Receivables Finance And The Assignment Of Receivables

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContents

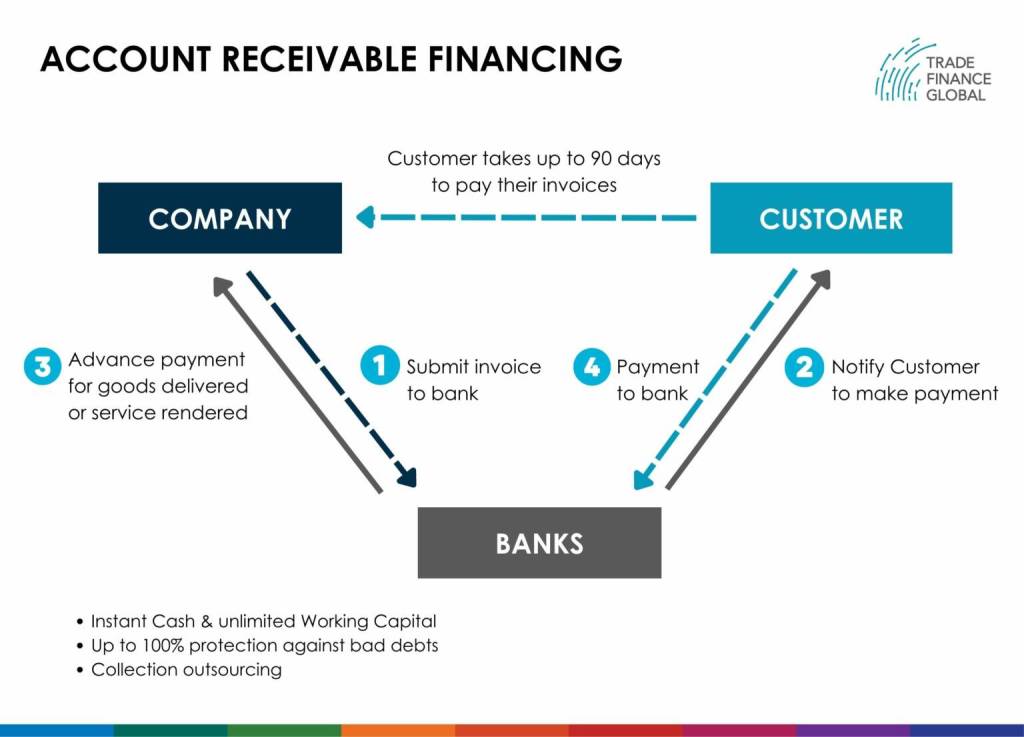

A receivable represents money that is owed to a company and is expected to be paid in the future. Receivables finance, also known as accounts receivable financing, is a form of asset-based financing where a company leverages its outstanding receivables as collateral to secure short-term loans and obtain financing.

In case of default, the lender has a right to collect associated receivables from the company’s debtors. In brief, it is the process by which a company raises cash against its own book’s debts.

The company actually receives an amount equal to a reduced value of the pledged receivables, the age of the receivables impacting the amount of financing received. The company can get up to 90% of the amount of its receivables advanced.

This form of financing assists companies in unlocking funds that would otherwise remain tied up in accounts receivable, providing them with access to capital that is not immediately realised from outstanding debts.

FIG. 1: Accounts receivable financing operates by leveraging a company’s receivables to obtain financing. Source: https://fhcadvisory.com/images/account-receivable-financing.jpg

Restrictions on the assignment of receivables – New legislation

Invoice discounting products under which a company assigns its receivables have been used by small and medium enterprises (SMEs) to raise capital. However, such products depend on the related receivables to be assignable at first.

Businesses have faced provisions that ban or restrict the assignment of receivables in commercial contracts by imposing a condition or other restrictions, which prevents them from being able to use their receivables to raise funds.

