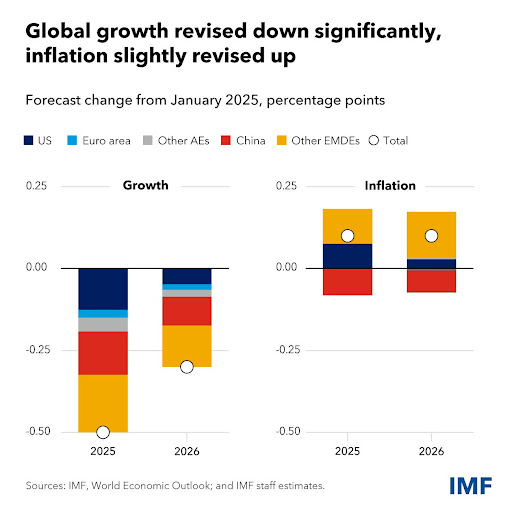

The International Monetary Fund (IMF) has just published its World Economic Outlook as of April 2025, portending a fall of global GDP growth by 0.5%, to 2.8% for the year.

This is largely the result of the “major negative shock” that US President Donald Trump’s tariffs have imposed on the global economy.

The report is structured in three chapters, covering global policy, demographic impacts (including of an ageing population), and the impact of refugee and migration policy on economic growth, particularly within developing economies.

Since February, the US has announced multiple waves of tariffs against trading partners, culminating in near-universal levies on 2 April, which triggered historic drops in equity markets. Though markets partially recovered following pause announcements after 9 April, uncertainty—especially regarding trade policy—has surged to unprecedented levels.

The impacts of tariffs, IMF reports, vary considerably across countries. In the US, where demand was already softening, growth projections have been lowered to 1.8% for this year, with tariffs accounting for nearly half the reduction. China’s growth forecast has been cut to 4%, reflecting weaker external demand. The eurozone faces a more modest reduction to 0.8%, with stronger fiscal stimulus providing some offset.

Source: IMF

Global trade growth is expected to decline more severely than output, dropping to just 1.7% in 2025.

The report presents several forecast scenarios reflecting differing policy paths. A pre-April 2 forecast (excluding the most recent tariff escalation) would have yielded 3.2% global growth in both 2025 and 2026. A model-based forecast incorporating announcements after 9 April suggests that even with temporary halts to some tariffs, global growth prospects remain similar to the reference forecast due to elevated US-China tariffs and continued uncertainty.

Despite the slowdown, global growth remains above recession levels. The IMF recommends restoring trade policy stability and forging mutually beneficial arrangements to address longstanding gaps in international trading rules.

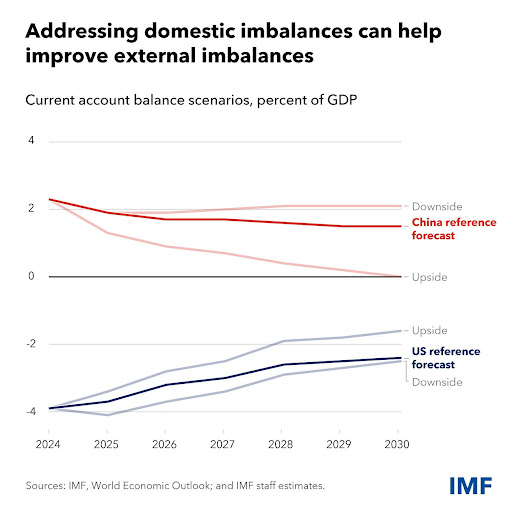

Domestic imbalances contribute to uneven growth, with high consumption in the US, weak demand in China, and subdued manufacturing activity in many economies. Addressing these underlying issues could help offset economic risks and close external imbalances whilst building a more inclusive trading system.

Interestingly, the IMF’s inflation forecast has been relatively stable. Emerging and developing markets in Asia, in particular, are expected to see more muted inflationary pressures. Yet this outcome is a likely result of the negative demand shock which tariffed countries are experiencing as export demand diminishes. Furthermore, rising import prices from a trade war could increase already tentative inflationary pressures.

In this vein, the IMF notes that since over 80% of trade invoicing is conducted in US dollars, this projection could be reversed if the USD appreciated.

Source: IMF

To doubt is to waver

Trade policy uncertainty has become a major impediment to economic growth, with the prolonged elevation of this uncertainty causing investment distortions and market volatility.

Trade uncertainty, the IMF emphasises, weighs adversely on supply- and demand-side indicators, creating a cycle of negative wealth effects.

The impact of this trade uncertainty manifests in financial market volatility, supply chain disruptions, and dampened investment.

To mitigate these impacts, the IMF recommends international cooperation through regional and cross-regional groups to sustain global growth and tackle common problems. It suggests that a stable and predictable trade environment could be achieved through pragmatic cooperation and deeper economic integration, including non-discriminatory unilateral reductions of trade barriers or expanded trade at regional, plurilateral, or multilateral levels.

The IMF also cautions against broad subsidies as a response to trade distortions, noting they generate large fiscal costs and additional distortions. While targeted industrial policies may alleviate specific sectoral market failures in certain cases, they should be subjected to a comprehensive cost-benefit analysis and narrowly focused on well-identified market failures to minimise distortions.

Reducing policy-induced uncertainty would at least go some way in working against the bubble of uncertainty which global trade currently doesn’t seem capable of bursting.

“Power hungry”: The impact on commodity markets

The future of commodities markets appears to be characterised by this same increasing volatility and changing dynamics across different sectors, as geopolitics and technology developments prove a double-edged sword: but also pose room for opportunity.

The report highlights some key metrics influencing their conclusion:

- In energy, oil prices declined 9.7% between August 2024 and March 2025, with further plummets in early April amid escalating trade tensions.

- Natural gas prices rose until March 2025 but reversed course in April, with futures suggesting declining prices through 2030.

- The IMF’s metals price index increased by 11.2% between August 2024 and March 2025, driven mainly by gold, aluminium, and copper.

- Gold prices have repeatedly set new records amid policy and geopolitical uncertainty, hitting $3,500 today.

- The IMF’s food and beverages price index increased by 3.6%, driven by higher beverage prices.

- Coffee prices jumped 33.8%, reaching historic highs due to weather-related supply concerns; on the flip side, rice prices fell 26.0% as crop conditions improved in India and other parts of Asia.

Trade war fears are adding to the “already-bearish outlook” in these markets, and a major structural shift is occurring with AI-related data centres dramatically increasing electricity demand. By 2030, AI-driven global electricity consumption could reach 1,500 TWh, comparable to India’s current total electricity consumption.

The future outlook appears to be one of continued volatility, with balanced risks for energy markets but significant structural changes due to technological developments like AI, which will reshape energy demand patterns and potentially impact all commodity markets through their effects on economic growth and costs.

—

The report comes as many world economies seek to reroute supply chains, creating an environment in which decades-old alliances are being rethought. The IMF report has forecasted relatively more stable economic growth, which fell just 0.3% to 6.2% in 2025; yet US Vice President JD Vance’s recent visit to Indian Prime Minister Narendra Modi has highlighted the paradoxicality of cutting China out while relying on their materials for manufacturing.

This, and similar contradictions, are what has led the IMF to call for “prudence and improved collaboration” across industries and national boundaries. Fiscal authorities face particularly difficult choices amid high debt levels, rising financial costs, and new spending demands, including increased defence expenditure in some regions.

The IMF highlights that the global economy needs a “clear and predictable trading system, addressing longstanding gaps in international trading rules, including the pervasive use of non-tariff barriers or other trade-distorting measures.” Countries must remain agile to stay afloat.