Trade Financial Supply Chain Management

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContent

What is Financial Supply Chain Management?

Supply chain management is a broad area of study which encompasses all managerial operations relating to the ‘supply chain’ – the flow of goods and services between a buyer and a supplier.

Within the treasury, supply chain management refers to all financial decisions regarding this supply chain. This is also known as ‘financial supply chain management’.

Financial supply chain management is an important function of the treasury which is responsible for things such as:

- Reducing costs at all points within the chain

- Increasing the efficiency of all points within the chain

- Collaborating with all other parties in the chain more effectively

- Releasing working capital in the supply chain

Of these responsibilities, there is a particular onus on freeing up working capital, as recent studies have estimated that, in Europe alone, there could be as much as €500 million of working capital locked up in the financial supply chain.

Financing the Supply Chain

It may be possible for businesses to unlock some of this trapped working capital by making sensible financing decisions.

The most basic and general definition of supply chain financing is the use of one of several financing options to make payments between buyers and suppliers better for one or both parties.

Supply chain finance is also commonly referred to as ‘trade finance’.

Trade Finance Uses at Different Points in the Supply Chain

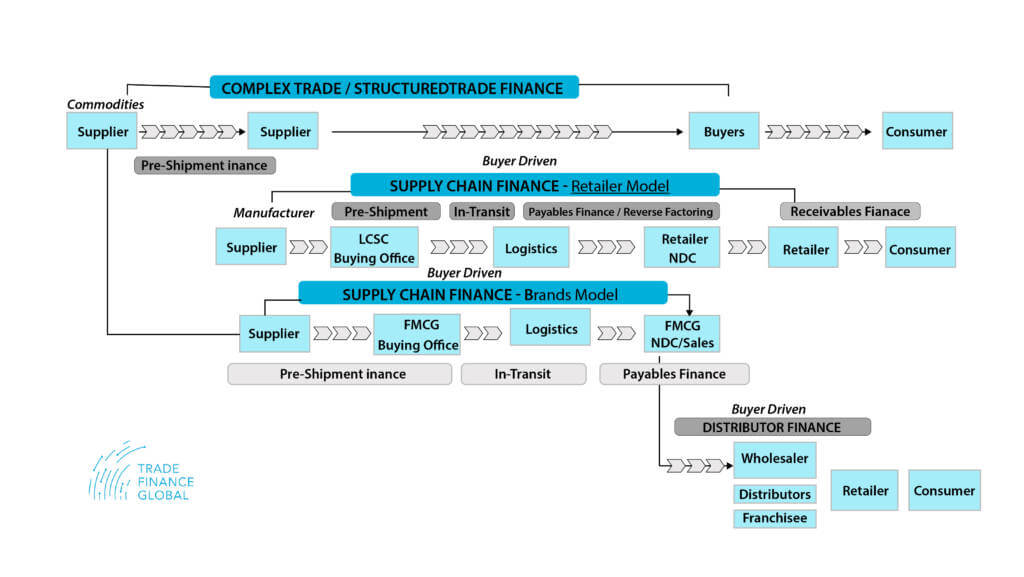

Below is a graph illustrating how trade financing can assist both buyers and suppliers at any phase of the supply chain:

Types of Trade Finance Solutions

As mentioned above, there are several types of financing solutions available which businesses can utilise to improve their supply chain processes.

We can split these into two main categories: buyer-centric financing solutions and supplier-centric financing solutions. The former being financing initiated by request of the supplier and the latter being financing initiated by request the buyer.

Types of Supplier-Centric Financing Solutions

- Inventory financing

This refers to a type of lending whereby inventory stock is used as collateral against a line of credit to secure more favourable credit terms.

- Factoring / Receivables finance

Factoring is a way of obtaining finance in which a supplier sells their accounts receivables to a third-party at a discounted price to obtain immediate working capital.

- Pre-shipment financing

Pre-shipment financing is when a supplier takes out a loan from a third-party finance provider before they export the goods to the buyer. It’s usually needed to source product components or fund manufacturing costs.

- Post-shipment financing

This refers to any loan which is taken out after goods have been shipped. It’s an advance given against the shipment to improve working capital.

Types of Buyer-Centric Financing Solutions

- Distributor finance programmes

Any financing solution which helps to ensure that a distributor can purchase goods from the exporter.

- Payables finance

A finance solution that covers the time period between when a buyer makes a payment obligation and the time when that payment is received.

- Reverse factoring

A buyer-initiated version of regular factoring, whereby the supplier gets access to the early payment of the receivable at a better cost due to the buyer’s better commercial credit rating.

The last of these solutions – reverse factoring – is also often referred to as supply chain finance. We’ll talk about this in more detail below.

Supply Chain Finance / Reverse Factoring

In regular factoring, a supplier will sell its accounts receivable to a factoring company directly. In supply chain finance, the buyer functions as an intermediary in this process to help its supplier gain more favourable terms.

To do this, the buyer – not the supplier – will initiate a reverse factoring agreement with a company offering supply chain finance. This company will then finance an early payment of the supplier’s accounts receivable in exchange for a small fee, and collect these funds back from the buyer once the invoice matures.

Advantages of Supply Chain Finance

Utilising supply chain finance is a win-win situation which benefits both the supplier and the buyer.

If the buyer is a larger corporation, they will typically have a higher commercial credit rating and, as such, can secure finance at a lower cost than the supplier.

From the supplier’s perspective, the advantage of this is that they can better manage their cash flow and access liquid working capital quickly and at a lower cost than through regular factoring on account of the buyer’s better credit rating.

From the buyer’s perspective, the advantages are that their supply chain is more resilient as they have helped their suppliers achieve more financial security and thus minimised the risk of losing a key supplier. They can also potentially achieve better terms and improve buyer-supplier relations.

References:

https://www.pwc.com.au/publications/pdf/supply-chain-finance-jul17.pdf

https://ctmfile.com/sections/background/trade-finance

https://www.comcapfactoring.com/blog/how-does-supplier-financing-work/

https://en.wikipedia.org/wiki/Supply_chain_management

https://treasurytoday.com/2007/01/introductionf-to-financial-supply-chain-management