In 2015, the UK Government enacted the Small Business, Enterprise and Employment Act (SBEEA) by which raising finance on receivables is facilitated. Pursuant to this Act, regulations can be made to invalidate restrictions on the assignment of receivables in certain types of contract.

In other words, in certain circumstances, clauses which prevent assignment of a receivable in a contract between businesses is unenforceable. Especially, in its section 1(1), the Act provides that the authorised authority can, by regulations “make provision for the purpose of securing that any non-assignment of receivables term of a relevant contract:

- has no effect;

- has no effect in relation to persons of a prescribed description;

- has effect in relation to persons of a prescribed description only for such purposes as may be prescribed.”

The underlying aim is to enable SMEs to use their receivables as financing to raise capital, through the possibility of assigning such receivables to another entity.

The aforementioned regulations, which allow invalidations of such restrictions on the assignment of receivables, are contained in the Business Contract Terms (Assignment of Receivables) Regulations 2018, which will apply to any term in a contract entered into force on or after 31 December 2018.

By virtue of its section 2(1) “Subject to regulations 3 and 4, a term in a contract has no effect to the extent that it prohibits or imposes a condition, or other restriction, on the assignment of a receivable arising under that contract or any other contract between the same parties.”

Such regulations apply to contracts for the supply of goods, services or intangible assets under which the supplier is entitled to be paid money. However, there are several exclusions to this rule.

In section 3, an exception exists where the supplier is a large enterprise or a special purpose vehicle (SPV). In section 4, there are listed exclusions for various contracts such as “for, or entered into in connection with, prescribed financial services”, contracts “where one or more of the parties to the contract is acting for purposes which are outside a trade, business or profession” or contracts “where none of the parties to the contract has entered into it in the course of carrying on a business in the United Kingdom”. Also, specific exclusions relate to contracts in energy, land, share purchase and business purchase.

Effects of the 2018 Regulations

As mentioned above, any contract terms that prevent, set conditions for, or place restrictions on transferring a receivable are considered invalid and cannot be legally enforced.

In light of this, the assignment of the right to be paid under a contract for the supply of goods (receivables) cannot be restricted or prohibited. However, parties are not prevented from restricting other contracts rights.

Non-assignment clauses can have varying forms. Such clauses are covered by the regulations when terms prevent the assignee from determining the validity or value of the receivable or their ability to enforce it.

Overall, these legislations have had an important impact for businesses involved in the financing of receivables, by facilitating such processes for SMEs.

Digital platforms and fintech solutions: The assignment of receivables has been significantly impacted by the digitisation of financial services. Fintech platforms and online marketplaces have been developed to make the financing and assignment of receivables easier.

These platforms employ tech to assess debtor creditworthiness and provide efficient investor and seller matching, including data analytics and artificial intelligence. They provide businesses more autonomy, transparency, and access to a wider range of possible investors.

Securitisation is an essential part of receivables financing. Asset-backed securities (ABS), a type of financial instrument made up of receivables, are then sold to investors.

Businesses are able to turn their receivables into fast cash by transferring the credit risk and cash flow rights to investors. Investors gain from diversification and potentially greater yields through securitisation, while businesses profit from increased liquidity and risk-reduction capabilities.

References:

https://www.tradefinanceglobal.com/finance-products/accounts-receivables-finance/ – 28/10/2018

https://www.legislation.gov.uk/ukpga/2015/26/section/1/enacted – 28/10/2018

https://www.legislation.gov.uk/ukdsi/2018/9780111171080 – 28/10/2018

https://www.bis.org/publ/bppdf/bispap117.pdf – Accessed 14/06/2023

https://www.investopedia.com/terms/a/asset-backedsecurity.asp – Accessed 14/06/2023

https://www.imf.org/external/pubs/ft/fandd/2008/09/pdf/basics.pdf – Accessed 14/06/2023

- International Trade Law Resources

- All International Trade Law Topics

- Podcasts

- Videos

- Conferences