Importing from Germany

Germany Country Profile

Official Name (Local Language) Bundesrepublik Deutschland (German)

Capital Berlin

Population 80,722,792

Currency Euro

GDP $3,495 billion

Languages German

Telephone Dial In 49

Germany Exports Profile

Exports ($m USD) 1,450,215

Number of Exports Products 4,408

Number of Exports Partners 231

Germany Economic Statistics

Government Website | https://www.bundesregierung.de/ |

| Sovereign Ratings | https://countryeconomy.com/ratings/germany |

| Central Bank | Deutsche Bundesbank |

| Currency USD Exchange Rate | 0.9214 |

| Unemployment Rate | 4.3% |

| Population below poverty line | 16.7% |

| Inflation Rate | 1% |

| Prime Lending Rate | 0.25 |

| GDP | $3,495 billion |

| GDP Pro Capita (PPP) | $48,200 |

| Currency Name | EURO |

| Currency Code | EUR |

| World Bank Classification | High Income |

| Competitive Industrial Performance | 5/138 |

| Corruption Perceptions Index | 12/180 |

| Ease of Doing Business | 24/190 |

| Enabling Trade Index | 9/136 |

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedImporting from Germany

Directly bordering nine European nations and housing the port of Hamburg, the world’s third largest seaport, Germany is strategically positioned for strong international activities. With a population of 83.2 million and a GDP per capita of $48,200, Germany has the fourth largest economy in the world.

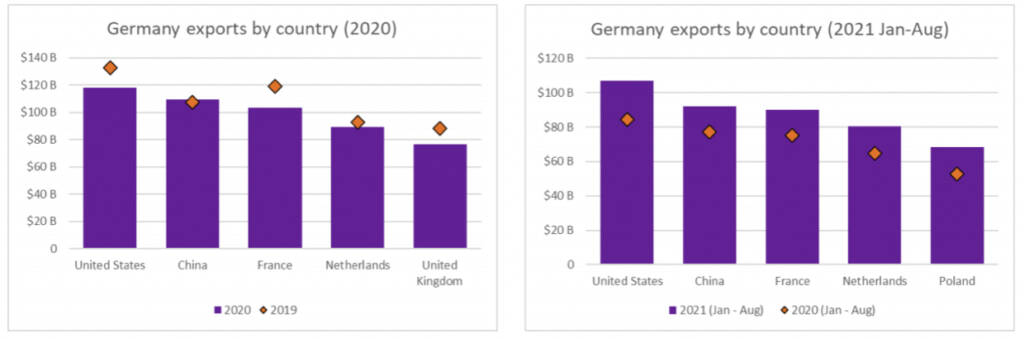

Germany is also the third-largest exporter in the world, with international trade accounting for nearly 45% of the country’s GDP. In 2019 Germany had over $1.5 trillion of exports, primarily to the USA, France, China, the Netherlands, and the UK. Germany’s strong export profile and stable economy has led to their sustained geopolitical and economic importance in the EU.

German governmental policy has promoted the shift to renewable energy, which now accounts for 25% of domestic consumption, with an expected increase in the coming years. This policy shift has led to Germany becoming the leading producers of wind turbines worldwide.

Importing from Germany: What is trade finance?

Trade finance is a revolving facility in which lenders offer financing options – it enables businesses to purchase products and can help ease the pressure from working capital issues.

Generally, an export finance bank will fund up to 100% of the cost of the products, including charges (e.g. insurance costs).

Trade finance offers upsides over more traditional bank financing, for example bridging mortgages or loans. Trade finance provides quick funding without affecting existing bank relationships.

How does it work?

If you’re a business importing or exporting goods around the world, then a trade finance facility would assist your company through offering a letter of credit (LC) or some form of cash advance.

I’m looking to import from Germany, how can Trade Finance Global help, and how does it work?

If you’re looking to import inventory from other countries, you may require import finance, which is an agreement between yourself (the importer) and the foreign exporter. A non-bank lender will act as the intermediary, paying the foreign exporter on your behalf until you get the products and have then sold them to your buyer. Repaying the financier then occurs over an agreed period of time.

Chart Showing GDP Growth Compared to rest of world

GDP Composition for Germany

Agriculture

0.6%

potatoes, wheat, barley, sugar beets, fruit, cabbages; milk products, cattle, pigs, poultry

Industry

30.3%

Iron, steel, coal, cement, chemicals, machinery, vehicles, machine tools, electronics, automobiles, food and beverages, shipbuilding, textiles

Services

69.1%

Map

Top 5 Exports Partners

| Country | Trade | % Partner Share |

| United States | 126,360 | 8.71 |

| France | 118,773 | 8.19 |

| China | 97,774 | 6.74 |

| United Kingdom | 94,819 | 6.54 |

| Netherlands | 91,278 | 6.29 |

Top 5 Exports Products

| Export Product | Number |

| Motor Vehicles | 10.9% |

| Parts and accessories for tractors, motor vehicles… | 4.3% |

| Medicaments consisting of mixed or unmixed… | 3.6% |

| Powered aircraft e.g. helicopters and aeroplanes;… | 2.1% |

| Human blood; animal blood prepared for therapeutic | 1.7% |

Speak to our trade finance team

Local Authors

Local Partners

- All Topics

- Germany Trade Resources

- Export Finance and ECA Topics

- Local Conferences