem is something not attempted before at this stage of the trade finance life cycle.

Why do you think TradeAssets is represented in the Tradetech 40?

TradeAssets is represented in TradeTech 40 for multiple reasons: TradeAssets is democratizing trade finance deal-making by making it accessible to banks all over the world over the internet. The team has digitized the traditional, manual process of asset trading and made it possible for bankers to discover more transactions, conduct more deals in a much lesser time, forge new business partnerships and make more returns for their shareholders.

While the total size of the secondary marketplace crosses USD 1 trillion, TradeAssets also addresses deal-making and price discovery at the issuance stage, which is worth another USD 2 trillion at least. TradeAssets brings technology and industry knowledge together, taking the burden of building expensive, individual banking platforms away from banks. The potential to disrupt the trade finance business is massive and TradeAssets is perfectly positioned to solve a trillion dollar problem and make the industry profitable and secure.

What are your biggest plans for 2019?

2019 has started on a very busy note. TradeAssets completed one year of operations with 25 banks signed on and onboarded as members. The first live transaction was successfully completed on the platform with leading banks from Bangladesh and India participating in what may be the world’s first, cross border, bank to bank digital asset sale.

Among other plans, we are aggressively working on signing up another 100 banks and onboarding them so they can start trading on the platform. A mobile app for member institutions is also on the cards. Geographically, we are expanding with TradeAssets staff now present in UAE, India, Bangladesh, Sri Lanka, Nepal, UK, USA, Saudi Arabia, Bahrain and Canada; and we are also happy to announce our entry into the Singapore market.

What are your top predictions for 2019?

Our prediction for 2019 is that more and more banks will be adopting a digitization strategy in non-consumer verticals. More barriers will break, and banks will do more business not just in their respective regions, but also in different parts of the globe. There will be more dialogue between banks and fintech companies as banks realize that they cannot built all their solutions in-house and will require partnerships. These partnerships will increase the relevance of technology further and its increased adoption will benefit everyone in the ecosystem. It will increase investment across the world and in trade finance, it will lead to more connectivity and availability of credit lines and capital in regions outside the traditional markets of large institutions, which will have a positive impact on the broader economy.