Akkreditive | Der TFG ultimative Leitfaden

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContent

Akkreditive | Der TFG ultimative Leitfaden

Importeure und Exporteure benötigen normalerweise Intermediäre wie Banken oder alternative Finanziers, um die Bezahlung und auch die Lieferung von Waren zu garantieren. Barvorschüsse oder ungesicherte Zahlungsziele werden gewöhnlich erst verwendet, nachdem Käufer und Verkäufer eine vertrauenswürdige Beziehung aufgebaut haben. Handelsfinanzierungsstrukturen werden verwendet, um diese Beziehungen entstehen zu lassen.

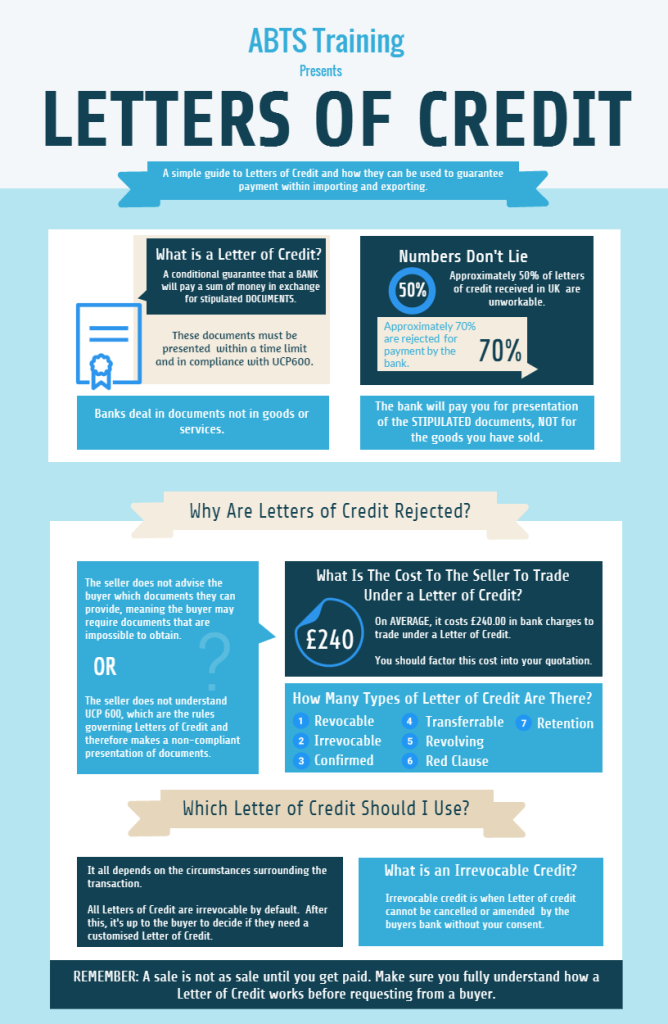

Was ist ein Akkreditiv?

Akkreditive, auch Dokumentenkredite genannt, sind Finanzinstrumente, die von Banken oder spezialisierten Handelsfinanzierungsinstituten ausgegeben werden, wobei die Zahlung an den Exporteur im Namen des Käufers erfolgt, wenn die im Akkreditiv festgelegten Bedingungen erfüllt sind.

Ein Akkreditiv benötigt einen Importeur, einen Exporteur, eine ausstellende Bank und eine avisierende Bank. Manchmal auch noch eine bestätigende Bank. Die Banken sind einbezogen, weil unter anderem ihre Kreditwürdigkeit wichtig ist; das Stichwort heißt hier Kreditgarantie – die ausstellende und eventuell bestätigende Bank ergänzen die Zahlungsgarantie des Importeurs gegenüber dem Exporteur. Dabei ist in der Regel der Importeur der Käufer und den Exporteur der Verkäufer.

Eine Akkreditiv-Transaktion läuft im Allgemeinen wie folgt ab

- Ein Importeur verpflichtet sich, Waren von einem Exporteur zu kaufen. Hierüber wird eine Bestellung ausgestellt.

- Der Importeur wird sich an eine ausstellende Bank (dem Handelsfinanzierer) wenden, die ein Akkreditiv ausstellt, wenn der Importeur ihre Kreditwürdigkeitsbedingungen und andere Kriterien erfüllt Der Exporteur arbeitet eventuell mit einer bestätigenden Bank, aber immer mit einem avisierenden Kreditinstitut zusammen.

- Der Importeur und die bestätigenden Bank werden dann die Akkreditivbedingungen prüfen und wenn diese akzeptiert werden, kann der Exporteur die Waren versenden.

- Der Exporteur sendet danach die relevanten Versanddokumente an die bestätigende Bank, die dann die Zahlung bearbeitet.

- Sobald die bestätigende Bank die Versanddokumente unter strikter Einhaltung der Akkreditivbedingungen der ausstellenden Bank positiv geprüft hat, leitet sie diese Dokumente an die ausstellende Bank weiter.

- Der Importeur bezahlt die ausstellende Bank.

- Die avisierende Bank gibt dann die Versanddokumente frei, so dass der Importeur die Waren, die versandt wurden, erhalten kann.

- Die Bank des Importeuers überweist dann das Geld an die eröffnende Bank, die dieses dann an den Exporteur überweist.

- Akkreditive sind flexible und vielseitige Instrumente (wir werden im weiteren Text über die verschiedenen Arten von Akkreditiven sprechen). Das Akkreditiv wird universell durch eine Reihe von Richtlinien geregelt, die als Uniform Customs and Practice (UCP 600) bekannt sind und erstmals in den 1930er Jahren von der Internationalen Handelskammer (ICC) veröffentlicht wurden.

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get started- Learn More About Letters Of Credit